Market Data

October 16, 2015

Currency Update for Steel Trading Nations

Written by Peter Wright

We have two data sources for this report: the Federal Reserve and the Oanda forex trading platform. An explanation of these sources is given at the end of this report. Oanda is current every day but the Federal Reserve daily Broad Index (BI) is normally about eight days in arrears. As of October 15th the Fed’s latest daily update was October 9th, therefore was six days behind the individual steel trading currency data that we are presenting here.

![]()

Our last update on the currency values of the 16 steel trading nations was September 21st, four days after the Fed announcement on the 17th that they were not going to make an immediate change to US monetary policy. Currency traders correctly anticipated that decision between the 10th to the 13th and began to act accordingly. The anticipation of a rate increase that had been priced in went away. The dollar began to weaken at that time against all 16 currencies except Japan.

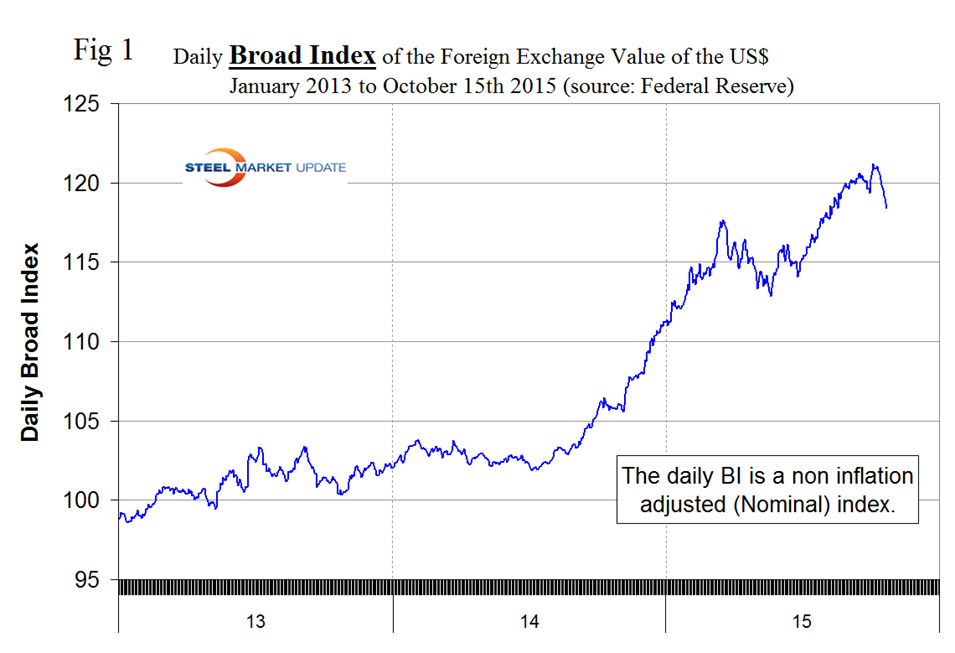

Through October 9th the BI continued to weaken and in 30 days had lost 1.6 percent (Figure 1).

The value on September 7th was the highest since April 29th 2003 driven both by anticipation of a Fed rate increase and by a flight to the safety of the dollar as uncertainty about the global economy continues. Through October 9th the BI appreciated by 11.8 percent in 12 months, 1.6 percent in 3 months and lost 1.6 percent in 1 month and 1.5 percent in 7 days. When (not if) the Fed raises rates it will drive the value of the dollar higher.

Christine Lagarde, Managing Director of the IMF made the following comments early this month: “The normalization of U.S monetary policy will be a major transition in the global economy. The Federal Reserve is poised to raise interest rates for the first time in nine years – although the Fed has also clearly indicated that rates are expected to remain low for some time. This transition reflects better economic conditions in the US, which is also good for the global economy.

Low interest rates contributed to a search for yield on the part of investors, which supported financial risk-taking and higher valuations of equities, sovereign bonds, and corporate credit. So the Fed also faces a delicate balancing act: to normalize interest rates while minimizing the risk of financial market disruption.

