Prices

September 28, 2017

Raw Material Prices in Flux

Written by Peter Wright

The price of iron ore is falling but zinc is at a 10-year high. In this report, we examine the latest prices for iron ore, scrap, coking coal and zinc and their relationship to the dollar.

“Right now, the dollar has a lot going against it. The administration in the U.S. continues to hope the dollar falls, and they are getting their wish,” writes commodities analyst Andrew Hecht. “The big winner could be commodities prices if the dollar has entered a multi-year bear market. All signs are pointing lower for the dollar, and this could be the perfect time to begin buying hard assets that come out of the crust of the earth. Perhaps the most compelling argument for higher commodities prices is that they are a reflection of inflationary pressures in the global economy. After almost a decade of monetary policy that has flooded the world markets with unprecedented levels of capital to encourage borrowing and spending and inhibit savings, an inflationary surge could be the ultimate price tag for accommodative central bank policy.”

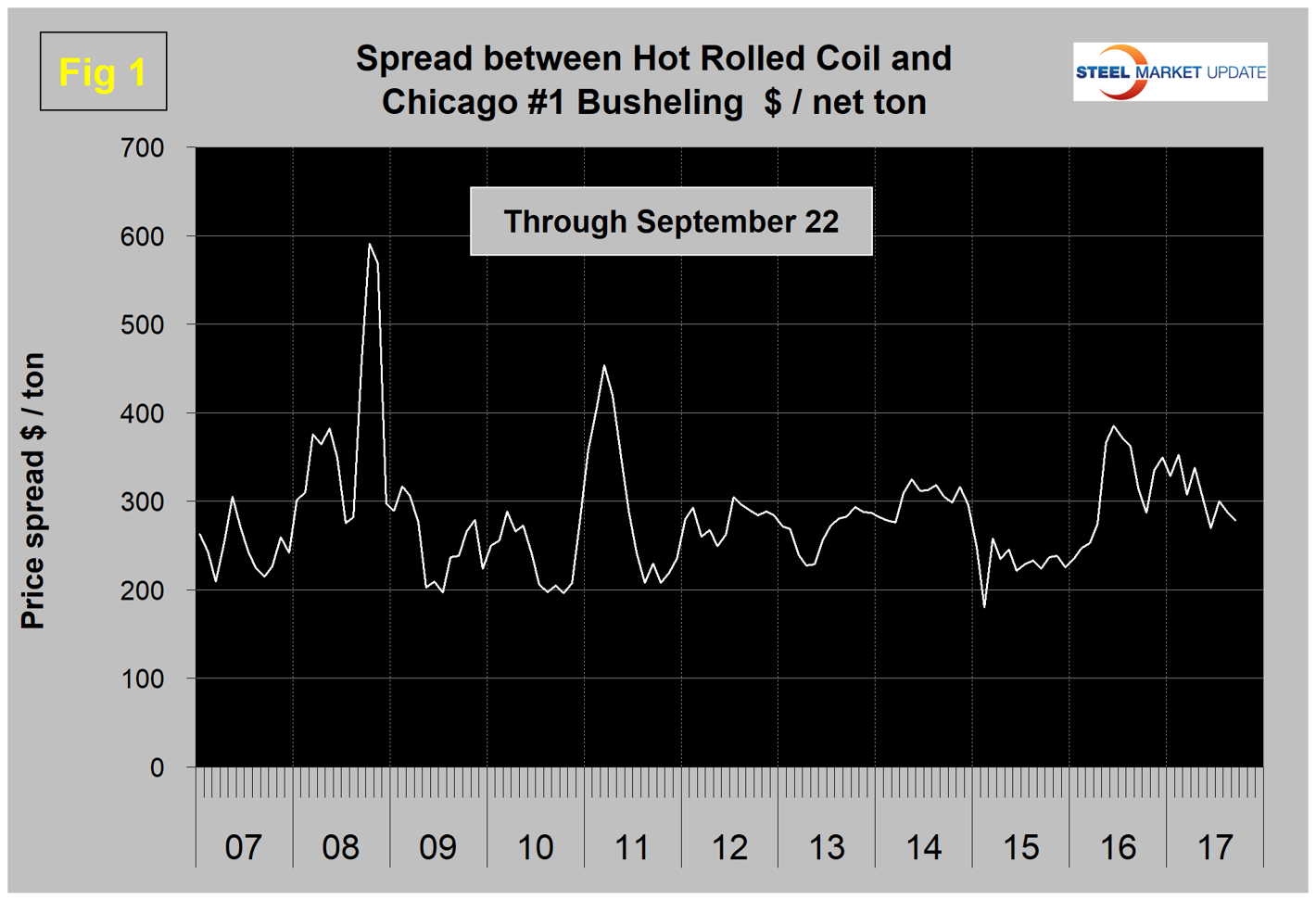

To put the raw materials analysis into perspective, we begin with Figure 1, which shows the spread between Chicago #1 busheling and hot rolled coil ex works Indiana through Sept. 22, both in $/net ton. On this date, Chicago busheling was priced at $341.52/net ton ($382.50/gross ton) and HRC ex works Indiana was $620.00/net ton for a spread of $278.48/net ton. The spread reached a recent high of $385.46 in June 2016.

