Prices

January 30, 2018

Raw Material Prices Volatile in January

Written by Peter Wright

Of the four raw materials tracked by Steel Market Update, scrap and zinc prices advanced in January, iron ore took a small step back and coking coal declined by 10 percent.

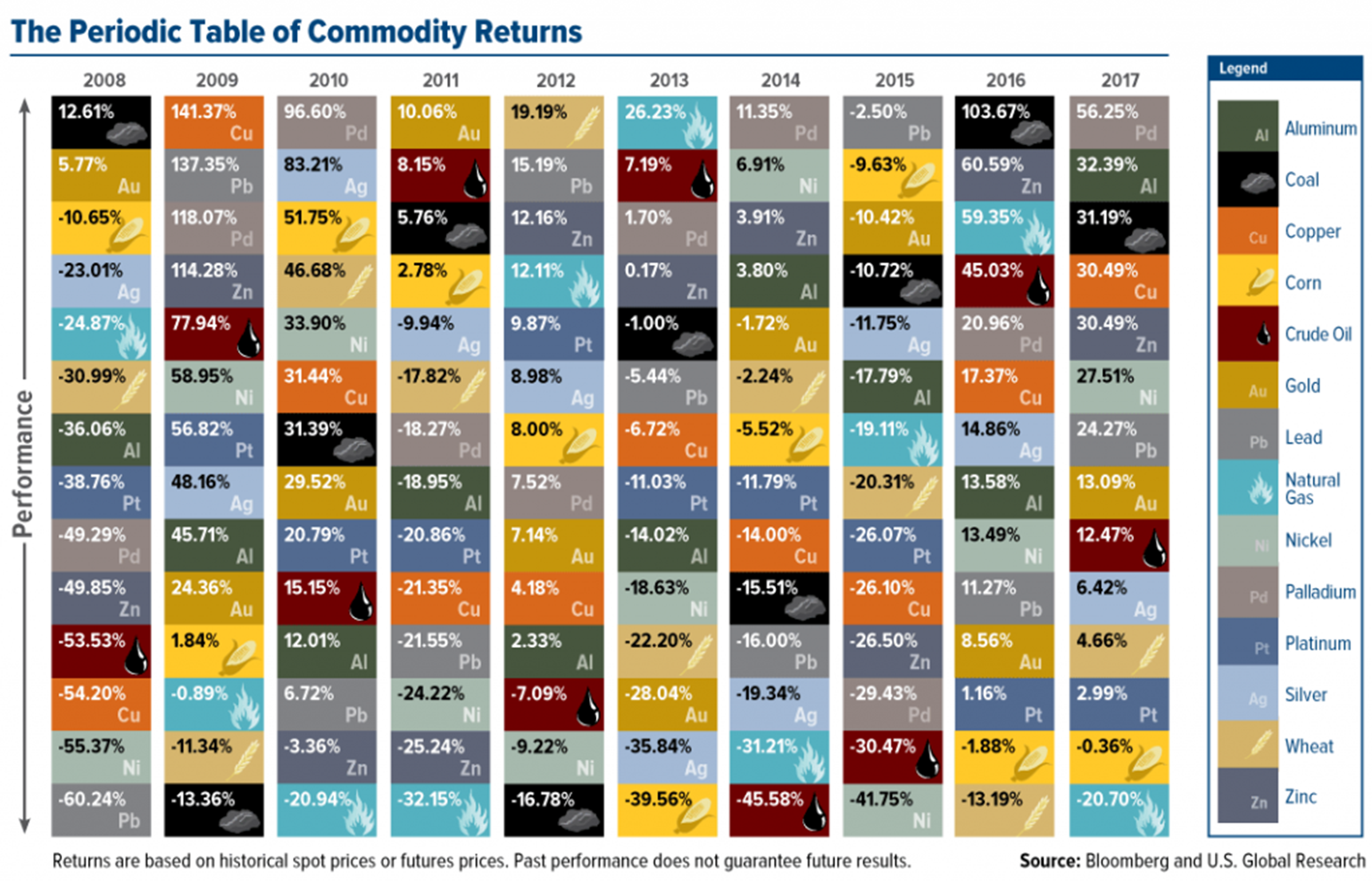

Each January, Bloomberg and U.S. Global Investors compile their Periodic Table of Commodity Returns. Figure 1 shows the returns of commodities each year of the past decade. Coal and zinc were No. 1 and No. 2 in 2016 and were both in the top five in 2017.

