Prices

April 18, 2017

SMU Price Ranges & Indices: No Clear Direction

Written by John Packard

The debate these days seems to be centered around how much inventory is really out there, how much is incoming (especially from foreign sources) and how much flat rolled will buyers need to buy come this summer? Earlier today I asked a small steel mill if they believed the low coated inventories (1.65 months) according to the MSCI data released earlier today. We were told, “Yes, hook line and sinker I believe. But, only customers know how much import they have on the way and I believe that the numbers are quite sizeable so they can afford to play it tight on domestic purchases. Lead times are relatively short, northern mills have tons available, and imports on ground, on boats and on order are enough to not have anyone worried.”

To put this thought process into perspective as SMU was inquiring with service centers about their inventories this afternoon we heard from one buyer, “We have 2.5 [months supply as of the end of March] but we always have 5 months of foreign on order.”

A very large service center told us of his concerns, “Very mixed signals on lead-times of late too. SDI Columbus is at 4-5 weeks on nearly all products, while others out 8+… Iron Ore is down to $64/ton or 33% in last 8 weeks or so. How that ends up correlating back here is unknown in the new protectionist environment. I’m concerned we see a fairly dramatic correction in China which ultimately puts downward pressure here, via scrap prices, as well as yet lower offers on imports from countries not affected by duties.”

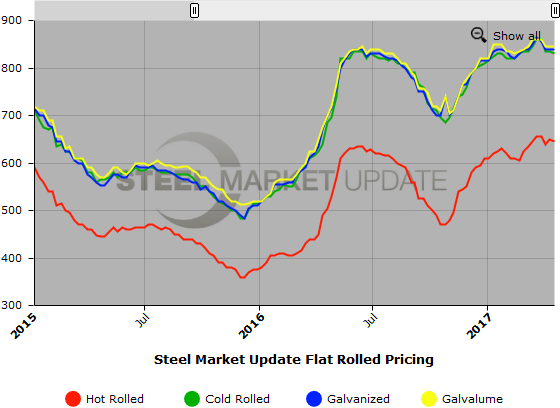

We saw hot rolled and cold rolled drop slightly this week while galvanized and Galvalume remained the same as one week ago. We are hearing of some holes out there but a number of the buyers are not biting on those holes as the need to buy is not there. If the MSCI numbers are correct on flat rolled, that ability to wait should evaporate quickly. If not, there may be lower prices coming. SMU is keeping our Price Momentum Indicator at Neutral as we do not yet know which side the pendulum will swing from here.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $630-$660 per ton ($31.50/cwt-$33.00/cwt) with an average of $645 per ton ($32.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago while the upper end remained the same. Our overall average is down $5 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $800-$860 per ton ($40.00/cwt-$43.00/cwt) with an average of $830 per ton ($41.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week while the upper end was unchanged. Our overall average is down $5 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $40.50/cwt-$43.50/cwt ($810-$870 per ton) with an average of $42.00/cwt ($840 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $888-$948 per net ton with an average of $918 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-10 weeks

Galvalume Coil: SMU base price range is $41.00/cwt-$43.50/cwt ($820-$870 per ton) with an average of $42.25/cwt ($845 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1111-$1161 per net ton with an average of $1136 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $720-$790 per ton ($36.00/cwt-$39.50/cwt) with an average of $755 per ton ($37.75/cwt) FOB delivered. Both the lower and upper ends of our range declined $20 per ton compared to one week ago. Our overall average is down $20 per ton compared to last week. Our price momentum on plate steel is now pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.