Prices

April 23, 2018

Raw Material Prices: Scrap, Zinc, Iron Ore, Coke

Written by Peter Wright

The prices of scrap and iron ore advanced in April, but coking coal and zinc declined.

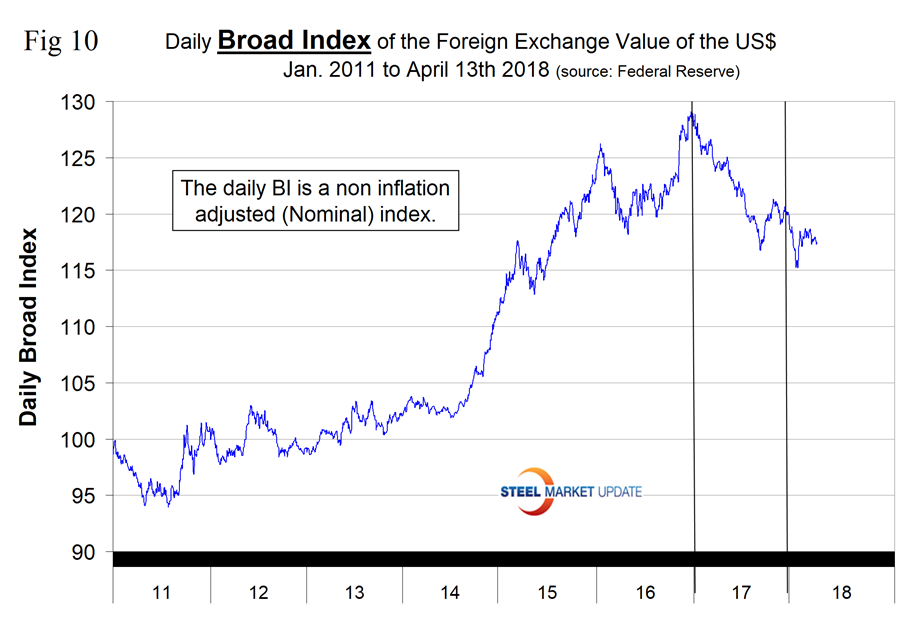

To put the raw materials analysis into perspective, Figure 1 shows the spread between Chicago #1 busheling and hot rolled coil ex works Indiana through April 13, both in dollars per net ton. The spread at $538.50 is now higher than at any time since the bubble of Q3 2008 and has increased every month since September 2017 when it stood at $278.48.

Scrap

Figure 2 shows the relationship between shredded and #1 busheling, both priced in Chicago. In April, shredded was $380.00 per gross ton, up from $275.00 in November 2017. Busheling was unchanged in January, February and March before rising $10 to $385 in April. The busheling premium was $5.00 in April, down from $77.50 in September last year.