Again, there are potential spillovers. The prospect of rising U.S. rates has already contributed to higher financing costs for some borrowers, including emerging and developing economies.

This is part of a necessary adjustment in global financial conditions. The process, however, could be complicated by structural changes in fixed-income markets, which have become less liquid and more fragile – a recipe for market overreactions and disruptions.

Outside the advanced economies, countries are generally better prepared for higher interest rates than in the past. And yet I am concerned about their capacity to buffer shocks.

Why? Because many emerging and developing economies responded to the global financial crisis with bold counter-cyclical fiscal and monetary actions. By using these policy buffers, they were able to lead the global economy in its time of need. And over the past five years, they have accounted for almost 80 percent of global growth.

These policy actions generally went together with an increase in financial leverage in the private sector, and many countries have incurred more debt – a significant portion of which is in U.S dollars.

So rising U.S. interest rates and a stronger dollar could reveal currency mismatches, leading to corporate defaults – and a vicious cycle between corporates, banks, and sovereigns.

The bottom line is that proactive policy management by everyone – and especially the emerging economies – is now more important than ever.”

It does not necessarily follow that the steel trading currencies follow the BI but in the last month that has been the case. In one month through August 29th the dollar strengthened against 13 of the 16 currencies examined here. In one month through September 21st it weakened against 8 and in one month through October 15th it weakened against 14. Quite a reversal and as we mentioned above, the main reason was that the market had priced in the anticipation of a US interest rate increase.

