Prices

March 8, 2018

Foreign Steel Imports Rise in January

Written by Brett Linton

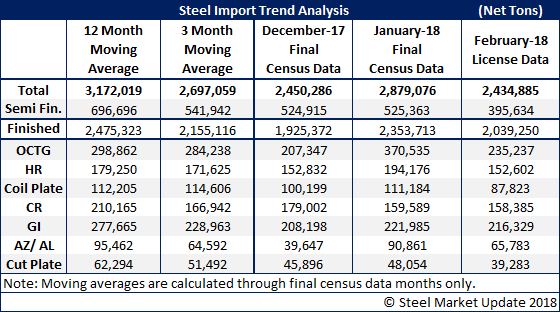

January foreign steel imports were finalized yesterday at 2,879,076 net tons (2,611,857 metric tons), according to the U.S. Department of Commerce. This is up 17.5 percent from December, and up 4.2 percent from November. It is also slightly greater than import levels seen in January 2017 (2,814,233 tons). Current February license data has imports down 15.4 percent over January. It is too early in the month to gather any useful information from March data.

Semi-finished imports (blooms, billets and slabs) remained steady (up 0.1 percent) from December to January at 525,363 tons. February license data suggests a decrease of 24.7 percent.

Imports of oil country tubular goods (OCTG) rose 78.7 percent in January, but February data is currently looking down 36.5 percent.

Hot rolled imports were up 27.1 percent from December to January. February levels are currently down 21.4 percent.

Plate in coil imports in January rose 11.0 percent, but are down 21.0 percent in February.

Cold rolled imports fell 10.8 percent over December figures. License data for February is currently down 0.8 percent.

Imports of galvanized products rose 6.6 percent in January. February data is currently looking down 2.5 percent.

Other metallic coated imports jumped 129.2 percent from December, but February data is down 27.6 percent.

Imports of plates cut lengths rose 4.7 percent in January. February license data is down 18.3 percent.

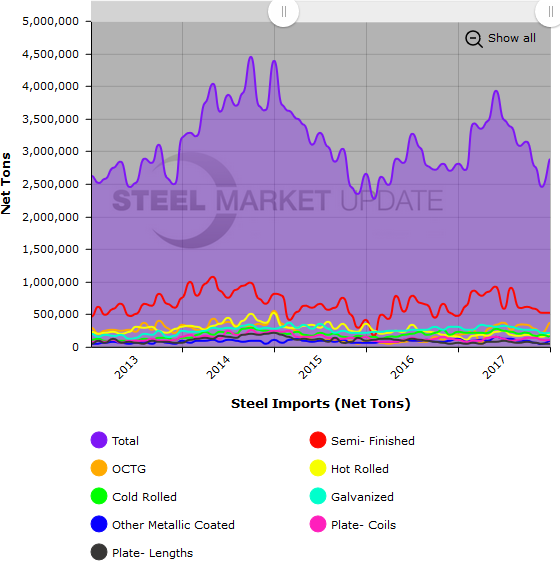

Below is a graph showing our steel imports history through final January data. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.