Mexico

May 17, 2018

HRC Futures: The Steel Shortage Is Coming!

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Director of Risk Management, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

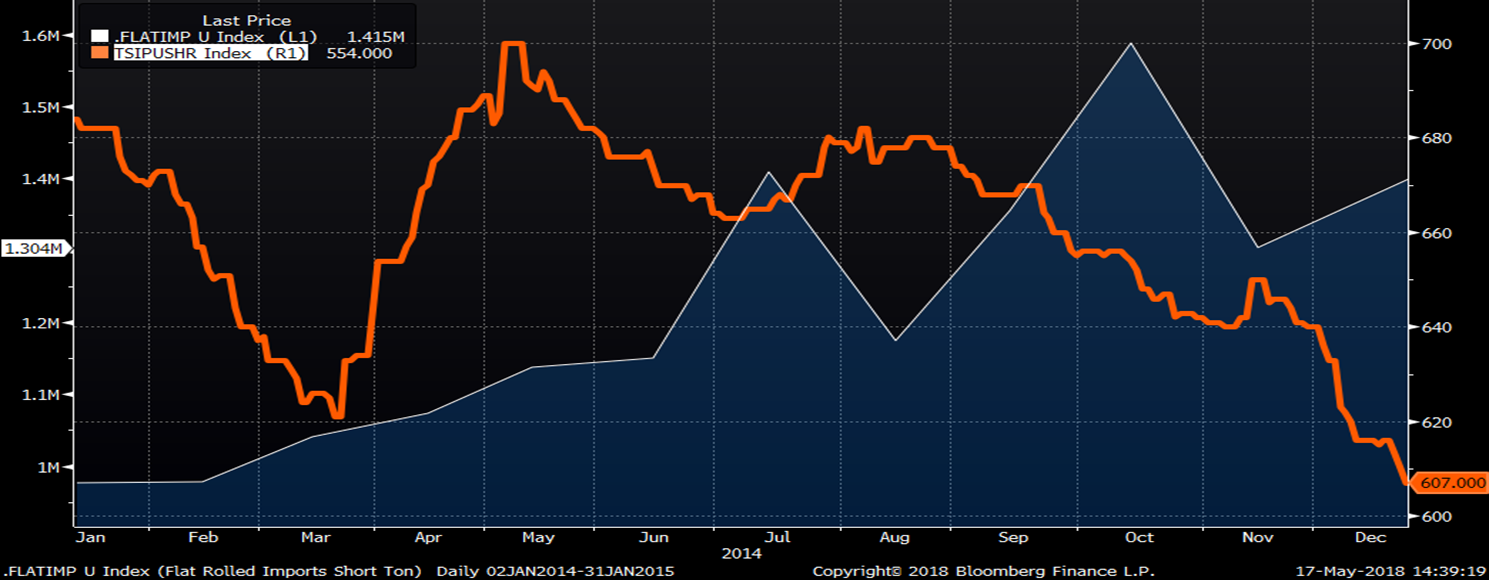

Do you remember 2014? In the first quarter, HRC prices fell from $680 to $630 until a number of domestic supply disruptions shook the market. First, in late February, a breakout incident at AK Steel Ashland resulted in an unplanned outage. Then in late March, a collector main pipe collapsed on the roof at U.S. Steel Great Lakes resulting in an unplanned outage. Last, the winter of 2014 was so harsh and so long that the Coast Guard ice cutters couldn’t safely clear a lane for the ore boats out of Lake Superior because the ice quickly refroze. This resulted in anemic ore inventory levels at Midwest mills, which sharply extended lead times overnight and slowed production. These incidents resulted in HRC prices rocketing higher with the TSI Daily index peaking at $700 in early May. This opened up an attractive import differential and imported steel began flooding U.S. shores starting in May and continuing all year. Despite the flood of imports, the lagged effect of these disruptions kept prices relatively elevated until Thanksgiving.

