Logistics

April 8, 2016

Logistics Update Mid-April

Written by Sandy Williams

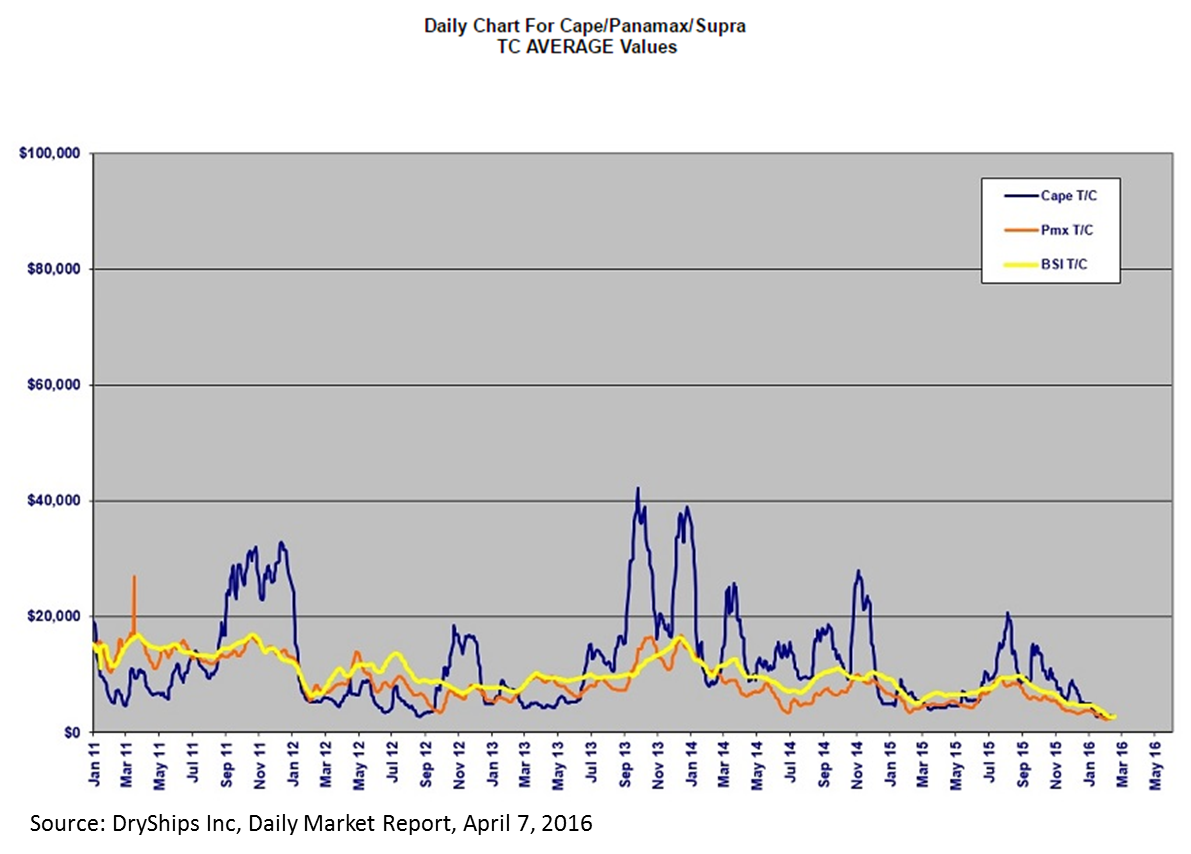

The ocean bound freight market had a bit of good news last week—the Baltic Dry Index rose to 517 on April 7 and closed the week out on April 9 at 539, nearly an 86 percent increase from mid-February’s historic low of 290.

MID-SHIP Report says a celebration is not yet warranted since the BDI was at 2299 in December 2013. The improvement is due to in part to aggressive vessel scrapping. According to MID-SHIP, a record 14.2 million deadweight of dry bulk vessels were scrapped in Q1 2016. Demand has increased slightly as has commodity prices in oil, iron ore, copper and coal. The start of the grain season in the Southern hemisphere has also added to seasonal strength.

Rivers

Barges are cautiously navigating the Mississippi River due to high water levels from spring rains. The Army Corps of Engineers is considering options for repairs to the Industrial Locks in New Orleans which are estimated to take as long as 120 days to complete. The Corps may delay the scheduled 2016 maintenance until 2017 due to lack of funding to dredge an alternative route. A decision is forthcoming by May 31st.

Rates for southbound grain have increase due to a surge in offseason demand, northbound rates are flat. Import break bulk cargoes on the Mississippi are up along with fertilizer imports and strong aluminum shipments.

Trucking

DAT Solutions reports truck shipments increased 11 percent between March 27 and April 2. Flatbed load volume jumped 12 percent and capacity decreased 10 percent during the weekly period for a 23 percent load-to-truck ratio increase to 22.1 loads per truck. For the month of March, flatbed load-to-truck ratio rose 68 percent, from 10.4 to 17.5 loads per truck, a 7 percent increase year over year.

The national flatbed sport market rate averaged $1.91 per mile during the week of March 27-April 2. Diesel fuel was reported at $2.115 per gallon, about 66.9 cents per gallon less than a year ago.

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index jumped 7.2 percent in February to 144, following a revised 0.3 percent reduction during January and for a February all-time high. Compared with February 2015, the SA index was up 8.6 percent.

“While it is nice to see a strong February, I caution everyone not read too much into it,” said ATA Chief Economist Bob Costello. “The strength was mainly due to a weaker than average January, including bad winter storms, thus there was some catch-up going on in February. Normally, fleets report large declines to ATA in February tonnage, in the range of 5.4% to 6.7% over the last three years. So, the small increase this year yielded a big seasonally adjusted gain. If March is strong, then I’ll get more excited.

Rail

The Association of American Railroads (AAR) reported carload traffic in March totaled 1,196,167 carloads, down 14.2 percent or 198,737 from March 2015. U.S. railroads also originated 1,250,925 containers and trailers in March 2016, down 7.7 percent or 104,343 units from the same month last year. For March 2016, combined U.S. carload and intermodal originations were 2,447,092, down 11 percent or 303,080 carloads and intermodal units from March 2015.

Total U.S. weekly rail traffic for the week ending April 2, 2016 was 491,979 carloads and intermodal units, down 10.4 percent compared with the same week last year. Carloads, at 238,138, were down 14.3 percent compared with the same week in 2015, while U.S. weekly intermodal volume was 253,841 containers and trailers, down 6.4 percent compared to 2015.

“Railroads are still looking for the light at the end of the tunnel, and for some commodities, including coal and other energy-related products, it’s just not there yet,” said AAR Senior Vice President of Policy and Economics John T. Gray. “That said, most economists are calling for continued slow but steady economic growth for the U.S. in the months ahead. Railroads stand ready to provide the freight transportation service the economy will require.”