Prices

January 3, 2018

Raw Material Prices Increase in December

Written by Peter Wright

All four raw materials tracked by Steel Market Update— iron ore, scrap, coking coal and zinc—increased in price in December.

From Australia News Digest on Dec.18: “Steelmaking raw materials made strong gains on Monday as Chinese mills, responsible for half the world’s steel output, restock ahead of the resumption of full production at the end of winter.The Northern China import price of 62% Fe content ore jumped 5.2 percent to the highest since September, trading at $74.40 per dry metric ton, according to data supplied by The Steel Index. Although down sharply from its February 2017 high, iron ore has averaged $70.60 since the start of the year compared to $56.50 over the course of 2016. Steelmaking coal (premium hard-coking coal FOB Australia) was pegged at $243.90 per metric ton, up 1.4 percent compared to Friday, a near eight-month high. Coking coal has surged 37 percent in value since the beginning of November and is averaging $185.70 in 2017, a gain of more than $40 compared to the average price last year.”

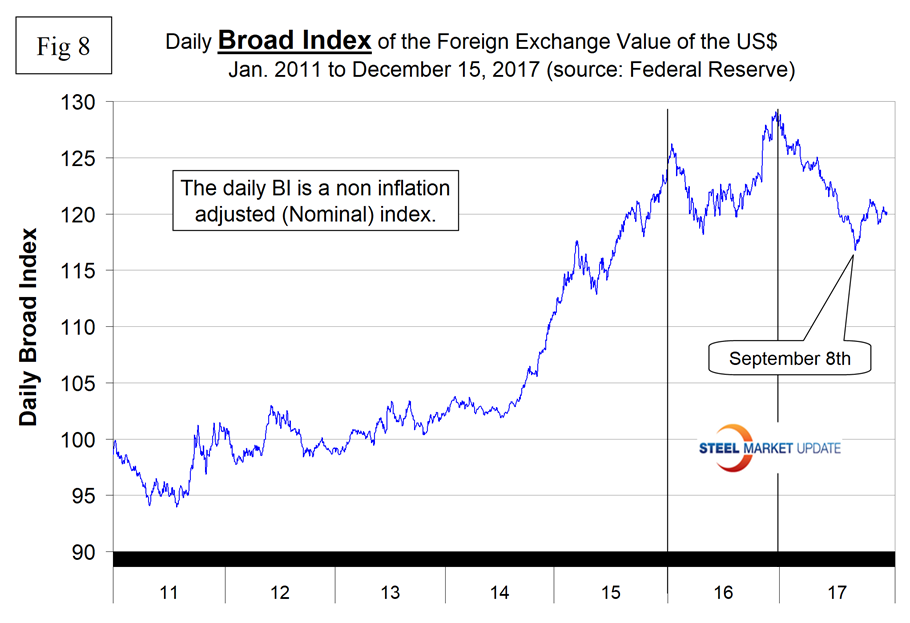

To put the raw materials analysis into perspective, we begin with Figure 1, which shows the spread between Chicago #1 busheling and hot rolled coil ex works Indiana through Dec. 17, both in dollars per net ton. On this date, Chicago busheling was priced at $323.21 per net ton ($362.00 per gross ton), and HRC ex works Indiana was $638.75 per net ton, for a spread of $315.54 per net ton. The spread reached a recent high of $385.46 in June last year.

