Market Segment

April 21, 2016

Steel Dynamics Flat Rolled Division Operating at 88 Percent

Written by Sandy Williams

Steel Dynamics announced a strong quarter with net income of $63 million on net sales of $1.7 billion for first quarter 2016.

Steel operating income increased 104 percent to $136 million from fourth quarter due to a 17 percent improvement in shipments which totaled 2.12 million tons. Average steel selling price dropped $40 from Q4 to $574 per ton. Ferrous scrap cost per ton melted decreased $21 to $184 per ton.

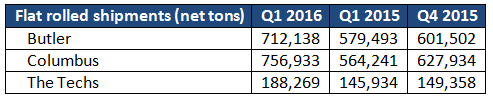

Flat rolled shipments were up 20 percent offsetting margin reduction. Long products shipments increased nine percent, also offsetting margin reduction. Steel Dynamics steel production utilization rate was 88 percent compared to 73 percent in Q4 and a domestic industry utilization rate of 71 percent.

Earnings for the Columbus flat-rolled division were severely impacted by the decline in the energy sector in 2015. Successful market and product diversification accomplished during the year resulted in record quarterly shipments for Q1 2015. Value added shipments from the Columbus facility increased almost 80 percent from Q1 2015.

“During the first quarter 2016, positive changes in the flat roll steel supply environment resulted in significantly improved sequential consolidated operating earnings, which increased over 175 percent to $132 million,” said Mark D. Millett, President and Chief Executive Officer.

Millet reported improved volume and profitability across all operating platforms in Q1 2016. Metals recycling returned to profitability and fabrication was supported by steady demand from non-residential construction.

Millet said during the earnings conference call that 2016 has provided a changing landscape to the domestic flat rolled market: flat rolled steel imports have declined and global steeling pricing appreciated; customer inventories are better aligned with actual consumption supporting domestic mill steel utilization; and mill lead times have remained steady.

In the outlook remarks Millett said, “Steel customer inventory levels have moderated and import levels have declined. When combined with steady underlying steel demand, the result has been some improvement in domestic steel producer utilization, yet industry utilization still remains below historical performance due to the issue of unfairly traded steel imports.”

Automotive strength and construction continues to improve in 2016. Said Millet, “Driven by the strength from the U.S. dollar, low iron ore costs and global overcapacity, steel imports were 2015’s principal headwind. However, recent import levels have declined and the trade cases are likely to erode them further. Reduced imports, idling of domestic capacity, and increasing global pricing, along with steady demand and rebalance of supply chain inventory, have created a positive pricing and volume environment for flat rolled products. As raw material prices moderate there is likely some margin expansion opportunity.”