Scrap

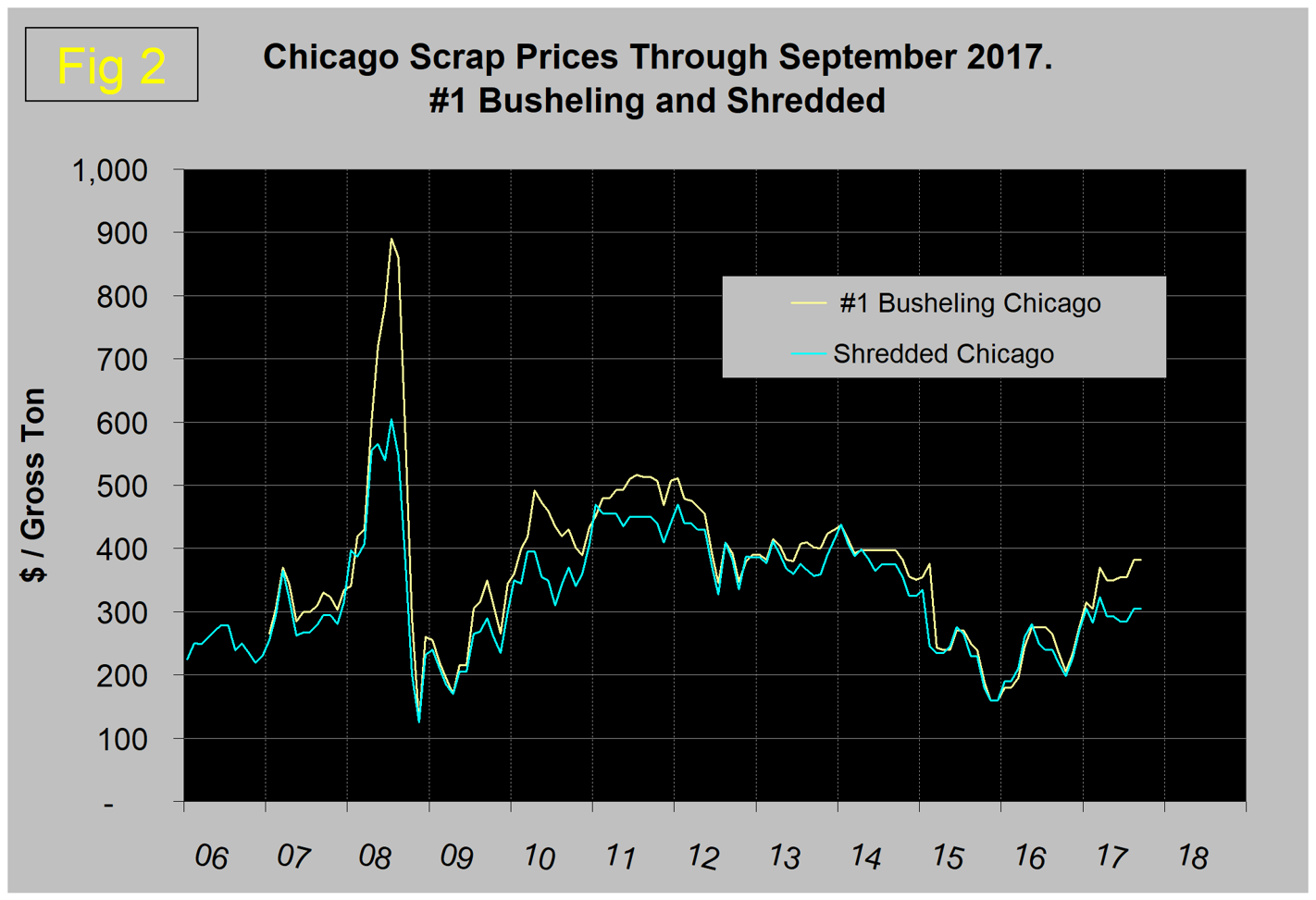

Figure 2 shows the relationship between shredded and #1 busheling, both priced in Chicago. In September, both grades were unchanged in price from the August value. The busheling premium was unchanged at $77.50, which was the highest premium since February 2015.

Iron Ore

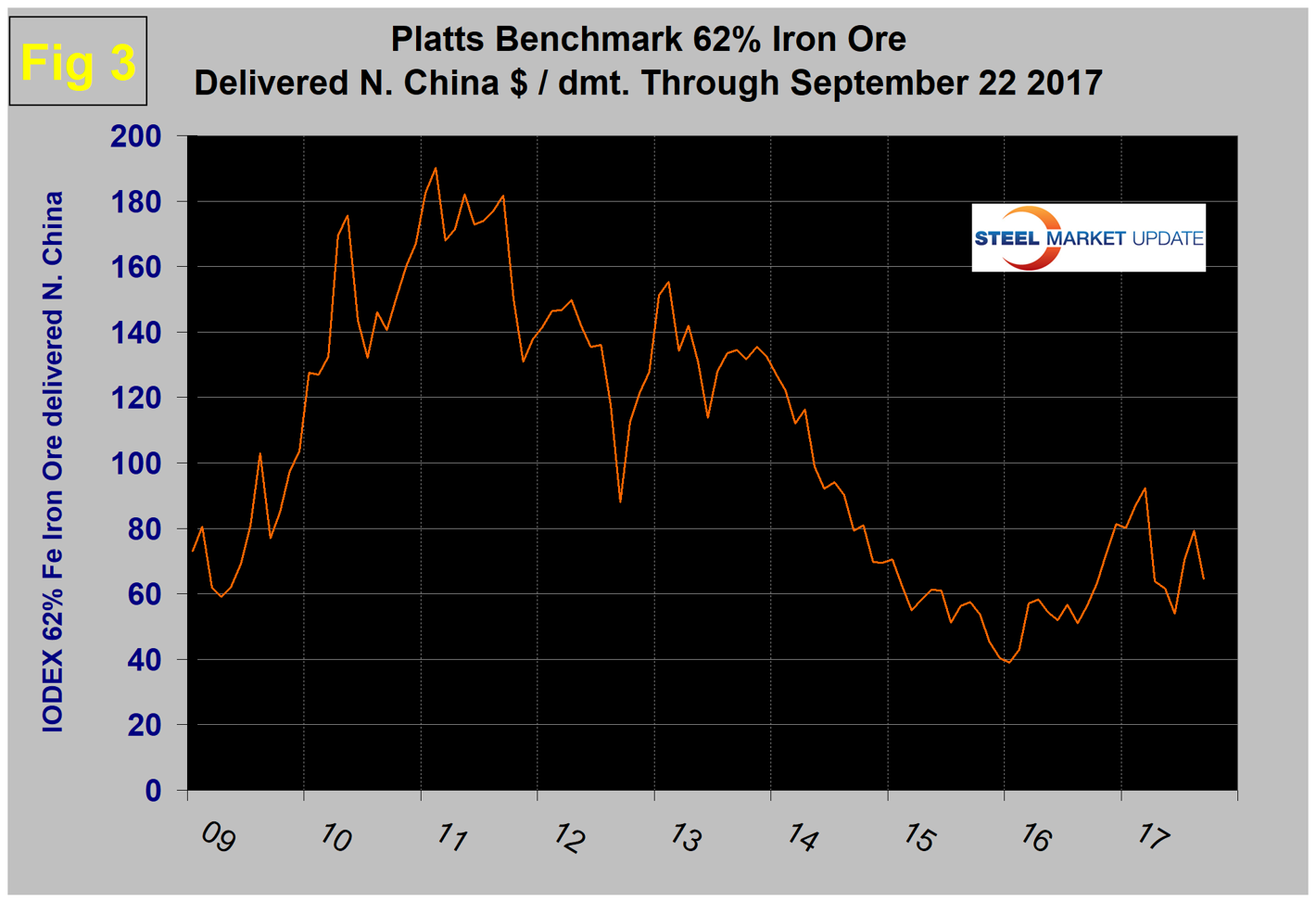

On Sept. 22, one of Steel Market Update’s trading contacts in China said to expect iron ore prices to continue a downward spiral as the ports are still holding 140 million metric tons. Also on Sept. 22, Mining.com wrote: “The decline in the price of iron ore over the past two weeks turned into a rout on Thursday as worries about new supply combined with fears that Chinese steel production may have peaked. The Steel Index benchmark price for Northern China 62% Fe ore sank by 7.4 percent to trade at $63.00 per metric ton on Thursday, an 11-week low. Year-to-date iron ore has lost 20.8 percent of its value. Lower grades came in for greater punishment with 58% Fe fines delivered to the port of Qinqdao falling 13.7 percent to $44.10, according to TSI. Chinese imports constitute around 70 percent of the seaborne trade and while 2017 shipments are in line with record imports of over 1 billion tons last year, supply continues to grow, particularly from major producers in Australia and Brazil.”

