Prices

October 22, 2018

Raw Material Prices: Iron Ore, Coking Coal, Pig Iron, Scrap and Zinc

Written by Peter Wright

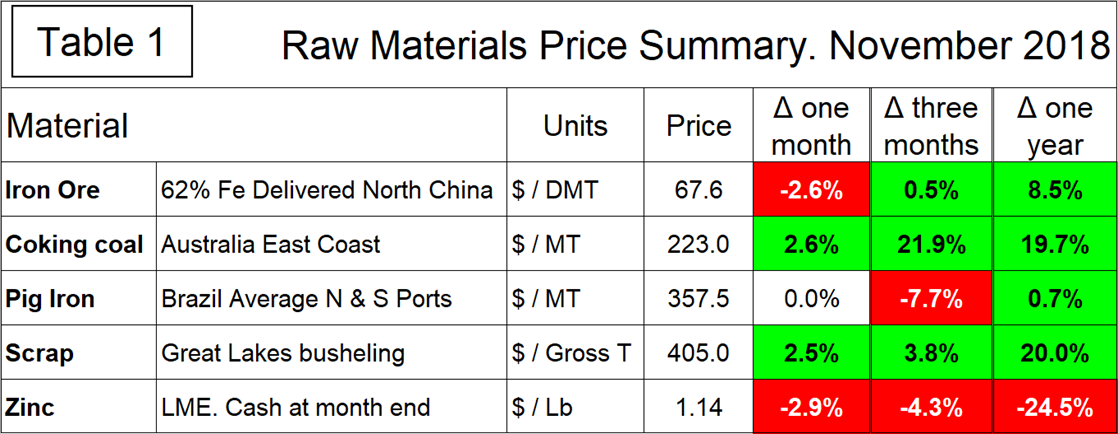

In the last 12 months, the price of coking coal and scrap have continuously trended up, zinc has continuously trended down, and iron ore and pig iron have been erratic. Table 1 summarizes the price changes through November of the five materials considered in this Steel Market Update report. It includes the month/month, 3 months/3 months and 12 months/12 months changes and tells us that price movements have not been consistent across the five materials.

