Prices

June 20, 2018

Foreign Steel Imports Trending Down in June

Written by Brett Linton

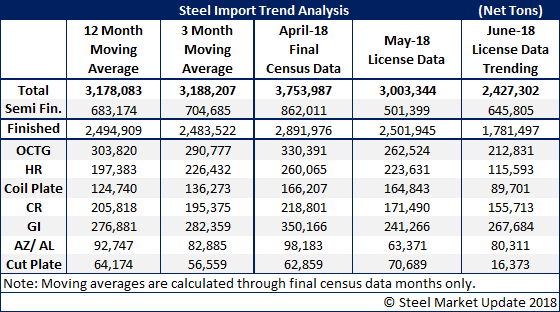

On Tuesday, the U.S. Department of Commerce reported foreign steel import license data for the first 19 days of June. The data is indicating to Steel Market Update a significant drop in imported foreign steel. Taking the daily license rate and spreading it across the 30 days of June, we see the month trending toward 2.4 million net tons. This would be 600,000 net tons lower than the prior month (May 2018) and 1.3 million tons less than what was reported for April 2018.

We are seeing significant drops in tonnage on oil country tubular goods (OCTG), hot rolled, coiled plate, cold rolled and cut-to-length plate. The two products of concern are galvanized, which is showing growth over May license data, and Galvalume, which has also increased market share compared to the previous month.

Semi-finished (slabs) continue close to the 12-month moving average.

Finished steels (total less semi’s) are running 700,000 net tons below last month’s rate.