Figure 3 shows the Platts IODEX of 62% Fe delivered North China since January 2009. The Index recovered to $92.30 on March 17, but has since declined to $64.60 on Sept. 22. There is a long-term relationship between the prices of iron ore and scrap.

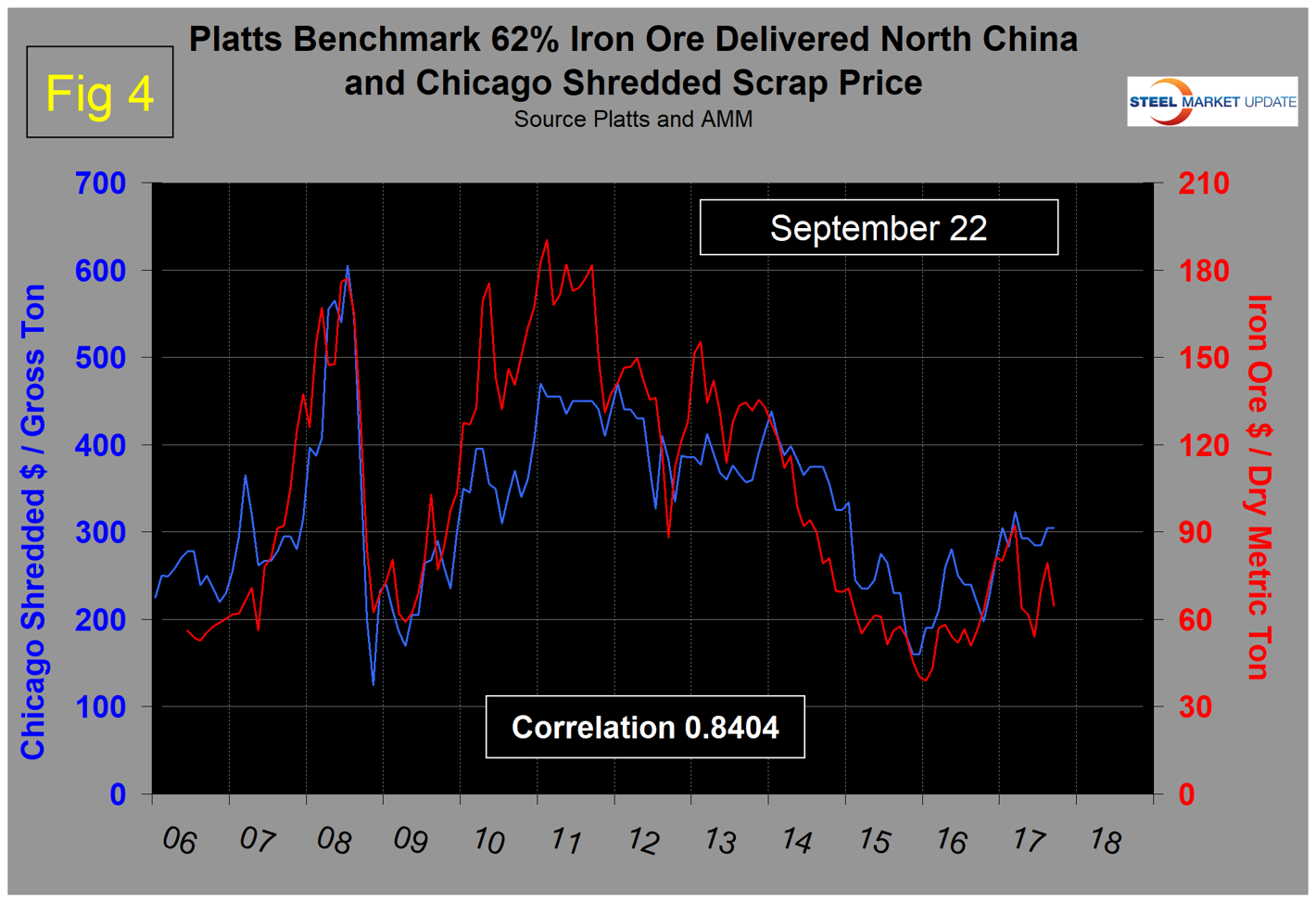

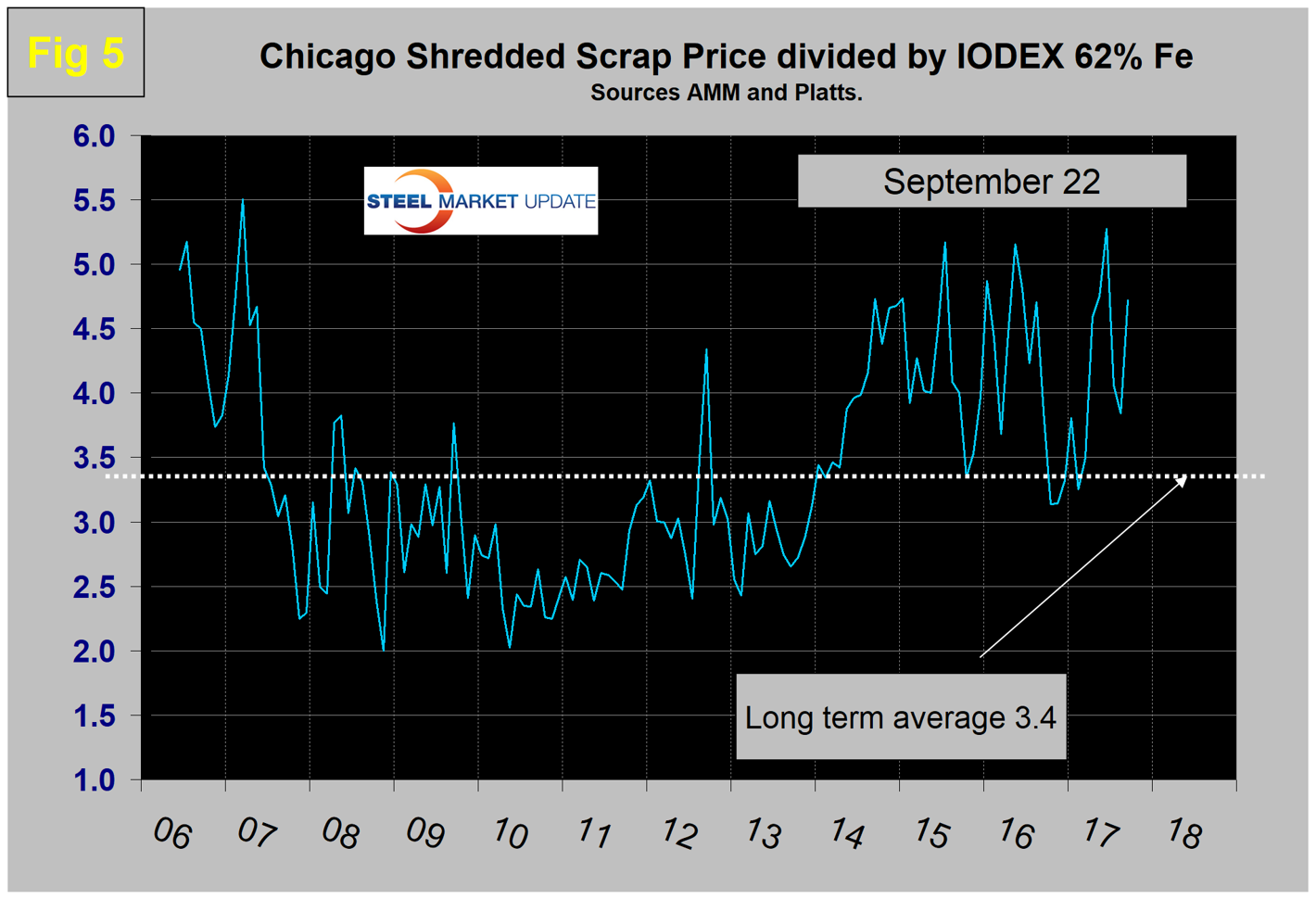

Figure 4 shows the IODEX and the price of Chicago shredded through Sept. 22. The correlation since January 2006 has been 84.04 percent, and in the last 10 years, on average, scrap in $/gross ton has been 3.4 times as expensive as ore in $/dmt.

The ratio has been erratic since mid-2014, but overall since then has benefited the integrated producers. There was a six-month respite for the EAF operators in Q4 ‘16 and Q1 ’17, but now the ratio is once again high with a value of 4.72 on Sept. 22. The June ratio of 5.28 was the highest in over 10 years (Figure 5). Since Chinese steel manufacture is 93 percent BOF, this ratio has allowed them to be more competitive on the global steel trade market. In addition, in the last four years there have been times when China could supply semifinished to the global market at prices competitive with scrap.

