Prices

February 27, 2018

Foreign Steel Imports: January Up 17%, February Down 18%

Written by Brett Linton

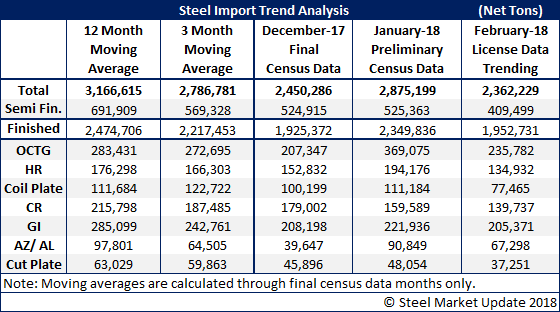

Preliminary steel import data was updated Tuesday afternoon showing 2.88 million net tons of imports for the month of January, according to the U.S. Department of Commerce. This is down from last week’s estimate of 3.08 million tons, but up 17.3 percent over December 2017 data. Preliminary data has been averaging 30,000 to 40,000 tons less than the final census data, so we anticipate the final January figure will be slightly over 2.9 million tons.

Steel Market Update sees February license data trending toward 2.36 million net tons, down from our previous analysis of 2.50 million tons last week and down 17.8 percent over January data. Semi-finished imports were previously trending around the same levels seen in January, but are now down to 409,000 tons, 22.1 percent less than January. Finished imports (total imports minus semi-finished products) are trending toward 1.95 million tons for February, down from our analysis last week and down 16.9 percent from January.

Every import product in the table below for February is down compared to January levels. Oil country tubular goods (OCTG) is trending down 36.1 percent, hot rolled down 30.5 percent, plate in coils down 30.3 percent, cold rolled down 12.4 percent, galvanized down 7.5 percent, other metallic coated down 25.9 percent, and plate cut lengths down 22.5 percent. We will see how this changes as the DOC collects more import licenses throughout the month and into March.

The table below uses final import data for the moving averages (through December 2017 data). January license data will be finalized next week. February data is derived from import licenses collected through the 27th, converted to a daily average rate, and assuming that rate will continue for the balance of the month.