Flat Rolled Imports (white) & The TSI Daily Midwest HRC Index (orange)

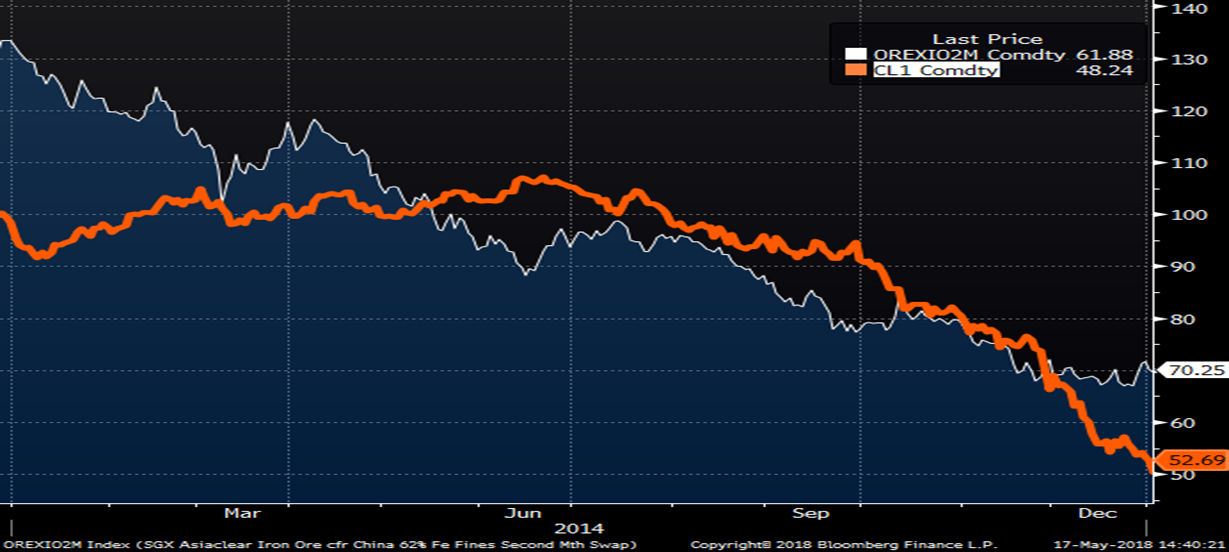

Moreover, HRC prices stayed elevated in spite of iron ore prices falling month after month to a cumulative 40 percent drop, while WTI crude prices fell from over $100/bbl in July to $75 at Thanksgiving before closing the year just above $50.

2nd Month Iron Ore & Front Month WTI Crude Oil

Flat rolled prices have exploded in 2018 due to tariffs and quotas. Domestic flat rolled steel production is running full. Actual flat rolled capacity utilization is not a data point that is tracked or known, but lead times (a proxy) are extended to almost two months for hot rolled, which leads to the assumption that the mills are running at maximum capacity.

In April, it was reported and then confirmed that a furnace at U.S. Steel Great Lakes needed maintenance and has not been operating at its full capacity. It was disclosed that the furnace was worse than was thought as it headed for a 50-60 day planned outage in July. U.S. Steel plans to make up for some of the lost production by ramping up a furnace at U.S. Steel Granite City. In addition to the Great Lakes furnace currently operating at less than 100 percent, an estimated 250k short tons of production will be lost during the Q3 planned outage, while the Granite City furnace is capable of 100k st/m. One analyst told me U.S. Steel is carefully and slowly ramping up Granite City and to expect only 50 percent of production in July. So the 250k st lost at Great Lakes will be mitigated by the approximately 150k st of production at Granite City, but still a net loss of production.

This week, Steel Dynamics announced it was purchasing CSN’s Terre Haute, Ind., cold mill and galvanizing line, which will divert some of SDI’s spot ton availability.

Last night, it was reported that Mexico’s Ahmsa announced it would advance scheduled maintenance following a controlled explosion in its blast oxygen furnace No. 2 on May 12.

Today, NLMK Pennsylvania suffered an unplanned outage and is rumored to be down for 10-14 days.

I’m no engineer, but it’s common sense that increased utilization rates result in higher incidents of supply disruptions. Take notice: domestic supply has been quietly decreasing due to the events listed above!

