Mexico

December 13, 2018

CRU: North American Supply Further Disrupted

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s Steel Sheet Products Monitor

The steel sheet market in North America is starting the second half of the year off with the same primary trends seen in the past few quarters: rising prices due to strong demand and supply that continues to be affected by unplanned disruptions.

The latest supply disruptions include an unplanned loss of production at Nucor Gallatin and at Steel Dynamics’ Columbus, Miss., facilities. These issues were minor compared to some prior disruptions like the winter storm in the South or an explosion that damaged a blast furnace in early 2020 Q3. Yet in this market where supply remains tight, the effects of these outages may continue to keep prices supported for longer than previously expected.

In addition to these unplanned disruptions, Cleveland-Cliffs confirmed what was widely expected, that their delayed 45-day outage at Indiana Harbor #7 would take place in 2021 H2, starting in September. This is planned maintenance, which means there is some slab getting produced to be rolled for contract customers. Like the similar outage at their Middletown, Ohio, works, it may not take all 45 days. But, more importantly, upside risk remains for any major furnace to come back online properly after an outage.

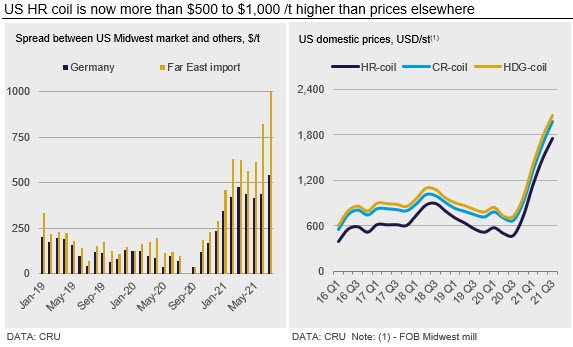

Even with these outages, we expect that U.S. crude steel production in July or August will reach the highest level since January 2020. In addition to this rebound in domestic production, sheet imports in June have come in at their fastest rate since October 2018. This increase of imports has been due to not only the record spread between sheet prices in the U.S. market and other major global markets (see chart), but also due to mills strictly allocating volume to many buyers.

Meanwhile, sheet prices in the U.S. Midwest market continue to set record highs each week. For July 14, our price assessment has HR coil up $42 /s.ton from June 9, while HDG coil is up $130 /s.ton over that same period. This difference clearly illustrates the recent trend of tighter supply of CR and HDG coil products versus HR coil.

Steel sheet prices on the U.S. West Coast increased by 11-13% m/m once the mills here opened their orderbooks for September production. Like recent months, strong buying activity allowed these order books to quickly close with most buyers receiving less volume than they desired. While customer activity remains high, there were recent instances of projects being delayed and customers passing on opportunities to purchase imported material. Due to higher-than-normal temperatures as well as the ongoing drought and lower than usual electricity generation from hydroelectric power, many companies are adjusting production schedules in an attempt to conserve energy, running fewer hours or only running during off-peak portions of the day.

In Mexico, HR and CR coil have increased by around 3% m/m. Domestic demand has been gradually improving, particularly from the construction sector, while demand for exports has intensified, resulting in reduced supply availability in the spot market. Thus, local mills have been able to increase prices consistently in recent months. Although the price increases have not followed the speed of the U.S. Midwest prices recently, YTD-July, Mexican HR coil prices in MXN have increased by around 112% y/y and 127% y/y in USD terms, given the local currency appreciation during the period. Market participants believe demand will improve further with more automotive production, while supply is also expected to grow on the back of the new hot strip mill from Ternium and increases in AHMSA utilization, with a possible resumption of their idled 1.5 Mt BF this quarter.

Outlook: Upside Risk Remains, Yet Supply Response Will Affect Prices

We wrote last month that our near-term view continues to contain a tremendous amount of risk and any disruption of supply, even a minor one, can quickly alter the timing of a price turn. This continues to hold true and more importantly, it bears repeating especially after two small unplanned disruptions at EAF producers. Additionally, the start-up of Steel Dynamics’ Sinton, Texas, EAF has been slightly delayed from the end of Q3 to early Q4.

At service centers, we have seen inventories continue to slowly rise from the bottom reached this past November. Outbound shipments have steadied since January. In addition, the amount of material that service centers have on order at mills appears to have fallen from an April peak. We expect that as domestic production continues to rise and import arrivals remain strong, the amount of material that service centers receive will soon rise at a faster rate. Currently, based on preliminary data for June, inventories may now be near balance with demand. Inventory building has been a significant factor behind the sheet price rise since last August. If in addition to rising domestic production and strong imports, active inventory-building slows, then we expect sheet prices to peak in the near term. Though risk remains to the upside due to any further unplanned supply disruptions.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com