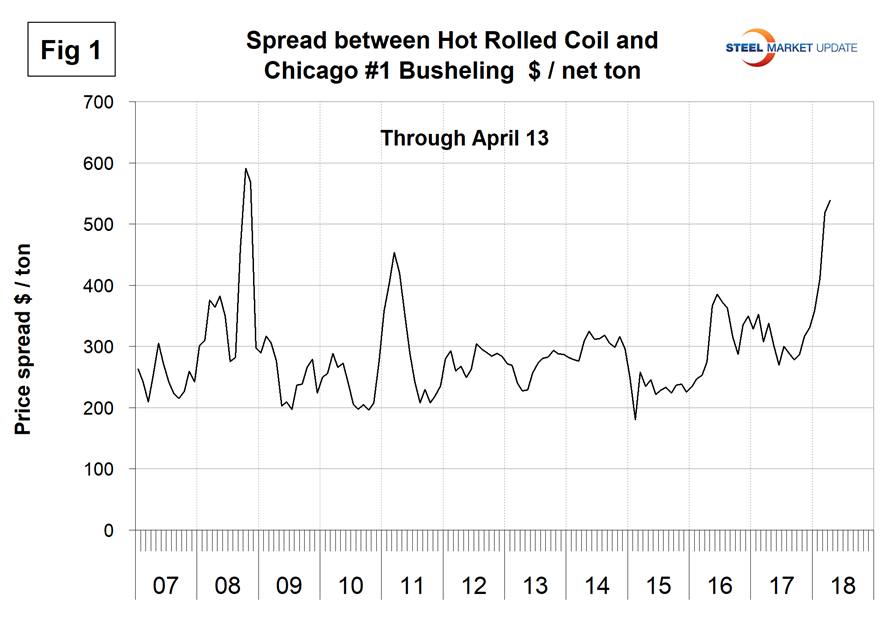

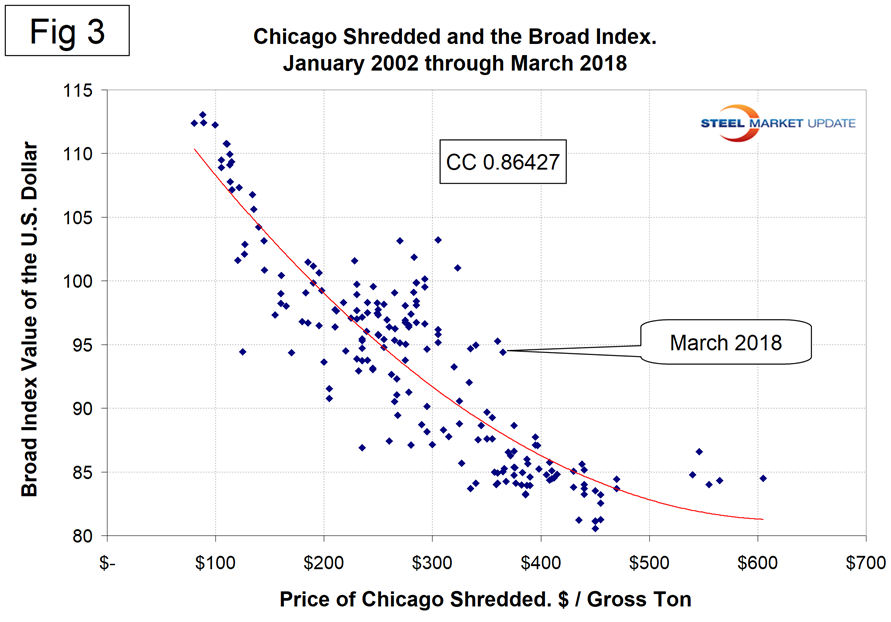

Figure 3 is a scatter gram of the price of Chicago shredded and the Broad Index value of the U.S. dollar as reported by the Federal Reserve. The latest data for the Broad Index was March. This is a causal relationship with a correlation of over 86 percent.

Iron Ore

Global iron ore miners have turned off the tap on adding new production capacity to feed China’s steel mills as the world’s largest customer is already awash with supplies, according to Fortescue Metals Group Ltd. “The reality is that most of the producers, ourselves included, are not actually looking to grow supply of iron ore into China,” Fortescue Chief Executive Officer Elizabeth Gaines said in a Bloomberg TV interview. “The market is very well supplied and the build-up of inventory at the ports is an indication of that. Nobody is looking at adding new supply into the market.”

Australia, the world’s largest iron ore exporter, delivered a mixed message Monday on the outlook, raising near-term price forecasts, but combined that revision with a more somber message that China’s gargantuan imports are set to level off as their steel production eases in the coming years.

