Prices

September 13, 2018

Steel Exports Fall to 9-Year Low in July

Written by Brett Linton

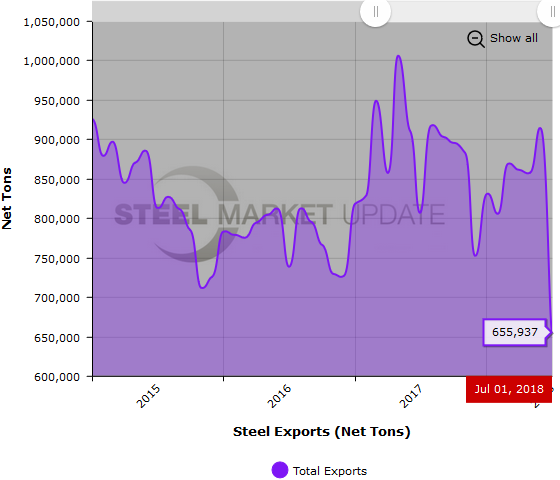

U.S. steel exports in July totaled 655,937 net tons (595,057 metric tons), down 28.2 percent over June and down 18.7 percent from July 2017. This is the lowest total export figure seen since May 2009 when 627,968 tons were shipped out of the country.

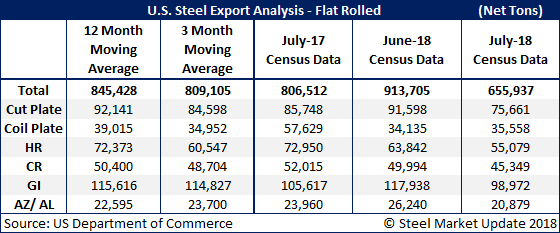

Prior to July, total exports had averaged around 875,000 tons the last few months. The total July export figure is below both the three-month moving average (average of May 2018, June 2018 and July 2018) and the 12-month moving average (average of August 2017 through July 2018). Here is a breakdown of flat rolled and plate steel exports:

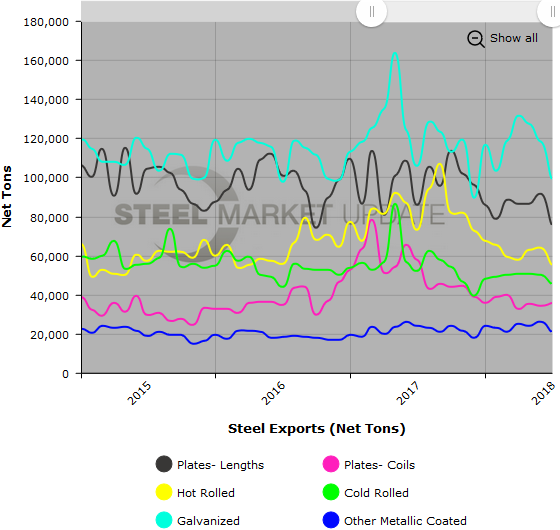

Cut plate exports decreased 17.4 percent from June to 75,661 tons, and were down 11.8 percent compared to levels one year ago. The last time cut plate exports were this low was October 2016 at 74,192 tons.

Exports of coiled plate were 35,558 tons in July, up 4.2 percent month over month, but down 38.3 percent year over year.

Hot rolled steel exports fell 13.7 percent month over month to 55,079 tons, and were down 24.5 percent from July 2017 levels. This is the lowest level seen since March 2016 when 53,664 tons of hot rolled steel was exported.

Exports of cold rolled products were 45,349 tons in July, down 9.3 percent from June, and down 12.8 percent over the same month last year.

Galvanized exports fell 16.1 percent month over month to 98,972 tons. Compared to one year ago, July levels were down 6.3 percent.

Exports of all other metallic coated products came in at 20,879 tons, a 20.4 percent decrease from June, and a 12.9 percent decrease compared to one year ago.

To see an interactive graphic of our steel imports history through final July data (examples below), visit our website here. If you need any assistance logging in or navigating the site, contact us at info@SteelMarketUpdate.com or 800-432-3475.