Market Data

May 19, 2016

SMU Steel Buyers Sentiment Index Sets New Record High

Written by John Packard

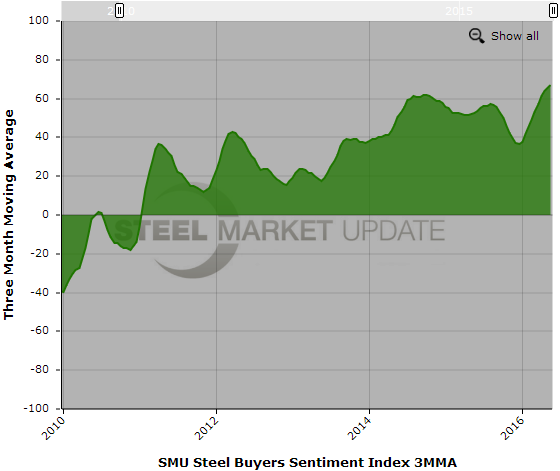

Buyers and sellers of flat rolled steel continue to remain optimistic about their company’s ability to be successful in the current market environment (our Current Sentiment Index). On a single data point our Current Sentiment Index was down -1 point from the beginning of May. However, we prefer to use the three month moving average (3MMA) in order to take any bumps out of individual data points and better provide us an accurate view of the trend. The 3MMA was +1.5 points higher than early May and set a new record high for our Sentiment Index at +67.

We continue to believe the optimism is being created because we are in a rising price environment which raises inventory values and makes it easier to convince customers to pay higher prices. The sharp rise in prices, however, is not good for everyone and manufacturing companies are questioning the validity of the increases which for them are more difficult to pass through to the final product buyer.

Future Sentiment Index

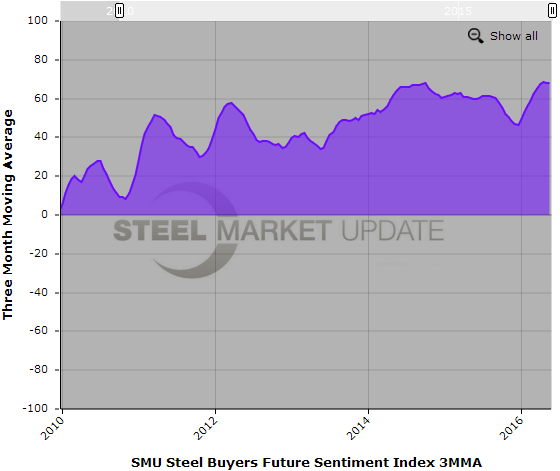

We also look at how buyers and sellers of flat rolled feel about their company’s ability to be successful three to six months into the future. On a single data point the Future Sentiment Index dropped -5 points from early May. Using a three month moving average (3MMA) the Index came in at +68 which is unchanged from our earlier measurement two weeks ago. The record high was set one month ago at +68.67.

What Our Respondents Are Saying

“Demand is stable, spot market steel almost non-existent, inventory is good. It is a struggle but we are optimistic.” Service center went on to say, “I believe the Domestic Steel Mills are raising prices too much too soon. We all wanted higher prices but this is sticker shock. It is like they are making all of us pay for their 2015 losses from imports. Not Fair. Too Much, Too Soon.”

“Starting to feel like 2009. One step forward, one step back…… Wash, rinse, repeat.” Manufacturing company

There is concern about the second half 2016 in light of the steep price increases, “Market overheated. Fear and uncertainty do not make for a stable market. Will we give it all back in the second half?” Service center

“Although we have the ability to lock in some gains using the derivatives market, if the market falls rapidly, we will have FIFO losses like anyone else.” Service center

“The domestic flat roll price increases are forcing our customers offshore for the parts we make for them.” Manufacturing company

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 43 percent were manufacturing and 42 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.