Prices

October 27, 2016

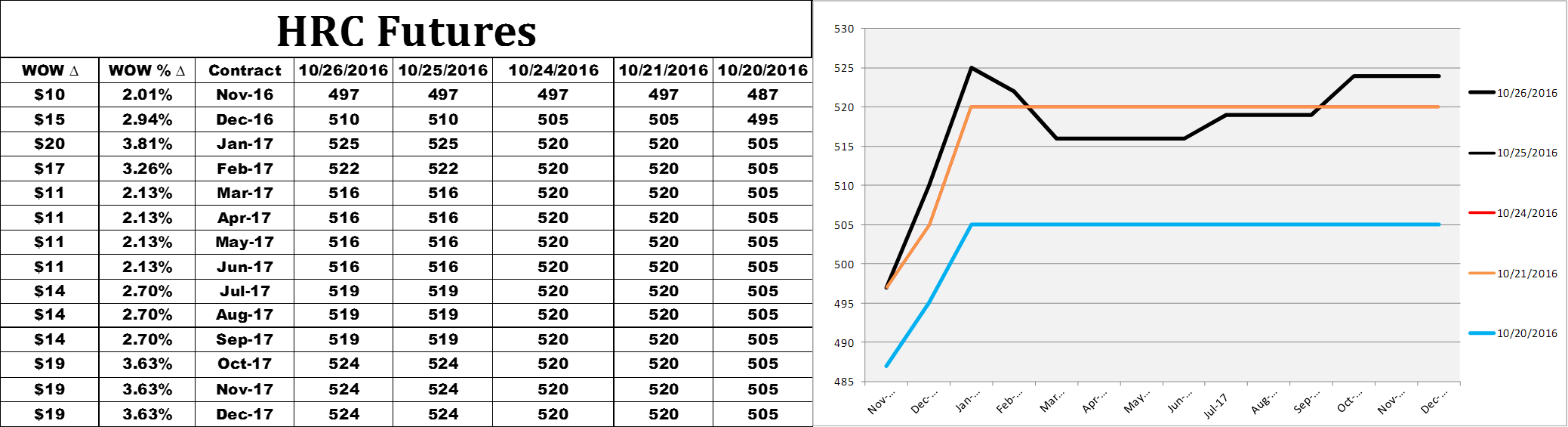

Hot Rolled Futures: Futures Market Pops on Price Hike Announcements

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

The CME Midwest HRC futures popped in anticipation of and after the confirmation of price hike announcements by domestic steel mills. Liquidity has dried up on the sell side as participants wait for the dust to settle. The steel industry is buzzing trying to get a grip on not only if the higher prices will stick, but will mills follow with a second price increase in the coming weeks. Nevertheless, 16,880 tons of futures traded since October 20th and open interest was 19,402 contracts or 388,040 short tons.

The CRU US Midwest HRC Index used to calculate the futures monthly settlement prices continues to grossly lag physical and futures prices. The gap between the futures and the index is currently anywhere from 5% to 10% in the front three months. We have seen this troubling divergence for a good part of 2016.

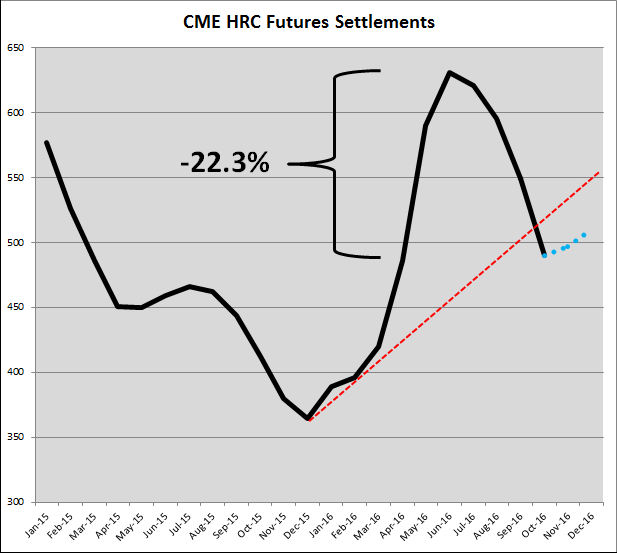

With October HRC futures settling at 490, futures are down 22.3% from their highs officially in bear market territory. With the domestic supply side fundamentals looking strong (i.e. low inventory levels, falling imports/trade case restrictions and the rationalization of the number of companies owning and controlling domestic steel mills), much of the weakness looks to be a result of feeble demand.

