Prices

May 14, 2018

March Apparent Steel Supply at 3+ Year High

Written by Brett Linton

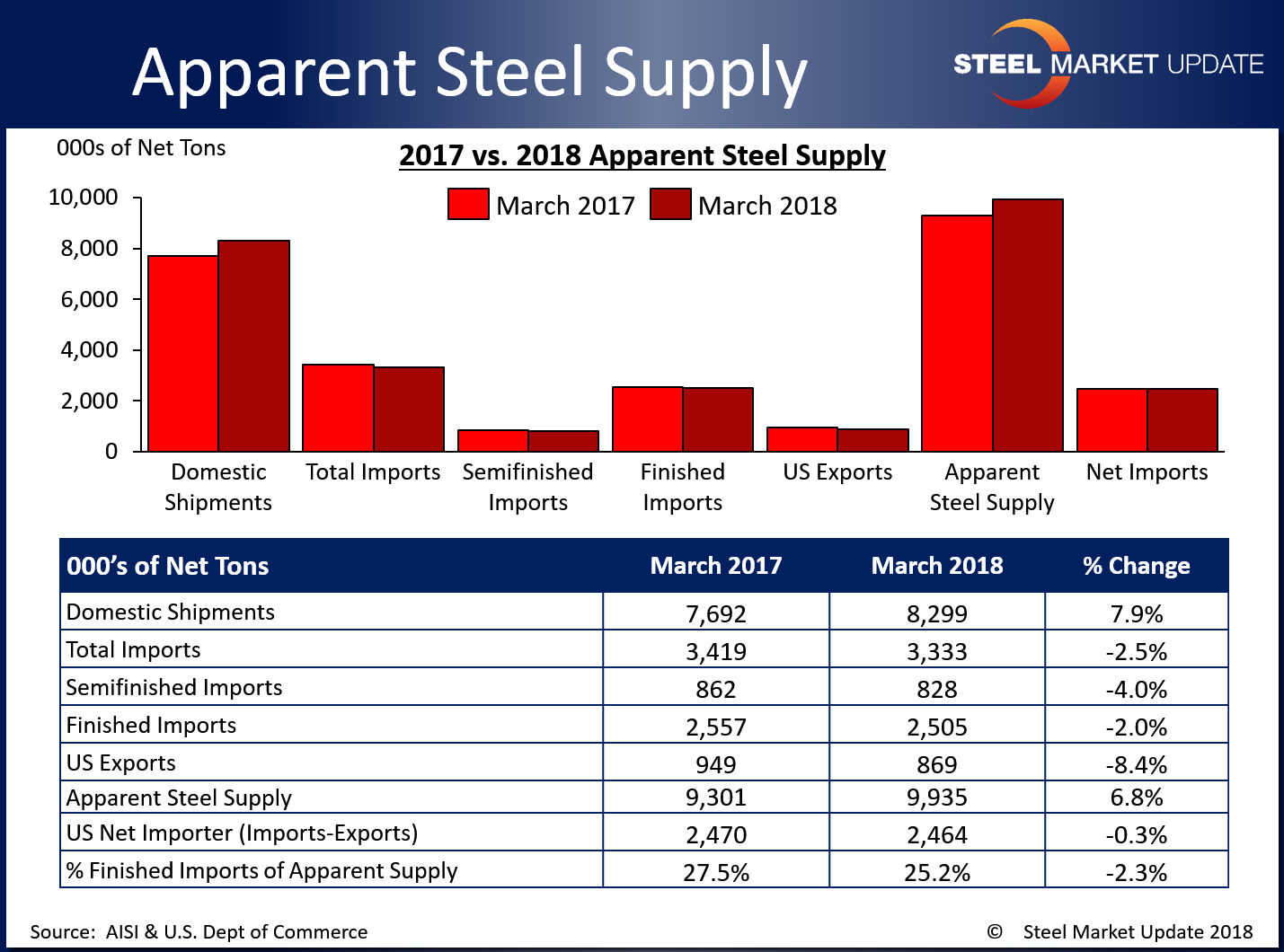

March apparent steel supply rose 13.2 percent over February to 9,935,479 net tons, according to the latest data from the U.S. Department of Commerce and the American Iron and Steel Institute. Apparent steel supply is calculated by adding domestic steel shipments and finished U.S. steel imports, then subtracting total U.S. steel exports.

This is the highest apparent steel supply level since January 2015 when it was 10,422,485 tons. At that time, domestic shipments were at 7,762,742 tons, finished imports were at 3,585,171 tons, and exports were at 925,428 tons.

March apparent steel supply saw a 634,761 ton or 6.8 percent increase compared to the same month one year ago. This change was primarily due to an increase in domestic shipments of 606,984 tons or 7.9 percent. Exports also fell 79,752 tons or 8.4 percent. A 51,975 ton or 2.0 percent decrease in finished imports lessened the overall rise in apparent steel supply.

The net trade balance between U.S. steel imports and exports was a surplus of 2,463,812 tons imported in March, a surge upwards from 1,672,615 tons from the prior month, but slightly down from 2,470,376 tons one year ago. Foreign steel imports accounted for 25.2 percent of apparent steel supply in March, up from 23.4 percent last month, but down from 27.5 percent one year ago.