Further, May’s DOC import licenses look to fall significantly and this trend is expected to continue as orders for imports lag by 3-6 months, so orders from February and March will be coming through the pipe in May and June. If you recall, not only were there no new imports being placed in February and March due to the 232 chaos, but boats with imports were being turned around due to the uncertainty.

Upside risks are increasing, not decreasing

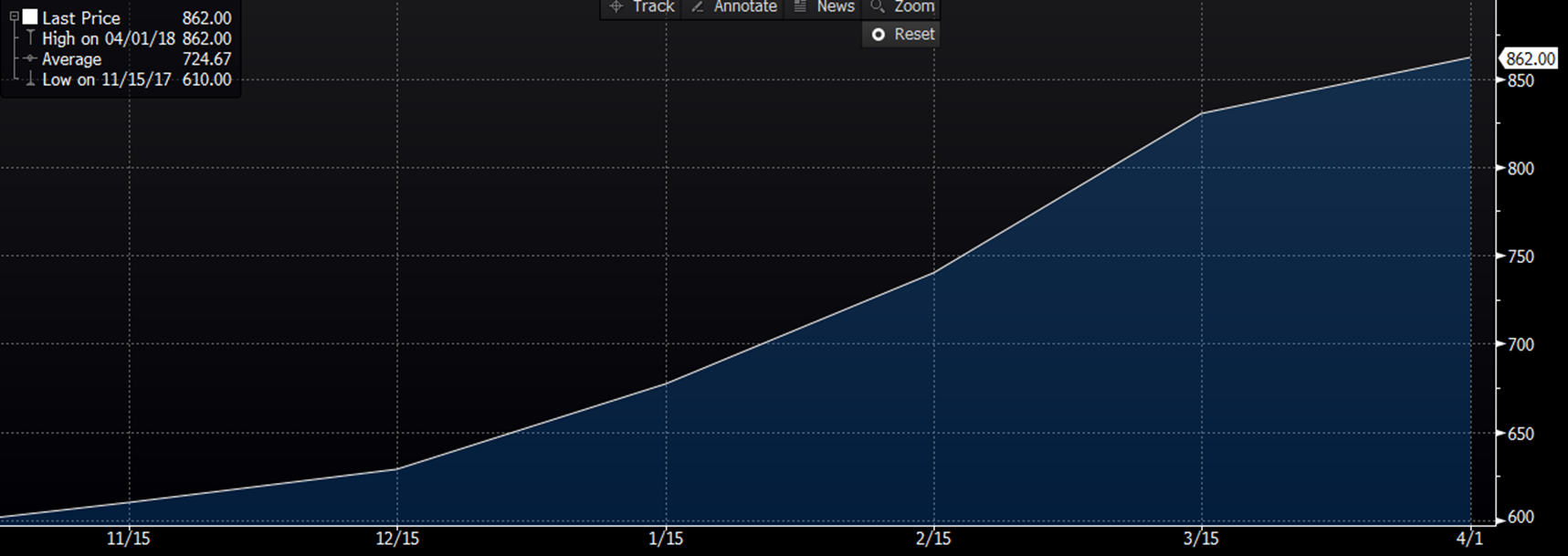

The CME Midwest HRC future settled at $830 in March, $862 in April and could settle in the $875 to $885 range in May. The sub-$800 metal has mostly been consumed and whether through spot or contract tons, steel buyers are starting to take in $800+ steel.