Iron Ore

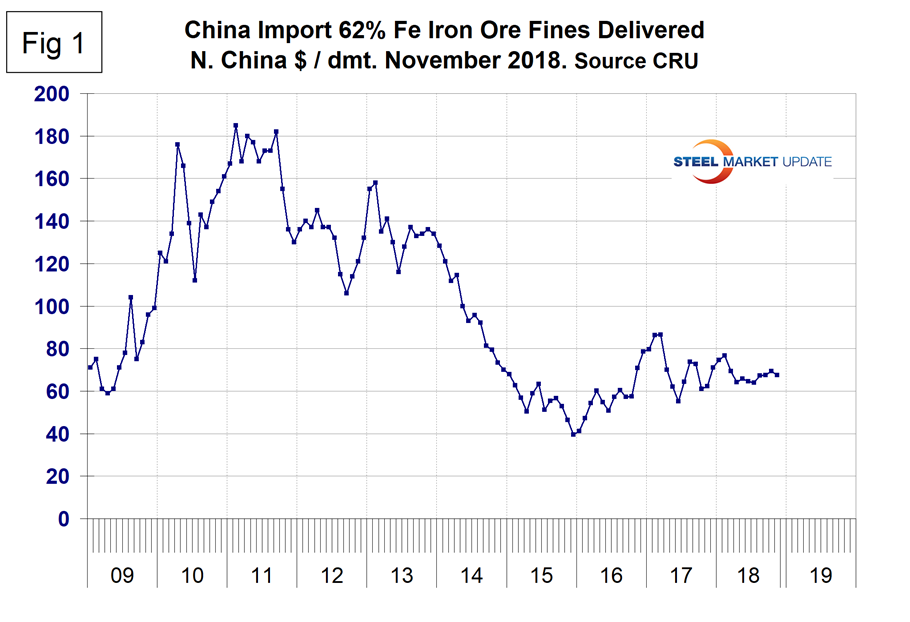

On Nov. 27, Mining.com reported: “Robust global steel output did nothing to stop a rout in iron ore prices on Monday, with the seaborne benchmark cratering amid growing fears about an economic slowdown in China and the impact of a trade war between the world’s two largest economies. Benchmark prices at the Chinese port of Qingdao of 62% Fe content ore fell 8% on Monday to trade at $64.25 per dry metric tonne, according to data supplied by Fastmarkets MB. Chinese steelmakers increasingly prefer high-quality imports from Brazil and Australia over domestic iron ore, but inbound cargoes fell to a four-month low of 88 million tonnes in November, despite heavy demand ahead of winter production curbs. Steelmaking coal (premium hard-coking coal FOB Australia) also retreated, falling to $218.46 a tonne on Monday and is now trading 16% lower than at the start of the year. The pullback in seaborne iron ore and metallurgical coal follows a sell off of steel futures in China, with Shanghai rebar entering a bear market – down more than 20% from seven-year highs hit in August.”

Based on CRU’s data, the weekly average spot price of 62% fines delivered North China was $67.60 per dry metric ton on Nov. 28. In one month, the price fell by 2.6 percent and in 12 months was up 8.5 percent. Figure 1 shows the price of 62% Fe delivered North China since January 2009.

Coking Coal

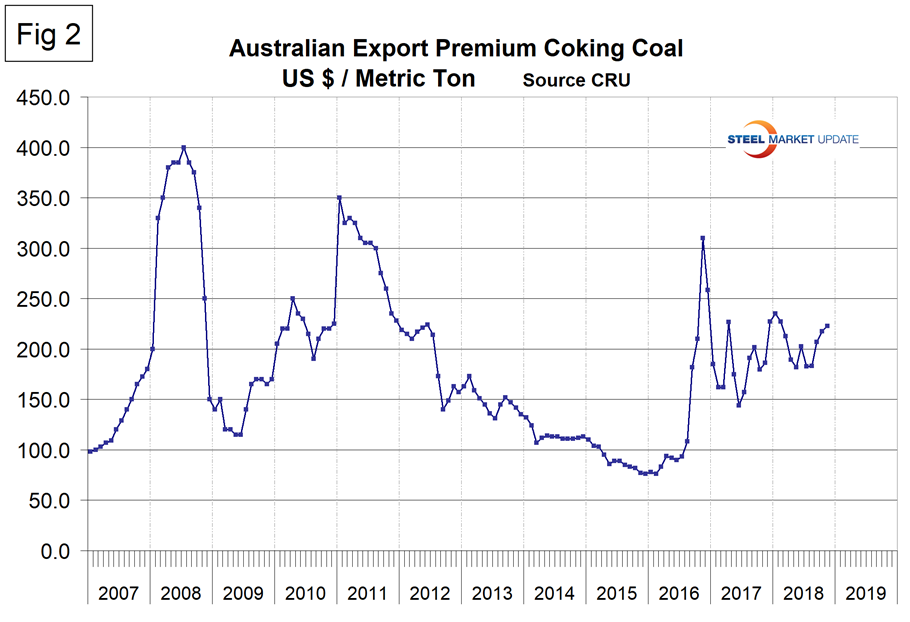

The price of premium low volatile coking coal FOB east coast of Australia has risen for each of the last four months. From February 2016 to November 2016, the price more than quadrupled from $76 to $310 per metric ton. On Nov. 28, the price stood at $223 per ton and has ranged between $144 and $235 per ton since January 2017 (Figure 2).