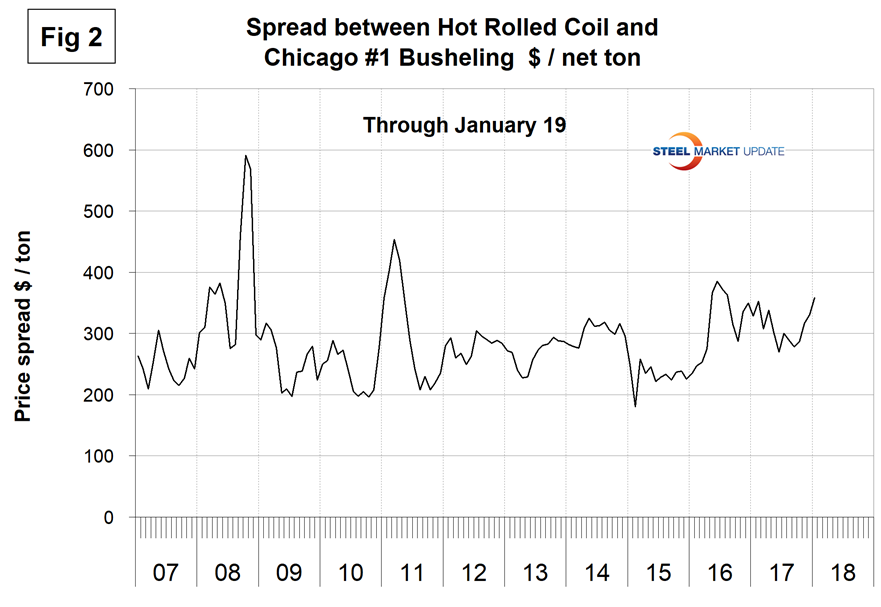

To put the raw materials analysis into perspective, we include here Figure 2, which shows the spread between Chicago #1 busheling and hot rolled coil ex works Indiana through Jan. 19, both in dollars per net ton. On this date, Chicago busheling was priced at $334.82 per net ton, ($375.00 per gross ton) and HRC ex works Indiana was $693.50 per net ton for a spread of $358.68. The spread was up from $330.71 in December and reached a recent high of $385.46 in June last year.

Scrap

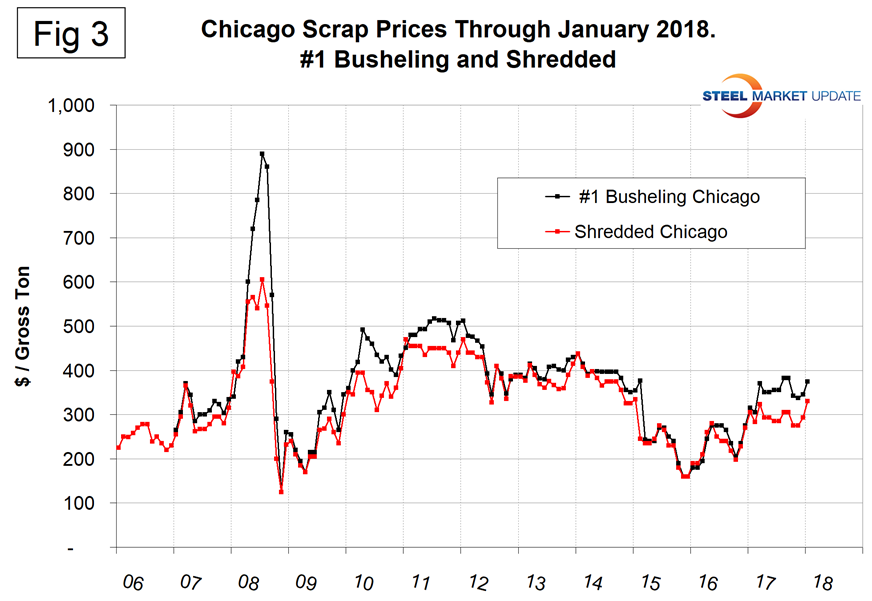

Figure 3 shows the relationship between shredded and #1 busheling both priced in Chicago. In January, shredded was $335.00 per gross ton, up from $293.00 in December. Busheling rose from $345.00 to $375.00. The busheling premium was $40.00, down from $52.00 in December.

