Prices

March 30, 2017

Hot Rolled Futures Prices Declined This Week

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

With HR spot hovering around $650/ST, HR futures prices declined in the latest week on modest trading volumes. Conflicting sharp price moves in the steel supply chain kept participants sidelined. Rising iron ore and pig iron prices in conjunction with plunging then recovering export scrap prices lead to some confusion.

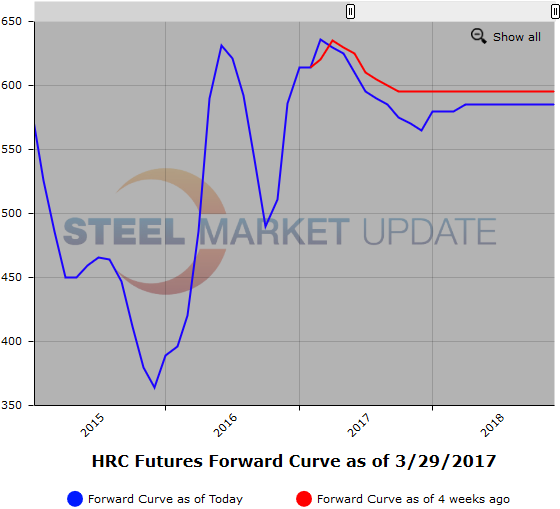

The past week just over 15,000 ST traded with the bulk of the volume trading in Q2/Q4’17. The futures curve for 12 months forward declined on average about $15/ST with the volumes pretty evenly spread across the balance of 2017. Inquiries for the first 2 quarters of 2018 picked up this past week, however only Jan’18 and Feb’18 traded this past week at roughly $580/ST. The main deals this week were two Apr/Feb’18 strips which traded at an average price of just north of $600/ST which represents a pretty good discount to the current spot level. While market forecasts point to fairly steady HR demand for the remainder of the year market sentiment remains mixed. April prime scrap prices will remain the focus as the market looks for clear signals on where HR prices are headed.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

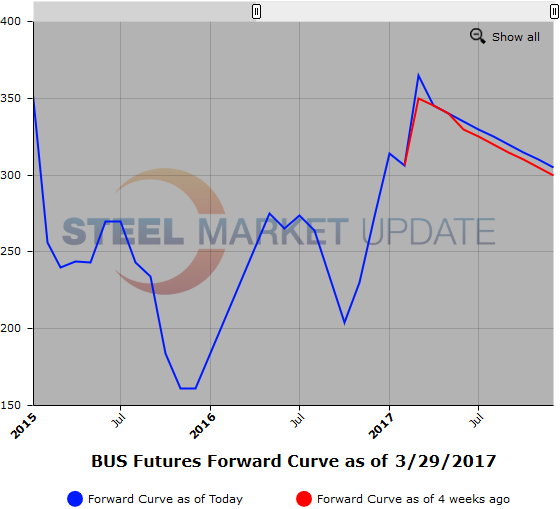

It has been a bit of a roller coaster ride in the CFR Turkish scrap market with prices dropping precipitously only to partially retrace nicely from sub $260 levels just a few days ago to $270 plus going into the end of the week. Rebounding iron ore and rising pig iron prices due to the Ukraine conflict are adding volatility to an already cautious futures marketplace due to soft markets for Turkish finished steel. With higher pig iron prices and steady prime scrap demand early chatter has U.S. Midwest BUS sideways for April. ($365). The BUS futures curve remains well backwardated with 2H’17 offered at $325/GT and Cal’18 offered at $315/GT.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.