Prices

June 14, 2018

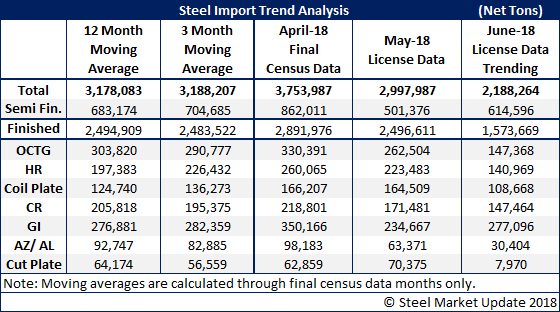

June Imports Trending Toward Low 2 Million Ton Month

Written by Brett Linton

Earlier this week, the Department of Commerce reported license data for the month of June 2018. Based on licenses through June 12, the trend is for June foreign steel imports to come in around 2.1 million net tons. If the pace of actual receipts matches the pace of the licenses seen so far this month, we believe steel imports will be 700,000 to 900,000 net tons lower than May and 1,500,000 tons lower than April 2018.

We are seeing significant reductions in finished steel imports, which are trending toward a 1.5 million to 1.6 million net ton month. This is down from 2.5 million tons in May and almost 2.9 million tons during the month of April.

Looking at individual products of importance to our flat rolled and plate readers, OCTG could be half what it was just a couple of months ago. OCTG is trending toward a 150,000 net ton month. Hot rolled, coiled plate, cold rolled, Galvalume and cut-to-length plate are all trending lower than one month earlier (May 2018).

The only product with a run rate at, or higher, than the previous month is galvanized. With the combination of the Section 232, AD/CVD and now a new circumvention case filed on CORE from Taiwan and Korea, the expectation is for these numbers to drop further in the coming months.