Prices

June 7, 2018

HRC Rally Explodes to New Highs On Trump Surprise

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Director of Risk Management, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

Last week’s decision by President Trump to remove tariff exclusions for Canada and Mexico shocked the steel market. Midwest HRC futures immediately responded trading to new highs and gaining between $40 and $60/st depending on the month.

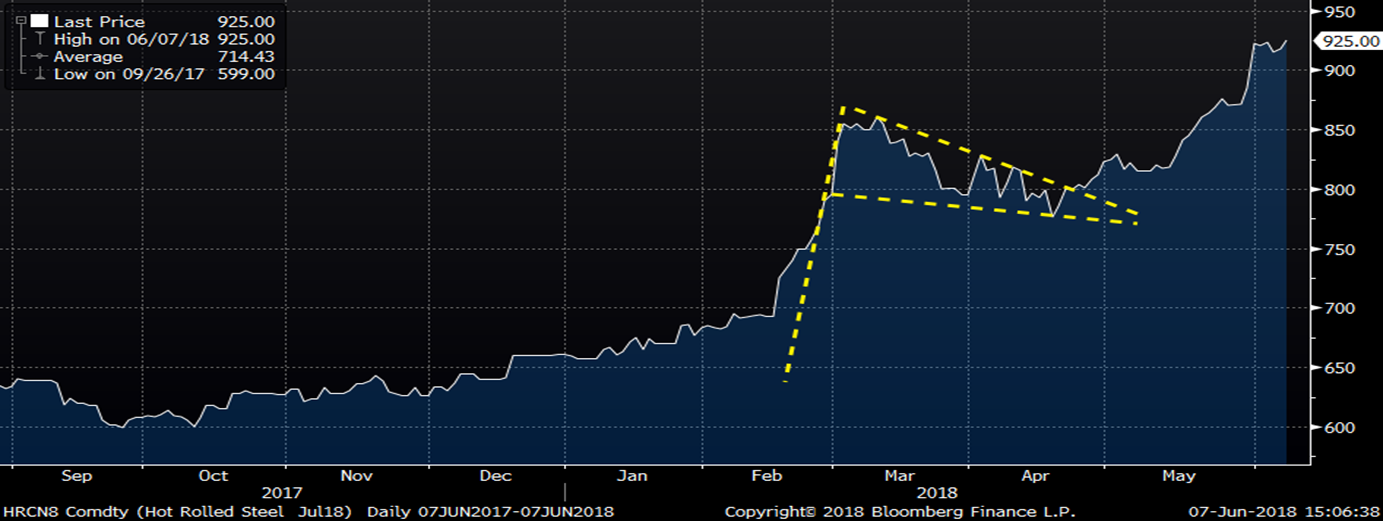

In the May 17th SMU edition of this article, HRC prices had broken out of a pennant pattern with the July future settling that day at $845. July futures traded as high as $930 today and have rallied $80 since May 17th.

July CME Midwest HRC Future

The Gary Cohn top (white line) is no more after last week’s explosive price action.