CME Midwest HRC Future Settlements

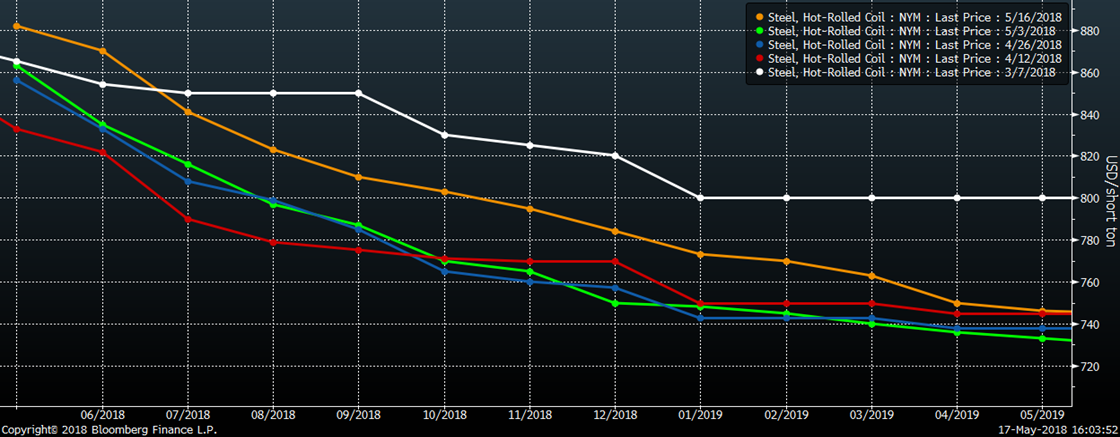

$800+ hot rolled is for real, and the fundamentals are pointing to these price levels sustaining for months to come with good odds of still even higher prices. Market participants are taking notice and have been bidding up second-half futures over the past couple weeks. The shape of the curve hasn’t changed much in past weeks with steep backwardation (downward sloping) and Q4 still at attractive levels. If June settles at $877 tonight, it will settle at a new high; however, the highest intraday trade for the June future was $895.