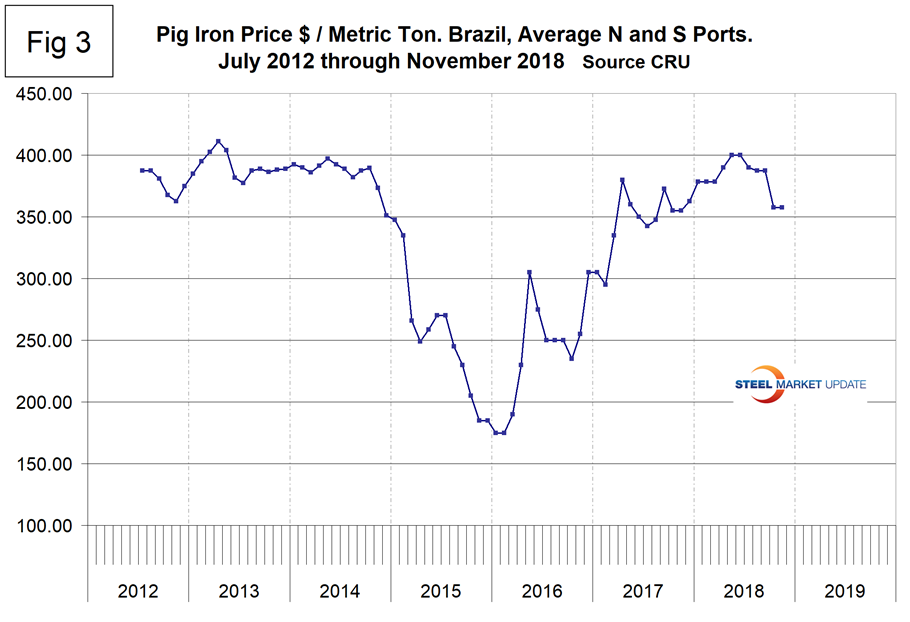

Pig Iron

Most of the pig iron imported to the U.S. currently comes from Russia, Ukraine and Brazil with additional material from South Africa and Latvia. In this report, we summarize prices out of Brazil and average the FOB value from the north and south ports. The price steadily increased from the $175 low point in January and February 2016 to $400 in May and June 2018 before declining to $357.50 in October and November. In the last three months, the price of pig iron has declined by 7.7 percent.

Scrap

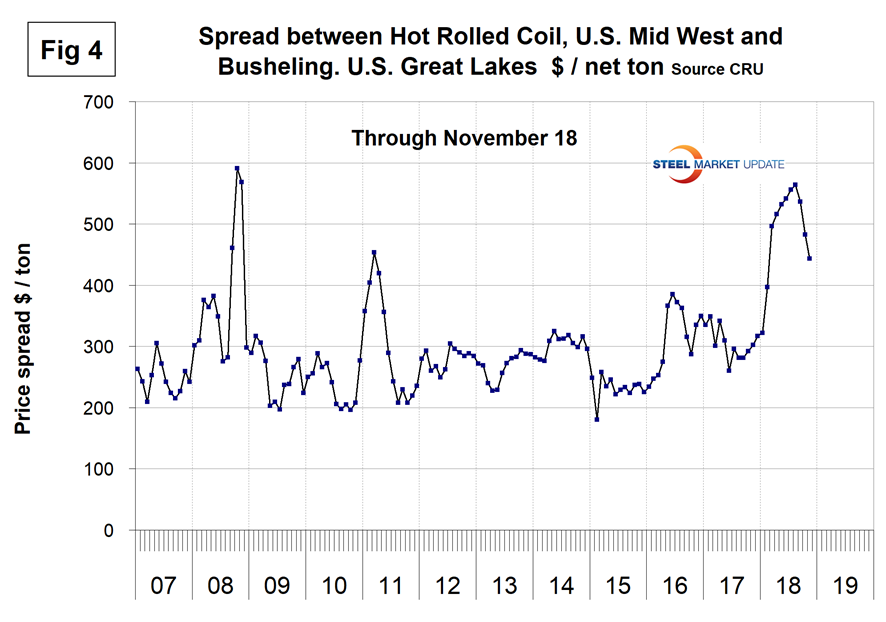

To put this raw materials commentary into perspective, we include here Figure 4, which shows the spread between busheling in the Great Lakes region and hot rolled coil Midwest U.S. through mid-November 2018, both in dollars per net ton. The spread has declined for three straight months to $443.39 in mid-November, but is still historically high and is up from $260.00 in June 2017.