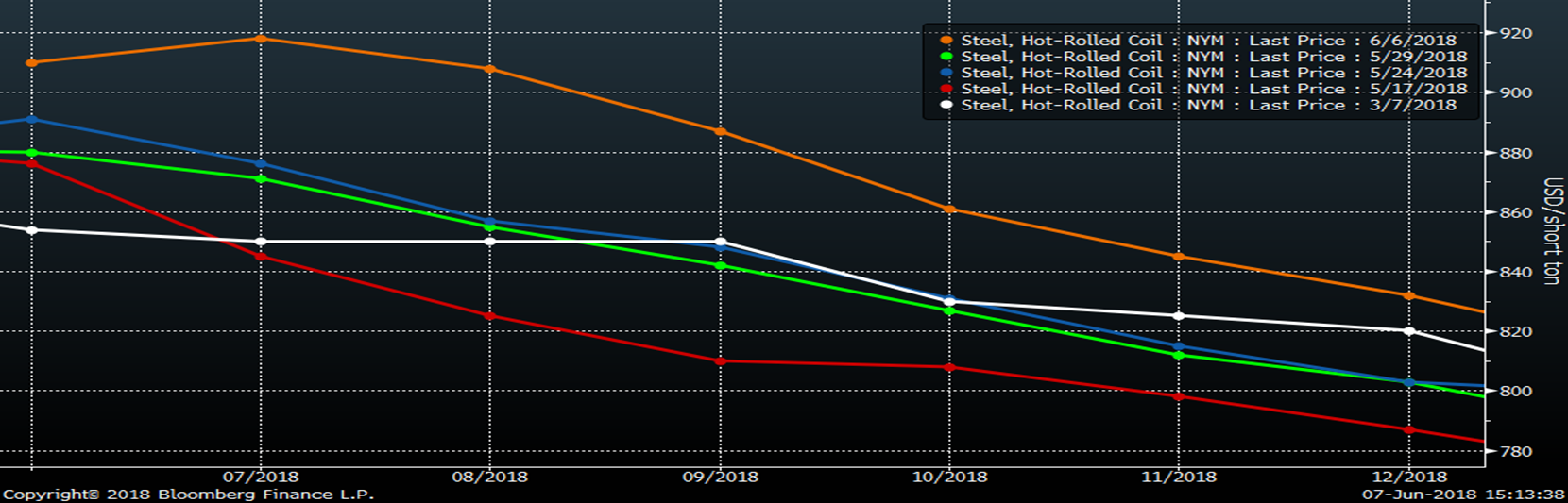

CME Midwest HRC Future Curve

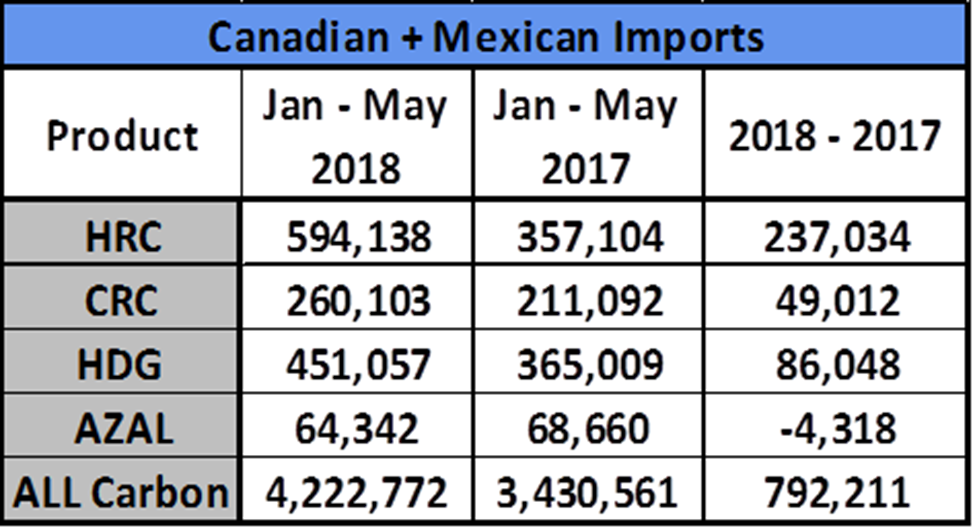

Last week’s development was unequivocally a shock to supply. In the past few months, domestic steel buyers became significantly more dependent on Canadian and Mexican steel imports excluded from tariffs as evidenced by the table below that compares short tons imported from Canada and Mexico into the US from January through May 2017 to tons imported during the same period in 2018. The YoY tonnage increase is shown in the right column with HRC imports up 66%.

Annualizing the 2018 Canadian and Mexican YTD imports equates to 1.43m short tons.

The Trump administration and Department of Commerce have been extremely clear and consistent with their message. They see long term damage to the steel industry, mostly from China’s breakneck growth in steel production capacity. Their time horizon is not over the past few quarters or years, but rather the past few decades of contraction in domestic steel mills. Their goal is to increase capacity utilization to 80%. Their method is to impose tariffs and negotiate with trade partners to get them to agree to quotas in order to take a proactive approach to protecting the industry (as opposed to the reactive trade case W.T.O. status quo). They have been consistently communicating their agenda for the steel industry since the election and have backed it up by taking actions consistent with this agenda since early 2017. Last week’s announcement was a clear message they are very serious about this issue. This week’s reading of the AISI steel capacity utilization rate of 74.9% remains far below their 80% goal.

Keep in mind that the president can implement any measures he wants under Section 232. At the end of Secretary Ross’s 232 findings and recommendations memo released in January, he included the following condition:

“Any exclusions granted could result in changed tariffs or quotas for the remaining products to maintain the overall effect”

That is, they can raise tariffs for other countries or products if they choose at any time.