CME Midwest HRC Future Curve

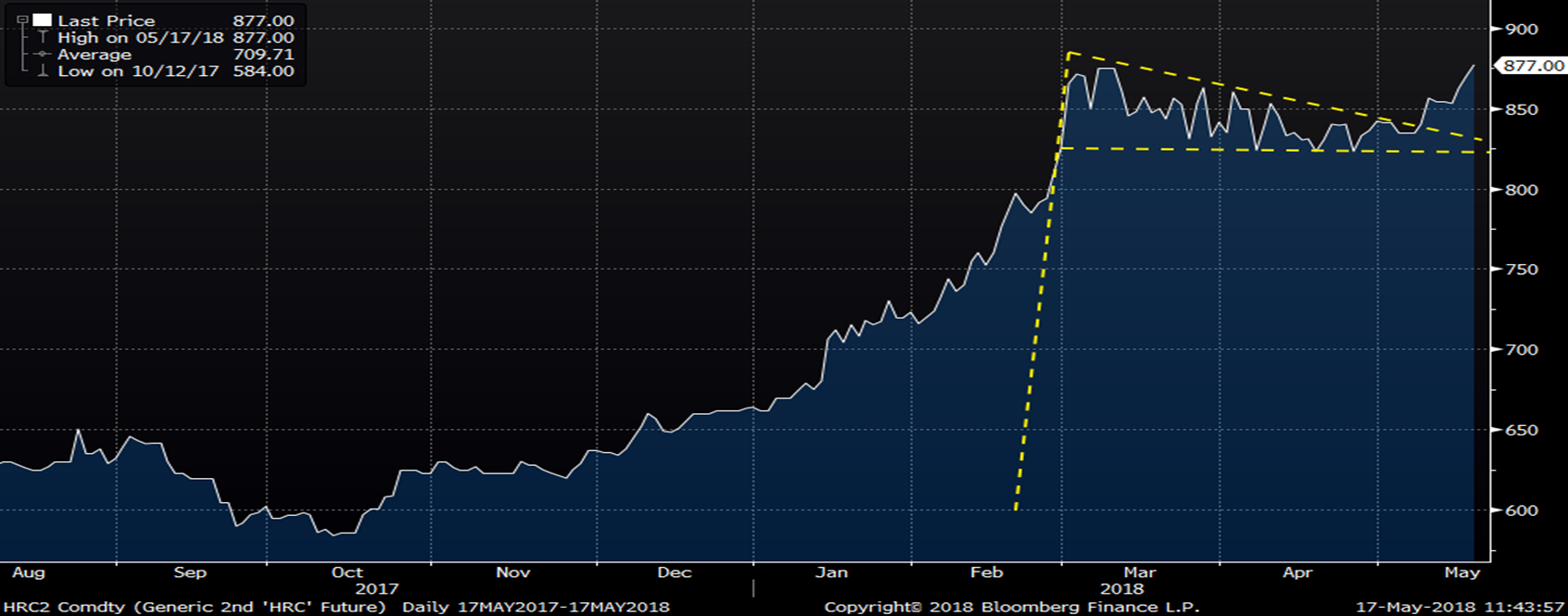

In the SMU article from May 3, it was shown that HRC futures broke out of a bullish “flag” formation. The chart below updates the chart as prices have continued to rally over the past two weeks with the June future gaining $42 to $877/st today.