Scrap

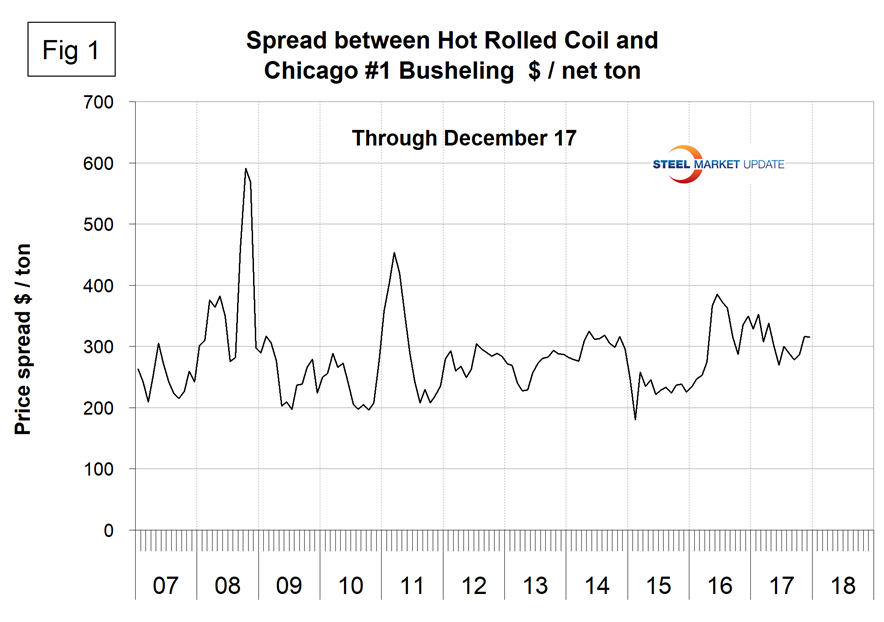

Figure 2 shows the relationship between shredded and #1 busheling, both priced in Chicago. In December, shredded was $297 per gross ton, up from $275 in November. Busheling rose from $337.50 to $362.00. The busheling premium was $65.00, up from $62.50 in November.

Iron Ore

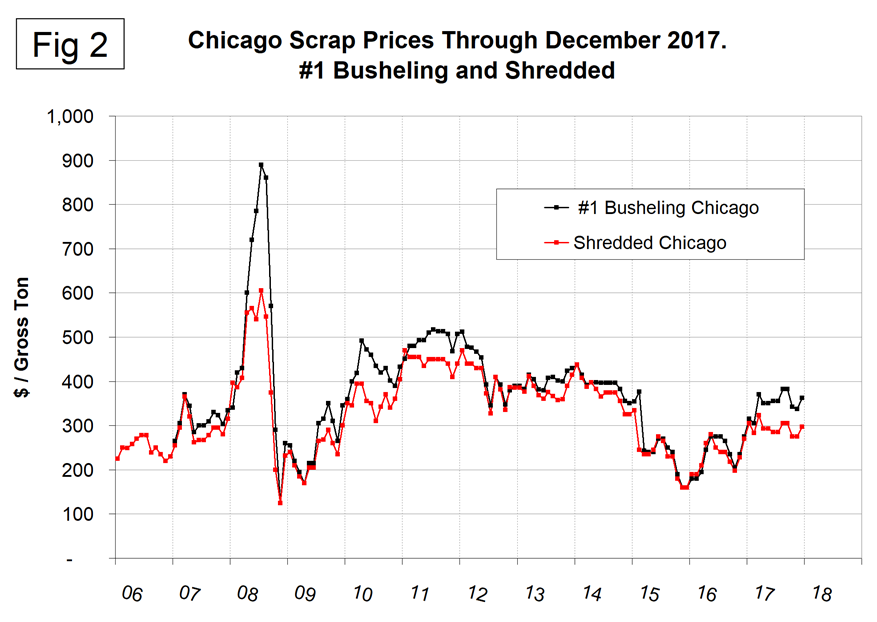

Figure 3 shows the Platts IODEX of 62% Fe delivered North China since January 2009. The Index recovered to $92.30 on March 17, but stood at $73.95 on Dec. 19.