If you are considering purchasing imported steel by calculating the cost of the metal, the duty and logistics to be lower than the cost of domestic tons, keep in mind you bear the risk that the duty you are using might end up being higher once the steel arrives.

DON’T FIGHT THE FED

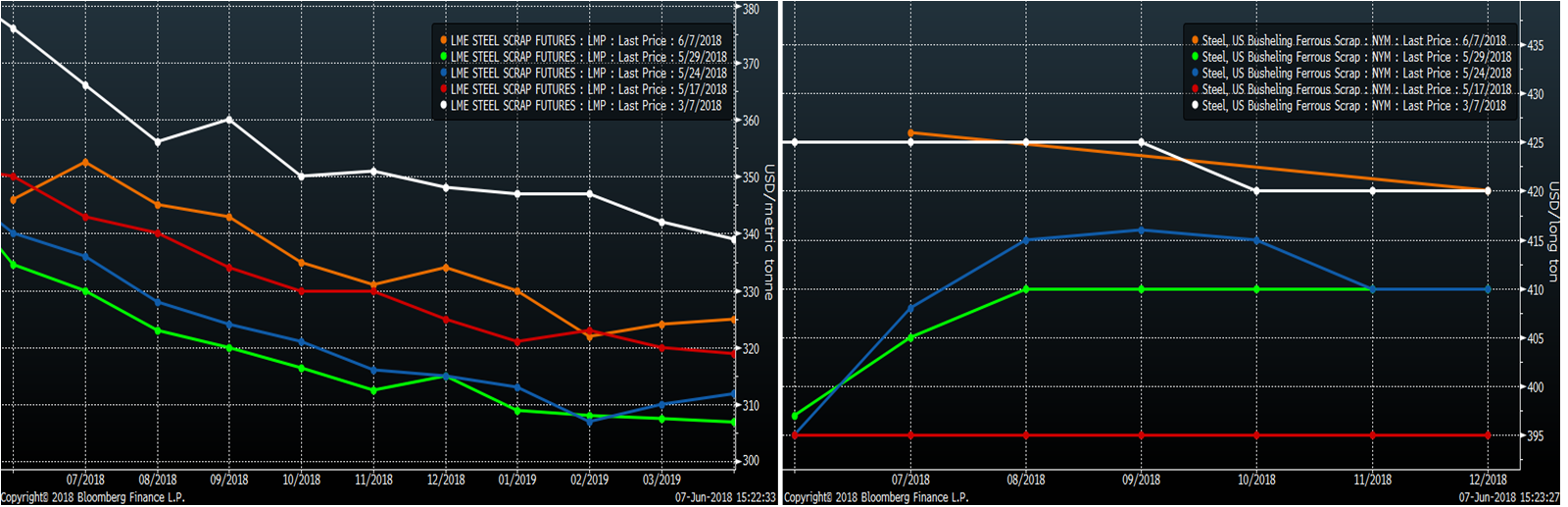

Scrap futures have gained over $20 since last Wednesday (prior to the announcement).

LME Turkish Scrap (left) & CME #1 Busheling (right) 2nd Month Rolling Futures

While the administration’s trade policy developments have dominated the attention of the domestic steel market, China has quietly stimulated their economy resulting in strong economic data and a rally in Chinese spot HRC and HRC futures prices.

