Prices

December 15, 2015

October Apparent Steel Supply Down 19.0% YTD, Up 3.8% Over September

Written by Brett Linton

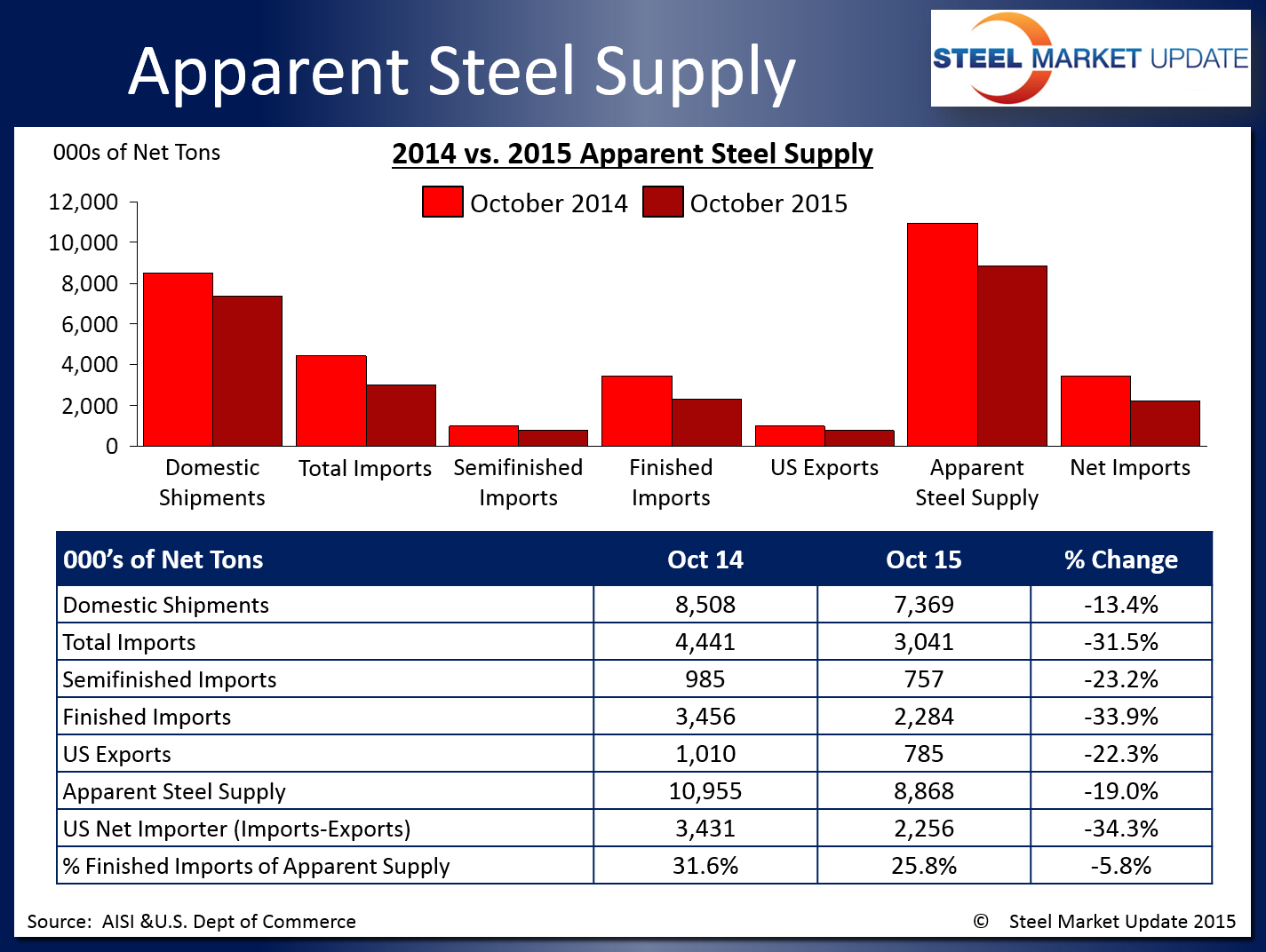

According to the latest data released from the US Department of Commerce and the American Iron and Steel Institute, apparent steel supply for the month of October 2015 was 8,868,427 net tons. Apparent steel supply is calculated by adding domestic steel shipments and finished US steel imports and subtracting total US steel exports.

October supply represents a 2,086,405 ton or 19.0 percent decrease compared to the same month one year ago when apparent steel supply was 10,954,832 tons (a record high in our 2008+ data history). This is attributed to a 1,139,005 ton or 13.4 percent decrease in domestic shipments and a decline in finished imports of 1,172,413 tons or 33.9 percent. A decrease in total exports of 225,012 tons or 22.3 percent slightly negated change. The net trade balance between imports and exports was a surplus of 2,255,626 tons in October 2015, 1,175,556 tons less than that of October 2014.