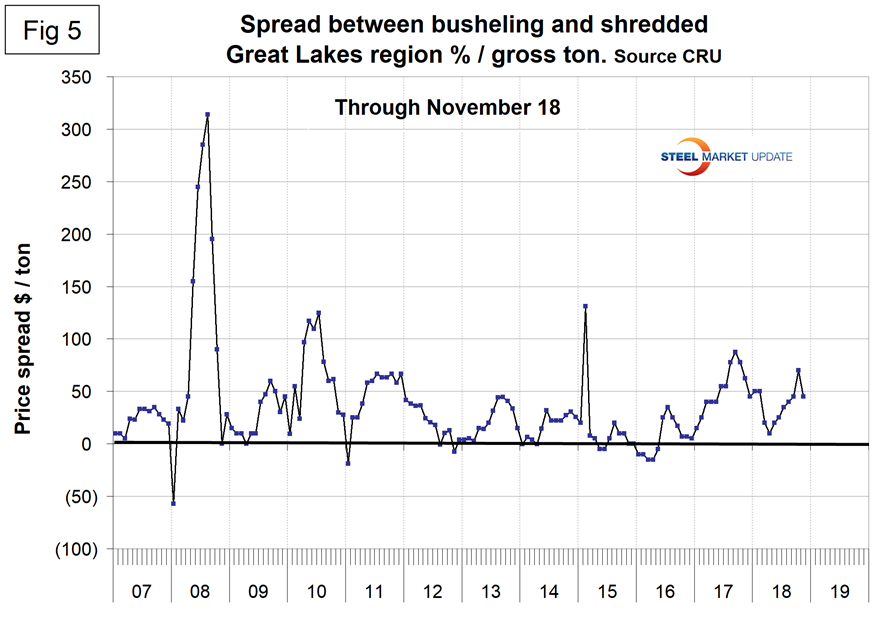

Figure 5 shows the relationship between shredded and busheling, both priced in dollars per gross ton in the Great Lakes region. This spread declined in November after increasing for six months. The busheling premium over shredded rose from $10 in April to $70 in October before declining to $45 in November.

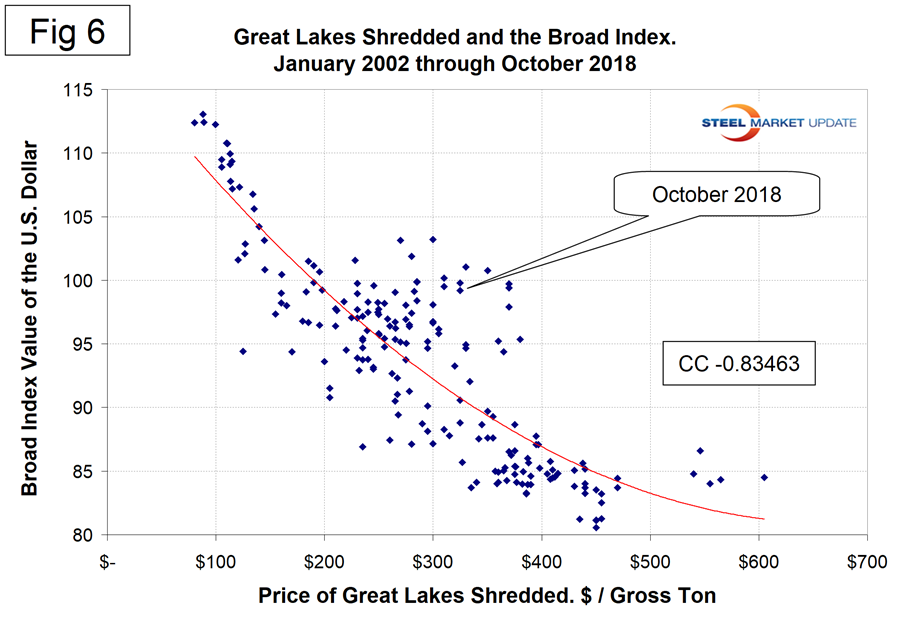

Figure 6 is a scatter gram of the price of Chicago shredded and the monthly Broad Index value of the U.S. dollar as reported by the Federal Reserve. The latest data for the monthly Broad Index was October. This is a causal relationship with a negative correlation of over 83 percent.

