Prices

October 14, 2018

August Apparent Steel Supply Nears 10 Million Tons

Written by Brett Linton

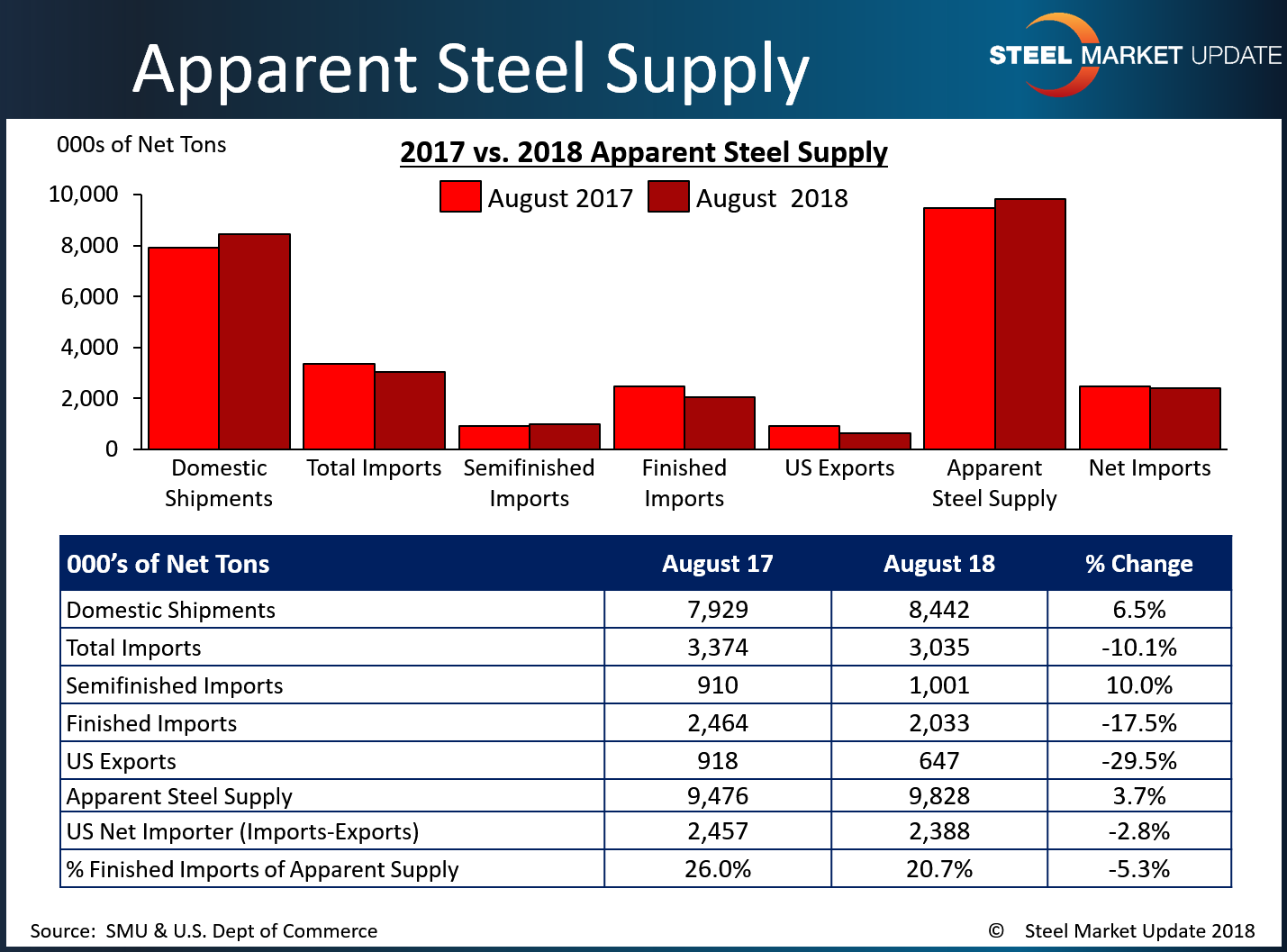

Apparent steel supply remained high in August, coming in at 9,828,339 net tons, according to government data released late last week. This is the third highest level of the year, just a hair under the April figure (9,829,298 tons), and both being about 100,000 tons under the March high (9,935,479 tons). Apparent steel supply is calculated by adding domestic steel shipments and finished U.S. steel imports, then subtracting total U.S. steel exports.

August apparent steel supply saw a 352,813 ton or 3.7 percent increase compared to the same month one year ago. This change was due to a mix of factors: an increase in domestic shipments of 512,802 tons or 6.5 percent, somewhat counteracted by a 430,814 ton or 17.5 percent decrease in finished imports and a decrease in total exports of 270,824 tons or 29.5 percent.

The net trade balance between U.S. steel imports and exports was a surplus of 2,388,060 tons imported in August, up 56,432 tons or 2.4 percent from the prior month, but down 68,843 tons or 2.8 percent from one year ago. Foreign steel imports accounted for 20.7 percent of apparent steel supply in August, down from 23.2 percent in the prior month, and down from 26.0 percent one year ago.