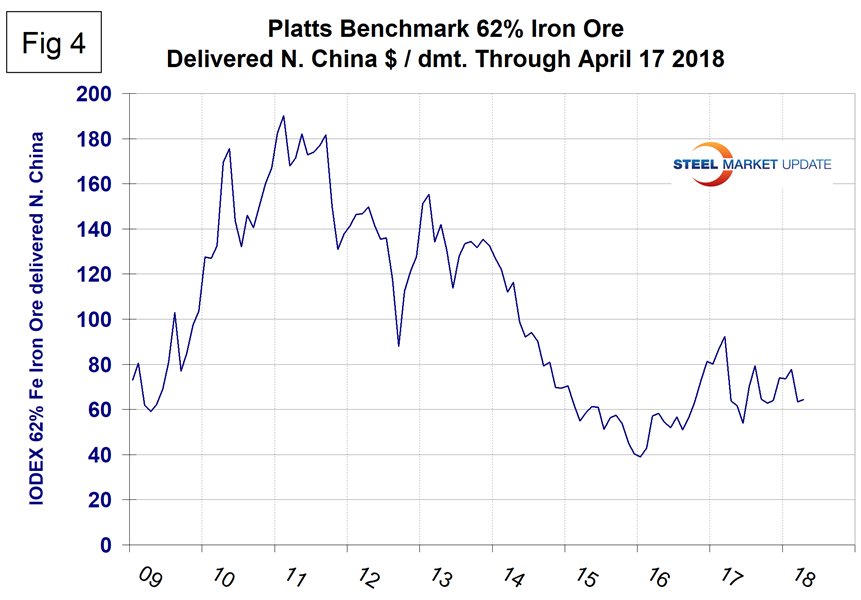

Figure 4 shows the Platts IODEX of 62% Fe delivered North China since January 2009. The Index recovered to $92.30 on March 17, 2017, but had declined to $64.45 on April 17, 2018.

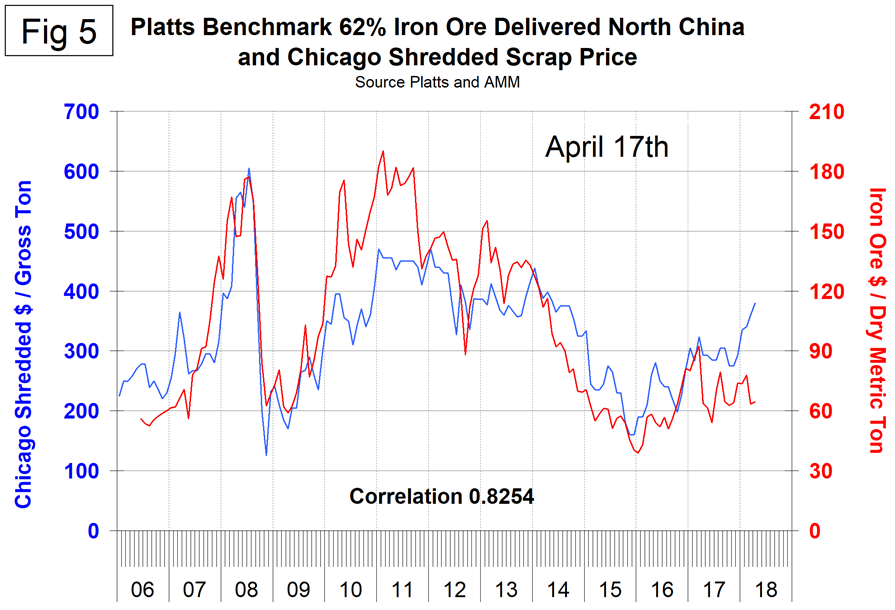

There is a long-term relationship between the prices of iron ore and scrap. Figure 5 shows the IODEX and the price of Chicago shredded through April 17. The correlation since January 2006 has been 82.54 percent. In the last 10 years, scrap in dollars per gross ton has been on average 3.4 times as expensive as ore in dollars per dry metric ton (dmt). The ratio has been erratic since mid-2014, but overall since then has benefited the integrated producers.