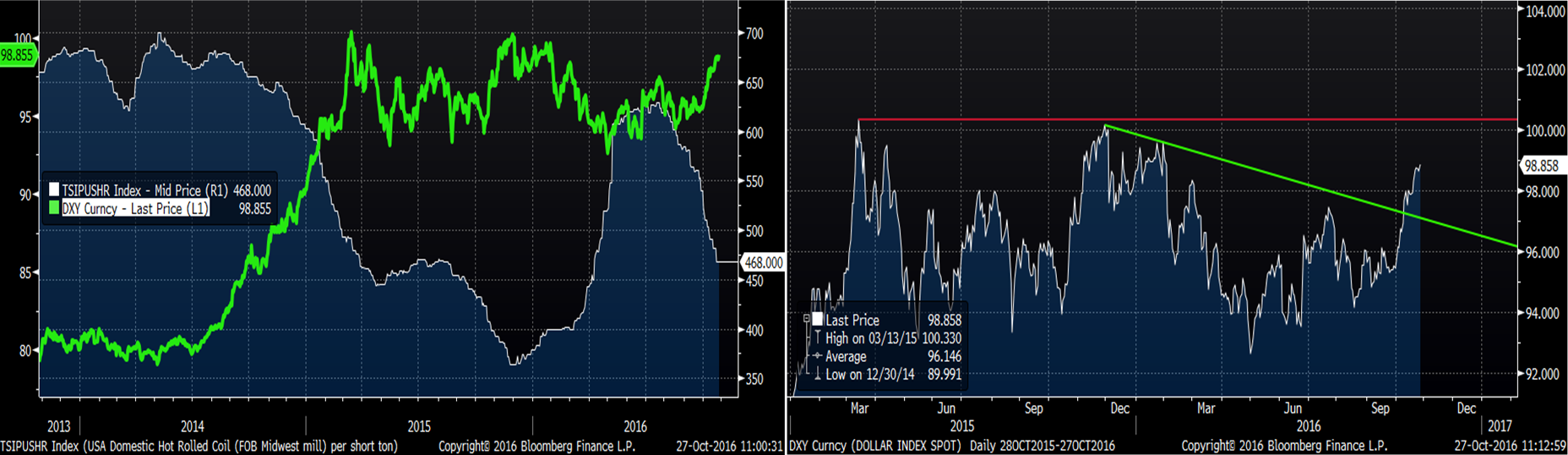

While the jury is out on how effective the price increases will be in spurring demand, a major headwind is building in the distance as the dollar has rallied to about 99 on the dollar index. Below you can see the lagged effect the 2014 rally in the dollar had on the price of HRC. The 100 level on the dollar index bears watching as it has failed to breaks through that level (right side). Watch for the beginning of another bull rally in the dollar if it does.