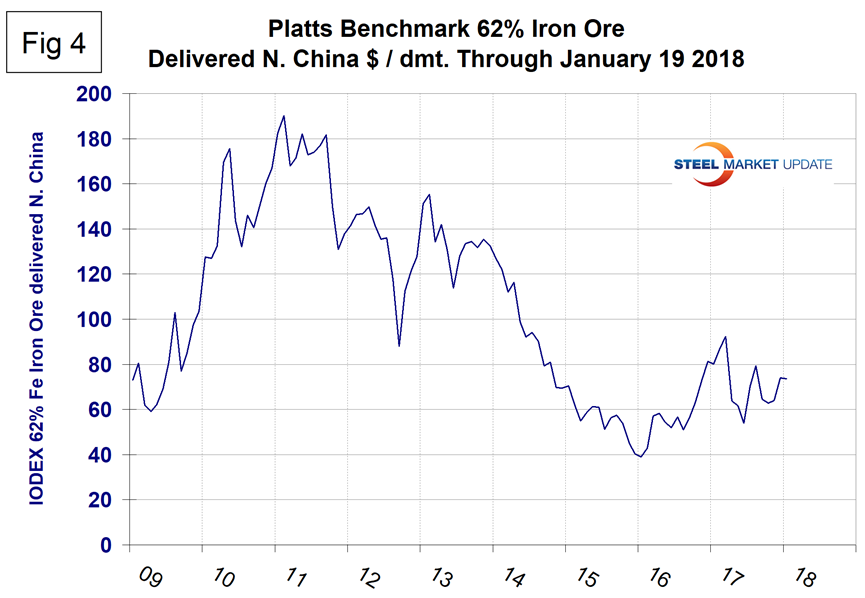

Iron Ore

Figure 4 shows the Platts IODEX of 62% Fe delivered North China since January 2009. The Index recovered to $92.30 on March 17 but stood at $73.70 on Jan. 19. Reuters Australia reported that iron ore prices are expected to average $51.50 per metric ton this year, down 20 percent from 2017 because of rising global supply and moderating demand from top importer China as its steel sector shrinks. The world’s top mining companies, BHP and Vale, rely heavily on iron ore sales for the bulk of their revenue despite efforts to diversify more into other industrial raw materials such as copper, aluminum and coal. Brazil-based Vale is planning to lift iron ore exports 7 percent in 2018 to 390 million metric tons. In Australia, Rio Tinto and BHP, along with Fortescue Metals Group, aim to add about 170 million tons of new capacity over the next several years. The forecast price decline, from an average of $64.30 a ton in 2017, continues into 2019 when the steelmaking raw material will average only $49 per metric ton, according to the Department of Industry, Innovation and Science. “The iron ore price is expected to experience some ongoing volatility in early 2018 as the market responds to uncertainty regarding the impact of winter production restrictions on iron ore demand,” the department warned in its latest commodities outlook paper. China imported over a billion tons of iron ore in both 2016 and 2017.