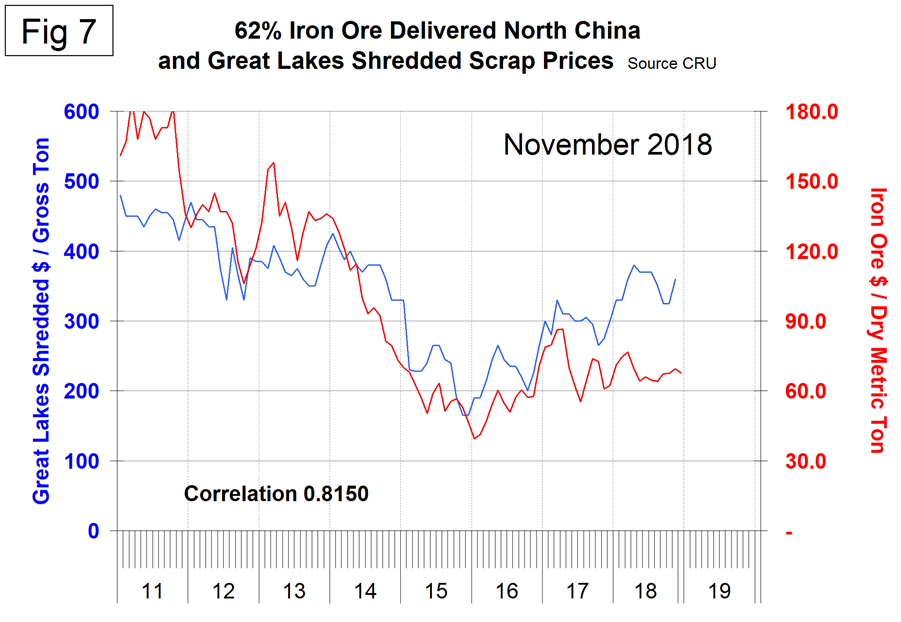

There is a long-term relationship between the prices of iron ore and scrap. Figure 7 shows the prices of 62% iron ore fines delivered N. China and the price of shredded scrap in the Great Lakes region through mid-November 2018. The correlation since January 2006 has been 81.5 percent. There has been a very unusual divergence in these prices since Q2 2017.

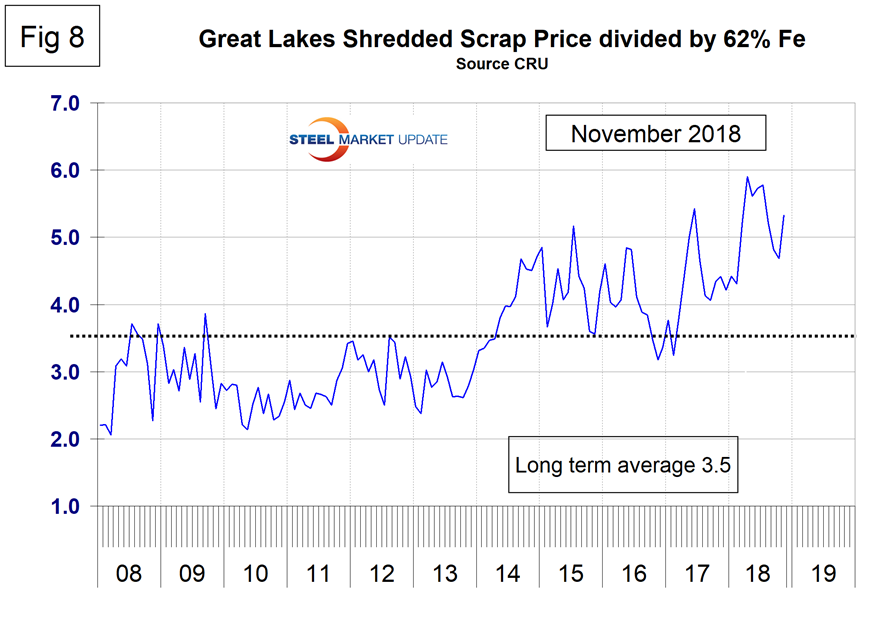

In the last 10 years, scrap in dollars per gross ton has been on average 3.4 times as expensive as ore in dollars per dry metric ton (dmt). The ratio has been erratic since mid-2014, but at 5.3 is highly beneficial to integrated producers (Figure 8). Since Chinese steel manufacture is 95 percent BOF, this ratio has allowed China to be more competitive on the global steel market. In the last four years, there have been times when China could supply semi-finished to the global market at prices competitive with scrap.

