Prices

June 7, 2018

Final April Steel Imports at 3.75 Million Net Tons

Written by Brett Linton

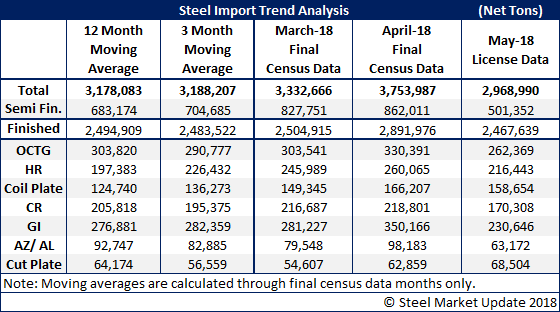

Final steel imports for the month of April were reported at 3,753,987 million net tons, according to the U.S. Department of Commerce data released yesterday. The last time import levels were this high was June 2017 with 3,923,126 tons. April imports are up 12.6 percent compared to the previous month, and up 12.0 percent compared to levels one year ago.

Semifinished imports (blooms, billets, and slabs) were up 4.1 percent over March to 862,011 tons. This is the highest monthly level since August 2017 when 910,171 tons were imported. Compared to the same month last year, semifinished imports were up 9.2 percent.

Finished imports (total products minus semifinished) totaled 2,891,976 tons in April, up 15.5 percent month over month and up 12.9 from April 2017. July 2017 was the last time we saw finished imports this high (2,896,410 tons).

Imports of oil country tubular goods (OCTG) were up 8.8 percent over March to 330,391 tons, down 5.6 percent compared to one year ago.

Hot rolled imports rose 5.7 percent to 260,065 tons, the highest level seen since July 2016 when 331,619 tons were imported. April was up 45.2 percent compared to the same month last year.

Cold rolled imports were flat at 218,801 tons, up 2.5 percent from one year ago.

Imports of galvanized products were 350,166 tons, up 24.5 percent from last month and up 6.0 from one year ago. This is the highest level seen since March 2015 when 365,492 tons were brought into the country.

Other metallic coated product imports rose 23.4 percent to 98,183 tons, down 8.5 percent from April 2017.

Imports of plate in coils were 166,207 tons, up 11.3 percent month over month and up 70.2 percent over the same month last year. July 2015 was the last time this much plate in coils was imported (191,016 tons).

Plates cut lengths imports rose 15.1 over March to 62,859 tons, up 30.7 percent from levels one year ago.

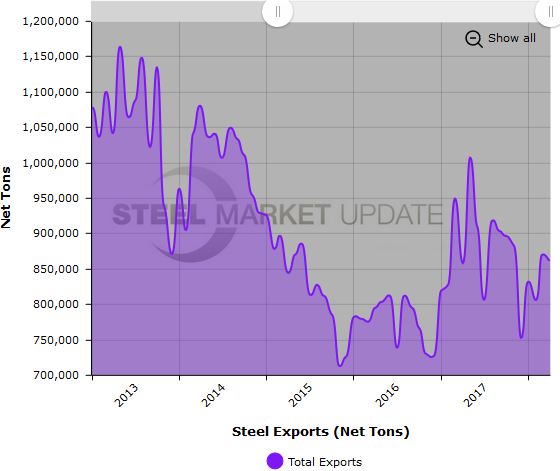

To see an interactive graphic of our steel imports history through final April data (example below), visit our website here. If you need any assistance logging in or navigating the site, contact us at info@SteelMarketUpdate.com or 800-432-3475.