Compared to the prior month when apparent steel supply was 8,773,912 tons, March supply rose by 1,161,567 tons or 13.2 percent. This was due to an increase in domestic shipments of 773,828 tons or 10.3 percent, and an increase in finished imports of 451,239 tons or 22.0 percent. Total exports rose 63,501 tons or 7.9 percent, slightly negating the overall increase in apparent steel supply.

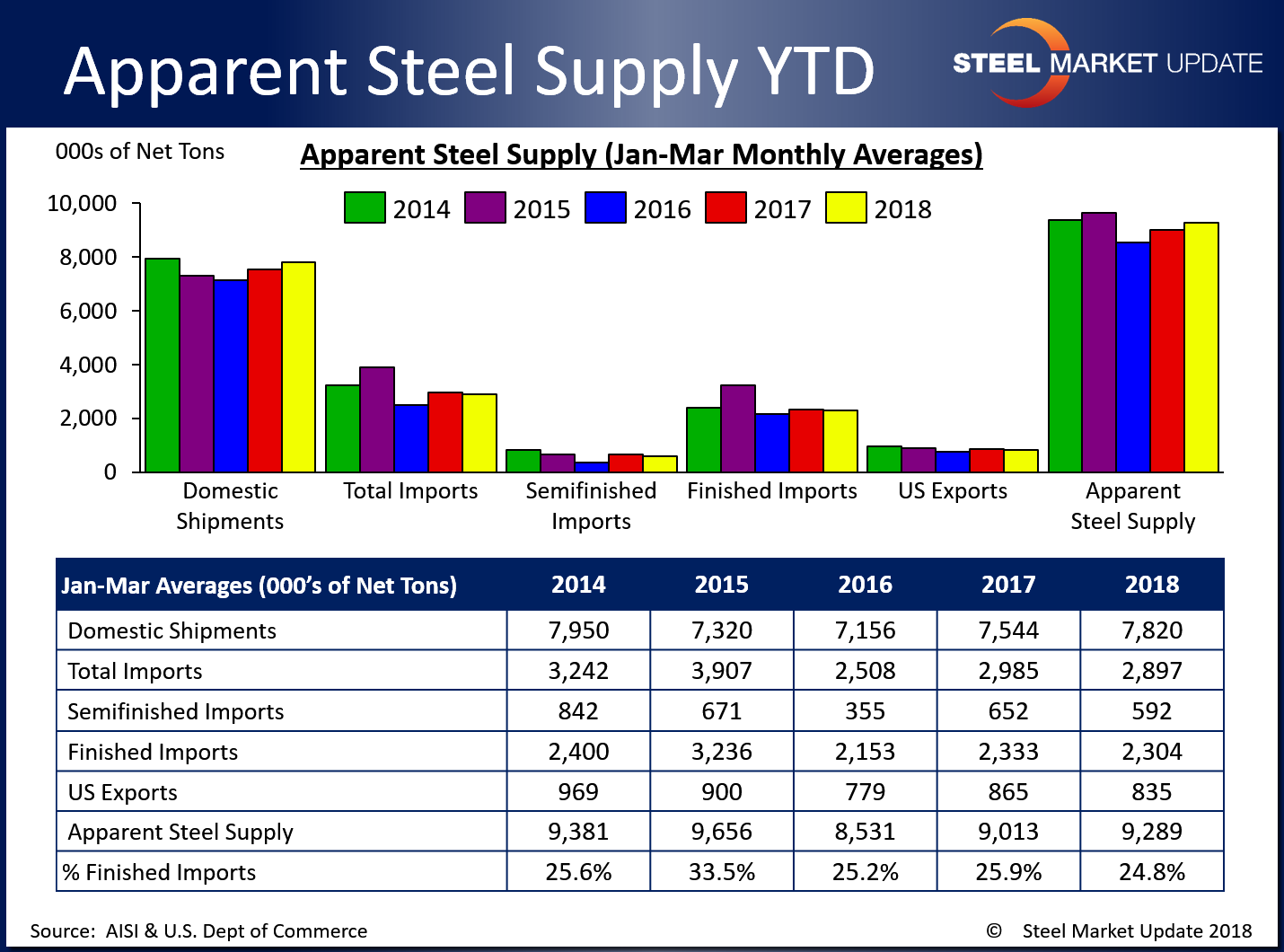

The table below shows year-to-date totals for each statistic over the last five years.

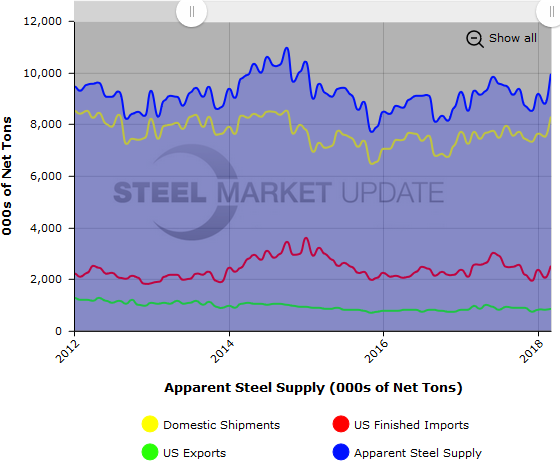

To see an interactive graphic of our Apparent Steel Supply history (example below), visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.