Prices

March 29, 2018

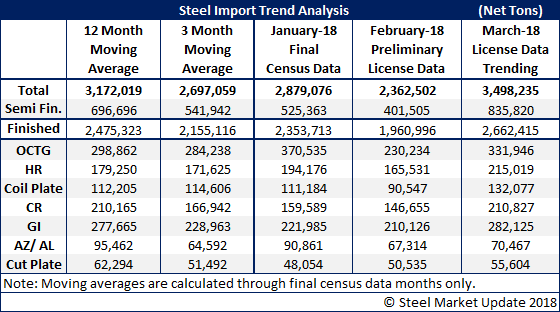

March Steel Imports Trending Toward 3.5 Million Tons

Written by Brett Linton

The steel import trend for the month of March is now approaching 3.5 million tons. This trend is based on license data through the 26th of March. If the month ultimately comes in above 3.2 million tons, it will top both the 12-month and the 3-month moving averages for steel imports.

SMU assumes that a portion of the increase above the January and February numbers is due to the March 23 deadline for the Section 232 tariffs. If traders could get the boats in, or at least get the paperwork through the system in time to beat the deadline, they have done so.

There is a big move in semi-finished steels (mostly slabs) now trending toward 835,000 tons.

There is also a big move in OCTG (oil country tubular goods), hot rolled and galvanized steels, which all are trending above their 12-month and 3-month moving averages.

SMU has spoken to a number of traders who indicate we may not see a huge drop-off in imports for the month of April. The combination of boats on the water, plus the fact that foreign is so much cheaper than current spot pricing out of the domestic mills, is keeping the steel coming.

We will continue to follow developments regarding imports for both March and April as data becomes available.