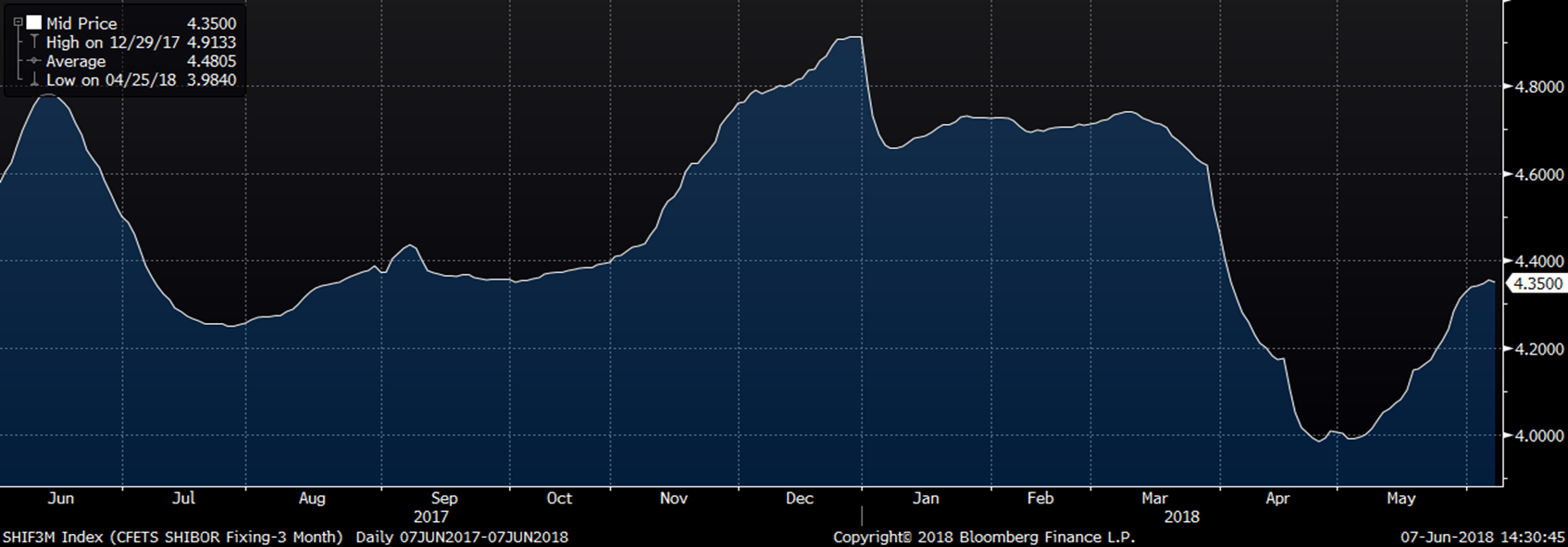

Starting in mid-March, China’s central bank pushed short term rates lower from 4.75% to 4%.

Shibor 3 Month Rate

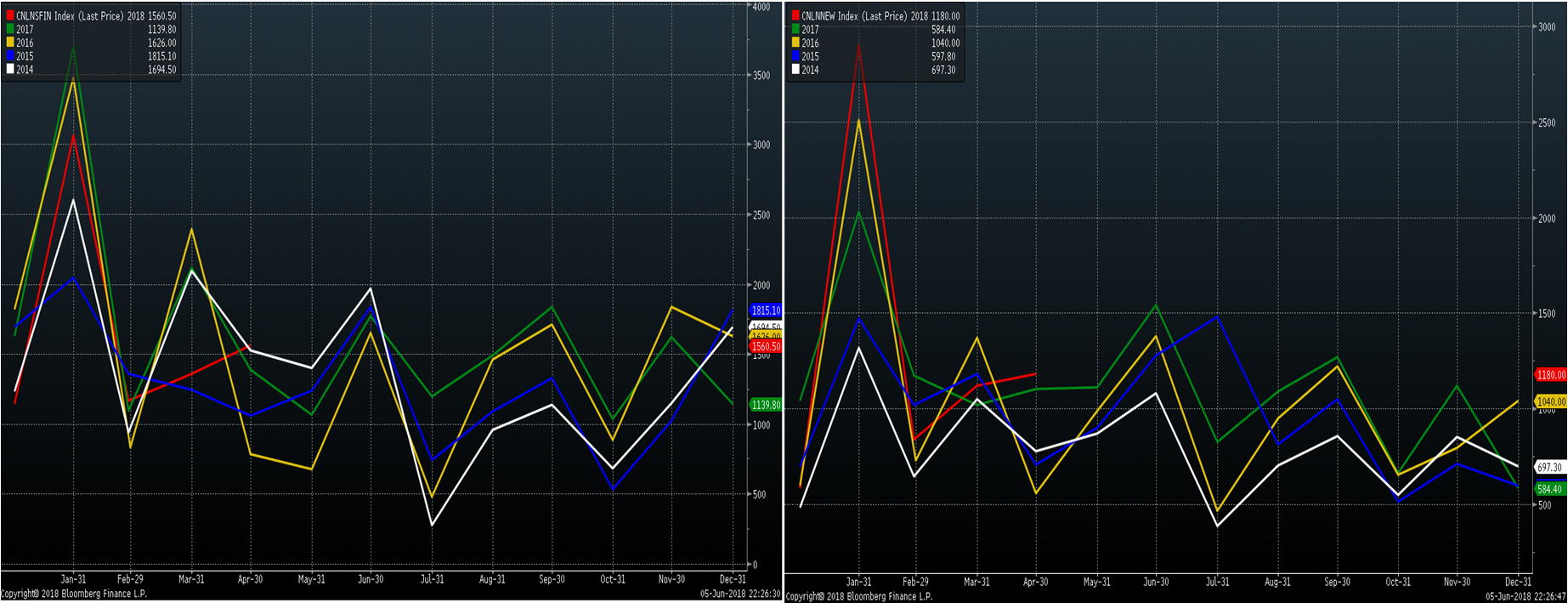

China’s April aggregate financing and new yuan loans were at the highest April level of the past five years. Strong aggregate financing and new yuan loans typically result in a boost to China’s industrial complex and real estate development.