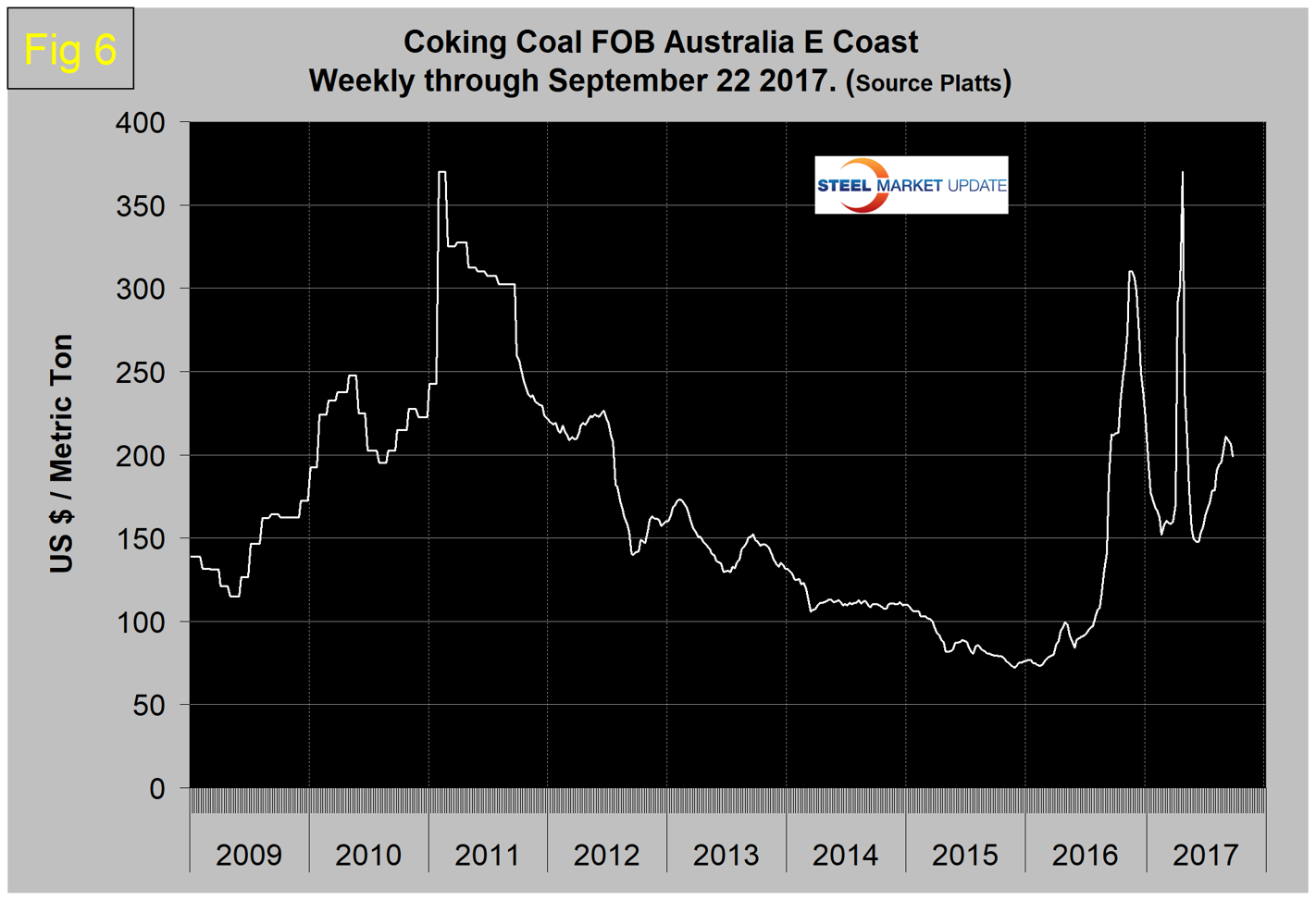

Coking Coal

On Sept. 22, Platts reported that premium low-volatile coking coal was down $7.50 per metric ton on the week to $199 FOB Australia. North and South China buyers appeared to be reluctant to buy seaborne imports due to regulatory uncertainty and possible mandated production cuts in some regions (Figure 6).