Zinc

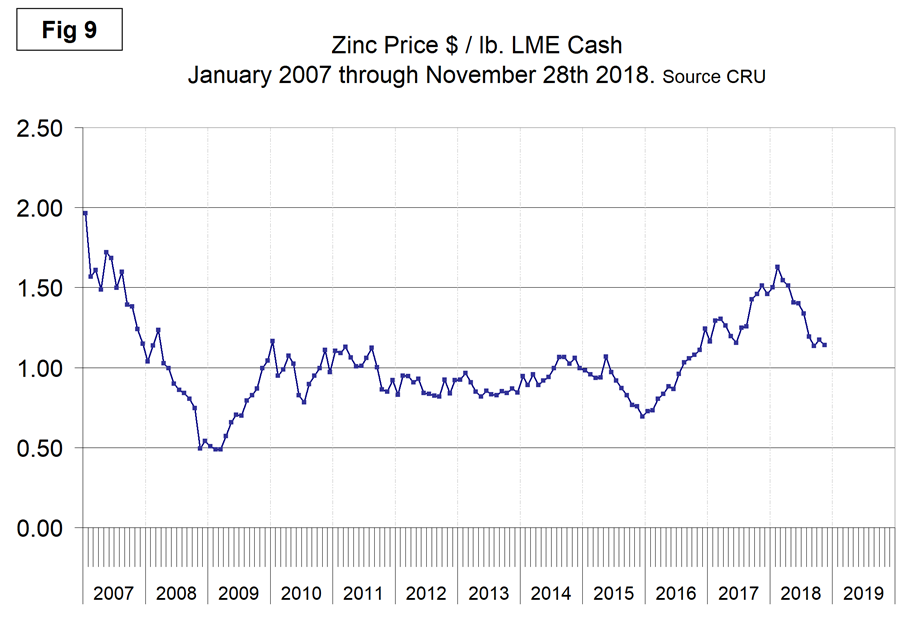

The LME cash price for zinc at the end of each month is shown in Figure 9. The latest data is for Nov. 28 when the price was $1.14 per pound, down from a high of $1.63 at the end of January. According to Bloomberg, zinc is the worst-performing base metal this year on the London Metal Exchange. “Continuously increasing LME inventories and weak Chinese demand added to worsening zinc fundamentals,” said Casper Burgering, an economist at ABN Amro Bank NV. “Supplies of zinc concentrates will continue rising. As a result, zinc prices will weaken further.”

Zinc is the fourth most widely used metal in the world after iron, aluminum and copper. Its primary uses are 60 percent for galvanizing steel, 15 percent for zinc-based die castings and about 14 percent in the production of brass and bronze alloys.

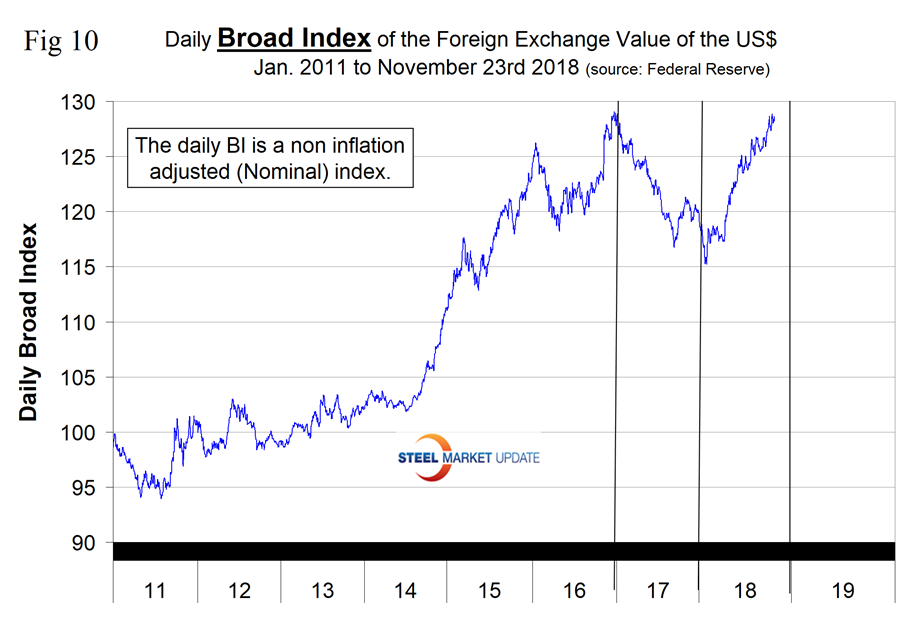

SMU Comment: There is an inverse relationship between commodity prices and the value of the U.S. dollar on the global currency markets. After falling for most of 2017 and through Feb. 1, 2018, the dollar has experienced a sharp upward revival and through Nov. 23 was up by 8.5 percent year to date (Figure 10). (Note: This is the daily index, which is not inflation adjusted. The monthly index mentioned above is inflation adjusted and isn’t updated until late the following month.) Supply and demand fundamentals are the primary drivers of raw materials prices, but a rising dollar acts as a headwind on the price of those global commodities that are priced in dollars. This effect is clearly shown by the relationship between scrap and the dollar index described above in Figure 6.