Prices

December 22, 2016

The Future of Ferrous Futures – Looking Ahead to 2017

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

The Future of Ferrous Futures – Looking Ahead to 2017

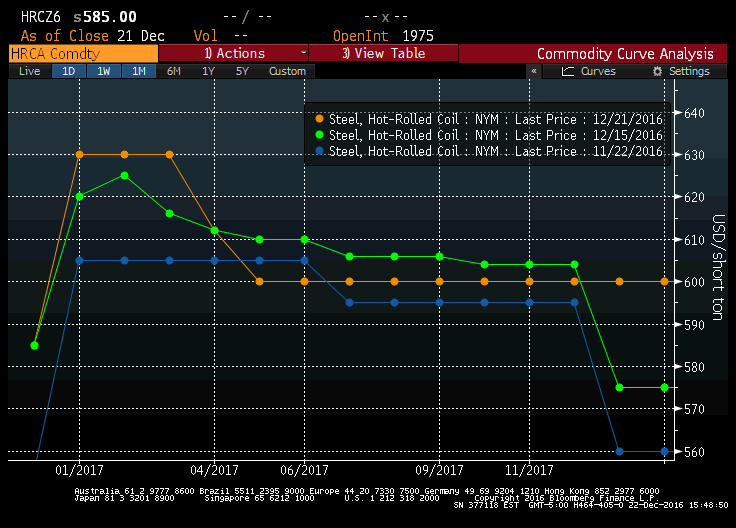

HRC futures continued trading higher this past week. Today, futures traded at $630/st for Q1 2017. Last night’s settlements surprised some with Q2 2017 trading down to $600. There was a spread trade where an individual paid $625 for Q1 and sold Q2 at $600. You can expect the Q2 settlements to move back up tonight. Rumors of an imminent price increase from a domestic mill have filtered through the trading (and physical) community. Perhaps today’s Q1 buyer is anticipating this announcement in close. HRC futures open interest currently stands at 306,400 tons.

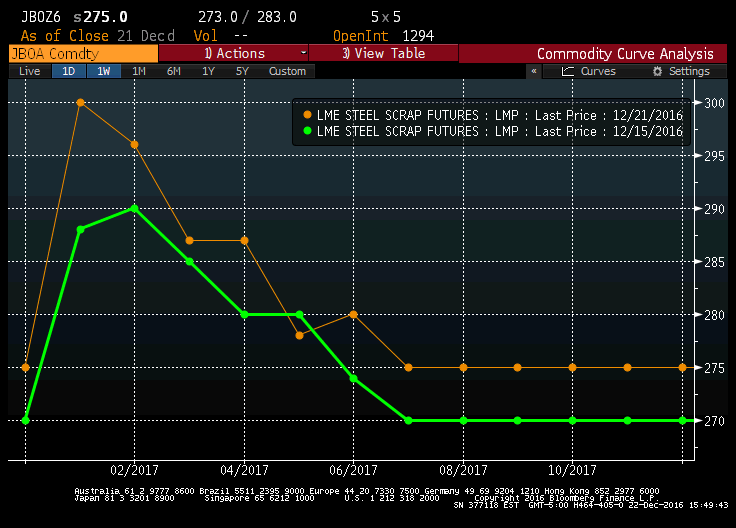

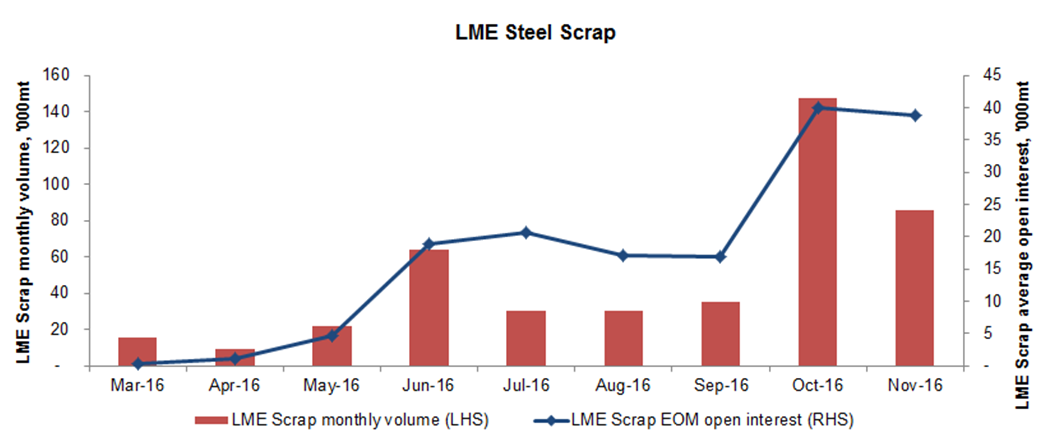

LME Turkish scrap also traded higher this past week with January up to $300/lt. Interest in the contract continues to improve. The LME scrap futures market has had a consistent two sided market on the screen.