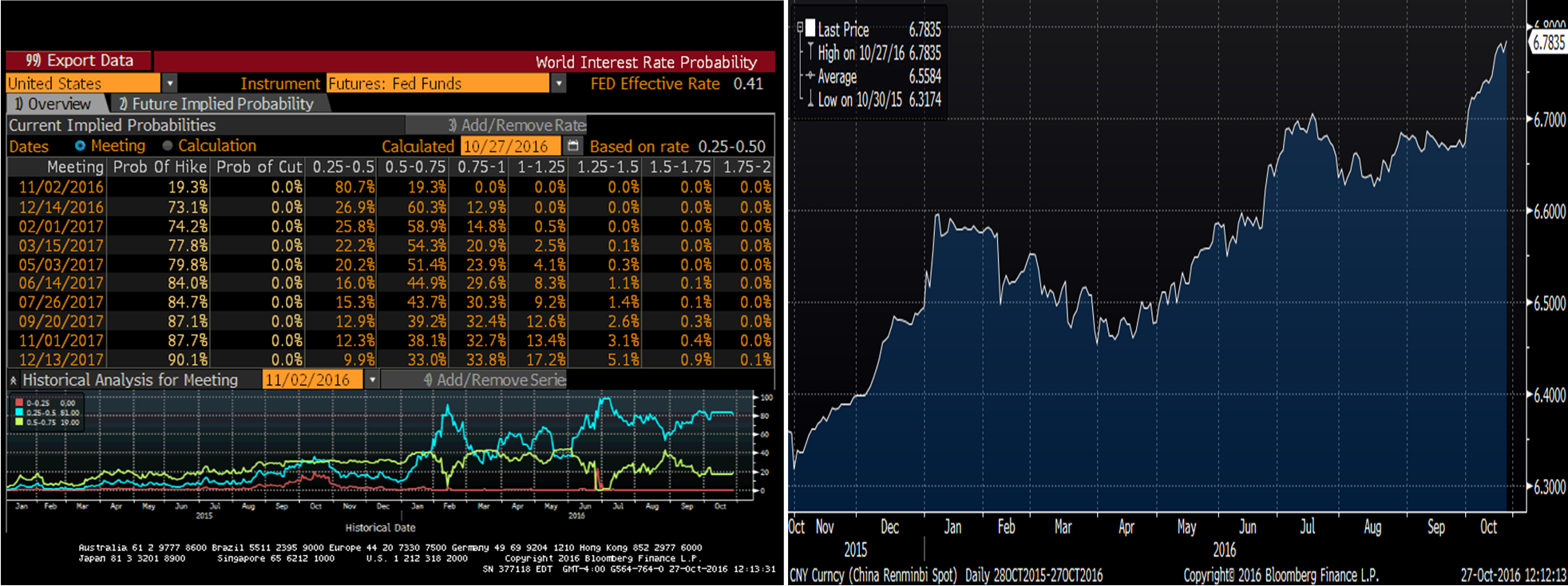

Much of that 2014 rally was an adjustment due to the diverging monetary policies between the US and the rest of the world. Currently, the Fed Funds futures market is implying a 73% probability of a December rate increase (left chart below). This could be the catalyst that pushes the dollar into a second leg of the rally that began in 2014.

