Prices

January 10, 2016

Ferrous Scrap Exports through November Down 17.5% YOY

Written by Peter Wright

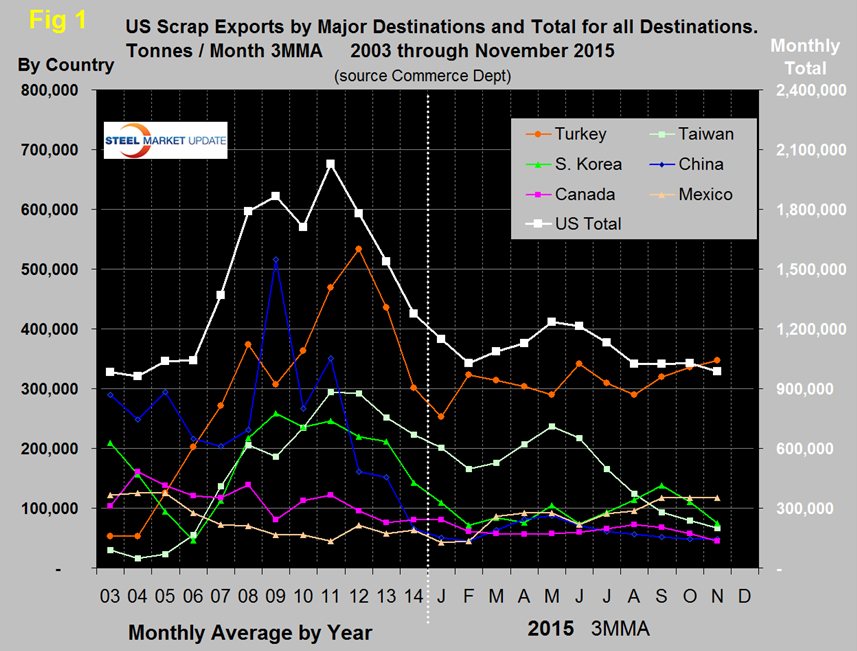

In the first eleven months of 2015 bulk scrap exports were 11,762,000 tonnes for an annual rate of 12,831,000 tonnes, down by 17.5 percent from the first eleven months of 2014. The tonnages shown in Figure 1 are based on three month moving averages (3MMA) for 2015 and on the annual monthly average for previous years.

The graph shows that exports declined for three consecutive years, 2012 through 2014 continuing through January and February this year. March saw a trend reversal that continued through May followed by three months of decline. The August, September and November tonnages were almost exactly the same on a 3MMA basis then the decline continued in November. Exports in the single month of November were the lowest since January 2006. In the twelve months of 2014, scrap exports totaled 15,308,000 tonnes, down by 17.1 percent from the same period in 2013 which is almost exactly the same as the trend through the first eleven months of 2015.

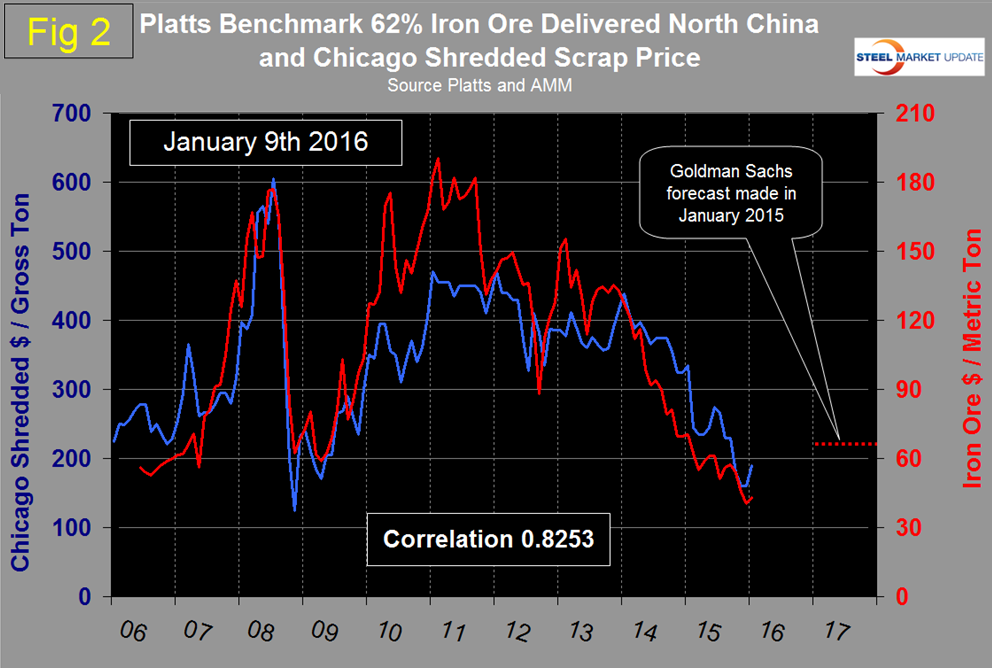

In the single month of November, Turkey was the major destination with 328,000 tonnes, followed by India with 135,000 tonnes and with Mexico a distant 3rd with 66,000 tonnes. September had the highest monthly tonnage into Turkey since December 2013, October returned to the recent norm then November picked up again. The tonnage into India in October was the highest since August 2011 and November was also historically strong. Turkey has been the major destination in ten out of eleven months of 2015. Our reading suggests that the purchase of scrap by Turkish mills is being reduced by semi-finished purchases from China in particular but also from Russia and Ukraine. We have no information at this time about how China’s deliberations regarding export tax rebates and what constitutes alloy steel will affect scrap trade into Turkey. Semi-finished imports will continue to be favored by Turkish mills until the decline in scrap prices upsets that balance. In the first eleven months of this year the global price of iron ore gave the integrated producers in China a cost advantage over the electric furnace steelmakers in Turkey. In 2014, China’s production mix was 93 percent BOF and 7 percent EAF. On December 4th iron ore broke through $40 heading down and reached $39.40/dmt. On January 1st the ore price had recovered to $43.25/dmt. The long term average ratio between the price of scrap and ore is a multiple of 3.3, the latest price moves of scrap in January have brought that ratio to 4.39 (Figure 2), which continues to be advantageous to the integrated producers and China in particular.

US scrap exports to the Far East through the first eleven months of 2015 were down by 37.2 percent year over year as the depreciated Yen allows Japan to pick up share in that region. YTD through November exports to Canada were down by 29.4 percent and to Mexico were up by 40 percent. India has become a big player this year and their tonnage out of the US has put them in 5th place as a destination, up by 86.5 percent year over year. Exports to South Korea and Taiwan were down by 37.5 percent and 36.1 percent respectively. Shipments to China YTD through November were 653,000 tonnes, down by 10.7 percent from 2014.

Scrap export prices are reported by the AMM every Tuesday for an 80:20 mix of #1 and #2 heavy melt in US $ per tonne FOB New York and Los Angeles for bulk tonnage sales. On January 1st the price on the East Coast was down by $131.47/gross ton in 12 months to reach $168 and by $98 on the West Coast to reach $179.5. Last month we stated that, “based on our benchmark comparisons between the price of scrap and the prices of iron ore and oil we see no upward potential for the domestic scrap price.” We were wrong, the January prices of shredded and busheling in Chicago were up by $30 and $20 respectively. We hereby stick our neck out again and say that current scrap prices have more downside than upside potential.