Prices

February 15, 2018

Hot Rolled Futures Have Bullish Tone

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

The HR futures prices continue to grind higher in the near dates but have been lagging in the latter half of Cal’18. Some of the factors driving the near end prices higher include:

• Recent data showing lower HR imports.

• Recent steel price hikes in rebar and plate steel products, which usually foreshadow sheet price increases.

• Spot HR steel trading in the $750/ST range.

• Increasing lead times.

• High global steel prices.

• Lower service center inventories.

• Stable mill capacity utilization rates (72-76 percent).

• Uncertainty due to White House response to Section 232 Commerce Department report.

• Market expectations of a price increase of $40-$60/ST in HR in the short term.

Market participants have been cautious on both the buy side and the sell side of the futures curve lately as high prices have increased the caution of prospective buyers trying to avoid buying a top while sellers are showing caution due to the prospect of a further mill price increase.

The average weighted futures prices in Mar’18, Apr’18 and May’18 have increased $18/ST to $760/ST, $28/ST to $751/ST, and $17/ST to $737/ST just since this past Friday. In contrast, Jun’18 future has only risen $3/ST to $720/ST. The curve remains well backwardated as there has been little price movement in the latter half of 2018. If someone were to sell the Mar’18 future today at the last traded price of $760/ST, he or she could buy Q4’18 at $695/ST — a $65 discount. The difference between the Mar’18 future and Q3’18 offered at $700/ST would render a $60 discount. We could see these spreads widen further if the expected mill price increase materializes.

This week volumes are off a bit coming in just at 22,160 ST.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

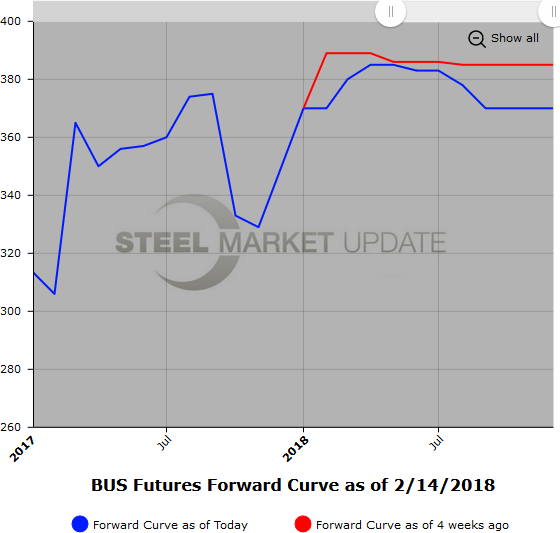

Scrap

BUS scrap was basically unchanged from Jan’18 to Feb’18 with the Feb’18 settling just under $370/GT. BUS futures have been very active month to date. Over 61,000 GT of BUS futures have traded across the CME. About 29,500 GT of those traded in the front month (Mar’18) between $380 and $385/GT. The rest was pretty evenly spread out over the balance of months in 2018 at a slightly lower $380/GT average.

Today, $380/GT traded Apr-Nov’18 BUS. BUS futures are slightly backwardated with the balance of 2018 offered at around $380/GT with the near dates offered at $385/GT and the latter part of 2018 offered at $375/GT. The Cal’19 is only slightly lower at $365/GT bid and $375/GT offered.

80/20 scrap futures SC have rebounded back into the low $370/MT range for the Mar and Apr’18 periods. Volumes have also been rising along with higher steel prices and improving conditions in Europe. However, the SC curve does remain backwardated with Mar’18 to Q3’18 running $20 back.

Of note, the metal margin, the difference between HR and BUS, has widened out. Today, one could have sold Apr’18 HR at $752/ST and purchased Apr’18 BUS at $385 and netted a $367 metal margin spread.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.