Prices

January 25, 2018

Imports of Flat Rolled Trending Lower, But Not OCTG

Written by Brett Linton

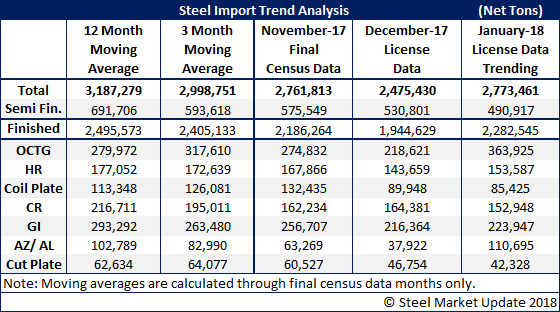

January imports are trending higher than expected at 2.8 million net tons, similar to what was imported one year ago. This is a bit disappointing to many in the steel industry who were expecting total steel imports to drop as they did in November and December 2017.

To get a more complete view, we look specifically at the various flat rolled products. Hot rolled is trending around 150,000 tons in January, which is lower than both the 3-month and 12-month moving averages. Looking at past years, the 150,000 tons is similar to January 2017, but significantly lower than previous years when HRC imports hit 300,000 to 500,000 tons per month.

Cold rolled is trending toward a 150,000-ton month, which is similar to December 2016 when the U.S. received 147,000 tons, but well below last year when the U.S. received 227,000 tons. CR for January is trending below the 3-month and 12-month moving averages.

Galvanized is trending toward a 224,000-ton month, which is below last year’s 311,000 tons and comparable to December’s 216,000 tons. GI is well below the 3-month and 12-month averages as shown in the table below.

Galvalume, on the other hand, is trending well above last month and above the 3-month and 12-month averages. One year ago, the U.S. imported 119,000 tons of Galvalume.

One of the items followed by Steel Market Update that has changed for the worse, from a mill standpoint, is oil country tubular goods. OCTG imports are trending toward 364,000 tons or double where they were one year ago and more than three times greater than January 2016.