Prices

November 18, 2016

September Apparent Steel Supply at Nine Month Low

Written by Brett Linton

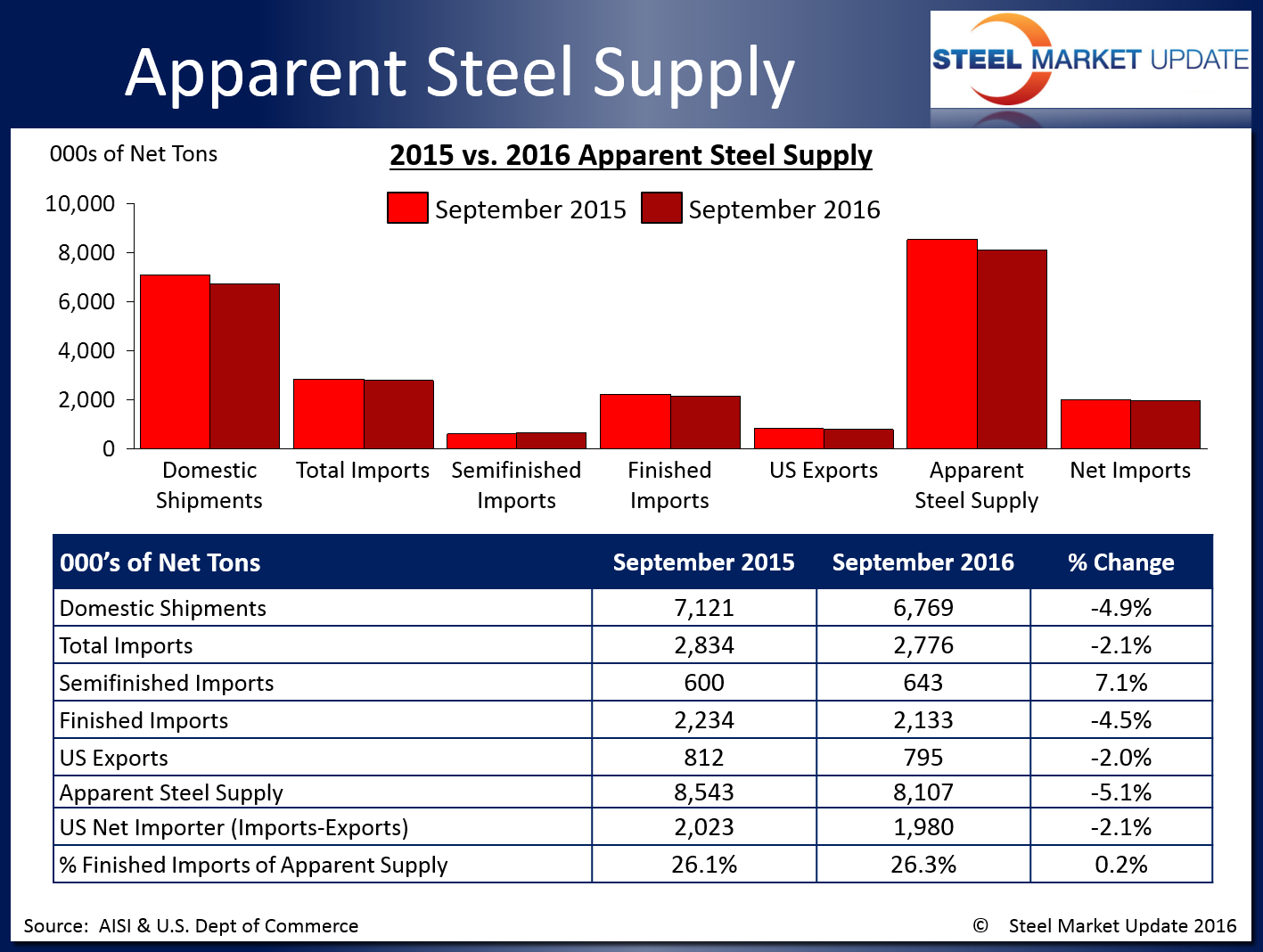

According to the latest data released from the U.S. Department of Commerce and the American Iron and Steel Institute, apparent steel supply for the month of September 2016 was 8,106,754 net tons. Apparent steel supply is calculated by adding domestic steel shipments and finished US steel imports, then subtracting total US steel exports.

September apparent steel supply represents a 436,267 ton or 5.1 percent decrease compared to the same month one year ago when apparent steel supply was 8,543,021 tons. The majority of this change came from a decline domestic shipments, which were down 4.9 percent or 351,351 tons, and a decline in finished imports of 4.5 percent or 101,181 tons. Total exports declined 2.0 percent or 16,265 tons.

This is the lowest apparent steel supply figure since December 2015 when apparent supply was 7,878,660 tons.