Compared to the prior month when apparent steel supply was 9,451,630 tons, August supply rose by 376,709 tons or 4.0 percent. This was due to an increase in domestic shipments of 530,369 tons or 6.7 percent, a decrease in finished imports of 162,905 tons or 7.4 percent, and a decrease in exports of 9,245 tons or 1.4 percent.

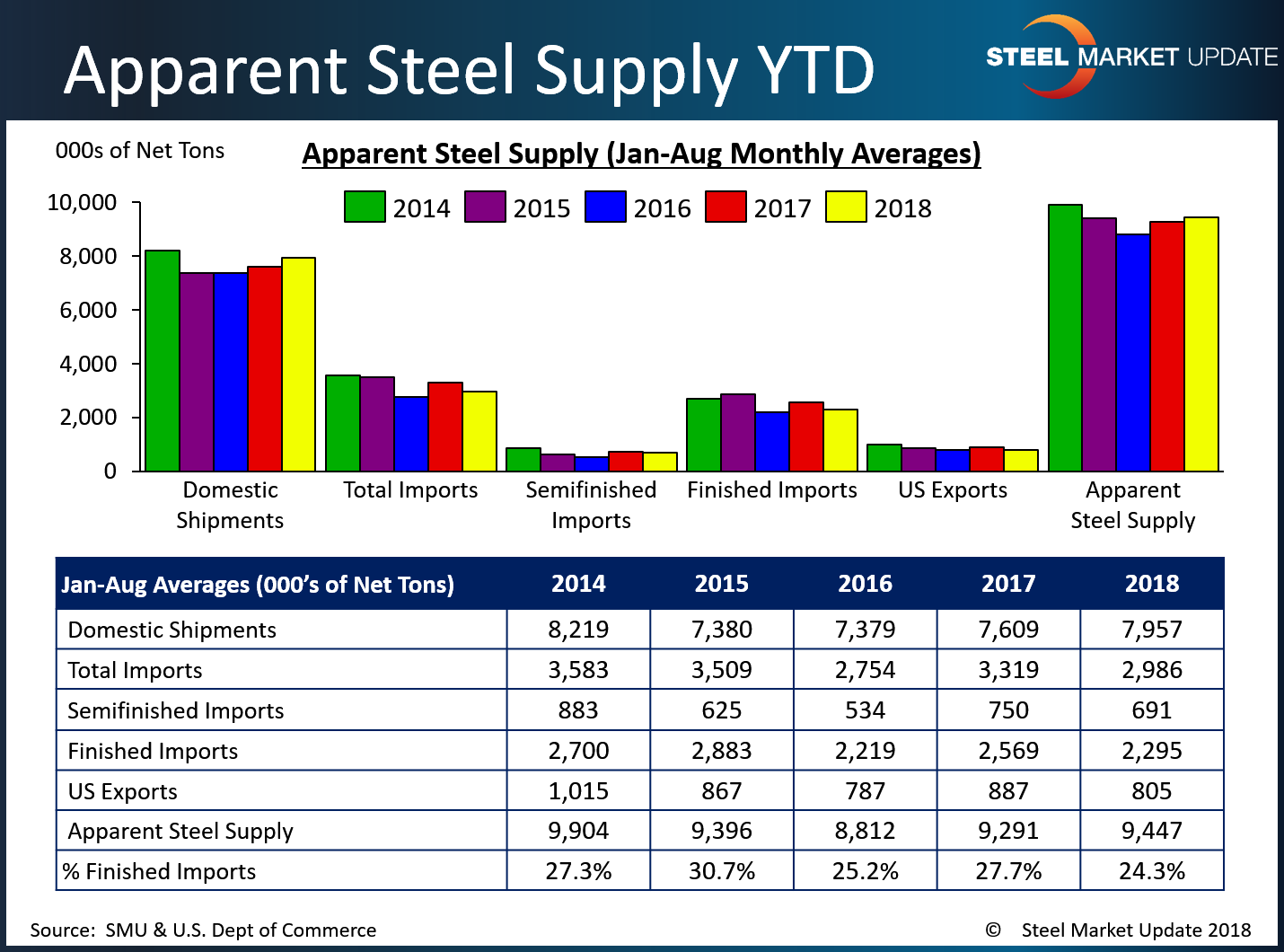

The table below shows year-to-date totals for each statistic over the last five years. The 2018 data was previously steady to higher compared to the prior two years, but has been mixed since July.

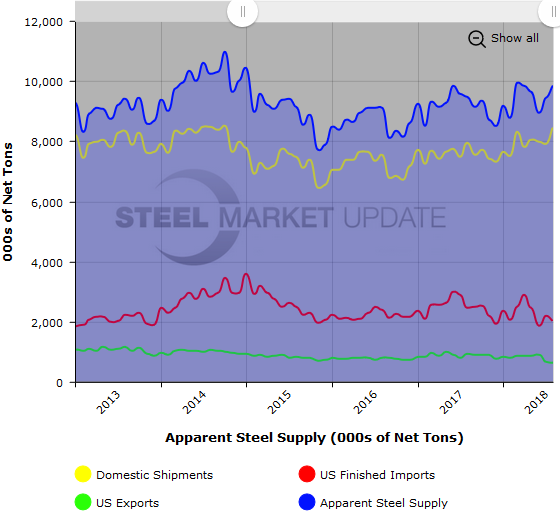

To see an interactive graphic of our Apparent Steel Supply history (example below), visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.