Market Data

November 17, 2016

Currency Update for Steel Trading Nations

Written by Peter Wright

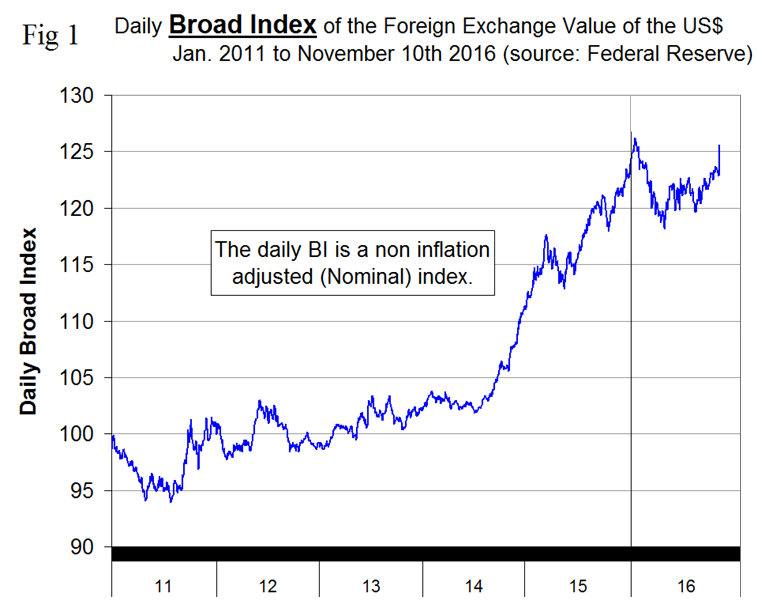

Please see the end of this report for an explanation of data sources. The Broad Index value of the US $ is reported several days in arrears by the Federal Reserve, the latest value we have was dated November 10th, Figure 1. The dollar has appreciated strongly since the election in anticipation of higher interest rates if and when Trumps policies come to fruition.

On Sunday, Dean Popplewell wrote, “US President elect Donald Trump continues to have a massive impact on capital markets. Global bond markets have lost more than $1 trillion in value: their worst rout in 18-months, on investors bets that Trumps new administration would boost business investments and spending while firing up inflation. In emerging markets, there is an exodus of capital as speculation builds that the US is heading into an era of rising interest rates and more protectionist trade policies. In forex, there have been broad gains for the “mighty” dollar as the market seems content, for the time being, to push aside some of its initial concerns about protectionism, and instead focus on rate differentials.