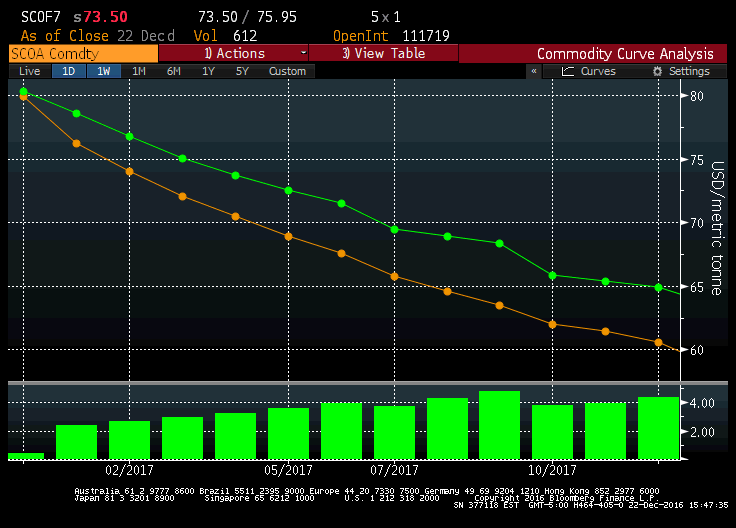

Iron ore has fallen $2 – $4/t over the past week and still remains deeply backwardated.

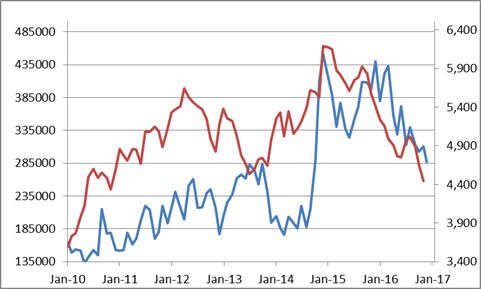

MSCI Flat Rolled Inventory (red) vs. CME HRC Futures (blue)

One major problem with the HRC futures is the lack of reliable supply as the contract has never been supported by a steel mill. The chart above and the correlation between the fall in open interest in the HRC futures contract and the fall in service center flat rolled inventory affirms the major supply source for the contract is a patchwork collection of service centers.

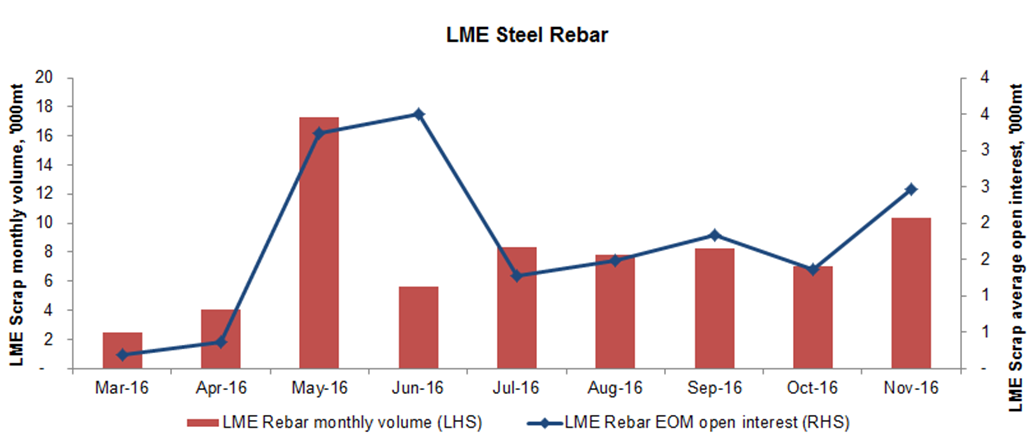

The open interest in CME busheling futures is only 7,340 gross tons and remains irrelevant (along with futures tied to the TSI North European and ASEAN indexes). However, the recently listed LME Turkish scrap and rebar have gotten off to a solid start. Also, the Nasdaq will be launching a shredded scrap futures contract in Q1 2017. Representatives from both the LME and Nasdaq told me that they are interested in developing a hot rolled futures contract of their own, however, these projects seemed to be contingent on the success of their respective scrap contracts. Regardless, perhaps the addition of these scrap futures markets results in significant liquidity growth in HRC futures. The ability for steel mills to hedge their scrap and iron ore purchases also provides the mills with the ability to hedge their profit margin or metal spread by selling HRC futures. This could have serious implications for the success of the ferrous derivatives market and the role they play in the steel industry.