Prices

May 26, 2016

Hot Rolled Futures: Beginning of a Reversal in Price?

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Dave Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

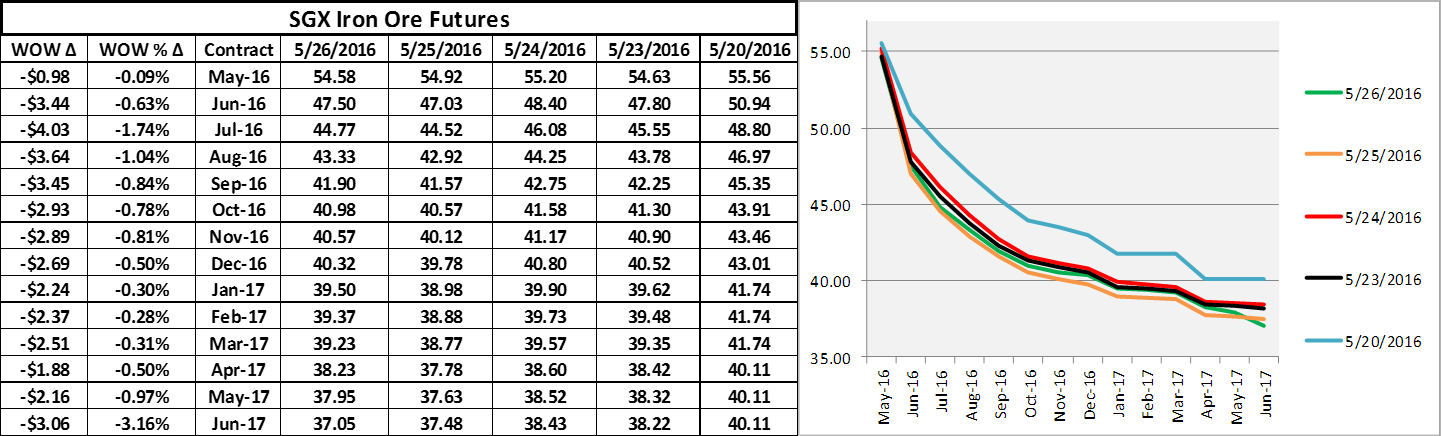

There has been further pressure on iron ore futures this week.

The iron ore curve remains in steep backwardation with a steep drop of almost 7% as Chinese port inventories exceed 100m tons!

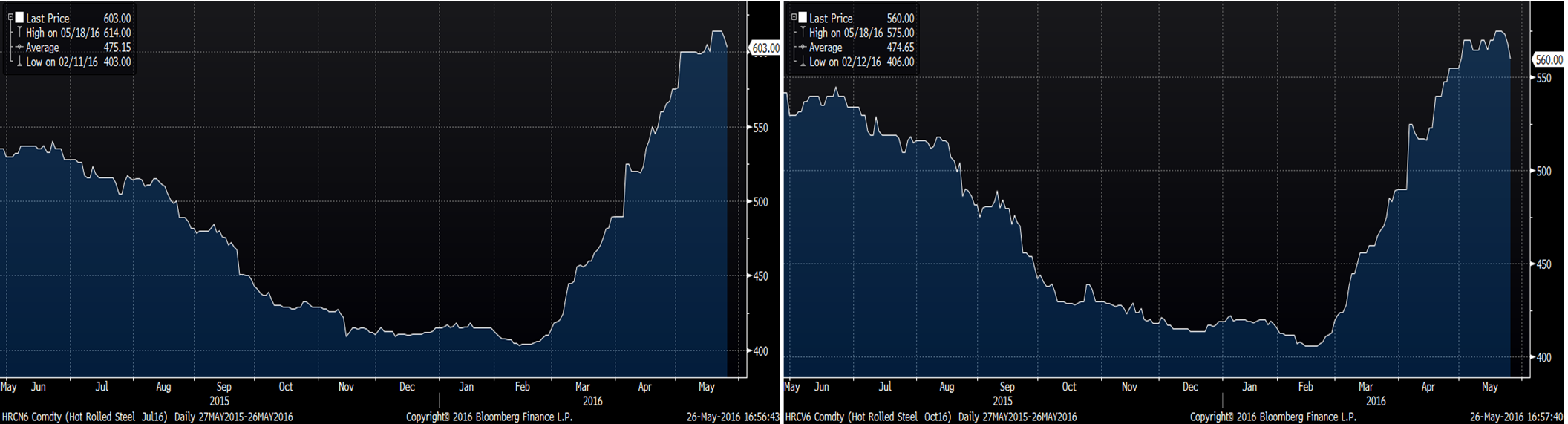

US Midwest HRC futures have consolidated and even given back some of the gains, but when put in perspective, is this a brief consolidation and profit taking or the beginning of a reversal in price? It has been a very quiet week with a “buyers strike” in the futures market. Only 10,040 st worth of futures were traded and open interest stands at a very low 395,260 short tons. (July and October futures below)

The curve is steeply backwardated expressing the supply imbalance seen in the domestic market and implying the imbalance will correct itself in time. However, after yesterday’s harsher than expected HDG ruling following last week’s stricter than expected CRC ruling, might the market be underestimating how long the market may remain imbalanced? Are we starting to see a trend? Political rhetoric has been increasingly protectionist with Presidential hopeful Donald Trump extremely vocal and leading the charge.

Further, with housing data that hit the cover off the ball this week and oil prices on a tear nearing $50/bbl, the future for HRC prices is tough to handicap. One would expect strong housing, automotive, durable goods, rebounding oil prices and a better than expected Chinese economy to remove much of the concerns for a sharp fall-off in US steel demand and economic performance.

Earlier today, there was further pressure on the HRC futures curve as $580/st for up to 3,000 st/m of Q3 was offered. Regardless of your opinion, a steel buyer has to consider if $580/st for July through September is a price that works for your purchasing needs considering the mini-mills are expected to open their books (for July) next week around $640/st and index pricing continues to move higher, especially with CRC and HDG. Currently, the upside risks outweigh the downside with the potential for US Steel’s Section 337 trade case gaining approval earlier today. Raw material prices might be falling, but does that free up the supply lines at domestic mills?

These are just some of the complex issues steel buyers face, but with Q3 trading $45 below and Q4 trading $75 below Flacksteel.com’s $625/st Midwest HRC Price, at some point, the rewards of locking in tons outweigh the risk. It might be time for you to lock in a certain percentage of your Q3 and Q4 buy in the futures market.

Prices jumped to almost $700/st in the Spring of 2014 after the ore shortage due to the frozen Great Lakes and a number of supply disruptions. Imports exploded starting in Q2, 2014 and remained at record levels all year, yet it took 9 months for prices to drift back to $600 before the price collapse started in full force in January, 2015. That year, buying backwardated futures as they traded higher to the spot price was a winning strategy/trade for many months in 2014. Will it be in 2016? Well, that’s why they play the game.

Stay thirsty my friends!! Have a happy and safe Memorial Day Weekend and God Bless America!!!