Government/Policy

September 22, 2016

CSI and SDI File Circumvention Complaint Against Vietnamese Coated Steels

Written by John Packard

Earlier today California Steel and Steel Dynamics filed a Request for Circumvention Ruling with the U.S. Department of Commerce against Vietnam. One of the trading companies Steel Market Update spoke to this afternoon termed the complaint a “game breaker” for steel trading companies importing foreign steel who will now shy away from any country that might put a target on the trading company’s back (since they are the importer of record).

The complaint alleges that Vietnamese exports of CORE (corrosion resistant = galvanized/Galvalume) are being done as a way of circumventing duties against those countries the Department of Commerce had found affirmative action of antidumping (AD) and countervailing duties (CVD) previously.

The complaint points out that shipments of CORE products from China were eliminated but, imports from Vietnam soared.

The following statements were taken directly from the complaint filed by Schagrin Associates on behalf of CSI and SDI:

The investigations and preliminary deposit requirements eliminated Chinese CORE from the U.S. market, as importers discovered Chinese product could not sell competitively in the U.S. market at fairly traded prices. Imports of CORE from China plunged from 577,064 tons in the first half of 2015 to 200,982 tons in the second half and 10,153 tons in the first half of 2016.

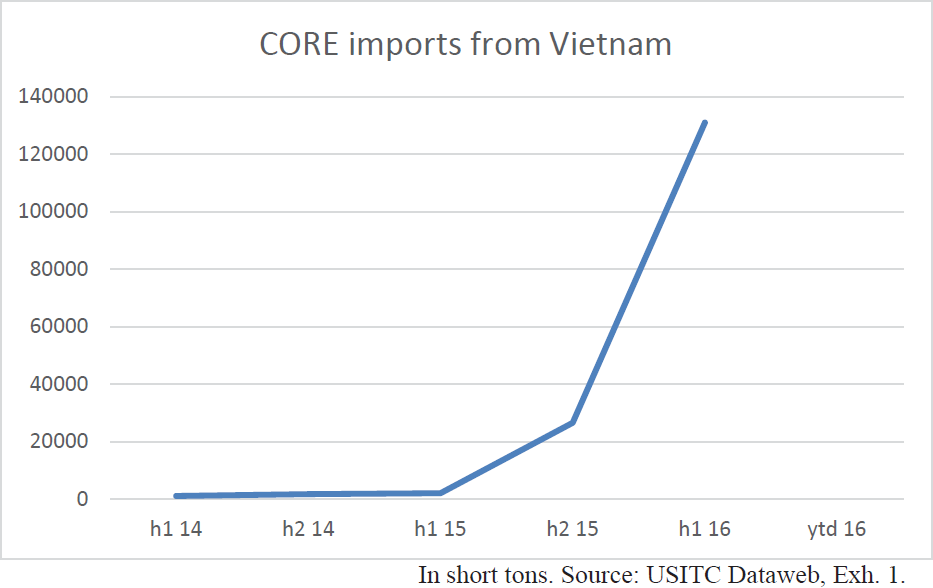

Imports of CORE from Vietnam, on the other hand, soared. Before the U.S. industry filed its petitions on CORE from China, imports from Vietnam were minimal: in the first half of 2014, the United States imported 1,129 tons of CORE from Vietnam, increasing slightly to 1,779 tons in the second half of 2014, and 2,142 tons in the first half of 2015.

But after the investigations began, CORE imports from Vietnam skyrocketed. From the tiny levels observed through the first half of 2015, they rose sharply to 26,582 tons in the second half of 2015, then reached 130,986 tons in the first half of 2016. In just one month, from November, 2015, when the preliminary countervailing duties on Chinese CORE took effect, to

December, 2015, imports of CORE from Vietnam increased by 1,182 percent or 17,398 tons, from 1,357 tons to 18,755 tons.

This would not be so remarkable in itself – when one country becomes subject to unfair trade orders, others may export more to take its place – but for one fact: Vietnam has no installed capacity to make steel flat products or hot-rolled coil, the input product for CORE.11 Thus, all of these surging CORE exports to the United States must be made from imported hot-rolled or cold rolled steel – and the large majority of CORE produced in Vietnam is made from HRS or CRS imported from countries now subject to the CORE orders, and particularly from China.

Further, Domestic Interested Parties have information that China Minmetals Corporation, the state-owned Chinese trading company that is one of the world’s largest metal trading firms, has planned and is executing a scheme to have Chinese-made HRS or CRS toll-processed in Vietnam for shipment to the United States as Vietnamese CORE. That constitutes circumvention of the Orders.

Importations of CORE from Vietnam made from Chinese HRS or CRS that is galvanized in Vietnam constitutes merchandise “completed or assembled” in Vietnam for purposes of circumvention of the Orders under Section 781(b) of the Act. HRS and CRS are not the same class or kind of merchandise as CORE, but the coating process requires relatively small investment, adds relatively little value, and is totally insignificant by weight – a clear example of the kind of “minor or insignificant” third-country completion or assembly process that constitutes circumvention of an order.

Given the dramatic shifts in trade patterns that have suddenly emerged in the wake of the antidumping and countervailing duty investigations, the Department should make an affirmative circumvention finding. Furthermore, since it is not possible to distinguish between CORE made from HRS or CRS imported from China or other countries subject to the CORE orders, and CORE made from HRS and CRS produced elsewhere, Domestic Producers ask the Department consistent with its usual practice in such situations12 to suspend liquidation of all CORE imported from Vietnam entered, or withdrawn from warehouse, for consumption on or after the date the Department initiates its investigation, and require a cash deposit on such CORE entries and withdrawals at the rates imposed by the AD and CVD order on CORE from China.

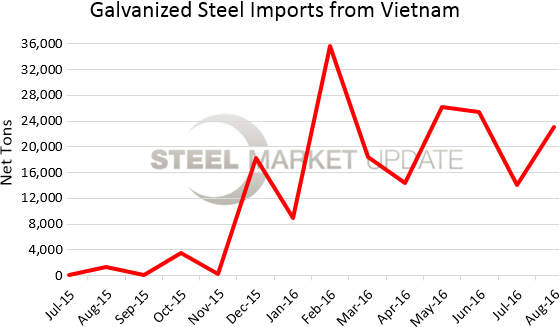

SMU Note: Here is what we are showing for exports of Vietnamese galvanized to the United States using Department of Commerce data: