Prices

November 9, 2015

Ferrous Scrap Exports Down 13.8% for First 9 Months 2015

Written by Peter Wright

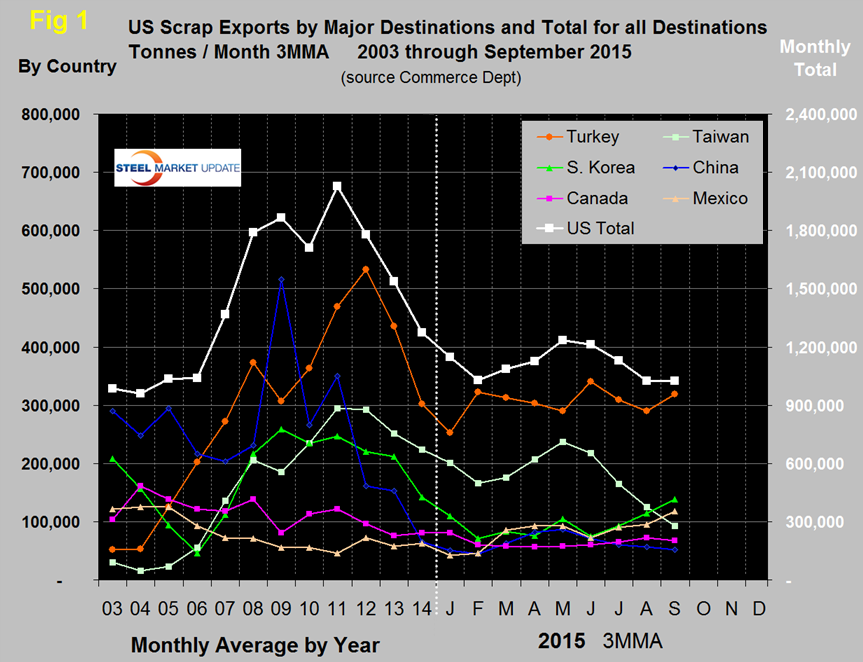

In the first nine months of this year bulk scrap exports were 9,968,048 tonnes for an annual rate of 13,290,731 tonnes, down by 13.8 percent from the first nine months of last year. The tonnages shown in Figure 1 are based on three month moving averages (3MMA) for 2015 and on the annual monthly average for previous years.

The graph shows that exports declined for three consecutive years, 2012 through 2014 continuing through January and February this year. March saw a trend reversal that continued through May followed by three months of decline. The September tonnage was almost exactly the same as August on a 3MMA basis. In the twelve months of 2014, scrap exports totaled 15,308,000 tonnes, down by 17.1 percent from the same period in 2013.

In the single month of September, Turkey was the major destination with 456,909 tonnes, followed by Mexico with 154,275, tonnes. This was the highest monthly tonnage into Turkey since December 2013 and the highest into Mexico since November 2005. Turkey has been the major destination in eight out of nine months this year but by all accounts the purchase of scrap by Turkish mills is being reduced by semi-finished purchases from China in particular but also from Russia and Ukraine. The latest export data available is for September; since then through November 4th, the East Coast US export scrap price is down by $70 per tonne. It remains to be seen whether this decline will have rejuvenated the US volume into Turkey. Semi-finished imports will continue to be favored by Turkish mills until the decline in scrap prices upsets that balance. In the first nine months of this year the global price of iron ore gave the integrated producers in China a cost advantage over the electric furnace steelmakers in Turkey. With the recent decline in the price of scrap that is no longer the case and the relative prices of ore and scrap have returned to exactly their long term relationship.