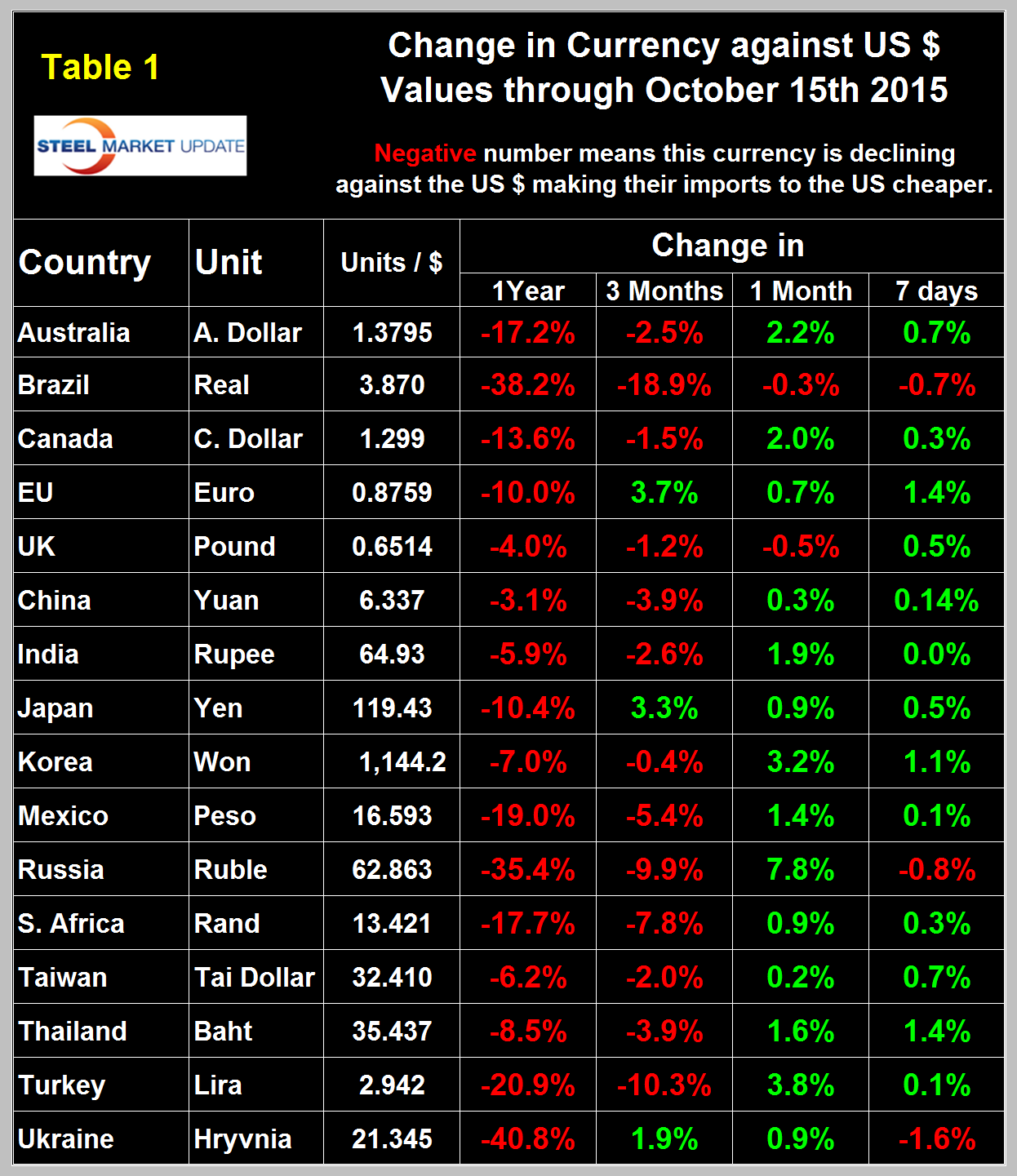

Table 1 shows the number of currency units of steel trading nations that it takes to buy one US dollar and the change in one year, three months, one month and seven days. The table is color coded to indicate strengthening of the dollar in red and weakening in green. We regard strengthening of the US Dollar as negative and weakening as positive because the effect on net imports.

In 2014, 25 percent of the U.S. economy was related to international trade therefore currency swings can have a huge effects on the economy in general and of the steel industry in particular. At the 12 month level the dollar has strengthened against every one of the steel trading currencies.

In each of these reports we comment on a few of the 16 steel trading currencies but charts for each are available through October 15th for any reader who requests them.

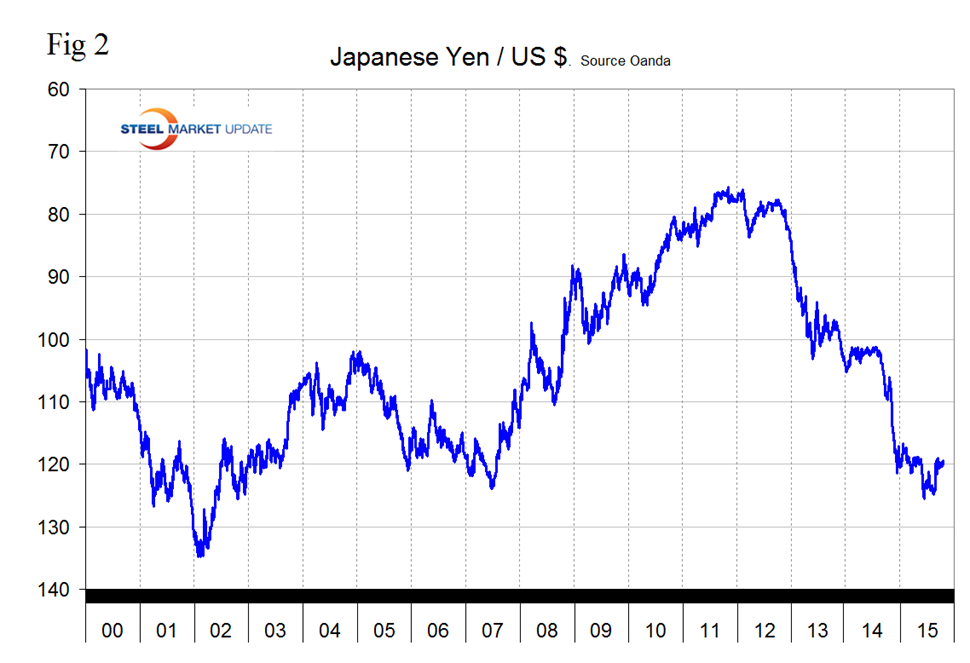

The Japanese Yen has strengthened against the $ by 3.3 percent in three months, by 0.9 percent in one month and by 0.5 percent in the last seven days (Figure 2).

