Prices

April 11, 2017

February Apparent Steel Supply 1.3% Better than Last Year

Written by Brett Linton

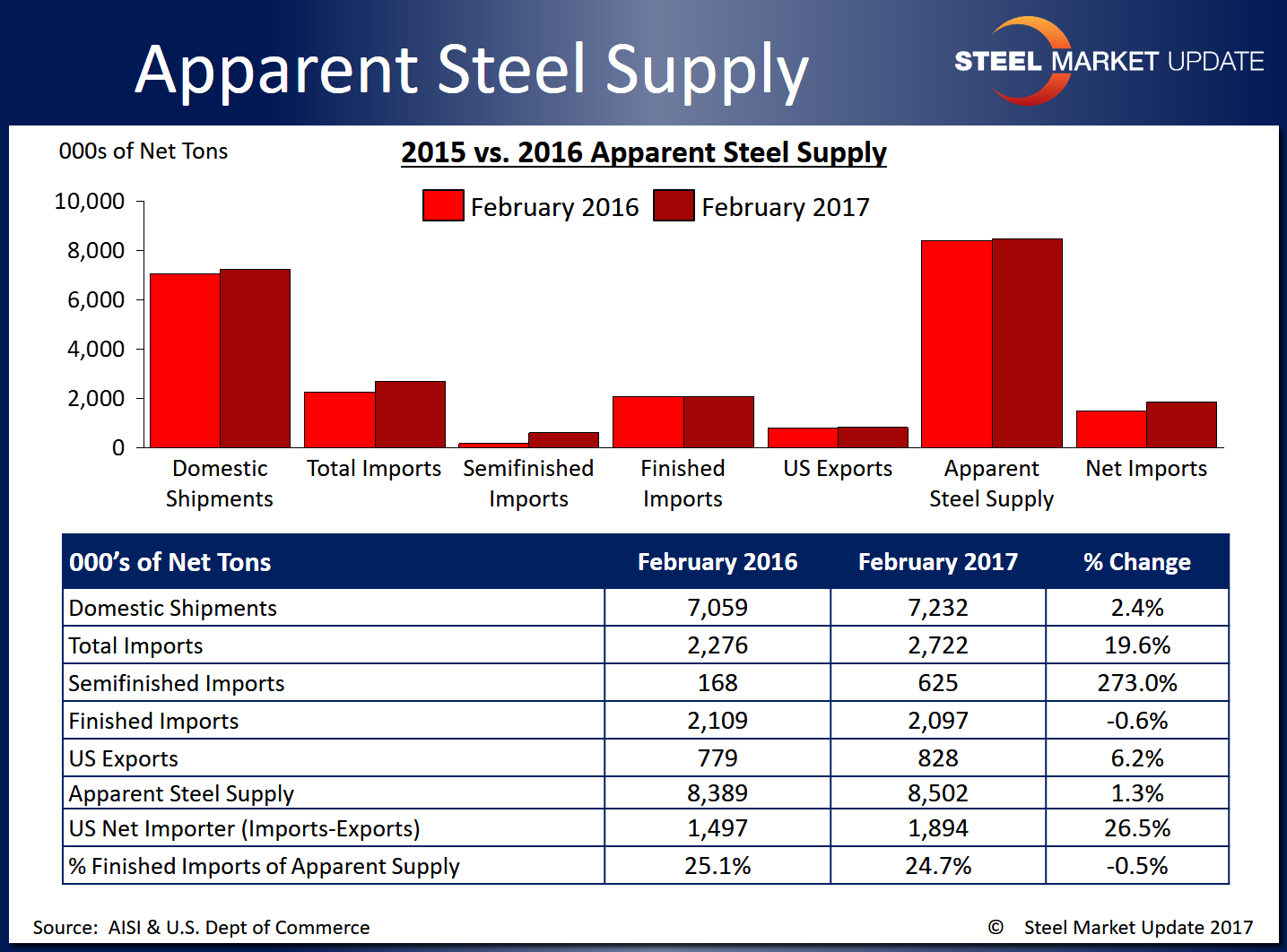

According to the latest data released from the U.S. Department of Commerce and the American Iron and Steel Institute, apparent steel supply for the month of February 2017 was 8,501,854 net tons. Apparent steel supply is calculated by adding domestic steel shipments and finished US steel imports, then subtracting total US steel exports.

February apparent steel supply represents a 112,690 ton or 1.3 percent increase compared to the same month one year ago when apparent steel supply was 8,389,164 tons. The majority of this change came from an increase in domestic shipments, increasing 172,899 tons or 2.4 percent. Finished imports were down 11,659 tons or 0.6 percent and total exports rose 48,550 tons or 6.2 percent, both lessening the overall rise in apparent steel supply.