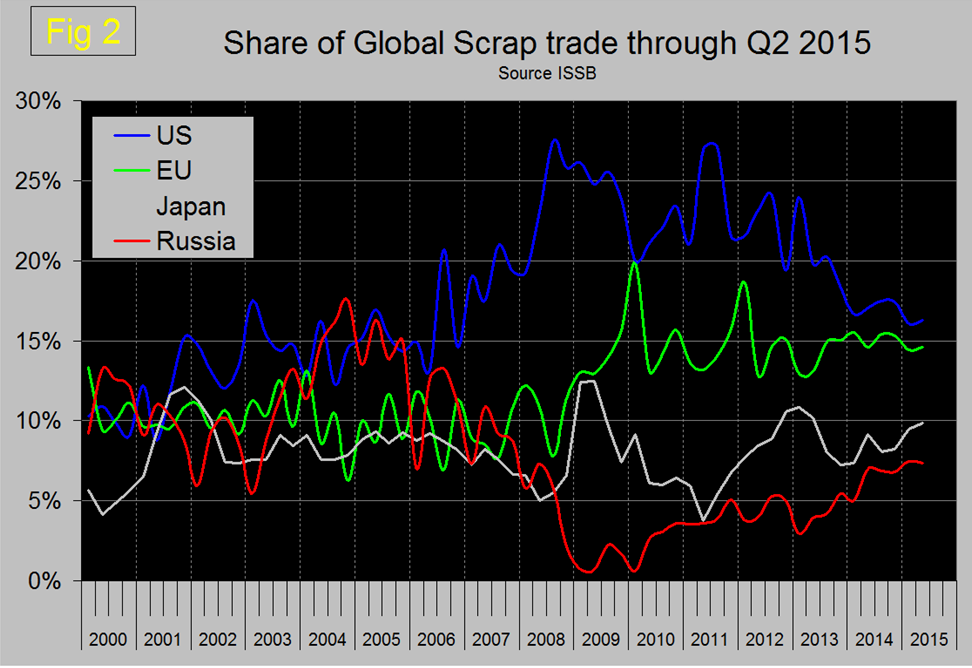

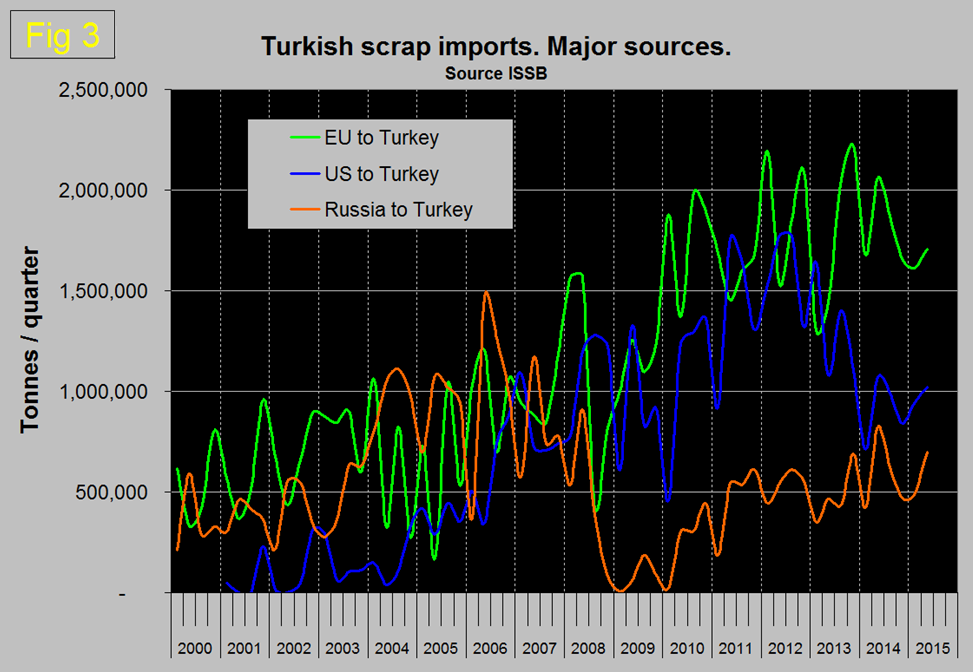

We published Figure 2 and Figure 3 last month and have left them in here for context.

Global trade data for the third quarter won’t be available until the end of this month because many countries are slow in reporting. The US share of global scrap trade has steadily declined since 2011as the share of Russia and Japan has increased backed by their depreciated currencies. Russia has taken share from the US as a scrap source to Turkey.

US scrap exports to the Far East through the first nine months were down by 32.6 percent from last year as Japan picks up share in that region. YTD through September exports to Canada were down by 8.1 percent and to Mexico were up by 54.5 percent. India has become a big player this year and their tonnage out of the US has put them in 5th place as a destination, up by 84.7 percent YTD. Exports to South Korea and Taiwan were down by 33.8 percent and 28.7 percent respectively. Shipments to China YTD through September were 557,883 tonnes, up by 1.2 percent from last year.

Scrap export prices are reported by the AMM every Tuesday for an 80:20 mix of #1 and #2 heavy melt in US $ per tonne FOB New York and Los Angeles for bulk tonnage sales. Through November 4th the price on the East Coast had collapsed by $142.47 per gross ton year to date and by $115.50 on the West Coast.