The strengthening is fragile though as illustrated by Mark Chandler’s comments on September 22nd. August trade figures released last week showed that exports on a year-over-year basis were up 3.1 percent. However, this is a function of the value in Yen, not volumes. Consider that Japanese exports to the US are up 16 percent in value terms but are virtually flat by volume. The value of exports to the EU are up 5.1 percent, but less by volume. Exports to China drive home the point. By value, they are up 1.6 percent, but down 4.4 percent by volume. S&P’s recent downgrade of Japan to A+, matching the earlier move by Moody’s, was coupled with an ominous warning. Abe will likely fail to reverse the deterioration over the next 2-3 years. Debt-to-GDP is around 246 percent and the budget deficit during the current fiscal year is near 6.2 percent, more than twice the size of the US shortfall.

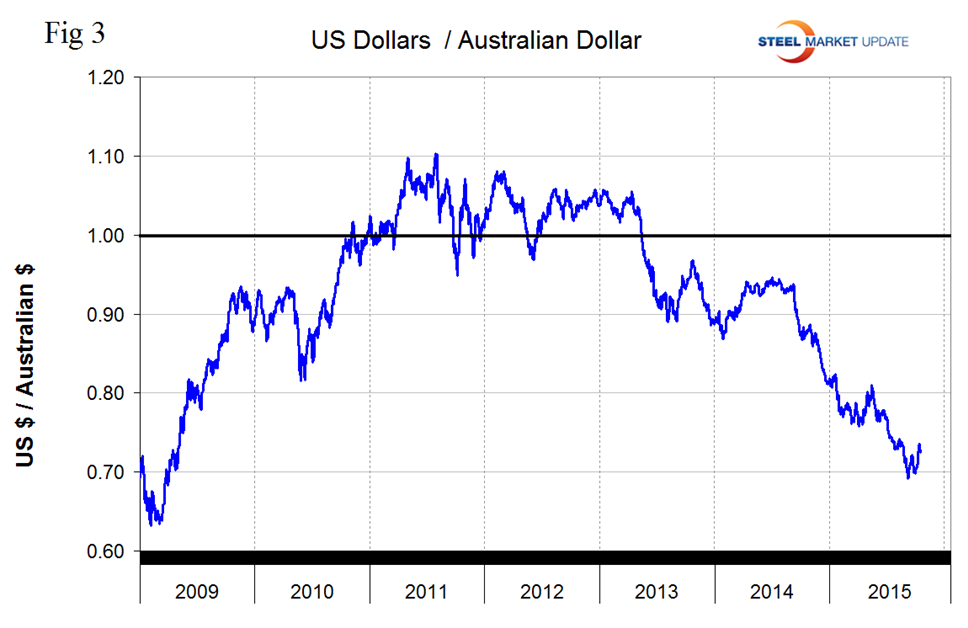

The Australian Dollar has declined by 17.2 percent in 12 months, by 2.5 percent in 3 months but gained back 2.2 percent in the last month (Figure 3).

The IMF Consultation with Australia reported on September 30th made the following observations. Australia has enjoyed exceptionally strong income growth for the past two decades, supported by the boom in global demand for Australia’s natural resources and strong policy frameworks. However, the economy is now facing a large transition as the mining investment boom winds down and the terms of trade has fallen back. Growth has been below trend for two years. Annualized GDP growth was around 2.2 percent in the first half of 2015, with particularly weak final domestic demand, and declining public and private investment. Capacity utilization and a soft labor market point to a sizable output gap. Nominal wage growth is weak, contributing to low inflation.

The terms of trade have fallen sharply over the past year. Iron ore prices have fallen by more than a third and Australia’s commodities prices are down by around a quarter since mid-2014. The exchange rate has depreciated further in recent months following news about economic and financial market developments in China. This has significantly reduced the likely degree of exchange rate overvaluation and should help support activity. Although the current account deficit narrowed to 2.8 percent of GDP in 2014, it is expected to widen somewhat in 2015.

