Prices

August 27, 2015

Hot Rolled Futures: $500/ton HRC Now a Thing of the Past?

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

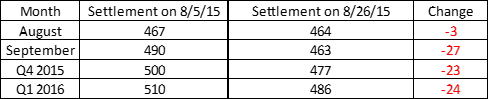

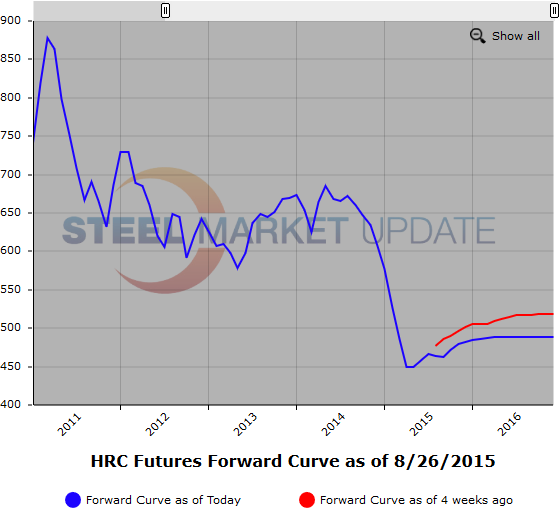

We certainly hope the answer to our article title is a resounding “No!”. And the reality is that is of course we will at some point see $500/ton HRC again, but the question is both when and why? The futures market has been asked that first question, and its current answer is “not any time before 2017”. Indeed the forward curve flattens dramatically once you get into the 2016 months with all of April 2016 and beyond valued nearly at par with Q1. Here is how it shapes up:

So in addition to the outlook dimming for 2016, the oversupply in the current spot market has clearly weighed on the nearby valuations as well. $490/ton seemed reasonable for September in the immediate wake of trade cases, but as is now abundantly clear, any upside we saw on the back of those announcements has faded quickly and dramatically. This is because those cases cannot create new orders for US mills in the near term, and that looks like it is going to be a problem.

July imports picked back up again, with CRC and HDG orders leading the way to a 2.94 million ton import month. That is up a solid 4.6% from a rather low June total. But imports aren’t the only problem of course; in the same month a year ago, the US imported 16% more tonnage than it did in July of this year. The spot price in July of last year you may be wondering? Last July spot was trading around $670/ton, over $200/ton higher than the current spot price. Despite the low overall July import totals, traders will still likely look at a 26% month on month increase in cold rolled and HDG and wonder if maybe the mills shouldn’t have just named every nation on earth in their trade case filings.

Even if they had named every nation, would that really have been enough? Probably not for some products, take for example OCTG. With crude oil continuing to see profound weakness (settling at just $38.60/bbl last night, though this will be up to nearly $43/bbl today) investment in any kind of energy projects in this part of the world would seem to be a virtual impossibility and thus demand for OCTG products is likely to remain dismal for the foreseeable future.

All this doom and gloom brings us back to the second part of our lead question. If the “when” of $500/ton HRC is presumably far off, what is the “why” that will get us there? Trade cases are a helpful start, but the market is clearly demanding more. One potential scenario would be a world where trade cases have dramatically limited import options, and stockists find themselves overly lean on inventory in the face of a potential run up in demand. It wouldn’t be the first time we saw that scenario play out, and we can expect mills to be VERY eager with their price hikes in that hypothetical context. Another scenario would be a brutally cold winter, and thus a potential replay of iced over Great Lakes keeping iron ore from key mills. These things may seem like longshots to some, but they are entirely possible and we have seen them play out in the recent past. The tough thing about those kind of events? It’s tough to effectively price them into the futures market when their probability is uncertain and the certainty of the current market’s weakness is all too abundant.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

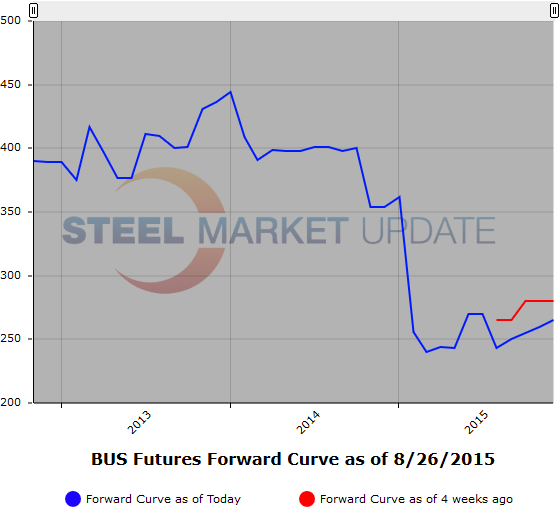

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.