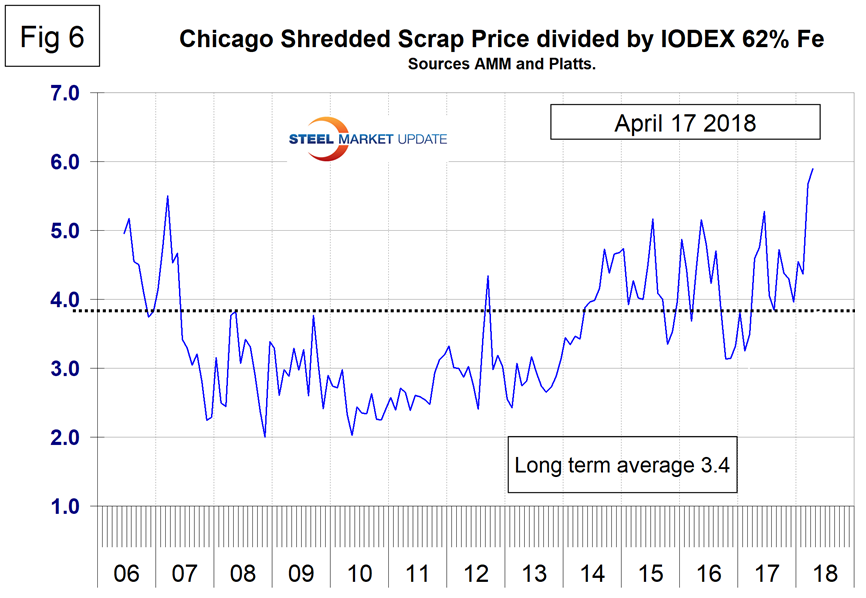

In April, the ratio at 5.90 is the highest since our data stream began in January 2006 (Figure 6). Since Chinese steel manufacture is 95 percent BOF, this ratio has allowed them to be more competitive on the global steel market. In the last four years, there have been times when China could supply semi-finished to the global market at prices competitive with scrap.

Coking Coal

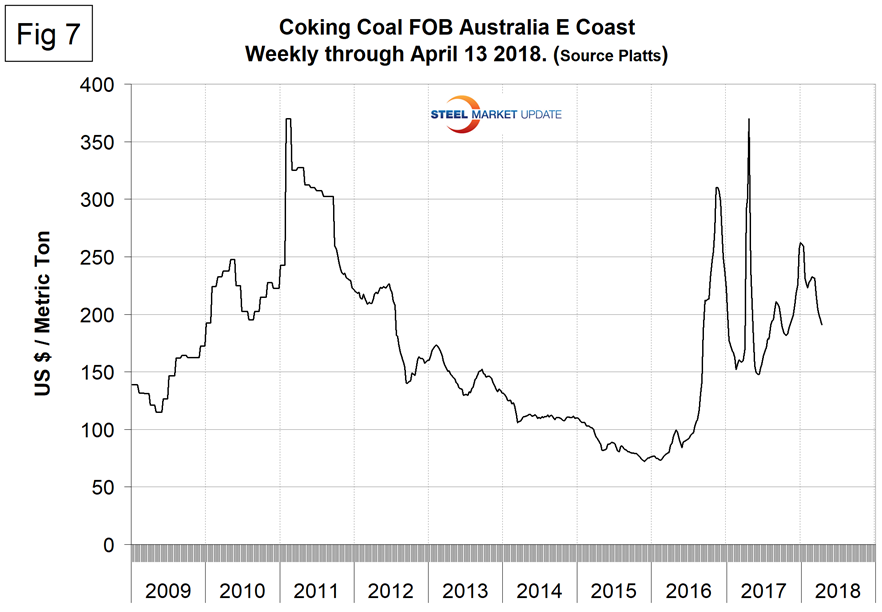

Coking coal prices have been highly erratic in the last 18 months. From mid-October 2017 to the end of December 2017, premium hard low volatile coking coal prices rose from $181.50 per metric ton to $262.25 FOB Australia’s East Coast (Figure 7). Since then the price has declined to $191.00 on April 13.