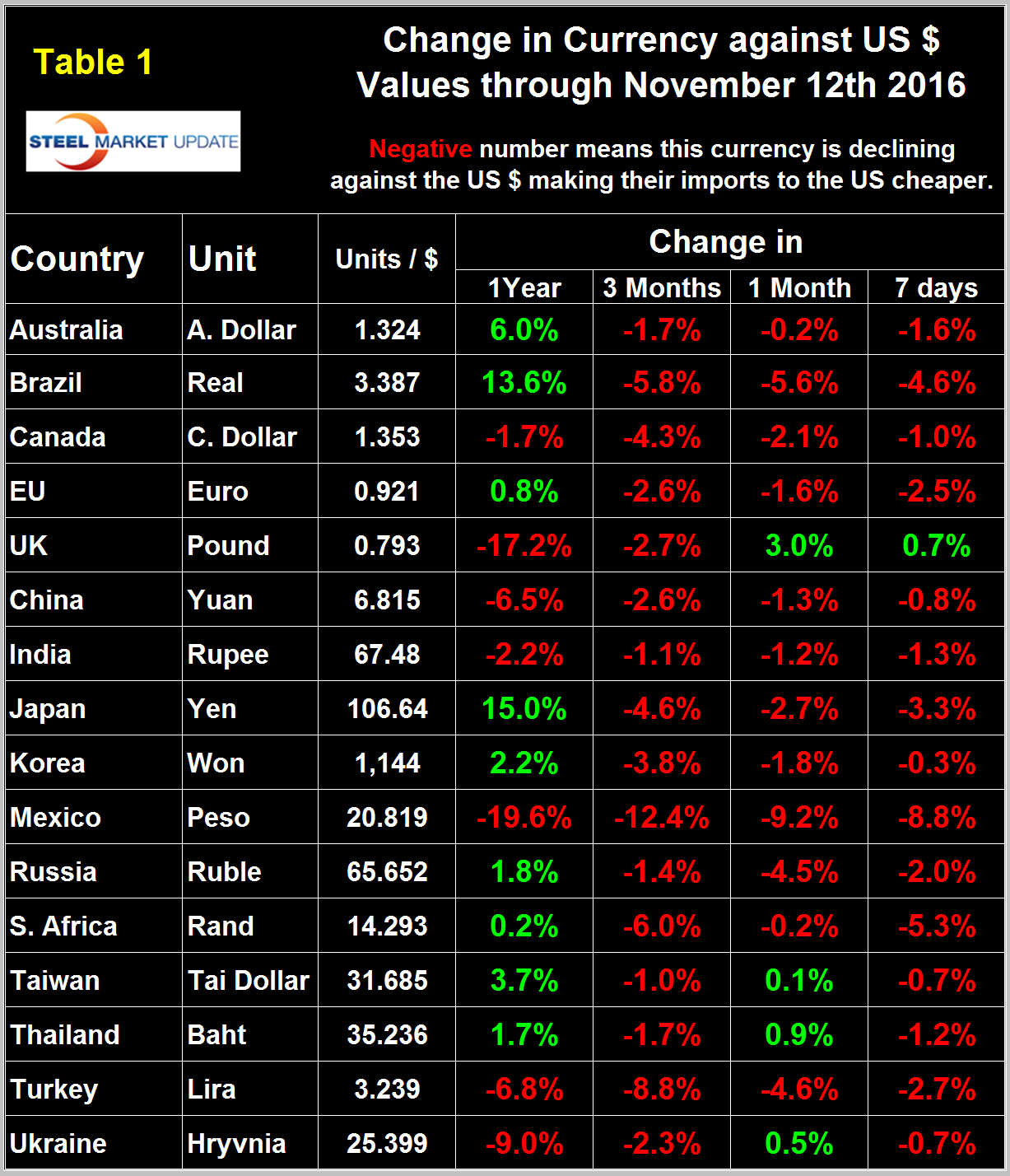

Table 1 shows the value of the US $ measured in the currencies of 16 steel and iron ore trading nations on November 12th, it reports the changes in one year, three months, one month and seven days for each currency and is color coded to indicate strengthening of the dollar in red and weakening in green.

We regard strengthening of the US Dollar as negative and weakening as positive because the effect on net imports. An estimated 25 percent of the U.S. economy has some involvement in international trade therefore currency swings can have a large effects on the economy in general and of the steel industry in particular. At the one month level the dollar has strengthened against twelve of the sixteen and weakened against the others. At the seven day level shown in Table 1 the dollar has strengthened against 15 of the 16 and the only currency that weakened against the dollar was the UK pound which because of Brexit is a unique case. There is much agreement amongst analysts today that the Fed will raise rates in December therefore we can expect currency markets to react to that expectation at least until some new economic data arises to upset the assumption. Of particular interest is the employment report that will be released on December 2nd.

In each of these reports we comment on a few of the 16 steel trading currencies listed in Table 1. Charts for each of the 16 currencies listed in Table 1 are available through November 12th for any subscriber who requests them. We also include writings from experts who we regard as credible to explain some of the currency moves that we are witnessing.

The Mexican Peso

On Monday last week, Mark Chandler wrote: “we note the central bank of Mexico is set to hike rates on November 17. The market expects a 50 bps hike that would lift the overnight rate to 5.25 percent. The three earlier hikes this year were also in 50 bps steps. The first hike in the cycle was delivered at the end of last year and was for 25 bps move. The reason rates will be hiked may not be so much about targeting the currency as containing the inflation feed. The peso fell by 8.75 percent last week and is off 12.5 percent over the past three months. The changing political climate in the US is the primary driver, but the underlying macro fundamentals are not particularly attractive. Also, rising US interest rates, a broadly stronger dollar, pressure as a proxy hedge vehicle for emerging market exposure generally, and falling oil prices would be negatives in any event. By any reasonable measure, the peso’s losses are exaggerated, given the volatility a 50 bps rate hike is unlikely to make much of a difference to short-term speculators. There are other measures the central bank can take, including tweaking its intervention rules. There does not seem to be an appetite to introduce dramatic measures, like capital controls.”

Table 1 shows that in 7 days before the 12th, the Peso declined by 8.8 percent and by 12.4 percent in three months. Two days after the election the peso broke through the 20/US $ level for the first time ever to reach 20.82 on the 12th (Figure 2.) Of relevance to future negotiations within NAFTA will be the observation that at the inception of this trade agreement on January 1st 1994, it took only 3.5 pesos to buy one US dollar.

