Prices

March 10, 2016

Hot Rolled Futures: $25 Jump Since Last Friday

Written by John Packard

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Dave Feldstein. As Flack Steel’s director of risk management, David Feldstein is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, David produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website (www.FlackSteel.com).

“A buying frenzy gripped the iron ore market following bumper gains in Chinese steel prices over the weekend on news of drastic production curtailments.” TSI

Steel and iron ore prices in China had been advancing nicely in recent weeks ahead of the National Congress of the Communist Party of China meeting that began last week. April SGX iron ore futures closed last Friday around $51/t. When markets opened in Asia Monday morning, April futures were bid $55/t right out the gate and climbed to as high as $62/t at which point trading officially reached ludicrous speed. They closed the day at $59/t.

The Communist Party of China announced their new 5-year plan this past weekend. Included in that plan was the curtailment of 100-150m tons of steel production (of the 300m in reported excess capacity) without specifying a timeframe, of course. However, another primary factor for the 20% overnight gain had to do with flowers. Huh? The city of Tangshan, which produced more steel in 2014 than the USA, will be hosting the 2016 World Horticultural Exposition from April until October. Temporary air quality control measures would see production at the city’s steel mills cut in half until the end of September.

Then Brazil’s Vale and Australia’s Fortescue announced plans late Monday afternoon EST of a joint venture between the top and fourth ranked producers to create 80-100 million annual tons of a blended ore product that would compete more closely with BHP Billiton and Rio Tinto. Prices snapped back down to $52/t on Tuesday as markets cooled for a $10 round trip in less than 48 hours. Markets rallied again Wednesday and April futures have steadied in the $53-$55/t range since.

I’m no mathematician, but if you curtail 150 million tons of steel and it take 1.65 million tons of ore to make a ton of steel, didn’t 250 million tons of iron ore demand just get curtailed? Less potential supply of steel drove up the steel prices and I get that, but shouldn’t the massive drop in demand for iron ore pressure prices lower? Apparently not!

Below, you can see the spike in ASEAN HRC and Turkish scrap prices over the past week.

TSI ASEAN HRC

TSI Turkish Scrap

In the US HRC futures markets, we saw prices jump almost $25 since last Friday! On Monday after the spike in iron ore, 1000 st/m of Q2 traded at $431, then on Tuesday 1000 st/m traded at $442 and 500st/m traded at $443. The indexes moved up slightly on Wednesday and there were no trades to report. Today, 1000st/m of Q2 and Q3 traded at $446. The TSI Index is lagging the futures market now at $409/st.

