Market Data

April 10, 2017

SMU Price Momentum Indicator Adjusted from Higher to Neutral

Written by John Packard

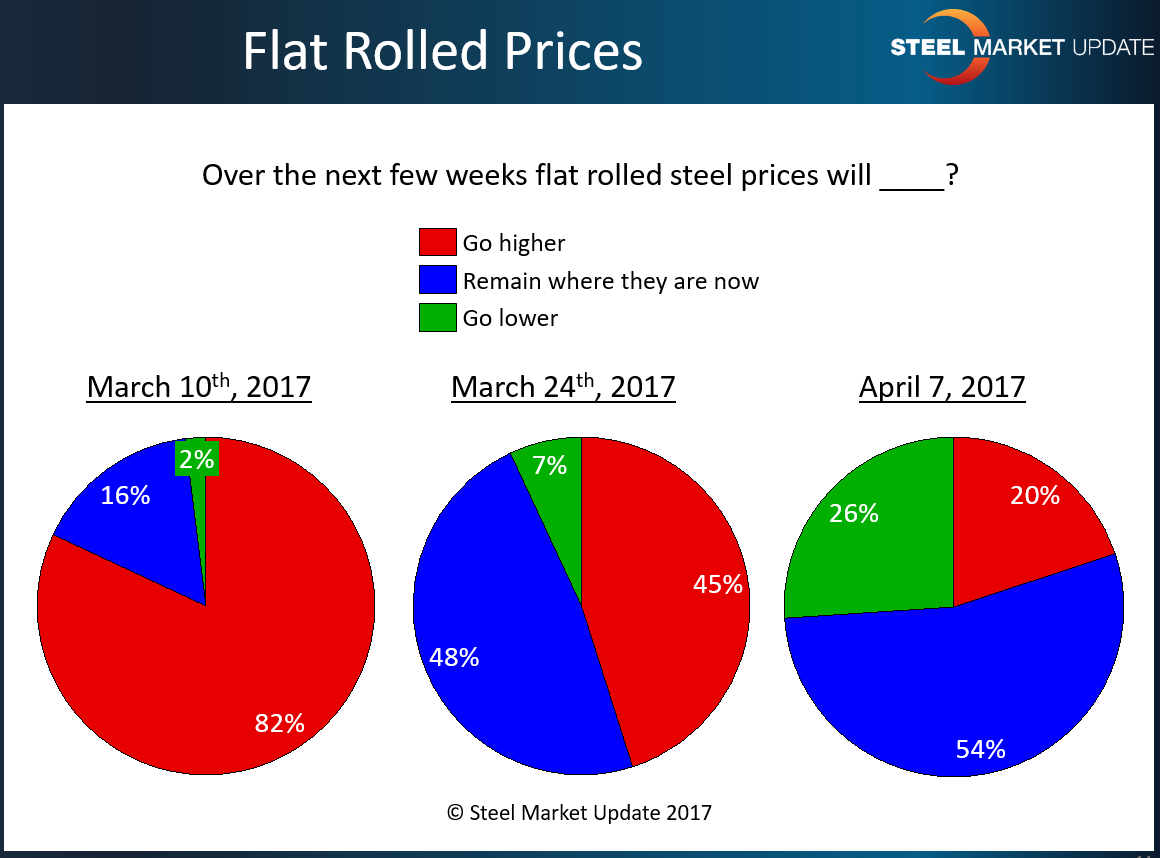

On Friday Steel Market Update (SMU) adjusted our flat rolled steel Price Momentum Indicator to Neutral from Higher. The key reason behind our decision to move our indicator is “indecision” in the marketplace. More about that in a moment.

The current market cycle began on October 21, 2016 when the domestic mills were able to reverse direction through the use of a price increase announcement. At that time, Steel Market Update went to Neutral as we waited to see if the market would follow the steel mills’ lead. By October 30, 2016 we had seen enough evidence to take Momentum to Higher where it has stayed with the exception of the month of February where challenges to the industry prompted SMU to go back to Neutral before returning to Higher on the 7th of April.

What we are seeing in the marketplace right now is a lot of indecision and mixed messages. We have been seeing it in our lead times, mills willingness to negotiate spot prices, and buyers and sellers of steel confusion regarding price direction (see graphic below).

Last week scrap prices turned and move lower by $10 to $20 per gross ton. The movements were not as strong as what was originally expected (down $30-$35 on shreds/obsolete and $10 on primes). We learned the cheapest prices were the first few deals. Those prices dried up as the week matured with prices ending up down $20 on shreds/obsolete and $10 on primes.