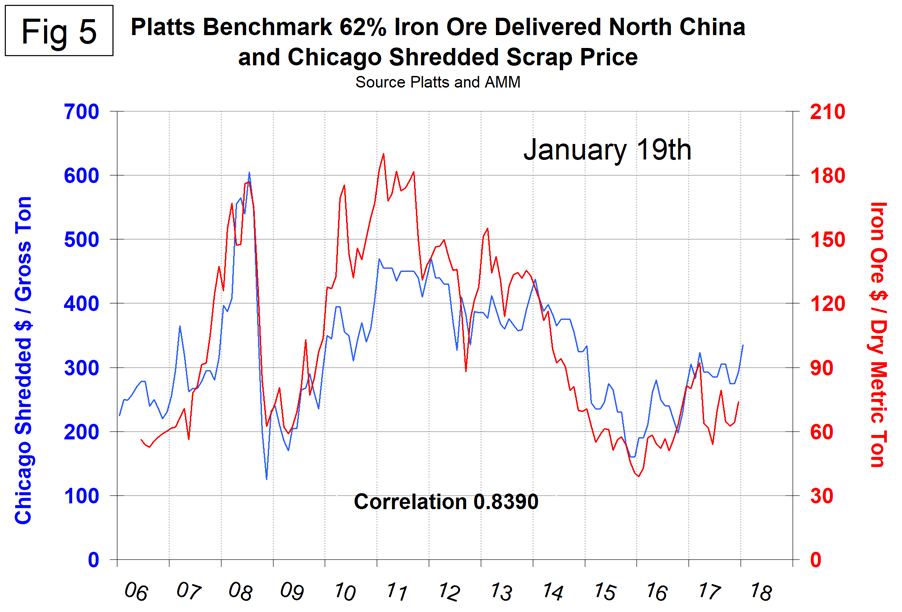

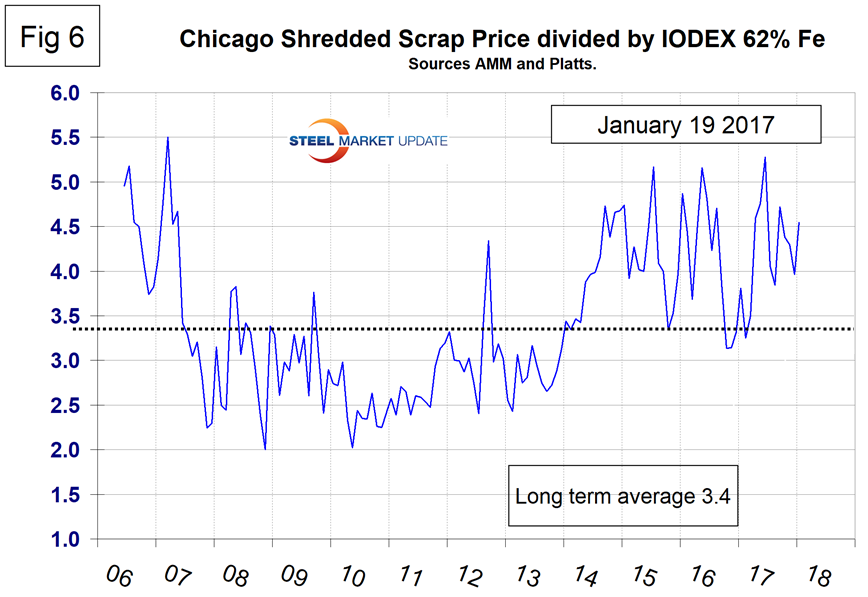

There is a long-term relationship between the prices of iron ore and scrap. Figure 5 shows the IODEX and the price of Chicago shredded through Jan. 19. The correlation since January 2006 has been 83.9 percent. In the last 10 years, scrap in dollars per gross ton has been 3.4 times as expensive as ore in dollars per dry metric ton (dmt), on average. The ratio has been erratic since mid-2014, but overall since then has benefited the integrated producers. There was a six-month respite for the EAF operators in Q4 16 and Q1 17, but now the ratio is once again high with a value of 4.55 on Jan. 19. The June ratio of 5.28 was the highest in over 10 years (Figure 6). Since Chinese steel manufacture is 95 percent BOF, this ratio has allowed them to be more competitive on the global steel market. In the last four years, there have been times when China could supply semi-finished to the global market at prices competitive with scrap.

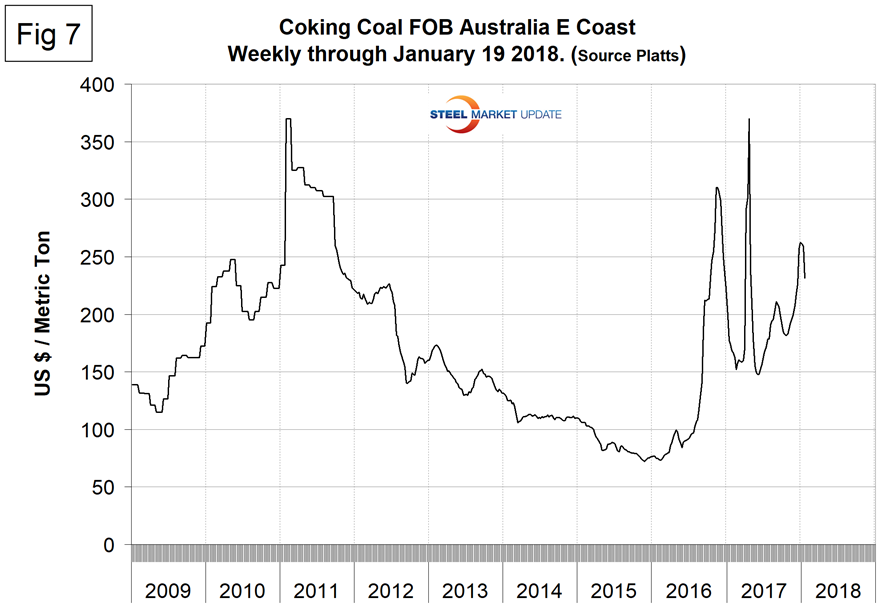

Coking Coal

Coking coal prices have been highly erratic in the last 14 months. A mixed picture of pricing sentiment has been evident in January. On Jan. 3, 2018, Platts reported that global steel prices could continue to rise in Q1 as surging coking coal prices work their way through the blast furnace cost structure. Since the beginning of November, premium hard low volatile coking coal prices have risen from $179 per metric ton to $262.25 FOB Australia’s East Coast (Figure 7). On Jan. 19, Argus reported that Asia Pacific coking coal prices had stabilized as bids crept higher and producers resisted further cuts in offers. On Jan. 25, Platts reported that the price of premium low volatile hard coking coal had tumbled in the previous week as declining offers failed to stimulate demand.