June CME Midwest HRC Future

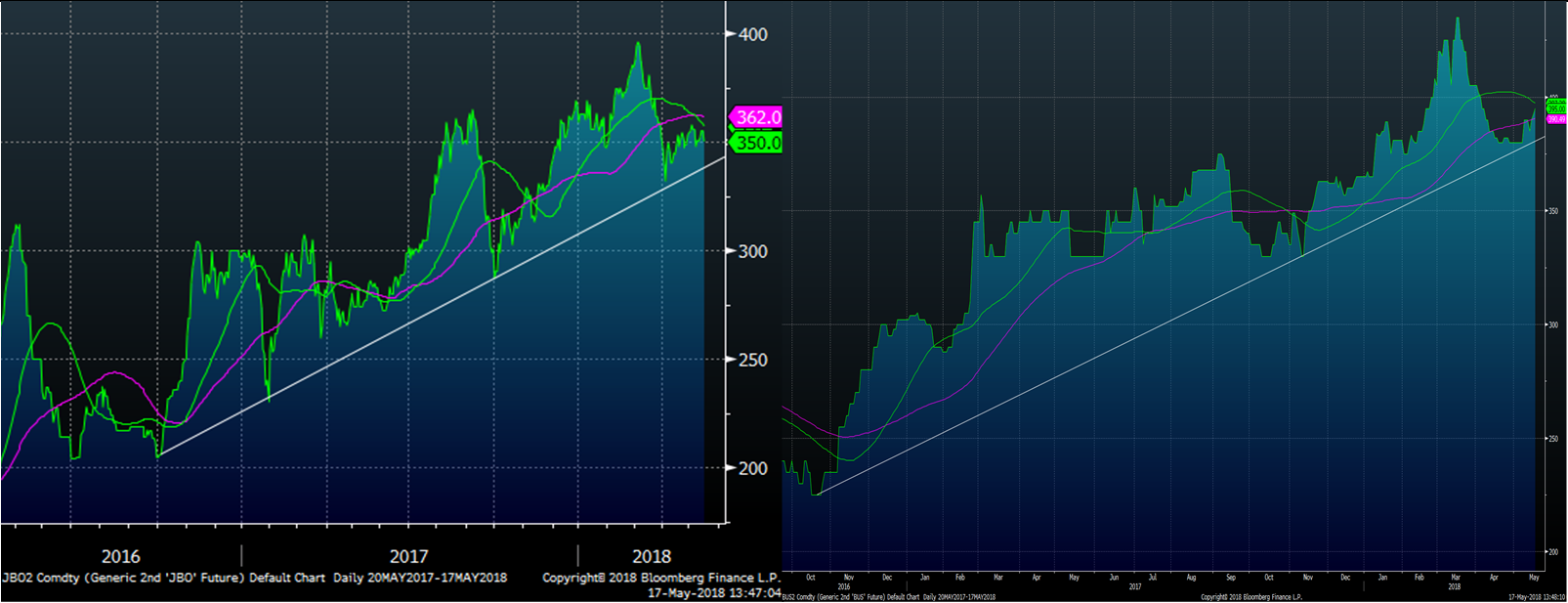

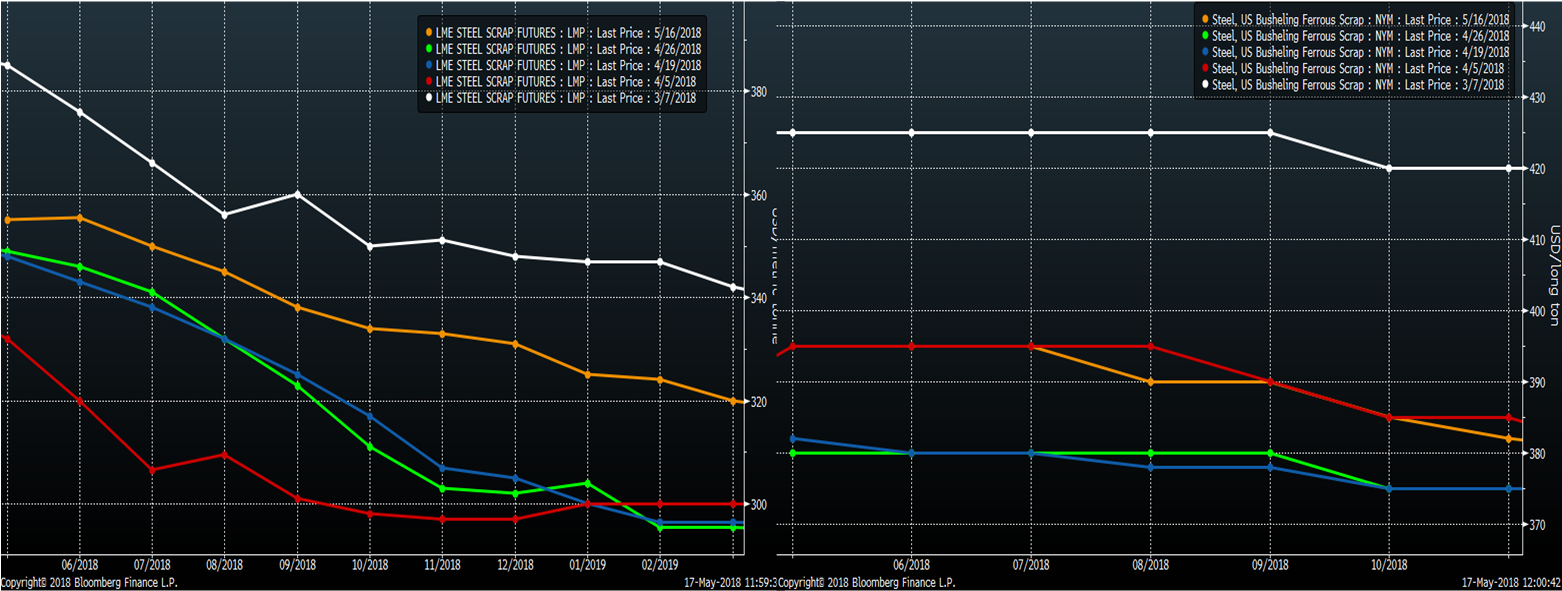

The June CME busheling future continues to trend higher, bouncing off its up trendline. The June LME Turkish scrap future has traded in the $350-$360 range this month.

LME Turkish Scrap (left) & CME #1 Busheling (right) 2nd Month Rolling Future

Both scrap futures remain below their March highs.

LME Turkish Scrap (left) & CME #1 Busheling (right) 2nd Month Rolling Future

Trading in iron ore futures has been quiet in recent weeks. The 2nd month future remains inside the triangle pattern. Continue to watch for it to break out of the triangle and for a sharp move in that direction to follow.