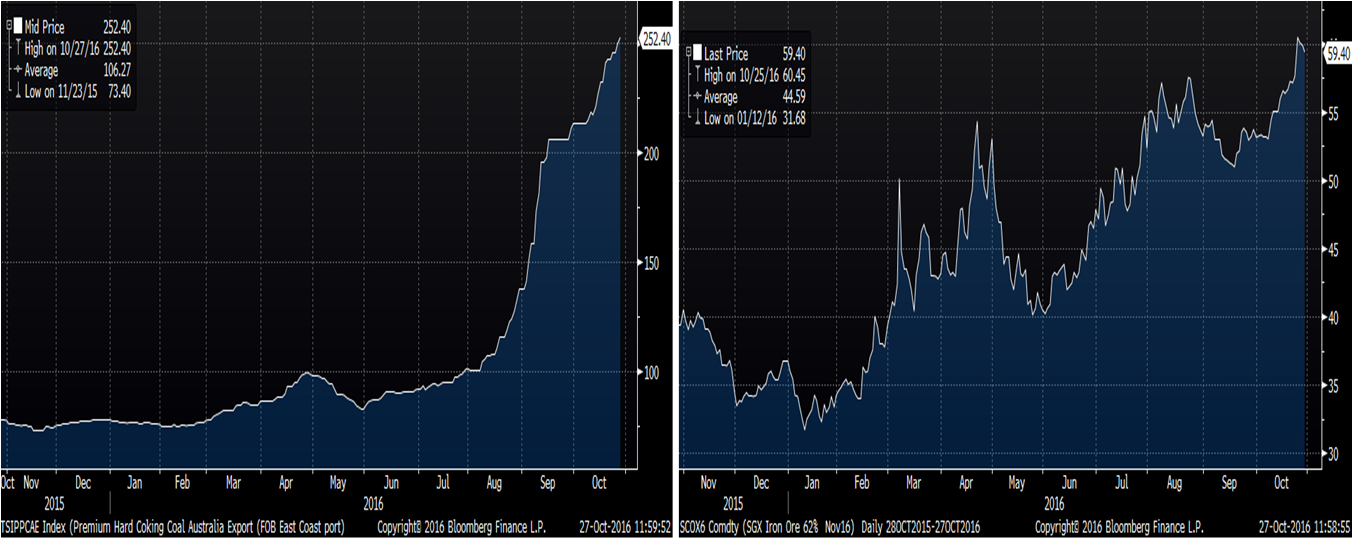

The Chinese yuan has been depreciating all year (right chart above). All things being equal, the weaker yuan should have pressured steel prices lower. However, China’s policies have bolstered global steel prices (ex-USA). China has pumped a significant amount of capital into their banking system in 2016, much of which found its way into the real estate market through developers and mortgages. A number of top tier cities have seen Y.O.Y. gains of 60% and higher! Then the implementation of the 276 day policy to curtail coal production sparked an epic rally in coking coal (see below left), which has helped elevate iron ore (below right) and steel prices.

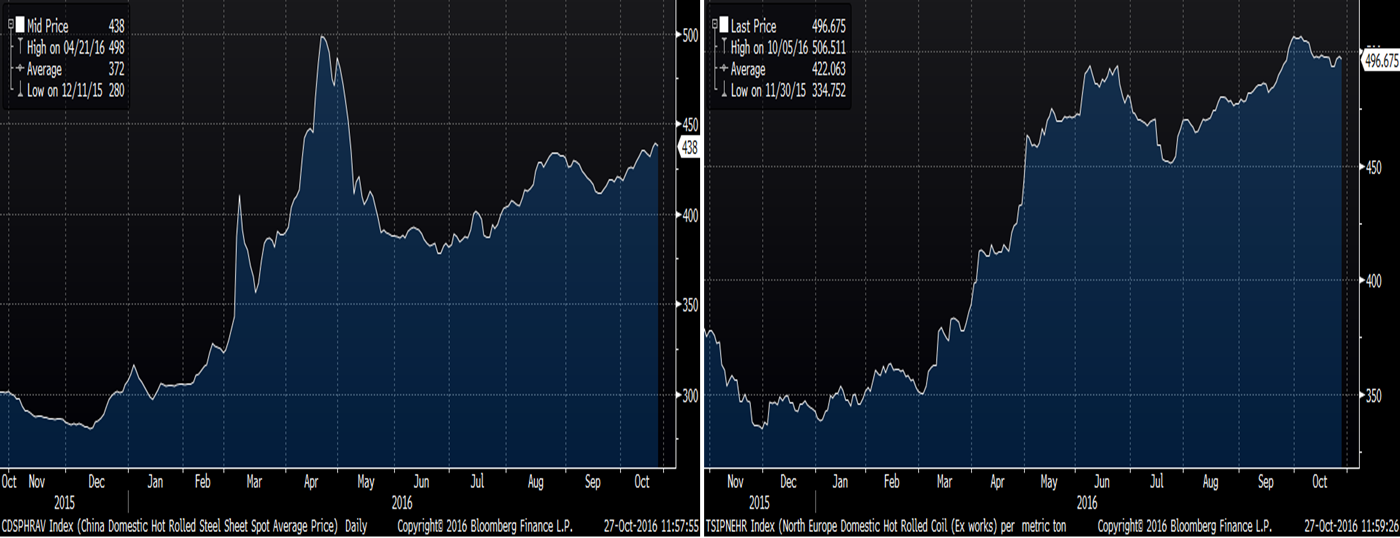

Chinese HRC and TSI Daily North European HRC

With the steel prices in the rest of the world strengthening and domestic HRC prices falling rapidly, the import arbitrage window has collapsed. This could be a boon for US prices into Q1 regardless of the dollar move (which hasn’t happened yet). For the next few months, unless demand is awful, the lack of import deals as an attractive substitute should push demand back to domestic mills. The gains in lead time could reverberate through what the data shows to be a relatively light level of inventory at service centers and OEMs elongating the run. The potential of this outcome and elevated uncertainty of where physical is transacting is to blame for the lack of liquidity in the HRC futures market.