Zinc

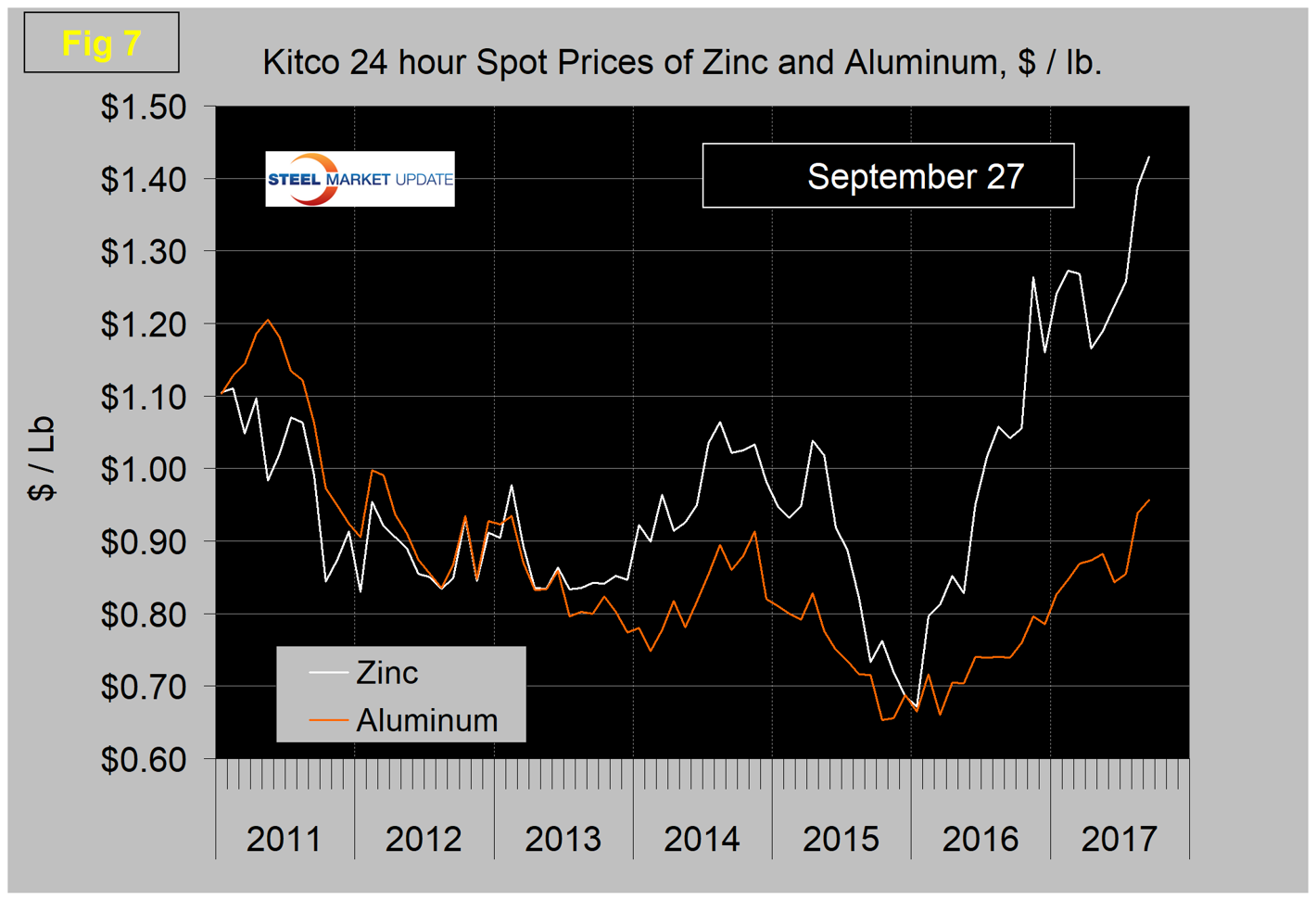

The major use of zinc is for galvanizing. Other significant uses include the alloying of brass and bronze and in zinc-based alloys used in the die-casting industry. Kitco publishes a daily spot price of zinc, which we have transcribed to Figure 7. Just as a point of reference, we have included aluminum in the same graph.

The price of zinc soared to $1.4299 on Sept. 27, on which date Kitco had this to say: “Stocks of zinc available to the market in LME-registered warehouses have fallen by more than 50 percent this year. Most warrants are held by two entities with large positions. London zinc rose to its highest price in a decade on Monday and nickel also rallied as investors ploughed into metals used by China’s steel sector, seeing robust demand even as capacity is constrained by Beijing’s drive to reform bloated industries.”

“Metals are pretty strong. The U.S. dollar has been weaker and the Federal Reserve has turned a bit more dovish, so that is supportive,” said analyst Lachlan Shaw of UBS in Melbourne. Shaw noted that China’s steel and aluminum markets could tighten with central government mandated cuts over the winter, although the aluminum cuts should be offset by rising Shanghai warehouse inventories.