SGX 2nd Month Iron Ore Future

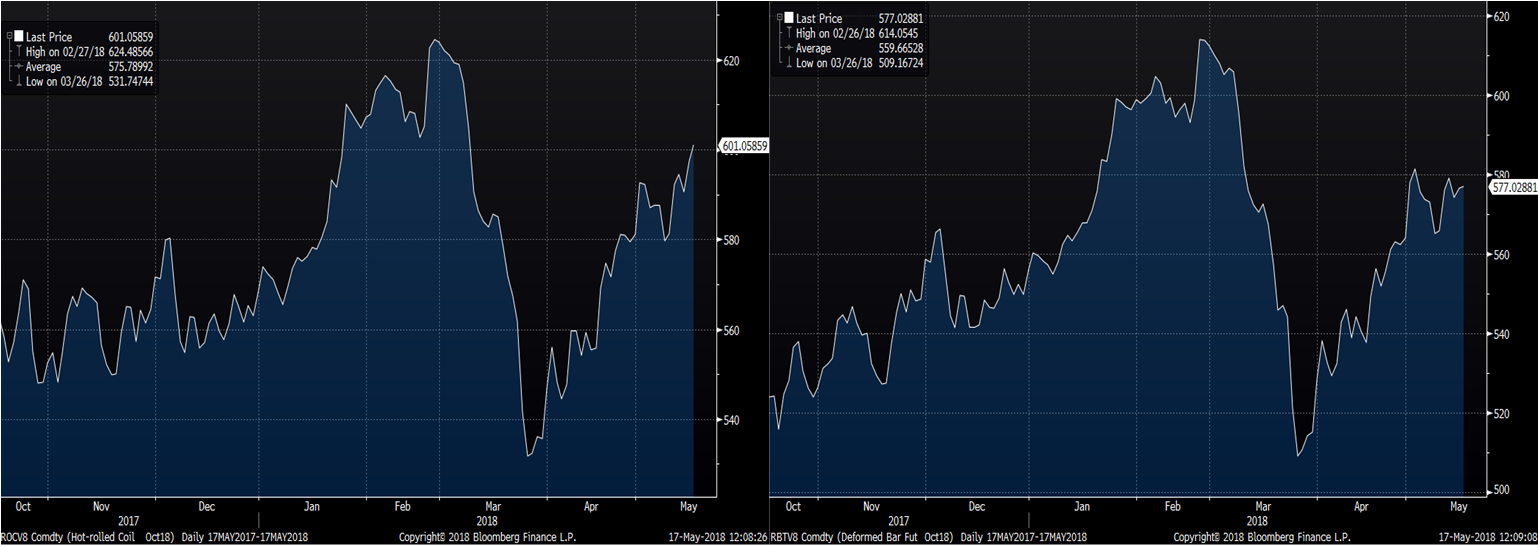

Chinese HRC continues to rally while rebar futures have been range bound with ore.

