Prices

January 11, 2018

Hot Rolled Futures: Ferrous Futures in Rally Mode

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Director of Risk Management, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading HRC or scrap futures enlist the help of a licensed broker or bank.

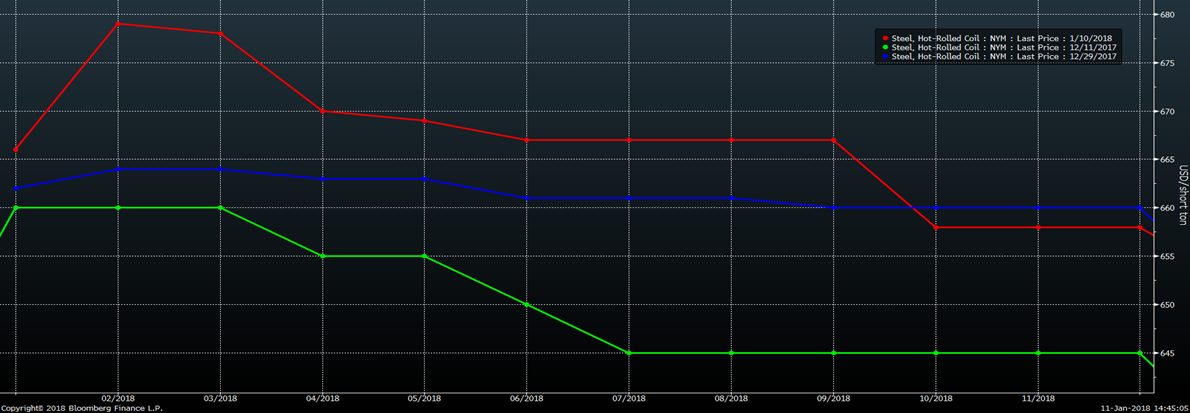

After breaking above $650, the February CME has continued to power higher, trading 500 tons as high as $685 yesterday (Wed. 1/10). The chart below shows the inverse head and shoulder pattern discussed in this article in November and December of last year, breakout above the neckline and nascent rally.

2nd Month Rolling CME Midwest HRC Future

Meanwhile, last night’s Platts TSI Midwest HRC Index print of $664.75 is above the most recent high of $661 set last March and is the highest the index has been since September 2014.

Platts TSI Midwest HRC Index

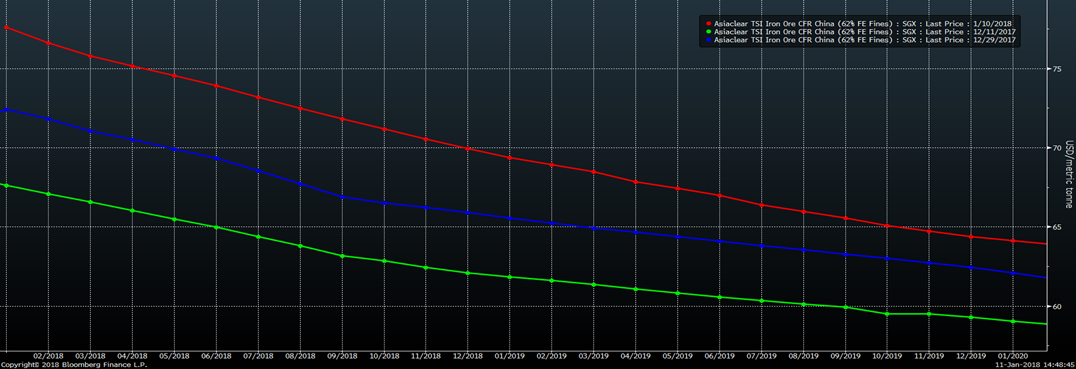

In addition to strong domestic demand and decreasing imports, raw material prices have been in rally mode perpetuating the flat rolled rally. Iron ore is up over 25 percent since Nov. 1.

2nd Month Rolling SGX Iron Ore Future

Turkish scrap is up 13 percent since Nov. 1 and 27 percent since Oct. 1.

2nd Month Rolling LME Turkish Scrap Future

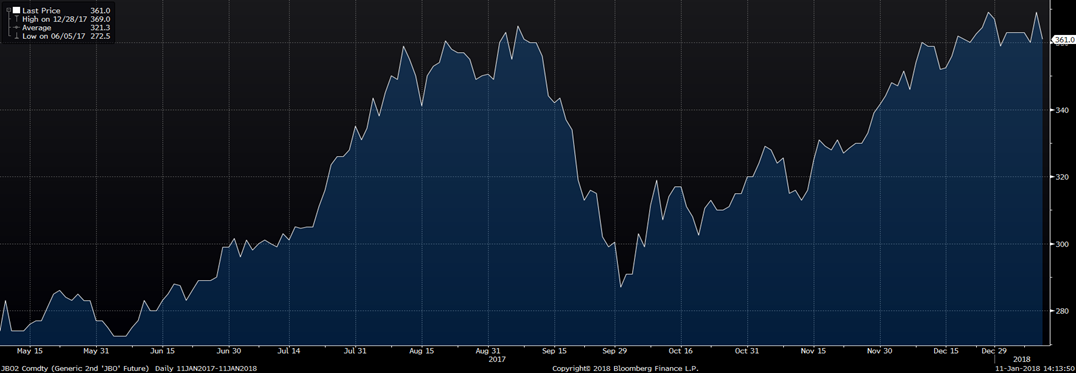

Australian coking coal is up 57 percent since Nov. 1.

January SGX Australian Coking Coal Future

The February CME WTI crude oil future traded a high of $64.77 today.

February CME WTI Crude Oil Future

While the U.S. dollar remains near three-year lows.

US Dollar Index

Check out these curves…

The HRC curve is in backwardation, reaching to new highs with the front end of the curve pushing higher in recent days.

CME Midwest HRC Future Curve

Iron ore futures are also backwardated with higher highs.

SGX Iron Ore Future

The LME Turkish scrap curve looks similar to HRC and ore with a continued incremental rally and backwardated curve.

LME Turkish Scrap Future

The CME HRC futures continue to reach to new highs, but each day this week sellers come in pushing futures prices back down. Both in the futures and on the physical side, there seems to be skepticism of this rally. With strong domestic and global industrial fundamentals, low inventory levels, rallying raw material and commodity prices, plummeting imports, the graphite electrode shortage persisting, the threat of a NAFTA breakup and uncertainty regarding import tariffs related to the 232 investigation, I would expect more enthusiasm.

One of the first things I heard when I got into steel was that buyers always think the price is going down and producers always think the price is going up. The fact that there are so many skeptics might provide the fuel for a long extended rally, perhaps one that reaches to prices no one can even fathom just yet.