The net trade balance between US steel imports and exports was a surplus of +1,894,327 tons imported in February 2017, 26.5 percent higher than that of February 2016 when it was +1,497,240 tons. Foreign steel imports accounted for 24.7 percent of apparent steel supply, down 0.5 percent over the same month one year ago.

When compared to last month, when apparent steel supply was 9,236,293 tons and at a 1.5 year high, February supply decreased by 734,439 tons or 8.0 percent. This was primarily due to a decrease in domestic imports and finished imports, with domestic shipments down 476,075 tons or 6.2 percent and finished imports down 249,234 tons or 10.6 percent. Total exports rose 9,129 tons or 1.1 percent month over month, slightly contributing to the overall decline in apparent steel supply.

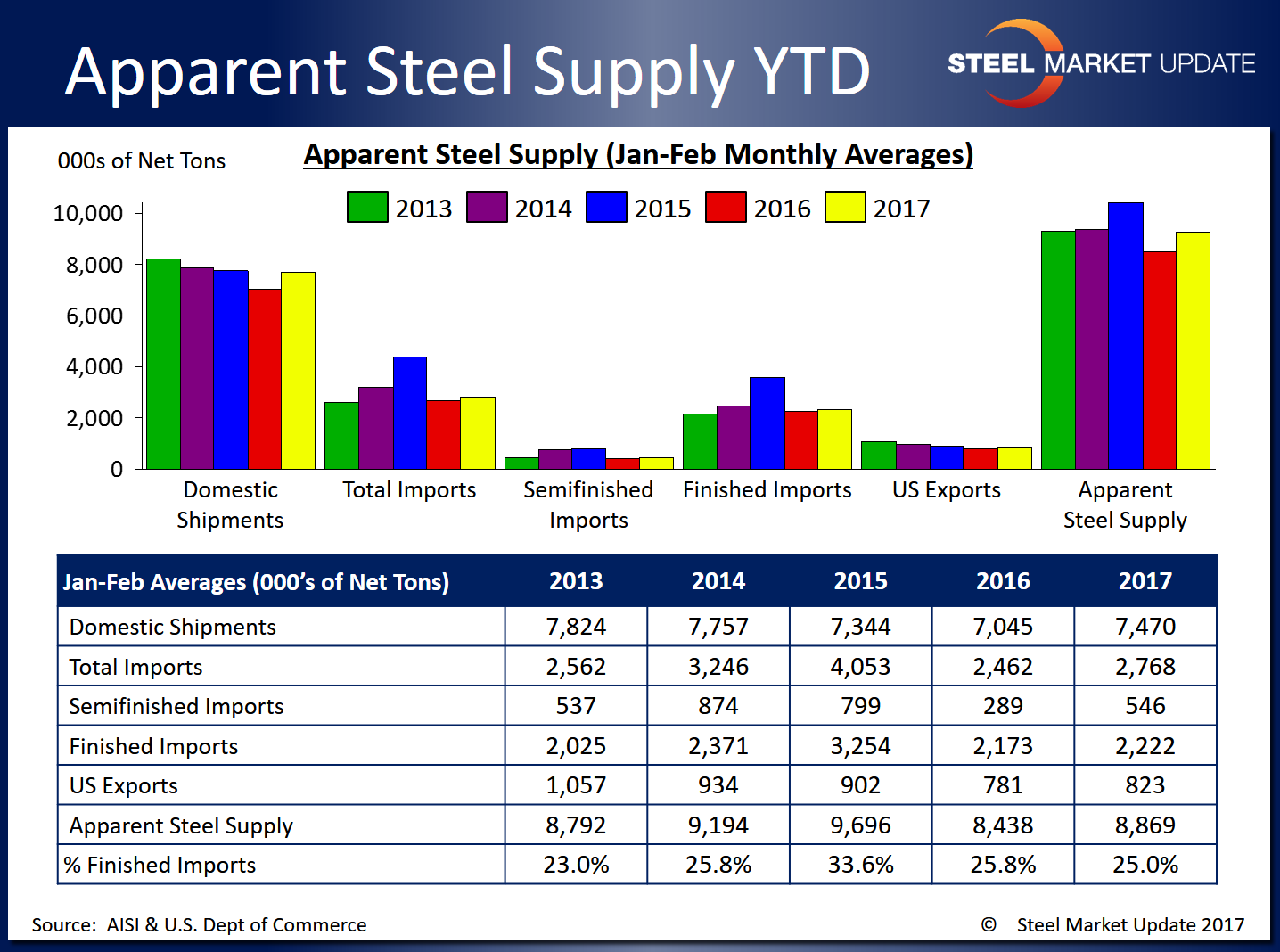

The table below shows year to date totals for each statistic over the last five years. Note that these averages are calculated through the first two months of each year for an equal comparison. The 2017 data points seem higher than the 2016 figures, but are mixed compared to 2013-2015 data for all items listed.

To see an interactive graphic of our Apparent Steel Supply history, visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.