Shanghai Futures Exchange October HRC (left) and Rebar (right) Futures USD/mt

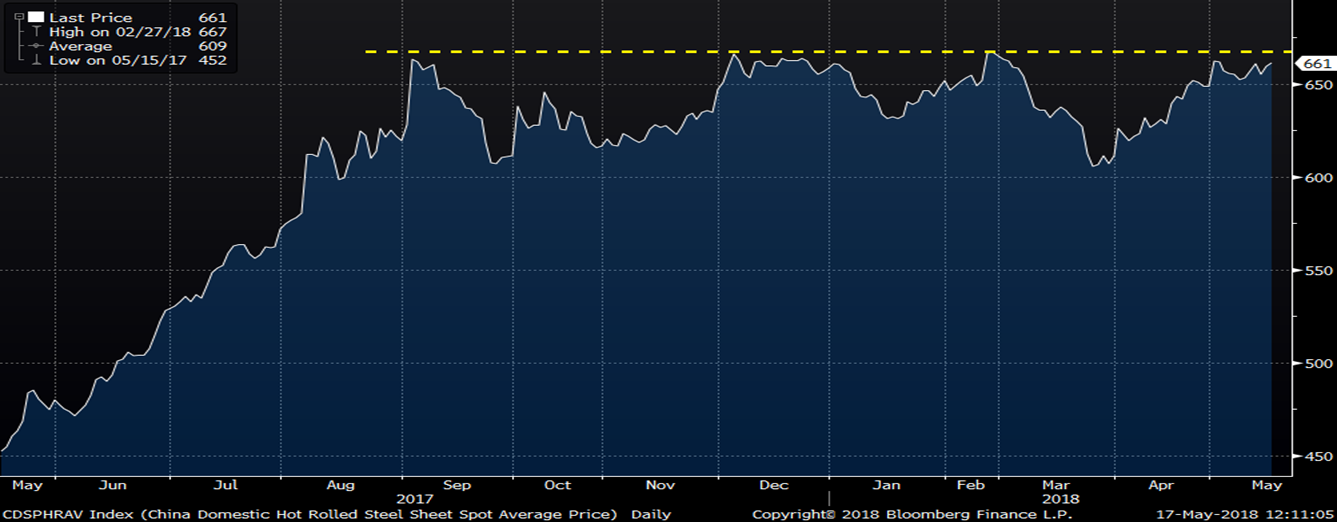

The Chinese domestic HRC spot price is on the cusp of failing or breaking above the resistance level seen below. If the price has enough strength to break above this resistance level, it could lead to a nice rally in Asian HRC prices, further tightening the U.S. import differential.

China Domestic HRC Spot Price USD/mt

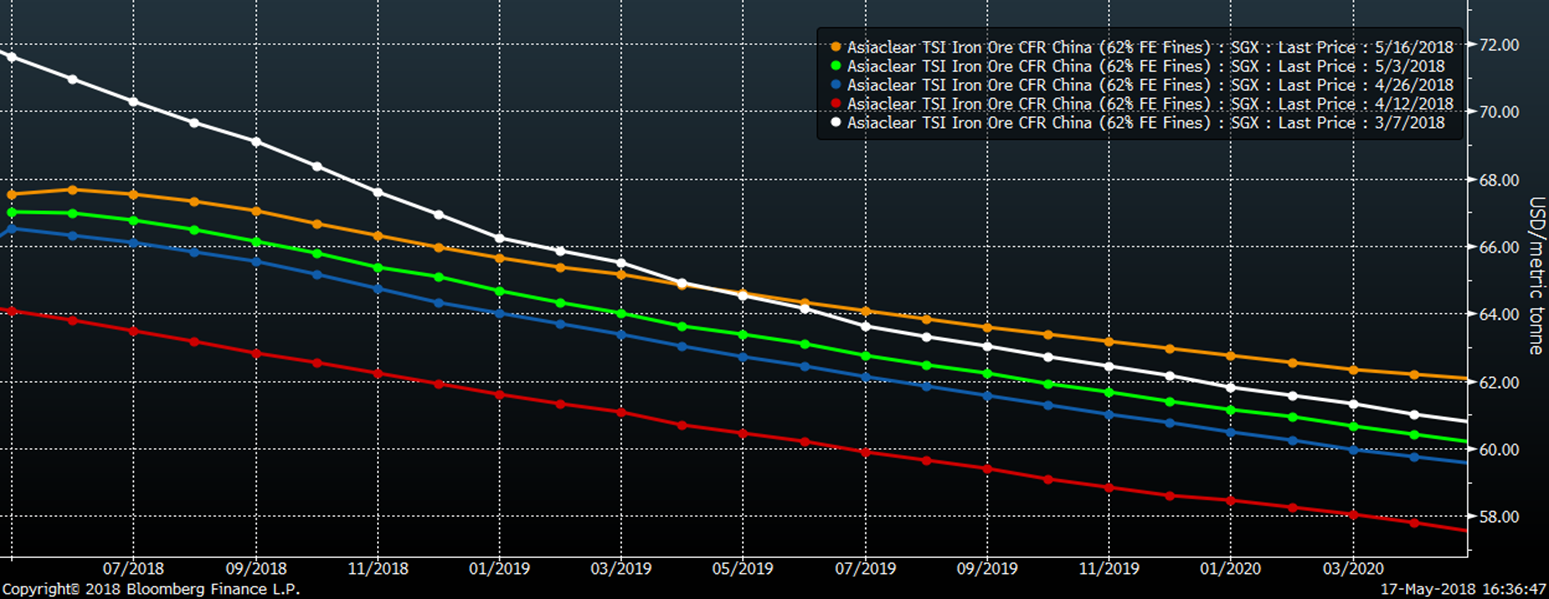

Below is the SGX iron ore futures curve, which has flattened noticeably in the past couple weeks.

SGX Iron Ore Future Curve