CME US Midwest HRC Futures Curve

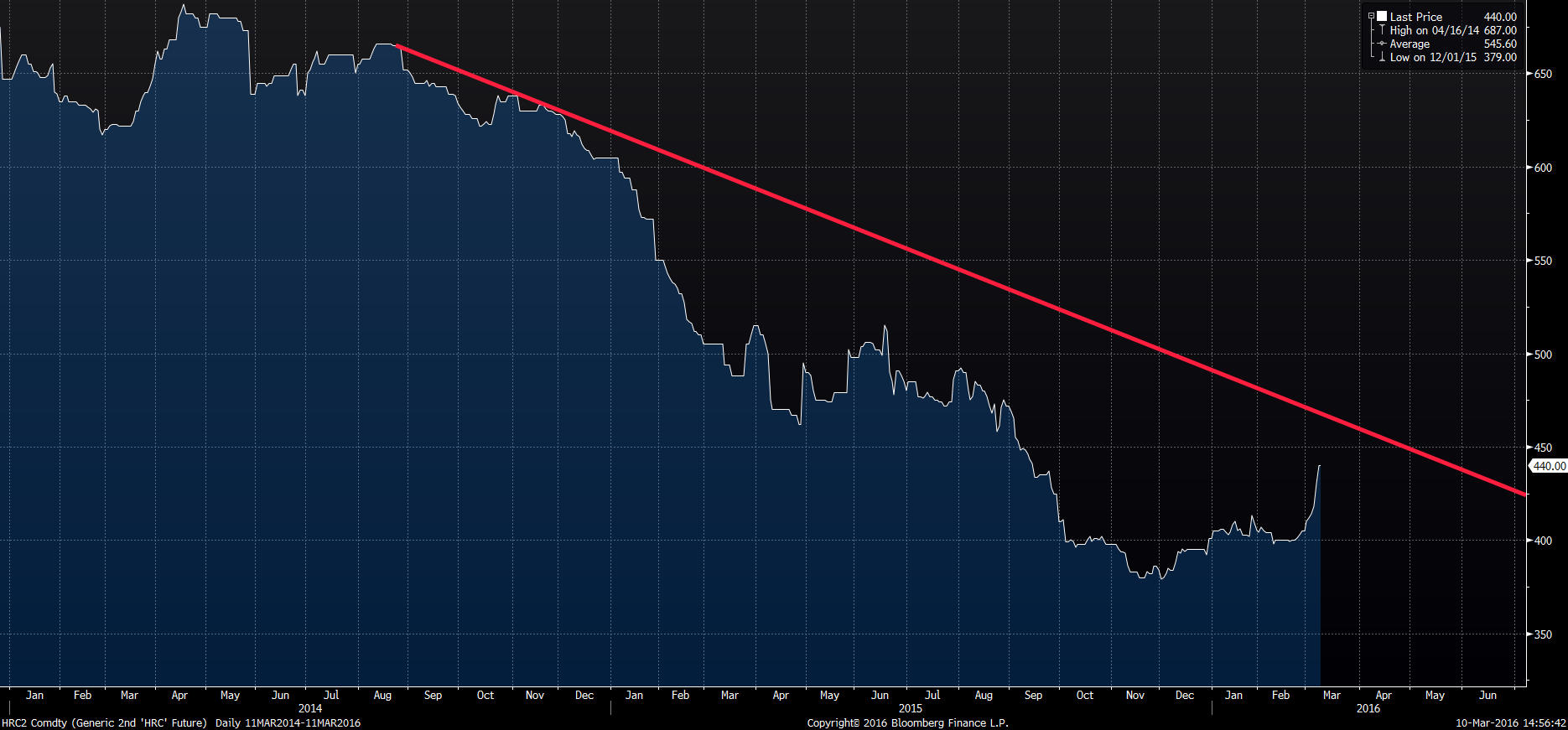

Remember the trendline from last week? The downtrend still hasn’t been broken, but it’s getting closer and closer.

CME HRC Futures (Rolling Second Month)

So what is “contango” and “backwardation”? Contango is when the spot price is below the futures price, and this is a “normal” market for futures to be in. Backwardation is when the spot price is above the futures prices. Below are examples of both.

This is timely because the futures curve looks to be shifting from contango to backwardation. Below is an example and the numbers are overstated to illustrate the point.

This is relevant because the tightness in the flat rolled market, especially for CRC and HDG, and the market fundamentals have spilled into the futures market. Q3 had been priced $5 above Q2 for most of 2016. As of today, the spread is flat after Q2 and Q3 both traded $446/st. If the upward pressure on the spot market continues, steel buyers are left with a number of questions for the remainder of 2016. Will domestic mills announce more price increases? Is there follow through in demand or is this a sharp restocking by the OEMs and service centers? Will domestic production be brought back online if prices reach a certain point? Will the rally in raw materials continue? Will imports start to be attractive and thus enter the market a few months from now? When does Big River’s capacity show up? All of these questions look toward the future, but the most recent downward pressure, i.e. imports, have been plummeting and a new wave will take months to arrive. So you might see spot prices continue higher with skepticism toward the second half. Thus you might see the futures curve go from contango to backwardation and that Q2-Q3 spread move from -$5 to a decent sized positive number. And that’s why they play the game!

Back to you John……