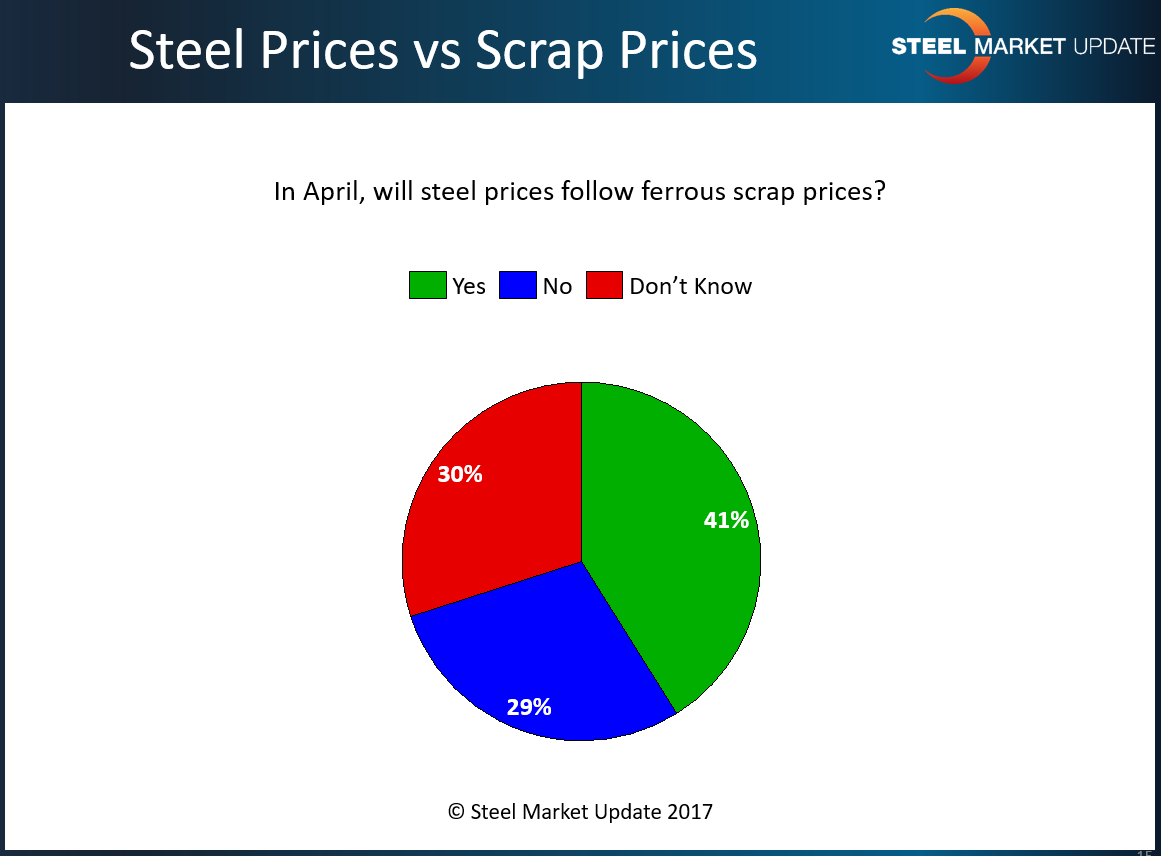

The largest percentage of those responding to our flat rolled steel market questionnaire last week believe flat rolled prices will follow scrap prices (see below graphic). Forty-one percent believe steel prices will follow scrap prices, 29 percent say no, and 30 percent don’t have a clue…

There is new supply coming on-stream with Big River Steel about to begin production on cold rolled. On the 29th of March, Big River Steel told SMU, “We have been commissioning our pickle line and tandem cold mill throughout March and have orders on the books for cold rolled as well as P&O. Timetable for the galvanized line remains April.” On top of Big River Steel, our sources are telling us that Acero Junction is now producing approximately 50,000 tons of hot rolled per month (product is going to service centers and tubers).

We have been reporting on the status of foreign steel imports which are showing signs of lower volumes of hot rolled (see BRS and Acero Junction above) while cold rolled and coated continue at high levels. Some of the domestic mills are reacting to the competitive pressures. Here is what one service center executive had to say on the subject, “Domestic mills just seem more sensitive to foreign offers and are more willing to work with buyers who have legitimate opportunities. Not tire kickers! This varies mill to mill. Some have little to sell and aren’t negotiating, but others are willing to discount where the opportunity makes sense.”

Another executive told us, “I think the current coated and CR prices are too high compared to foreign markets and it’s tough to not draw in more imports if the spread continues, plus we’re starting to see the markets in Asia weaken at least recently. I think the HR price here has been weaker than normal (but still high compared to Asia) due to demand. With energy, construction, and equipment markets beginning to pick up and imports declining, it appears to be the place the domestics can move up with little resistance. We’ve also seen a mill or two have trouble closing out April on coated. Just in a couple of instances as most mills are doing quite well on coated, but the guys that rely mainly on spot seem to be having a little more trouble as the pricing has the spot market still scared.”

John Anton, Principle Economist – Steel for IHS Markit, reported to SMU last week, “Sheet prices are peaking now, and will soon start a decline that will continue through the end of 2017. Initially prices moved up through mid-2016 simply because the January level was too low to be sustainable. The second move – late 2016 through early 2017 – was driven by rising raw materials prices, particularly Australian coal and iron ore. The increases were not demand driven, for demand (both globally and in North America) is flat or barely increasing. It wasn’t supply driven, because there is idle capacity and I haven’t heard of any mills blowing up. Nor has China actually made substantial cuts to output.

“So, sheet will follow raw materials. Coal retreated in Q1, iron ore will retreat in Q2 then scrap will follow. There is support from trade protection, but it only serves to create a higher floor, rather than keep prices at the ceiling. That is, prices still decline but they don’t go all the way down as far as if there was no protection.”

So, for now Steel Market Update is inclined to watch and wait to see if there is something that can turn Momentum in one direction or another. Until then, we are now at Neutral waiting for a sign.