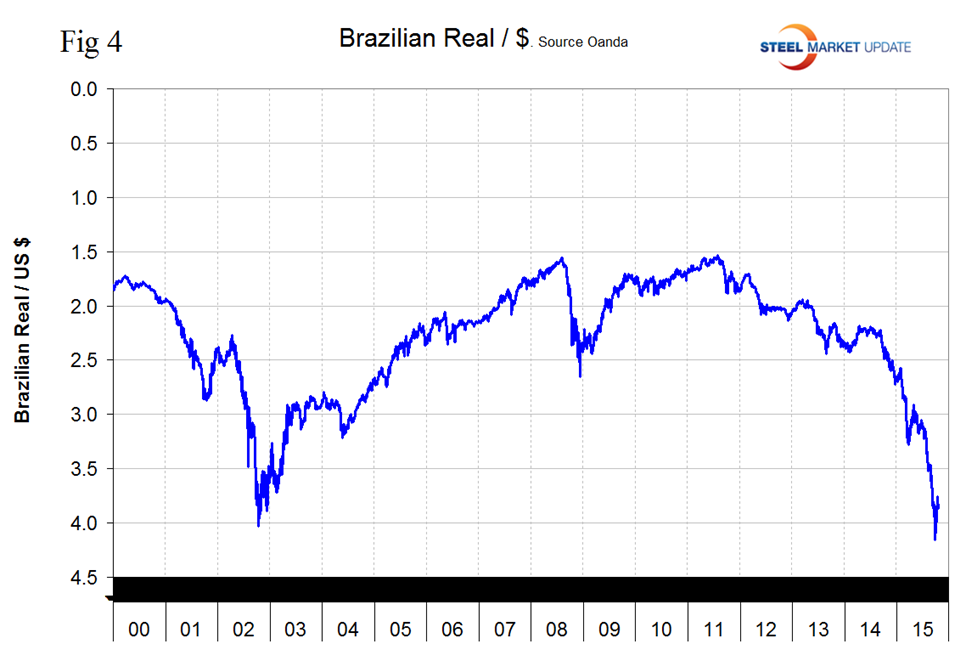

The Brazilian Real is one of only three of the steel trading currencies to have continued to decline in the last month. It has declined by 38.2 percent in 12 months, by 18.9 percent in 3 months, by 0.3 percent in 1 month and by 0.7 percent in the last 7 days (Figure 4).

On September 30th Banco Central do Brazil president, Alandre Tombini, made the following comment, “all instruments are available for the central bank to support the currency” then on the same day the bank announced plans to auction $2bn worth of new currency swaps over two days – in effect restarting a program that was scrapped earlier this year. Alexandre Tombini the next day sought to further shore up investor confidence, hinting at deploying its $371bn of foreign currency reserves to buttress the Real. When the Fed raises interest rates it will make U.S. fixed income instruments more attractive, potentially spurring more capital flight from Brazil. Brazil’s attempt to support the Real is likely to be long and protracted. It could also be a waste of money given that it’s difficult to fight natural market forces.