The Chinese Yuan (Renminbi)

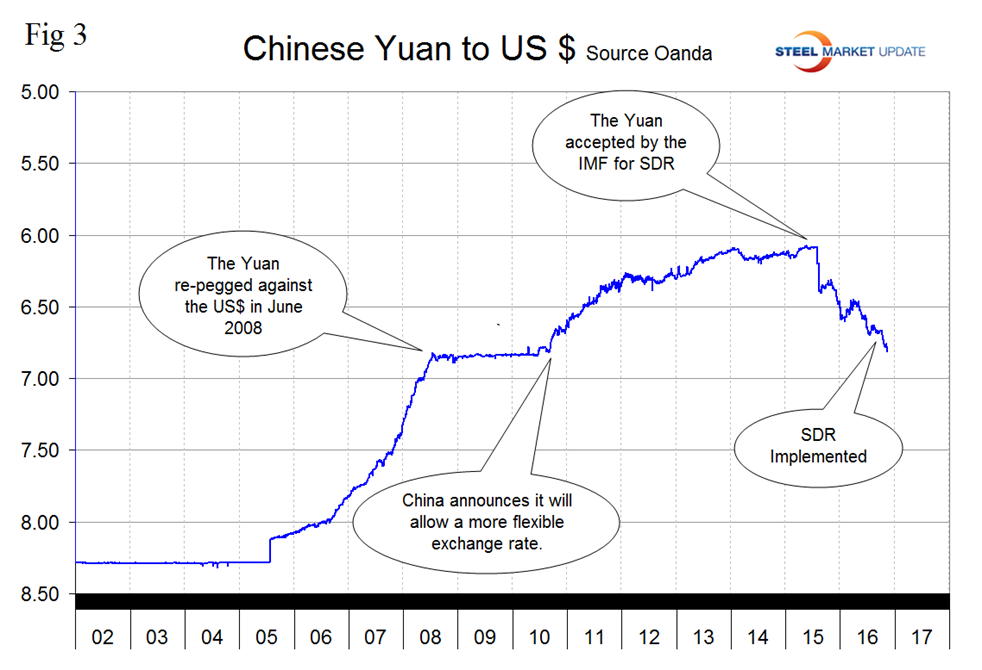

On November 11th IDC reported: “the Yuan as broken through the 6.70 line in the sand, and will likely keep going as interest differentials narrow. It’s unlikely that the movement in the Yuan will spillover as a risk to global markets unless the move is symptomatic of something going really bad in China, which there is no signs of at present, or unless it’s symptomatic of a broad-based surge in the US dollar – which would have a tightening influence on financial conditions in the US and emerging markets and complicate the picture for commodities. The trouble is, there are some signs it is of the latter kind.”

The Yuan has declined by 6.5 percent against the US $ in the last year and by 1.3 percent in the last month (Figure 3). In November 12th the Yuan was at 6.815/US $.

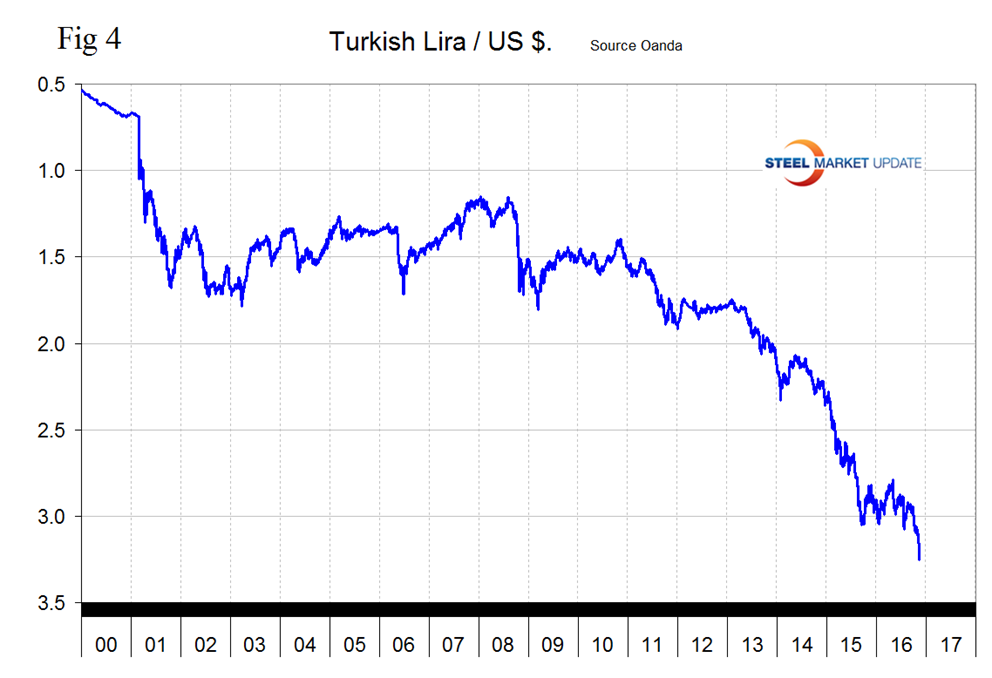

The Turkish Lira

The Turkish Lira has declined by 8.8 percent in 3 months and by 4.6 percent in one month to finish at 3.239 on the 12th. Figure 4 shows the Lira to be in free fall at the moment.

