Prices

January 5, 2017

Sleepy Start to 2017 for Ferrous Futures

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

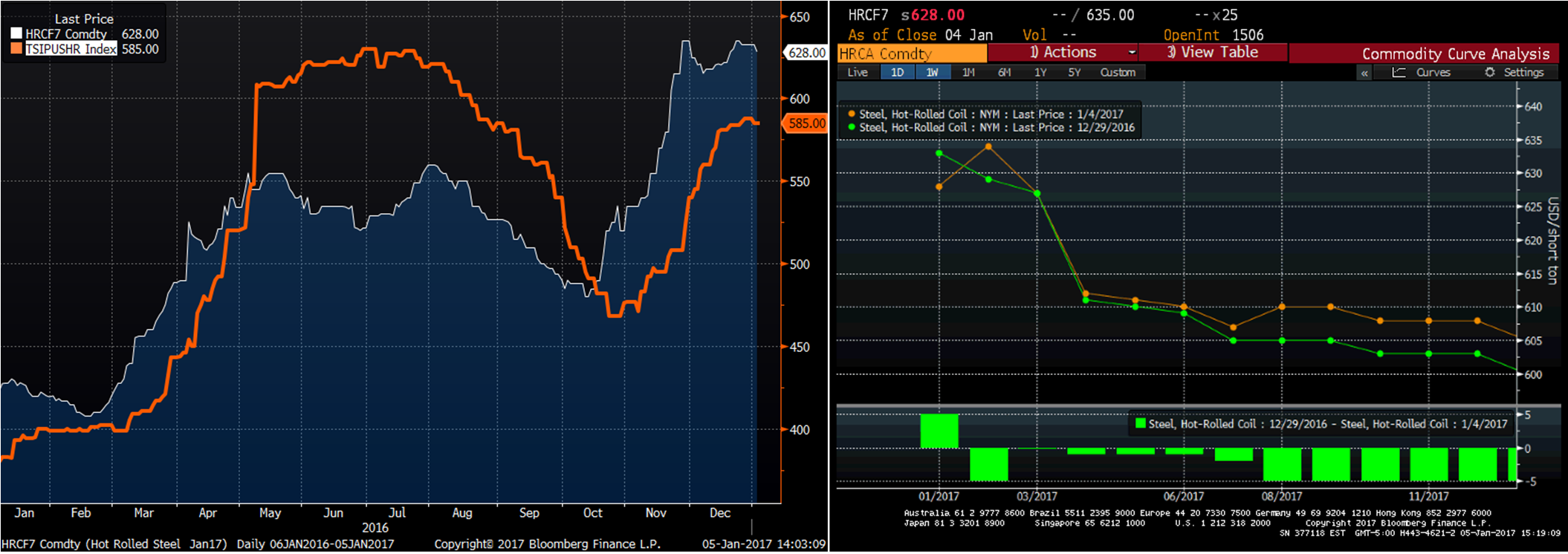

Midwest HRC futures have been relatively quiet to kick off the New Year. Yesterday, February traded up to $633/st while the back half of the year traded up to $609. The curve has moved into a decent backwardation perhaps due to expectations that additional capacity will pressure prices lower, even in the face of very low flat rolled inventory levels, falling imports, record auto sales, growing construction and an impressive December ISM PMI. Perhaps service centers and OEMs are still proceeding with caution following two years of increased volatility.

Service centers and OEMs adjusted to historically lean inventory levels in 2016. It will be interesting to see if these firms’ inventory management practices adjust back to long-term average levels or if the inventory strategy shift is a permanent phenomenon. 2017 steel demand will be the key as months-on-hand will plummet if demand bounces back abruptly.

Consider November MSCI YTD flat rolled shipment data showing shipments falling in excess of 2 percent. For shipments to average 2 percent growth across 2016 and 2017, 2017 shipments will have to increase over 4 percent. If demand improves in 2017 forcing service centers and OEMs to shift back to a more normal level of inventory, a 4 percent increase in shipments is certainly possible. What could 4 percent flat rolled shipment growth do to flat rolled prices? 2017 could be very interesting.

