Prices

May 31, 2018

May Imports Trending 1 Million Tons Down from April

Written by Brett Linton

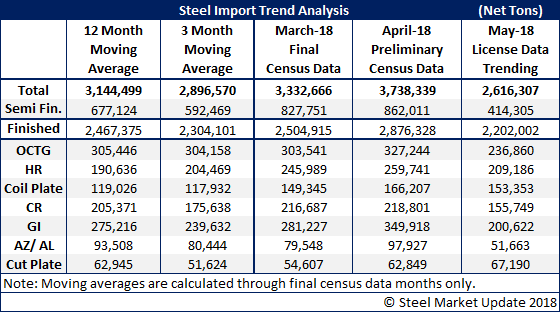

Based on the latest license data from the U.S. Department of Commerce reported earlier this week, we are expecting the trend for May steel imports to total approximatley 2.6 million net tons. That’s just over one million tons less than what was imported in April. We continue to see strength in coil and sheet plate imports. Finished imports are trending toward 2.2 million net tons, approximately 675,000 net tons less than April.

OCTG (oil country tubular goods), hot rolled, cold rolled, galvanized and Galvalume continue to trend lower than what we saw in April.

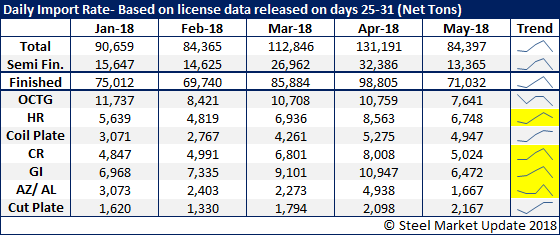

The table below shows the daily import rate based on license data collected between the 25th and 31st days of each month. Plate imports remain strong in May, but all other products listed are down considerably compared to April.