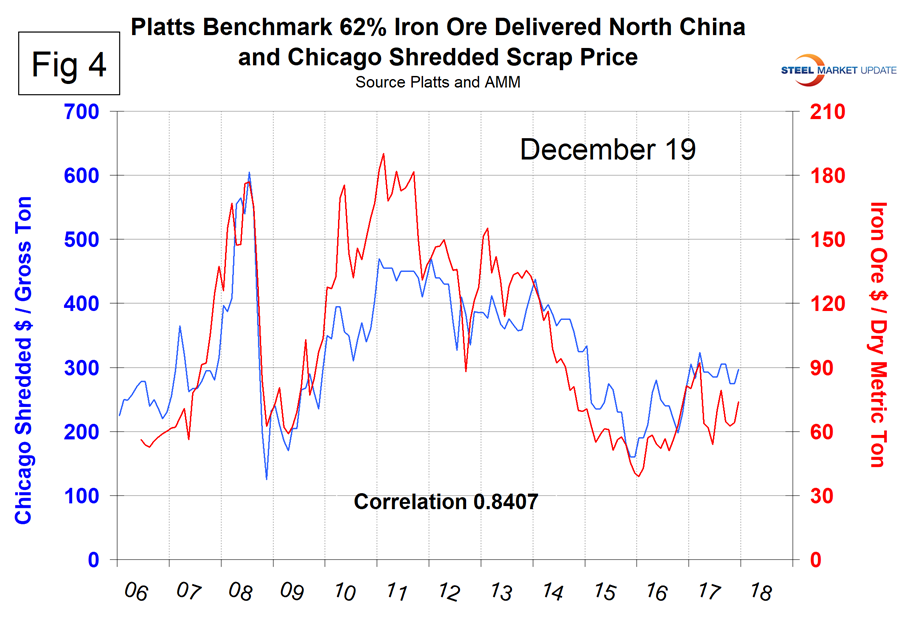

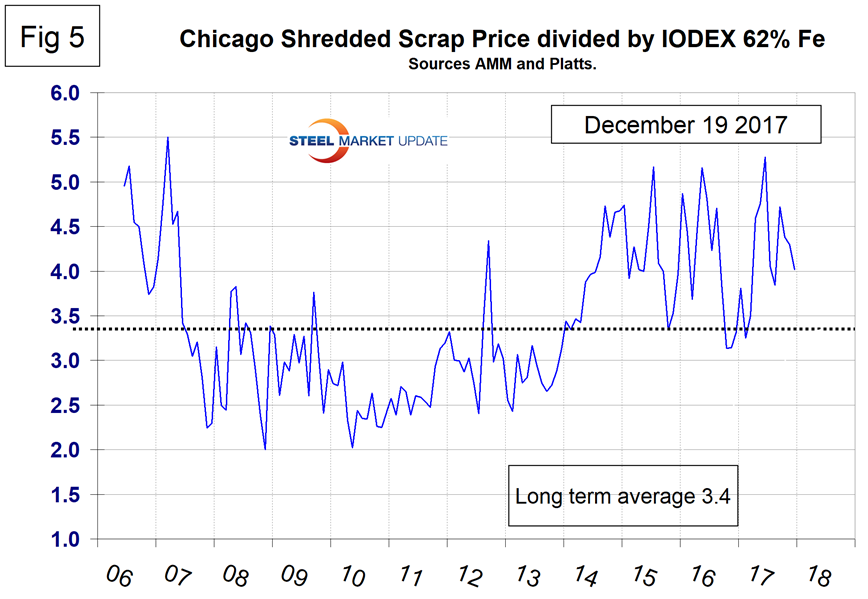

There is a long-term relationship between the prices of iron ore and scrap. Figure 4 shows the IODEX and the price of Chicago shredded through Dec. 19. The correlation since January 2006 has been 84.07 percent, and in the last 10 years on average scrap in dollars per gross ton has been 3.4x as expensive as ore in dollars per dmt. The ratio has been erratic since mid-2014, but overall since then has benefited the integrated producers.

There was a six-month respite for the EAF operators in Q4 ’16 and Q1 ’17, but now the ratio is once again high with a value of 4.02 on Dec. 19. The June ratio of 5.28 was the highest in over 10 years (Figure 5). Since Chinese steel manufacture is 95 percent BOF, this ratio has allowed them to be more competitive on the global steel market. In addition, in the last four years there have been times when China could supply semi-finished to the global market at prices competitive with scrap.