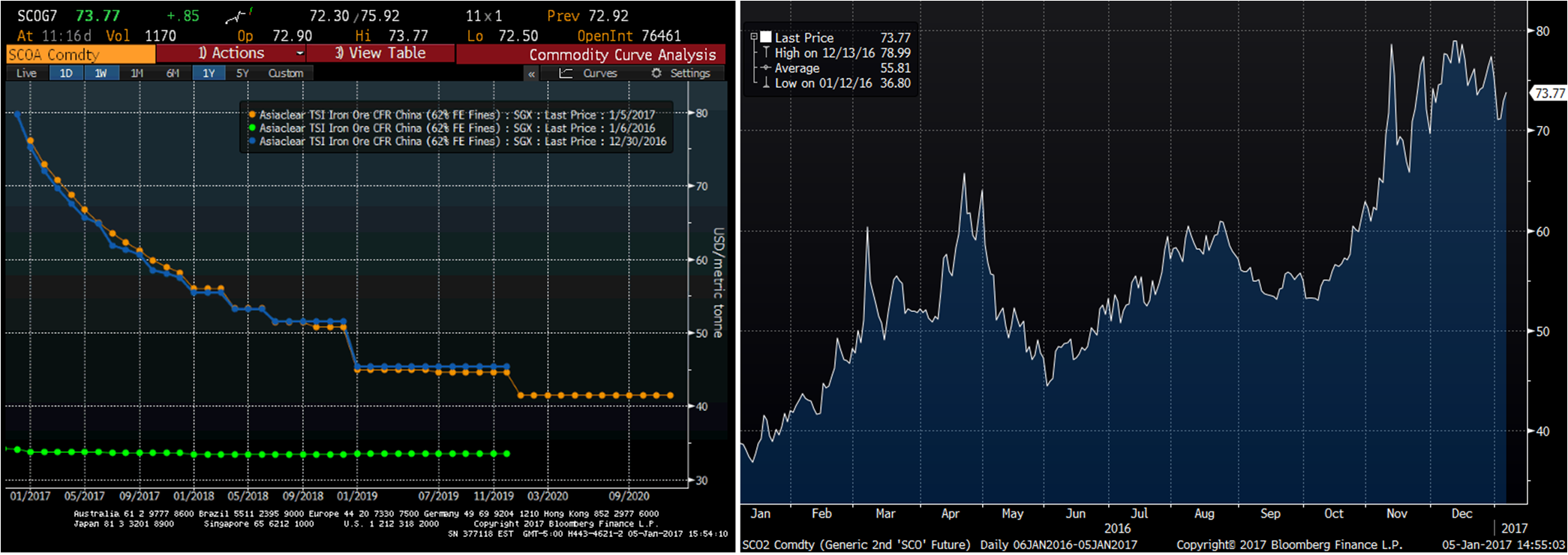

SGX iron ore futures were little changed week over week, but what a difference a year makes! The chart on the left shows the curve today, last week and one year ago. Ore is up over 100% year over year!

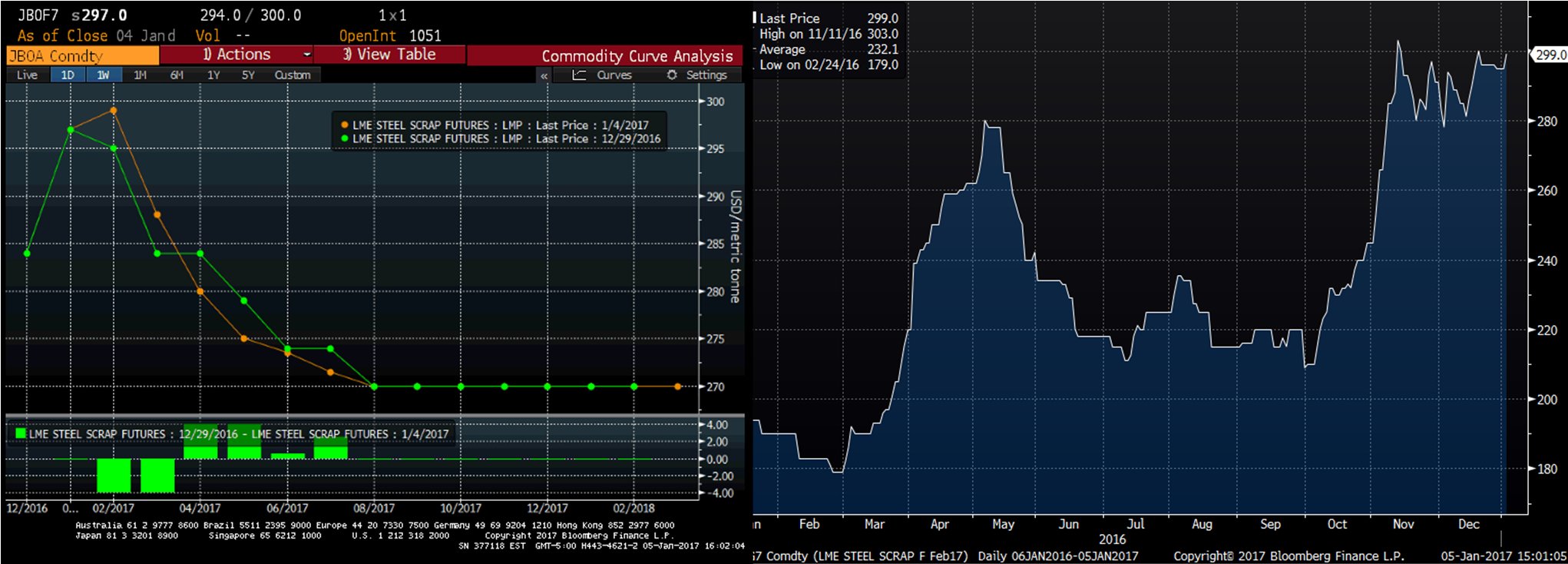

LME Turkish Scrap saw some gains this week in the front of the curve with February trading up to $299/lt.