Zinc

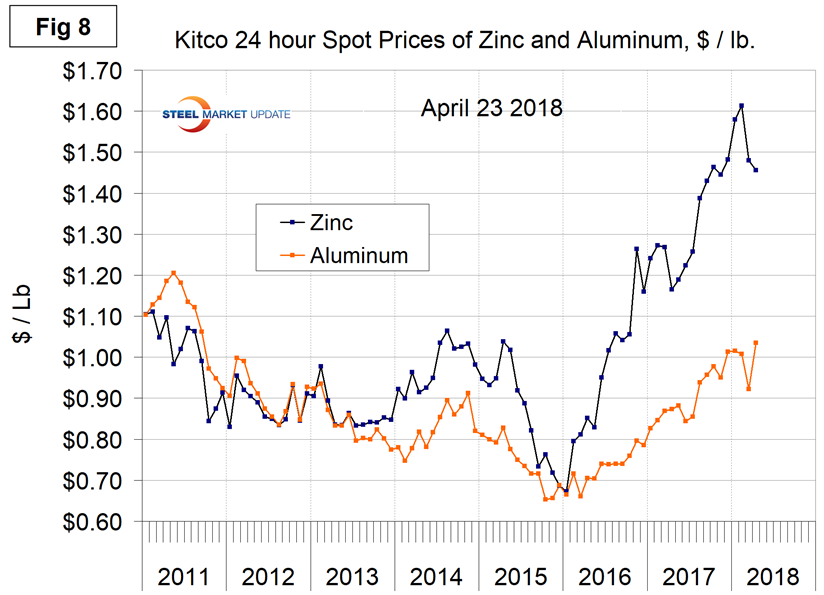

Kitco publishes a daily spot price of zinc, which we have transcribed to Figure 8. Just as a point of reference, we have included aluminum in the same graph.

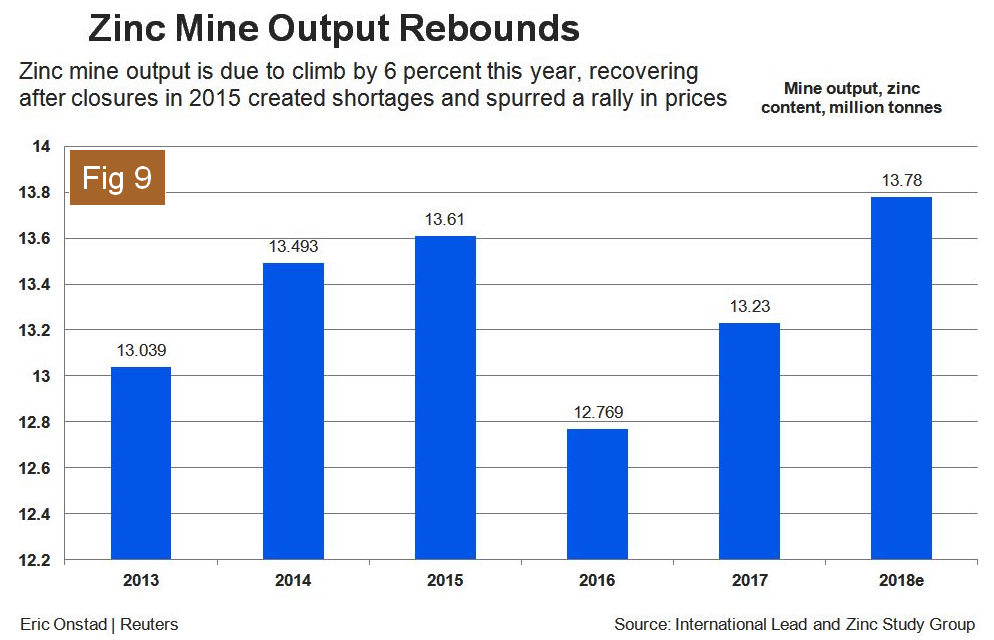

On March 29, Reuters reported that shortages of zinc after the closures in 2015 sent benchmark zinc metal prices on the London Metal Exchange soaring by 29 percent last year and they touched the highest point in over a decade at $3,595.50 per metric ton last month. Since then, however, prices have slumped while inventories of metal on the LME and Shanghai Futures Exchange have climbed. While the industry consensus is for weaker prices next year, some analysts such as Max Layton at Citi expect one last burst of strength. “Zinc bull markets like this in the past haven’t lasted and this one won’t last,” Layton told the zinc conference, saying a final surge would take LME zinc to around $3,800-$4,000 a ton in the next several months, but then it would slump to around $2,500 in the coming years. “The zinc price in the next three to six months is the best we’re going to see for the next three to five years.” Figure 9 shows the global production from zinc mines since 2013 with an estimate for 2018.

Zinc is the fourth most widely used metal in the world after iron, aluminum and copper. Its primary uses are 60 percent for galvanizing steel, 15 percent for zinc-based die castings and about 14 percent in the production of brass and bronze alloys.

SMU Comment: There is an inverse relationship between commodity prices and the value of the U.S. dollar on the global currency markets. Since its recent peak on Jan. 3, 2017, the dollar has weakened by 8.9 percent and in 2018 is down by 1.0 percent through April 13 (Figure 10). A weakening dollar puts upward pressure on the price of those global commodities that are priced in dollars, as is clearly shown by the relationship between scrap and the dollar index described above.