Prices

February 8, 2018

Hot Rolled Steel and Scrap Futures

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Increased HR futures buying this week reflects the slightly more bullish narrative in the domestic HR price expectations. Concern that lead times are increasing along with slightly constrained imports and the specter of further action by the Trump administration on steel imports due to possible sanctions as part of the Commerce Department 232 report has helped further bolster HR prices. In addition expectations of further mill price hikes have kept the futures markets well bid.

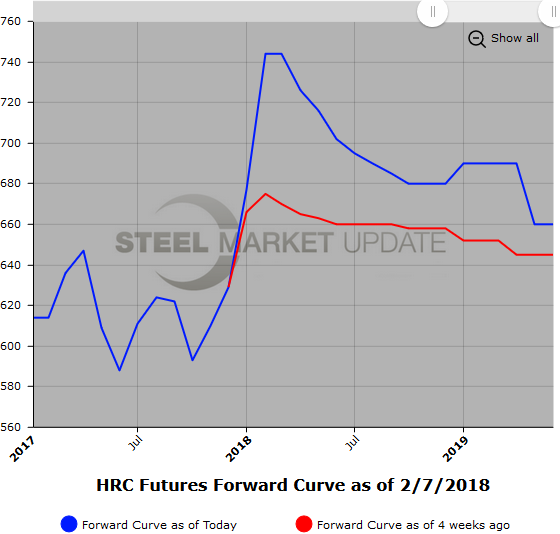

This week, HR futures traded about 47,000 ST of which over 32,000 ST traded in the 1H’18. The HR futures market took a breather last week. HR futures average weighted prices retrenched by a few dollars as hedge buyers waited for a price pullback, which did not really materialize. Buyers were spurred by this week’s strong move higher in HR spot, which was up by $20/ST, as reflected in the indexes, and translated into a $19-$25/ST rise in the average weighted prices on 1H’18 futures. Today, nearby HR futures were trading in the low $740/ST range, about $20/ST above spot. Q2’18 HR futures traded today at $720/ST, just below cash HR. Q3’18 today traded at $691/ST, roughly $30 below Q2’18 and cash HR. Q4’18 is trading about $10/ST below Q3’18 on small trading volume and $40/ST below cash HR.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

Focus this week has been on U.S. Midwest prime scrap (BUS) with 80/20 scrap having traded off in the last week or so.

With the latest physical export prices for 80/20 falling in the $340-$349/MT range, volumes have been a bit muted as participants wait for the prices to find some support.

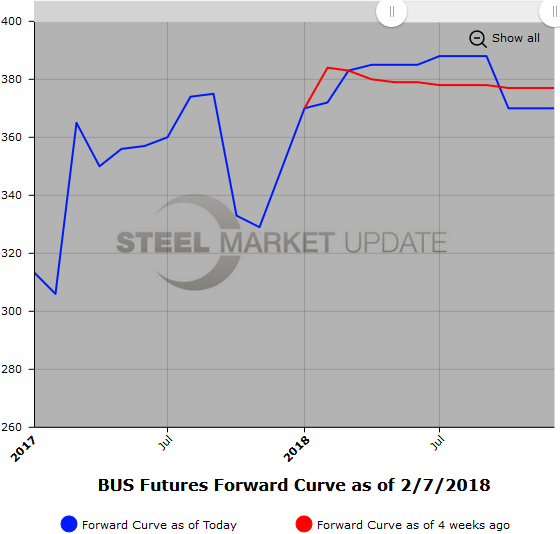

It has been fairly active in the BUS futures in the early part of February as 53,500 GT of BUS has traded. Open interest has pushed up to almost 4,000 contacts or 80,000 GT.

The nearby month (Mar’18) has been actively trading in the $380-$385/GT range. We’ve also seen increased activity for the Apr-Dec’18 period, which has traded from $370 to $382 in the last week. Participants have even been inquiring out into Cal’19 BUS, which was most recently quoted at $365-$375/ GT.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.