Zinc

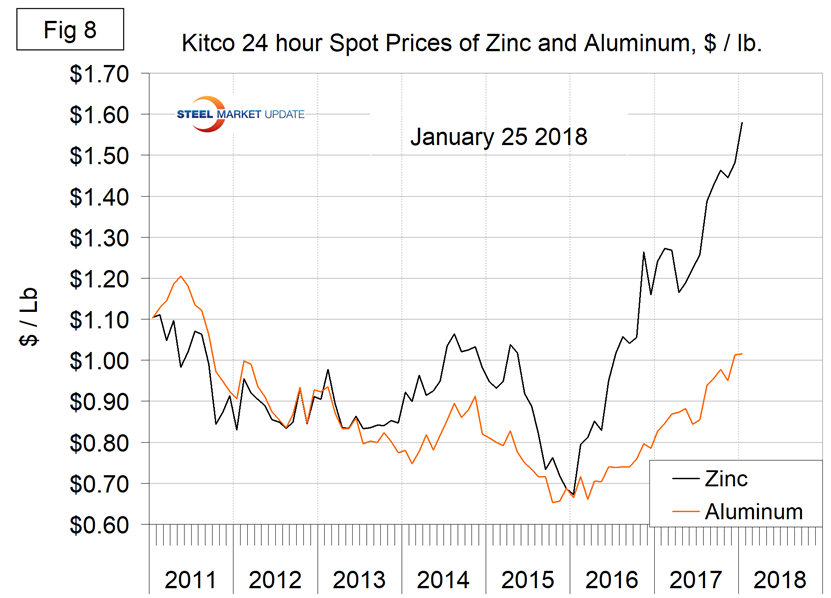

The major use of zinc is for galvanizing. Other significant uses include the alloying of brass and bronze and in zinc-based alloys used in the die-casting industry. Kitco publishes a daily spot price of zinc, which we have transcribed to Figure 8. Just as a point of reference, we have included aluminum in the same graph. In January, the price of zinc resumed its upward trend reaching another all-time high of $1.5796 per pound on Jan. 25. Chinese trade statistics report that imports of refined zinc ingots increased by over 59 percent in 2017.

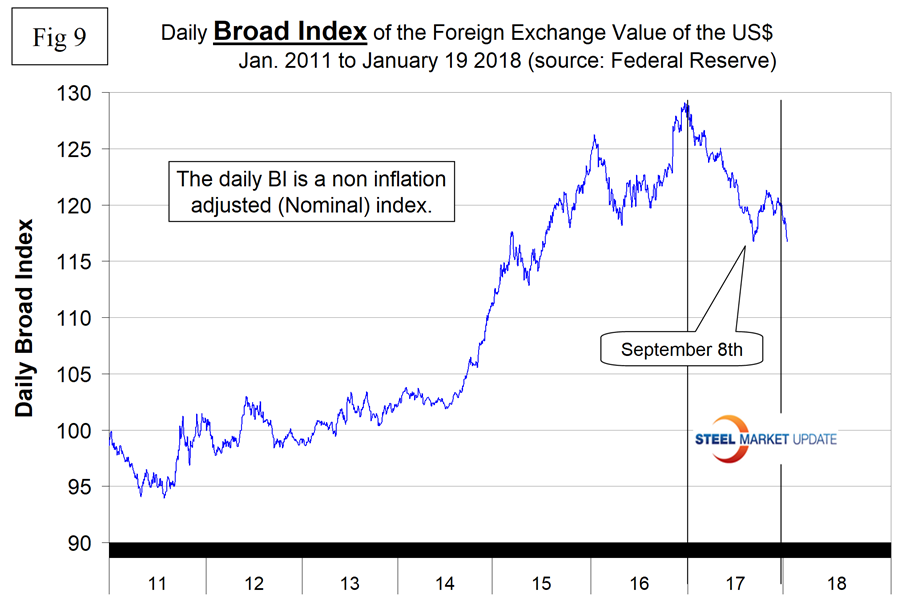

SMU Comment: There is an inverse relationship between commodity prices and the value of the U.S. dollar on the global currency markets. The value of the dollar declined by 9.3 percent between Jan. 3 and Sept. 8 last year, then turned around and appreciated erratically by 2.9 percent between Sept. 8 and Dec. 27 before going back into free fall through Jan. 19 (Figure 9). A weakening dollar puts upward pressure on the price of those global commodities that are priced in dollars.