Chinese Aggregate Financing & New Yuan Loans

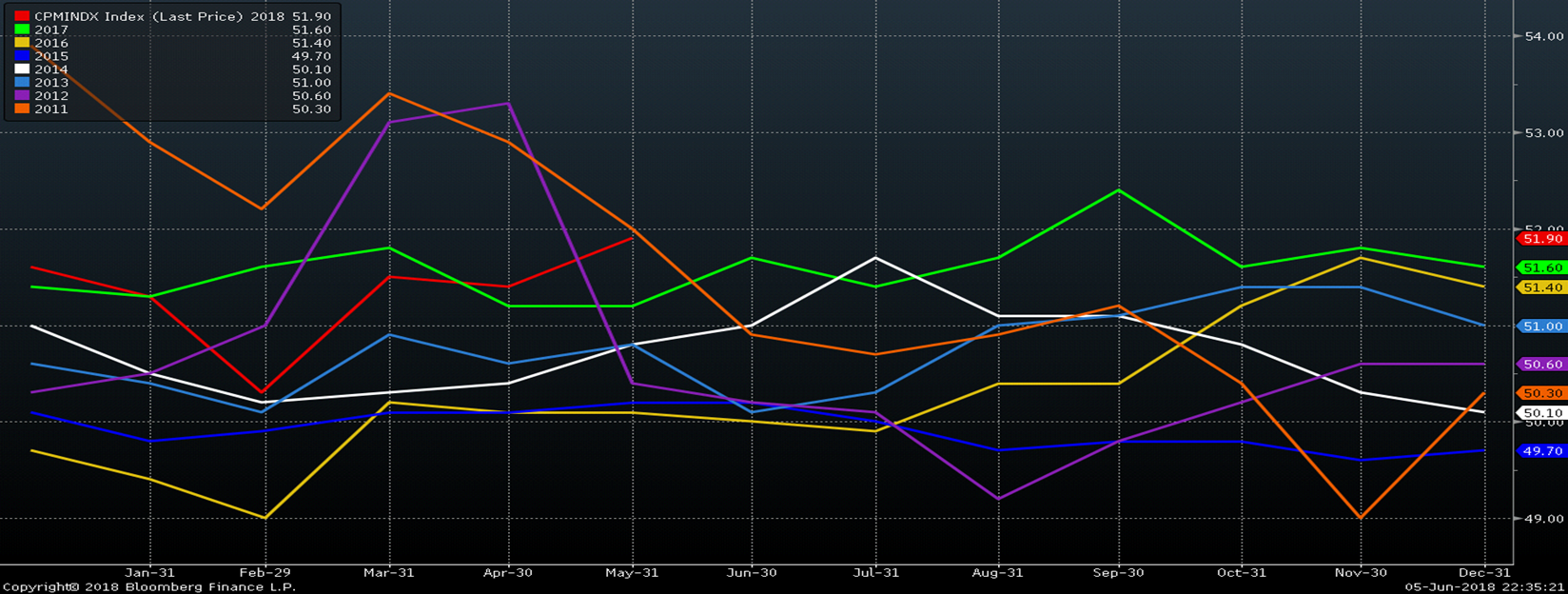

China’s official manufacturing PMI gained 0.5 points to 51.9 in May, its highest May level since 2011.

China Official Manufacturing PMIs

China’s domestic spot HRC price broke out of its recent range and above its resistance level to the highest level since January, 2013.

China Domestic Spot HRC Price USD/mt

The October Chinese HRC future continued to rally closing today at $618.58 since bottoming at $533 on March 26th, a 16% gain.

Shanghai Futures Exchange October HRC Futures USD/mt

The 2nd month SGX iron ore future closed today at 65.38 still remaining above its long term uptrend line.

SGX 2nd Month Iron Ore Future