Prices

March 22, 2018

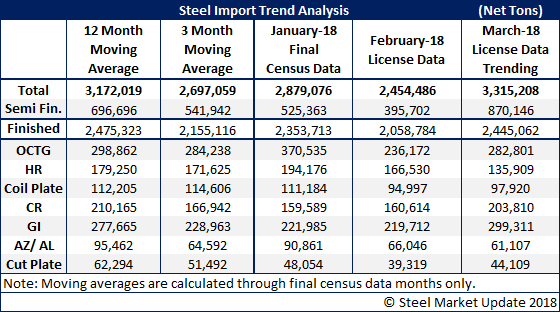

March Steel Imports Trending Toward 3-Million-Ton Month

Written by Brett Linton

As importers rush to get steel into the United States, unloaded and customs released prior to the March 23 tariff deadline (tomorrow), the trend for March is for imports to exceed 3 million net tons. This would be a big month considering the tapering off we saw in January and February.

With the deadline for Section 232 quickly approaching, the 3.3 million tons of expected licenses may be a bit overstated as we believe there may be fewer vessels arriving after the 23rd than during a normal month. We do not, however, expect imports to drop significantly right away because of the run-up in domestic steel prices. This means that adding 25 percent duty to steel that was bought months ago still provides the ability to make a margin on the steel.

Import licenses totaled 2,138,844 net tons through the 20th of the month. The trend is calculated by dividing the license total by 20, which equals the daily average, and then projecting that average over the entire month to come up with the 3.3 million ton number shown below.

When we dig deeper into the data, we see a surge in slabs, which should be expected since semi’s have shorter lead times than finished steels. Semi’s are on pace (if the trend continues) to equal just about all that was shipped to the U.S. in January and February combined.

Hot rolled imports continue to shrink, cold rolled is moving higher, galvanized is higher, and Galvalume is in line with February and the three-month moving average.

Here is what imports looked like as of March 20.