Government/Policy

December 1, 2015

Canada Assigns Duties to Chinese Steel Line Pipe

Written by Brett Linton

It will soon be more expensive to export Chinese steel line pipe to Canada.

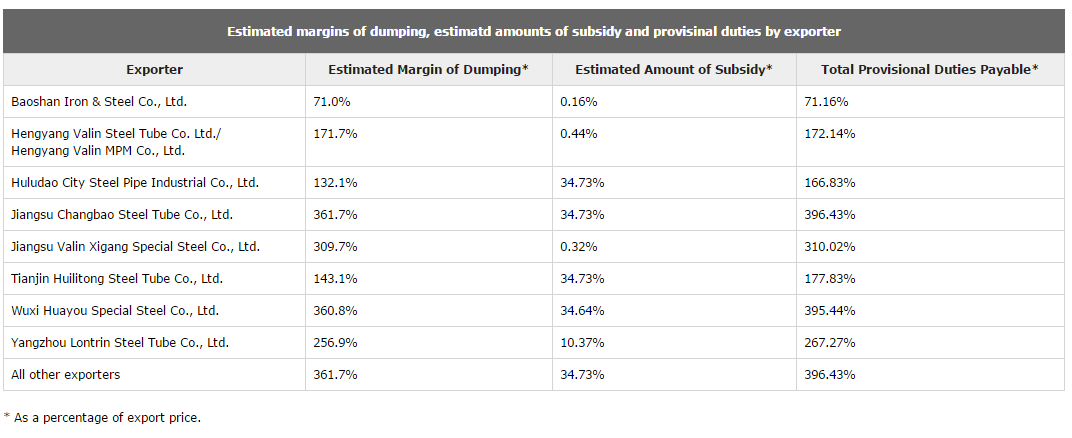

Canada Border Services Agency released its preliminary determination on dumping and subsidization of steel line pipe exported from China and assigned provisional duties ranging from 71 percent to 396 percent. CBSA estimates that in 2014, 48.8 percent of carbon and alloy steel pipe imports to Canada were from China. That share increased to 55.9 percent from July 2014 to June 2015.

The chart below lists provisional duties. The reasoning behind the determination will be released by CBSA within 15 days.

EVRAZ North America, one of the complainants in the case against China, said it was pleased with the CBSA findings.

“We applaud the Government of Canada and the CBSA for their diligent analysis and decisions, which will positively impact the Canadian job market while sending a message that illegal dumping and foreign government subsidization will be met with strong action by the Canadian government,” said Conrad Winkler, President and CEO of EVRAZ North America. “We actively compete globally with line pipe manufacturers, but foreign companies should not be allowed to dump their product while we reduce Canadian employment to save their subsidized jobs.”

“China is the definition of a non-market economy, exporting product at prices below its own home market to support its steel industry even as its own internal steel consumption continues to decline,” stated Winkler. “This decision underscores the need for strong trade remedy laws and regulations.”

EVRAZ NA Canada operates electric resistance weld (ERW) and submerged arc weld (SAW) line pipe manufacturing facilities in Regina, Saskatchewan, and in Red Deer, Alberta. The EVRAZ North America group of companies also owns Canadian National Steel Corporation, which operates ERW and SAW line pipe manufacturing facilities in Camrose, Alberta.

Tenaris Global Services (Canada) Inc., also a complainant in the case, is the commercial agent for Tenaris’ sales in Canada. Tenaris produces pipe for the Canadian oil and gas market at its Algoma Tubes Inc. (ATI) facility in Sault Ste. Marie, Ontario using the seamless process and at its Prudential Steel Inc. (PSI) facility in Calgary using the electric resistance welded (ERW) process. The company has a manufacturing capacity of 650,000 tons of seamless and ERW pipe.

“Trade cases in Canada are intended to restore fair market based prices and market based competition,” said a spokesperson for Tenaris. “These decisions are critical to the continued development of domestic manufacturing for oil and gas.”