Prices

December 10, 2015

Hot Rolled Futures: Green Shoots?

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), iron ore and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Here is how Andre saw trading over the past week:

Financial Markets:

The stock market is taking a small breather. We are last 2050 on the S+P 500 on the Dec futures contract, down from the 2210 high set November 3rd. We are still likely headed to make new highs, but with the Fed Dec. meeting set to raise interest rates (I’m still skeptical) the market isn’t going to make that move just yet, until there is more clarity on that eventual Fed trajectory. In meantime, we are likely headed to test 2000 support and maybe even more likely to test the support line in the zone of 1940-1950. Meanwhile commodities stink. Crude has broken $40/bbl. on WTI and is trading in the $36-38/MT zone and probably headed to test $33/MT zone low of 2009. We may even see lower, albeit for a short time, before this re-adjustment is finished. In Copper we are still above $2.00/lb. at $20.4-2.05/lb. zone but also prob. Headed to test that support at some point in the intermediate future as China demand and the worlds health still weight on commodity prices in a strong dollar environment (raising rates won’t help).

Steel:

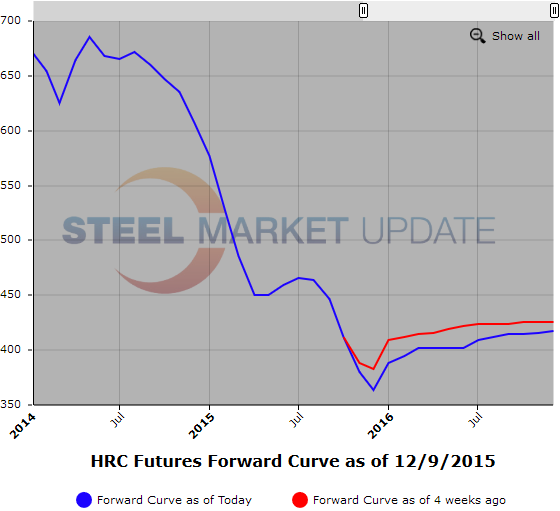

The HRC focus remains in the 1H’16. Yesterday HRC futures continued to trade nearby at same levels following HRC index release (down $5 to $354) due to steady buying interests. However, today we saw buyers pay higher prices. With talk of higher mill prices and current very low capacity utilization rates (below 63%), perhaps the market is trying to establish a bottom.

This past week 41,800ST of HRC has traded mainly in 1H’16. CME reported trades in Q1’16 @$395/ST[$19.75cwt] and @ $398/ST[$19.90cwt]; and in Q2’16 @ $402/ST[$20.10cwt], @ $405/ST[$20.25cwt] and @$406/ST[$20.30cwt]. Take note of the spread between Q2’16 and Q3’16 versus Q1’16 and Q2’16. The spread narrows as you go further out the futures curve. The best market we see today in Q3’16 is $408/ST[$20.40cwt]bid and offered @ $411/ST [$20.55cwt]. It has been a quiet week for futures interests further out the curve. However, we are seeing inquiries further out into 2017.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

Iron Ore

We’re probably not that far from completely deflated here. Now that we are sub $40/MT with the index last $37.50/MT and the futures still backwardated most prices are sub $40/MT. Pollution in China has become such a hot-spot there it seems unlikely that the smaller polluting steel mills will make it into the new year, i.e. no more bank lines. This is almost certainly priced into the malaise in this market as like crude overcapacity and a scarcity of demand cripple its future. That said, there are a lot of shorts built up in this market and we could see a big rally at some point if the market senses a bottoming. We’re probably not far from there. Let’s call Jan either side of $36.00/MT, Feb. either side of $35.65/MT, Q1 either side of $35.70/MT, Q2 either side of $35.00/MT, Q3 35.00/MT and Cal 17 either side of $33.75/MT.

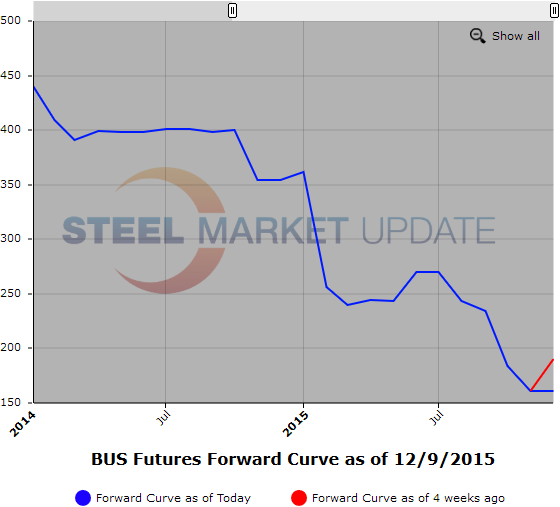

Busheling Scrap (BUS):

Not much change in December BUS when compared to November. Light mill demand for scrap in the Midwest leaves prices for Midwest Busheling sideways. Concern lower iron ore and energy prices will further impact scrap prices. A trickle of East Coast shipments of scrap to Turkey have traded at $190/MT which is a $2 drop from recent shipments. Strong USD in conjunction with inexpensive billet limiting demand for US based scrap to Turkey. Prices feel mired at recent levels. However market focus will remain on strong currency levels, soft energy prices, and abundant alternative inputs sources such as semi-finished imports.

Current CME BUS interests we have seen are , Jan’16 $160/GT bid – offered @ $185/GT, Feb’16 $160/GT bid – offered @ $180/GT and 1H’16 offered @ $225/GT. We continue to get inquiries for Cal’16. LME steel scrap interests :Dec ’15 offered @ $186/MT, Jan’16 $190/MT.

Another graphic is below, to use it’s interactive features you must visit this page on our website.