The net trade balance between US steel imports and exports was a surplus of +1,980,247 tons imported in September 2016, 42,410 tons or 2.1 percent less than that of September 2015. Foreign steel imports accounted for 26.3 percent of apparent steel supply, up 0.2 percent over the same month one year ago.

When compared to last month when apparent steel supply was 9,115,482 tons, September supply decreased by 1,008,729 tons or 11.1 percent. Similar to the year over year changes, the majority of this change also came from a decline domestic shipments, which were down 10.3 percent or 773,293 tons, and a decline in finished imports of 10.6 percent or 252,128 tons. Total exports declined 2.1 percent or 16,692 tons.

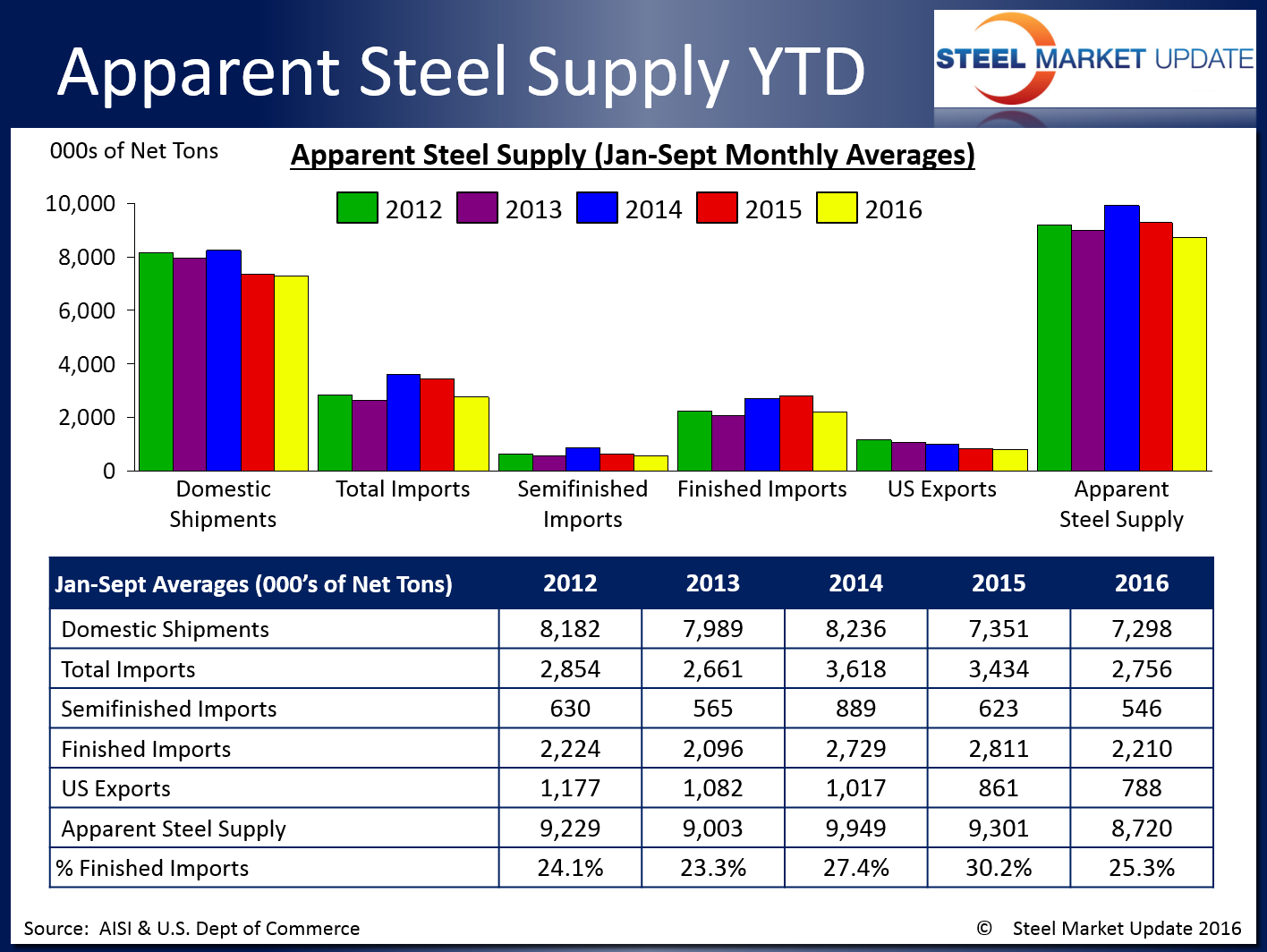

The table below shows year to date totals for each statistic over the last five years. Note that these averages are calculated through the first nine months of each year for an equal comparison. 2016 figures remain lower than most of the previous years for all items listed.

To see an interactive graphic of our Apparent Steel Supply history, visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.