Prices

June 28, 2018

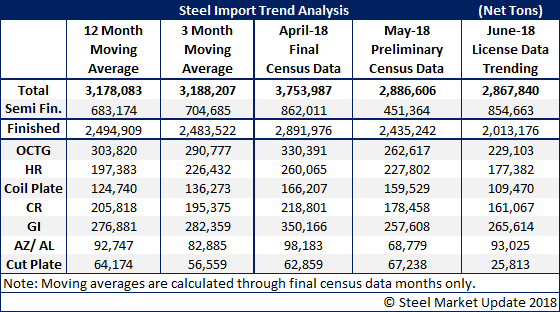

May Preliminary Imports Decline to 2.9 Million Tons

Written by Brett Linton

On Tuesday, the U.S. Department of Commerce reported preliminary steel import license data for May at 2,886,606 net tons, a decrease of 23 percent from the April high and a decrease of 17 percent compared to the same month last year.

Updated June license data was also released; taking the daily license rate and spreading it across the 30 days of June, we see the month trending toward 2.9 million net tons total. Our late-month trend figures over the past few months have been within 200,000 tons of the final monthly figures.

Looking through the June trending data, semi-finished imports appear to have rebounded from the May dip, while finished imports are slowing. Hot and cold rolled imports are trending downward for June, while imports of coated products are increasing. Plate, both coiled and cut to length, are down significantly from May to June.