Prices

May 10, 2018

Hot Rolled Steel and Scrap Futures

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

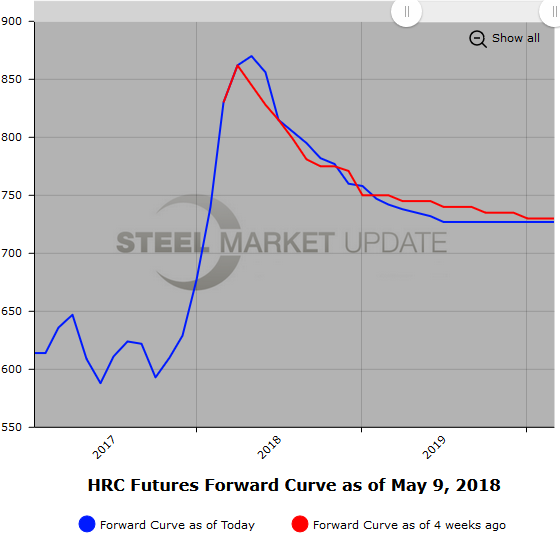

HR futures markets continue to adjust to the continually changing narrative on global trade. While flat rolled steel demand has remained fairly consistent, the market is having difficulty sorting out the supply side given our current adversarial import trading regime. Interestingly, the latest steel import data suggest potentially higher steel prices in the near future due to supply constraints, but the current shape of the futures curve reflects softer prices going forward.

Spot HR ($880/ST) has risen about $15 in the last two weeks, which has pushed the nearby futures month’s prices slightly higher. However, Jun’18 HR future still remains $24/ST lower than spot. ( May 9th CME settlement Jun’18 HR $856/ST) Q3’18 HR and Q4’18 HR have also firmed slightly last settling at $805/ST and $773/ST as of Wednesday, May 8. The backwardated slope of the futures curve continues to get steeper. For example, the spread between Jun’18 HR versus Sep’18 HR for the period May 1 to May 9 has widened by $17/ST from $44 back to $61 back. (CME settlements – May 1: $841 Jun’18 minus $797 Sep’18; May 9 $856 Jun’18 minus $795 Sep’18)

To highlight this point even further, we can take the April 9 settlements for the Jun’18 HR vs Dec’18 HR spread ($815 – $767) or $48 back and compare that to the settlements for May 9 Jun’18 HR vs Dec’18 HR spread ($856 – $760) or $96 back. The spread has doubled in the last month. On balance, most of the movement in the spread has occurred on the front legs of the calendar spreads with just slight declines in the far date periods.

We have seen a recent increase in inquires for offers as prices have bounced off a technical support point, but are more likely driven by expectations of declining HR imports. Another issue which will potentially impact futures interests are the upcoming summer and early fall mill furloughs for maintenance and repairs.

May HR futures volume month to date in just shy of 48,000 ST, slightly off the recent trading volumes.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

Scrap

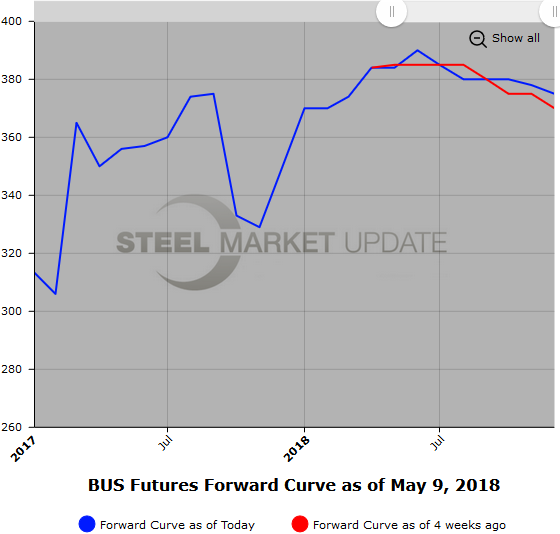

May BUS prices look to be unchanged compared to April 2018 ($384/GT). Initial expectations were for BUS to decline by about $10/GT, but late purchases at unchanged prices surprised. Potential logistics issues and light deliveries, as well as expectations for extra demand due to dropping imports, has helped buoy prime scrap prices. Nearby BUS futures prices have firmed $5-$10/GT on changing sentiment around spot. Latest Jun’18 BUS $390/$395 per GT and latest 2H’18 BUS $380/$400 per GT.

80/20 Scrap SC futures have retraced just slightly since last week with May’18 and Jun’18 off about $5 and the rest of the curve basically unchanged.

USSQ U.S. Midwest Shred futures curve has remained relatively flat hovering just above the mid $365/GT range. Trading has been limited with scrap prices reportedly off about $10/GT from April.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

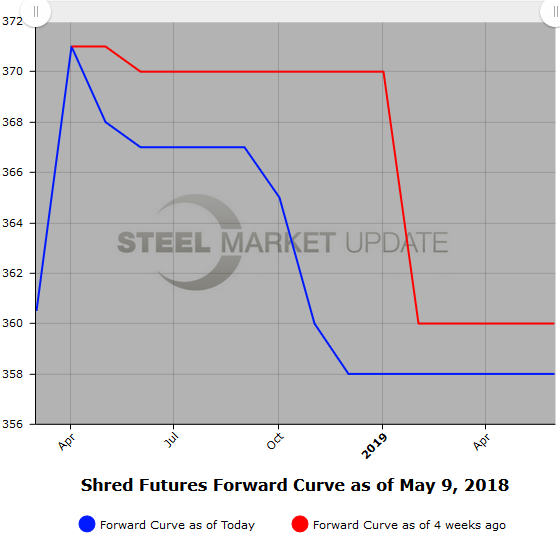

We have started tracking shredded scrap futures, shown below. Once we have built a sizeable database, we will add this data to our website.