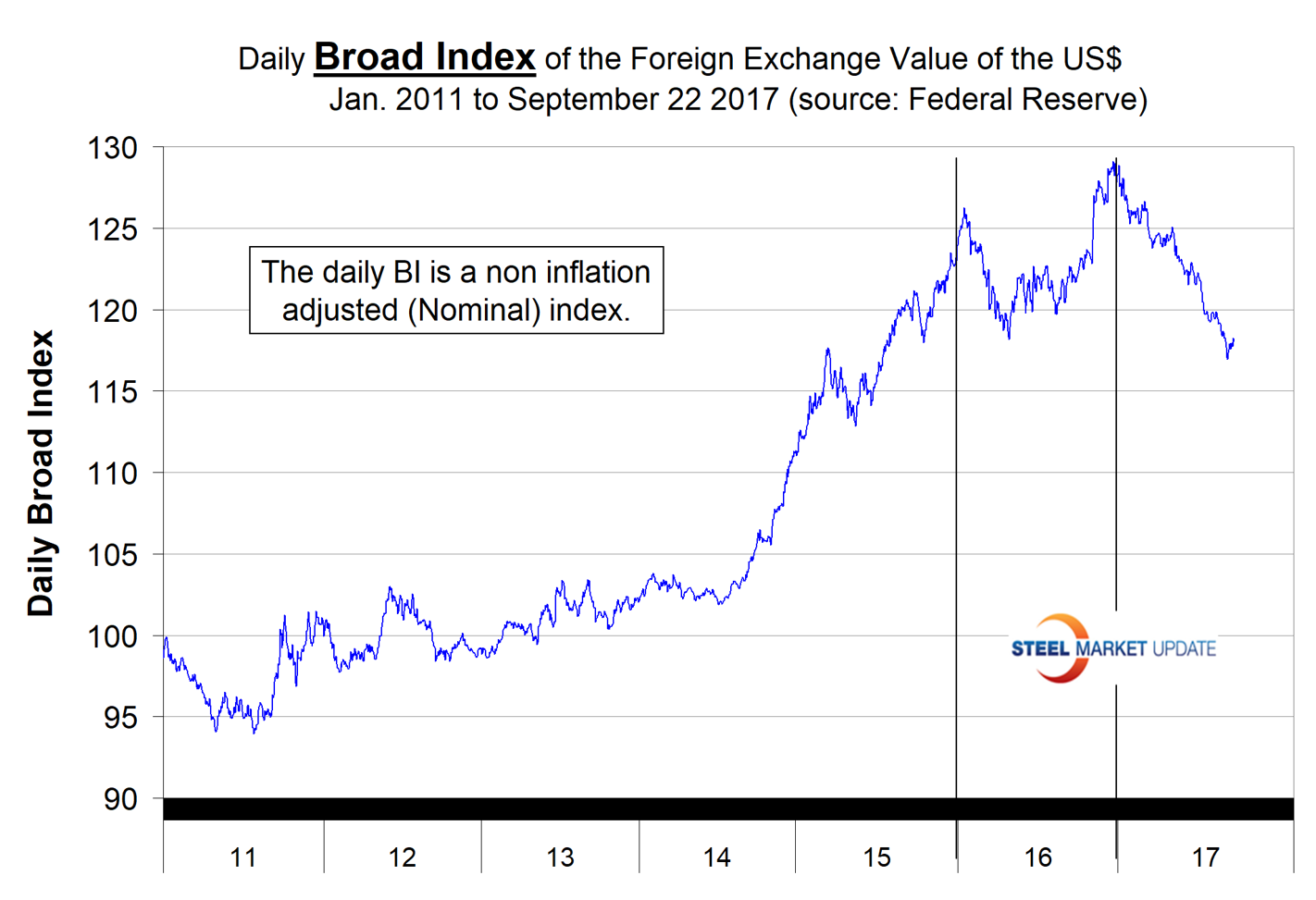

SMU Comment: The prices of raw materials are driven by normal supply and demand forces and by unexpected events such as Cyclone Debbie that recently hit the supply side of the coke equation. However, behind the scenes there is an inverse relationship between commodity prices and the value of the U.S. dollar on the global currency markets. As we reported in our currency update last week, the value of the dollar declined by 9.3 percent between Jan. 3 and Sept. 8 this year. Since then, through Sept. 22, the decline had moderated to 8.5 percent (Figure 8).

A weakening dollar will put upward pressure on the price of those global commodities that are priced in dollars. Last week, Platts reported that the international steel price rally appears to have come to an end with finished steel and raw materials prices weakening during the week of Sept. 22. The Chinese market was further impacted by government-imposed steelmaking restrictions.