Prices

February 13, 2018

February Foreign Steel Imports Trending Toward Lowest Level in Years

Written by Brett Linton

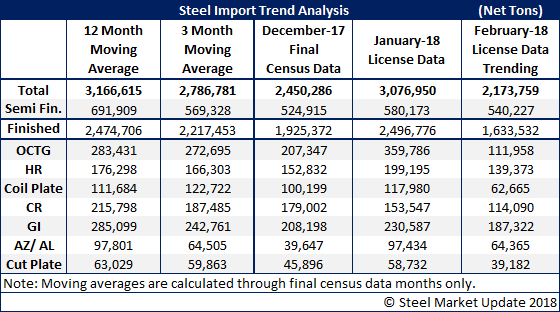

The U.S. Department of Commerce released license data through the first 13 days of February that “suggests” foreign steel imports could be at the lowest levels seens in many years. The trend is for imports to barely exceed 2 million net tons, almost one-third lower than the 3 million tons that were reported for January. The U.S. imported 2.7 million tons of foreign steel during February 2017 (2.2 million in 2016).

If February steel imports do end up around 2.1 million tons, it will be the lowest level for a month since December 2011 when the U.S. imported 2,064,143 tons.

Imports are decreasing on essentially all flat rolled products (see table below). Remember that we have taken the first 13 days’ license rate and calculated where the totals would be if that rate were to continue over the full course of the month. We will continue to carefully watch the import numbers each Tuesday evening to see if the trend continues. If it does, and March follows along behind February at the same daily rate, we could see a dramatic pullback in service center inventories.

Just something else buyers need to watch…

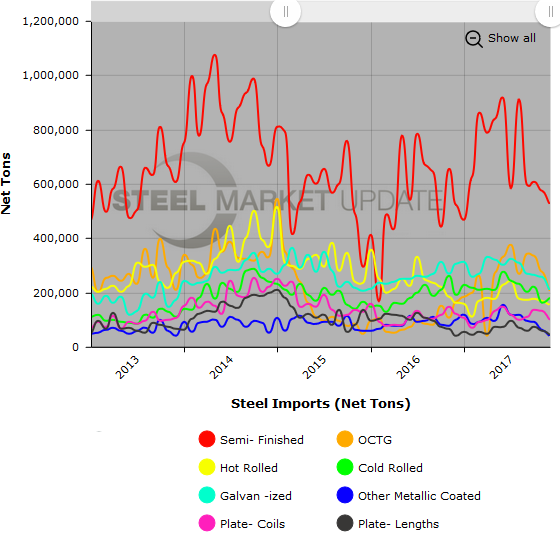

Below is a graph showing our steel imports history through final December data. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.