Coking Coal

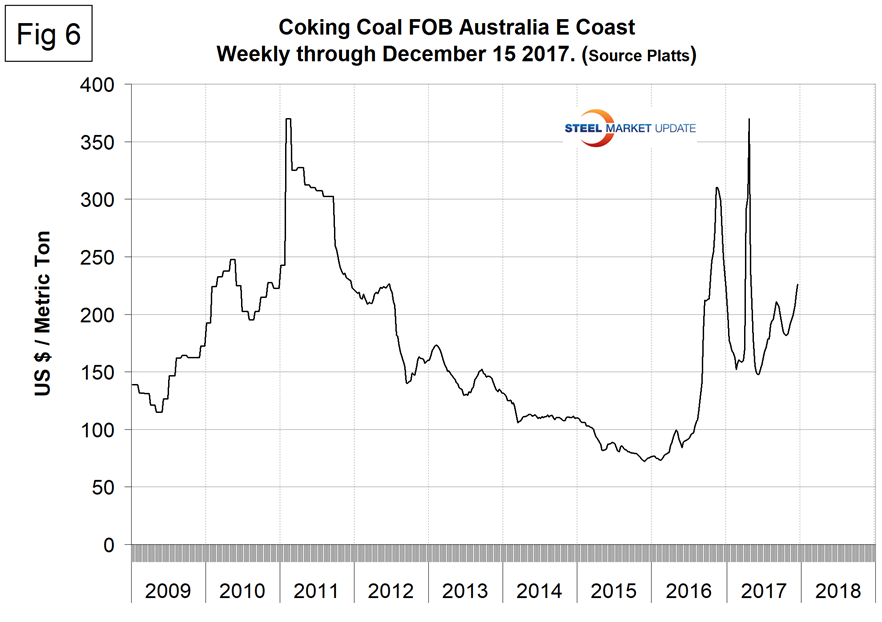

On Dec. 15, Platts reported that premium low-volatile coking coal was up $8.00 per metric ton on the week to $226 FOB Australia (Figure 6). China’s December coal imports are set to hit 28 million metric tons, the highest since December 2013, according to Ralph Leszczynski, head of research at ship broker Banchero Costa in Singapore. For all of 2017, China is on course to import 220.2 million metric tons of coal, up 10 percent year-on-year, according to shipping services firm Clarkson. Iron ore imports are set to hit 1.07 billion metric tons, up 6 percent compared with 2016, Clarkson said. Mining.com on Dec. 27 reported continuing gains in coal prices: Steelmaking coal (premium hard-coking coal FOB Australia) was pegged at $243.90 per metric ton, up 1.4 percent compared to Friday, a near eight-month high. Coking coal has surged 37 percent in value since the beginning of November and is averaging $185.70 in 2017, a more than $40 gain compared to the average price last year.