Brazilian Real

On November 12th the Brazilian Real was 13.6 percent stronger than it was a year ago as it appreciated from January 22nd through October 26th. In the last 7 days the Real declined by 4.6 percent to 3.387/US $ on the 12th (Figure 5).

The Euro

Published by PowerShares on Monday, “There is a great deal of strength ahead for the U.S. dollar in our eyes. Raising rates and lower tax rates should result in rampant demand for U.S. dollars. Whereas for the euro we see very little but short-to-medium term weakness. When Article 50 is triggered by the United Kingdom early next year the Brexit will be officially underway. This is expected to cause both the euro and the British pound to weaken considerably as fears of economic uncertainty rear their ugly heads. Furthermore a number of elections are coming up next year in Europe which could cause a Brexit/U.S. election-type surprise. If there is talk of more European Union members leaving the union, then the ramifications for the euro could be extremely negative. Overall the European Union and the euro look to be very fragile right now as far as we are concerned we anticipate the Euro moving roughly to parity for the EUR/USD pair with a gain of around 8 percent for short traders. It is early days of course, but so far we feel President-elect Donald Trump’s policies will cause the U.S. dollar to strengthen considerably over the next 12 months.”

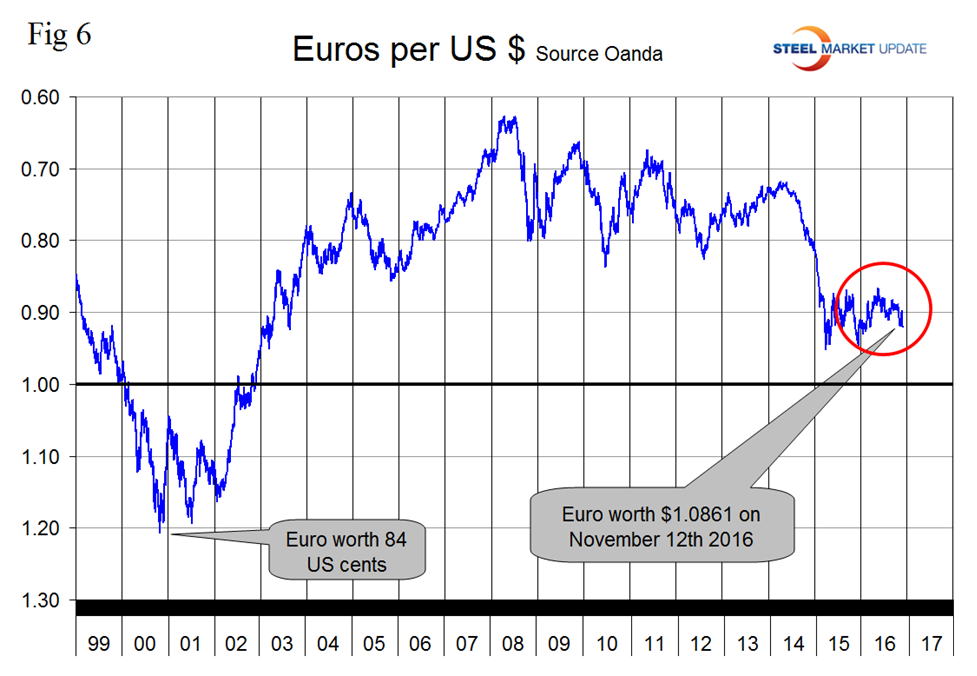

The Euro declined by 2.7 percent in the 7 days up to the 12th to a value of 1.0861 (Figure 6).

Explanation of Data Sources: The broad index is published by the Federal Reserve on both a daily and monthly basis. It is a weighted average of the foreign exchange values of the U.S. dollar against the currencies of a large group of major U.S. trading partners. The index weights, which change over time, are derived from U.S. export shares and from U.S. and foreign import shares. The data are noon buying rates in New York for cable transfers payable in the listed currencies. At SMU we use the historical exchange rates published in the Oanda Forex trading platform to track the currency value of the US $ against that of sixteen steel trading nations. Oanda operates within the guidelines of six major regulatory authorities around the world and provides access to over 70 currency pairs. Approximately $4 trillion US $ are traded every day on foreign exchange markets.