Market Data

March 31, 2018

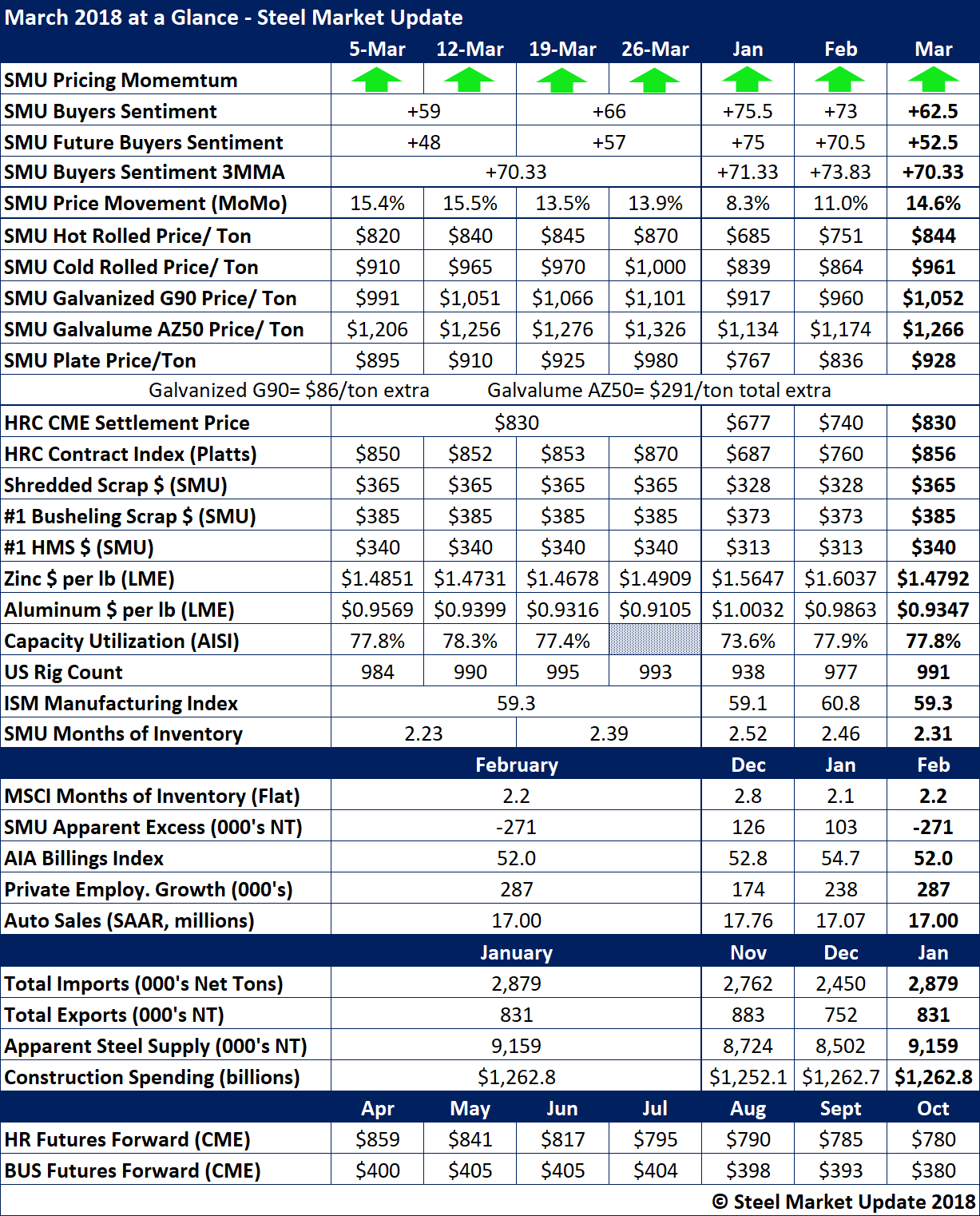

March 2018 at a Glance: Prices Rise, Uncertainty Lingers

Written by Brett Linton

Steel price momentum remained on the upswing in March, but steel buyers appeared slightly less optimistic about their prospects as President Trump’s tariffs and fears of a trade war weighed on many minds.

The price of benchmark hot roll hit $870 per ton in late March, up $50 per ton from the beginning of the month and up about $185 per ton from the beginning of the year. Cold rolled and galvanized base prices topped the $1,000 per ton mark. Scrap prices maintained high levels throughout the month, reflecting solid demand from domestic steelmakers. Mill capacity utilization has still not eclipsed the desired 80 percent level, however, averaging 77.8 percent in March.

While steel buyers as a group remain highly bullish, SMU’s Steel Buyers Sentiment Index moderated a bit in March, dipping to +62.5 from +73 the prior month. SMU’s Future Sentiment Index, measuring buyers’ feelings about their ability to be successful three to six months in the future, took an even bigger dip, declining by 18 points from February to +52.5.

Mill lead times on flat rolled steel continued to inch out in March as supplies tightened and mills scrambled to fill orders. SMU data indicates the average lead time for hot rolled in March was between five and six weeks, while cold rolled, galvanized and Galvalume were at or near eight weeks.

Lead times may shorten a bit in April as the market supply sees a bump in imports. Steel imports into the United States trended higher in March, approaching 3.5 million tons, as traders rushed to beat the March 23 deadline for the Section 232 tariffs. Despite the uncertainty on the trade and pricing fronts, the vast majority of respondents to SMU’s inquiries reported steel demand as stable or improving last month.

Those are some of the highlights for the month of March. See the month-at-a-glance below for much more information on market conditions.

To see a history of our monthly review tables, visit our website.