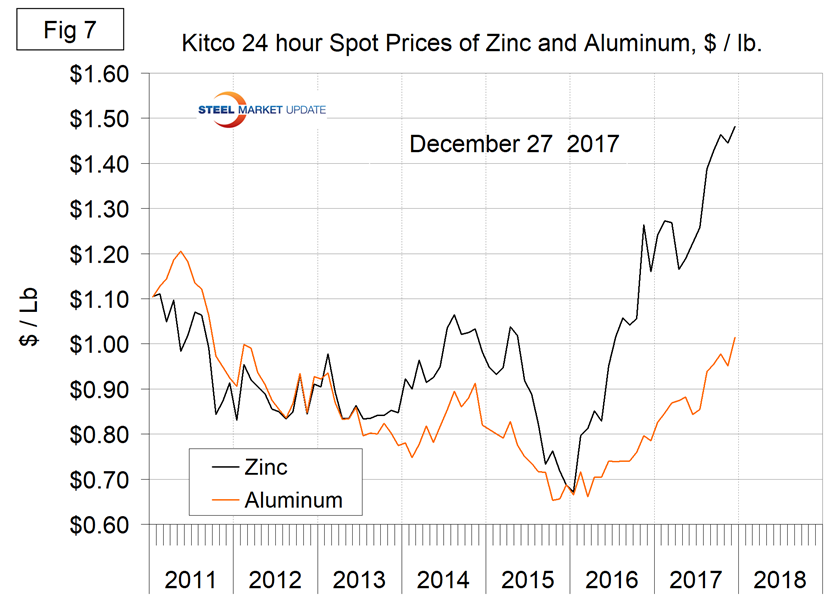

Zinc

The major use of zinc is for galvanizing. Other significant uses include the alloying of brass and bronze and in zinc-based alloys used in the die-casting industry. Kitco publishes a daily spot price of zinc, which we have transcribed to Figure 7. Just as a point of reference, we have included aluminum in the same graph. In December, the price of zinc resumed its upward trend reaching another all-time high of $1.4817 per pound on Dec. 27.

Mining.com reported that after an initial dip, zinc prices rose on Dec.19 after top producer of the metal Glencore held its output forecast steady for next year. On the LME, zinc was exchanging hands for $3,170 per metric ton on Tuesday, up more than 1 percent from the previous close, bringing gains for 2017 to 23 percent. The metal has more than doubled since hitting multi-year lows in January 2016, which prompted Swiss-based Glencore to curtail production to shore up prices. Glencore told investors it would restart its Lady Loretta mine in the first half of 2018, but added that it expects zinc output to fall slightly to about 1.09 million tons from 1.1 million tons this year. In 2019, Glencore sees its zinc output creeping up to 1.16 million tons. “Based on their guidance numbers, it does remain fairly constructive for zinc. The market was expecting more of an immediate supply increase,” said ING commodities strategist Warren Patterson. However, he added, ING expects overall global zinc supply to increase next year with the addition of capacity coming online in Australia (MMG’s Dugald River project) and South Africa (Vedanta’s Gamsberg mine).

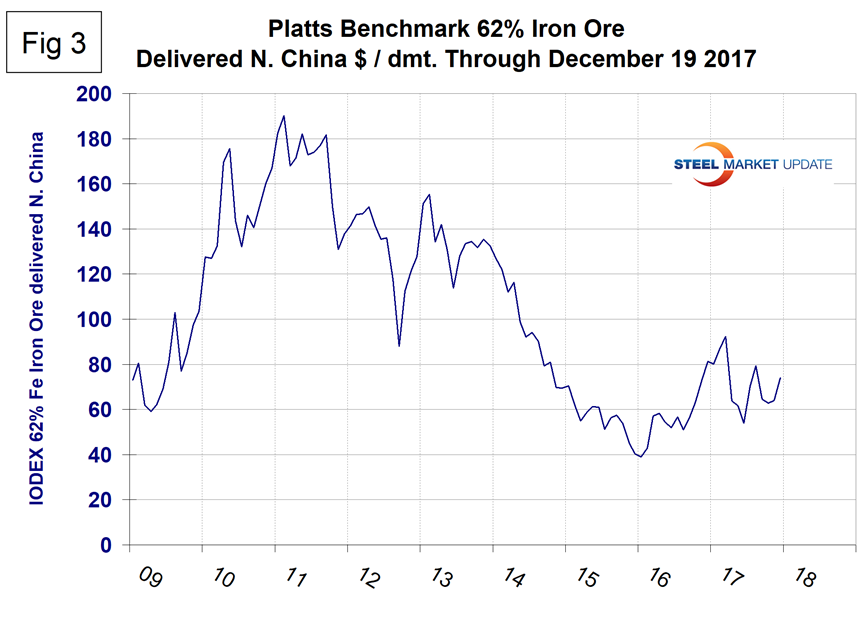

SMU Comment: There is an inverse relationship between commodity prices and the value of the U.S. dollar on the global currency markets. As we reported in our November currency update, the value of the dollar declined by 9.3 percent between Jan. 3 and Sept. 8 this year, but then turned around and appreciated erratically by 2.9 percent between Sept. 8 and Dec. 27 (Figure 8). A weakening dollar puts upward pressure on the price of those global commodities that are priced in dollars.