When compared to last month when apparent steel supply was at 8,543,021 tons, October supply increased by 325,406 tons or 3.8 percent. This is attributed to a 248,809 ton or 3.5 percent rise in domestic shipments, a 50,091 ton or 2.2 percent increase in finished imports, and a 26,506 tons or 3.3 percent decline in total exports. The net trade balance between October 2015 imports and exports was 232,969 tons or 11.5 percent higher than the previous month.

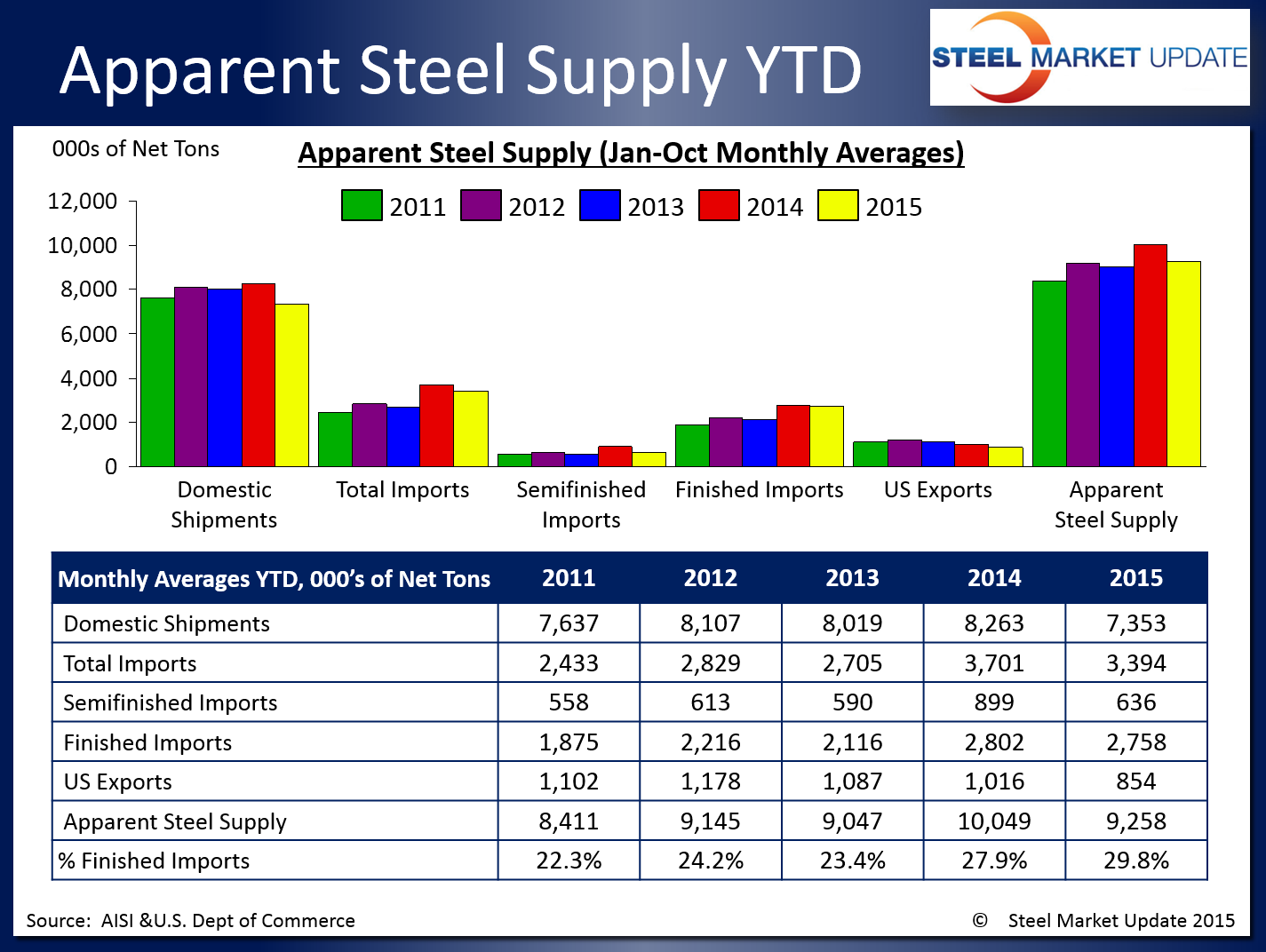

The table below has been revised from the one we normally publish per member request; the monthly averages for each year are now calculated on a year to date basis. Each figure below is based off of January through October data for a more consistent comparison between years.

To see an interactive graphic of our Apparent Steel Supply History, visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.