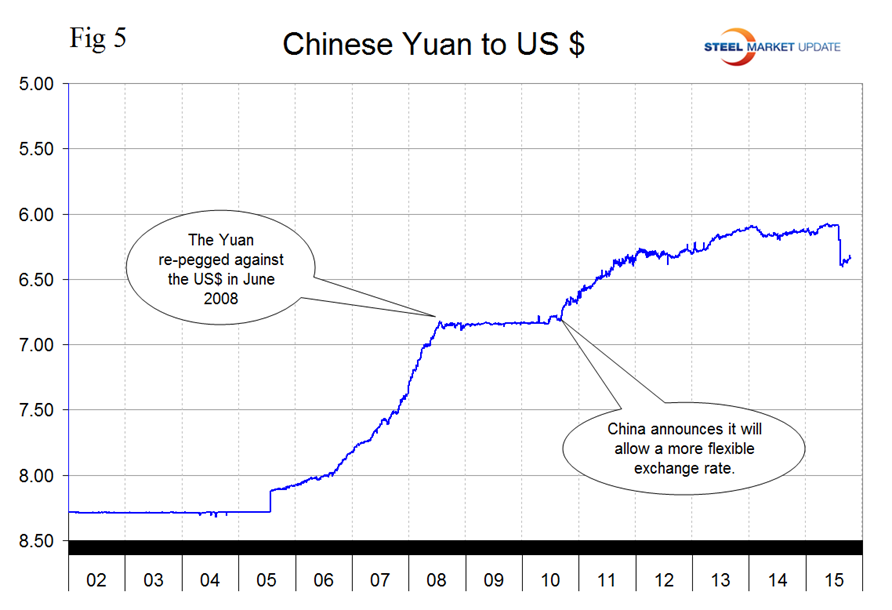

The Chinese Yuan has weakened by 3.1 percent in the last year but in the last month has strengthened by 0.3 percent (Figure 5).

In the latest data, China’s preliminary manufacturing index hit a 78-month low, signaling a decline in manufacturing activity. The Asian Development Bank also lowered its 2015 growth forecast for China to 6.8 percent, down from the 7 percent widely expected. If declining economic activity prompts China to devalue its currency again, it could cause Brazil and Australia’s exports to slow, spur more capital flight and hurt both those currencies.

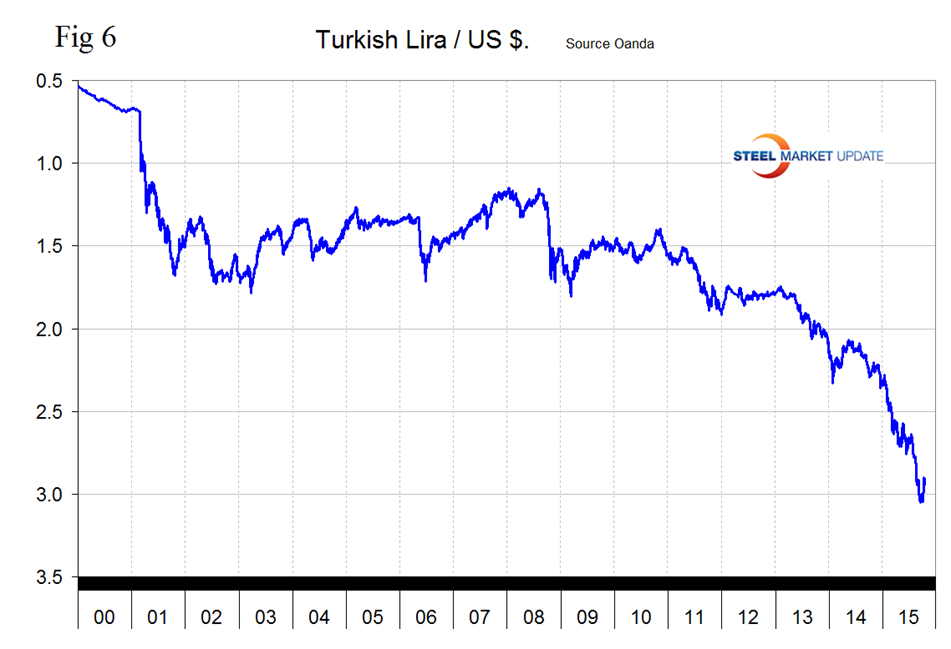

The Turkish Lira has declined by 20.9 percent in 12 months and by 10.3 percent in 3 months but in the last month has gained back 3.8 percent (Figure 6).

Explanation of Data Sources: The broad index is published by the Federal Reserve on both a daily and monthly basis. It is a weighted average of the foreign exchange values of the U.S. dollar against the currencies of a large group of major U.S. trading partners. The index weights, which change over time, are derived from U.S. export shares and from U.S. and foreign import shares. The data are noon buying rates in New York for cable transfers payable in the listed currencies. At SMU we use the historical exchange rates published in the Oanda Forex trading platform to track the currency value of the US $ against that of sixteen steel trading nations. Oanda operates within the guidelines of six major regulatory authorities around the world and provides access to over 70 currency pairs. Approximately $4 trillion US $ are traded every day on foreign exchange markets.