Prices

August 15, 2015

June Apparent Steel Supply Down 6.3% YOY, Up 3.4% Over May

Written by Brett Linton

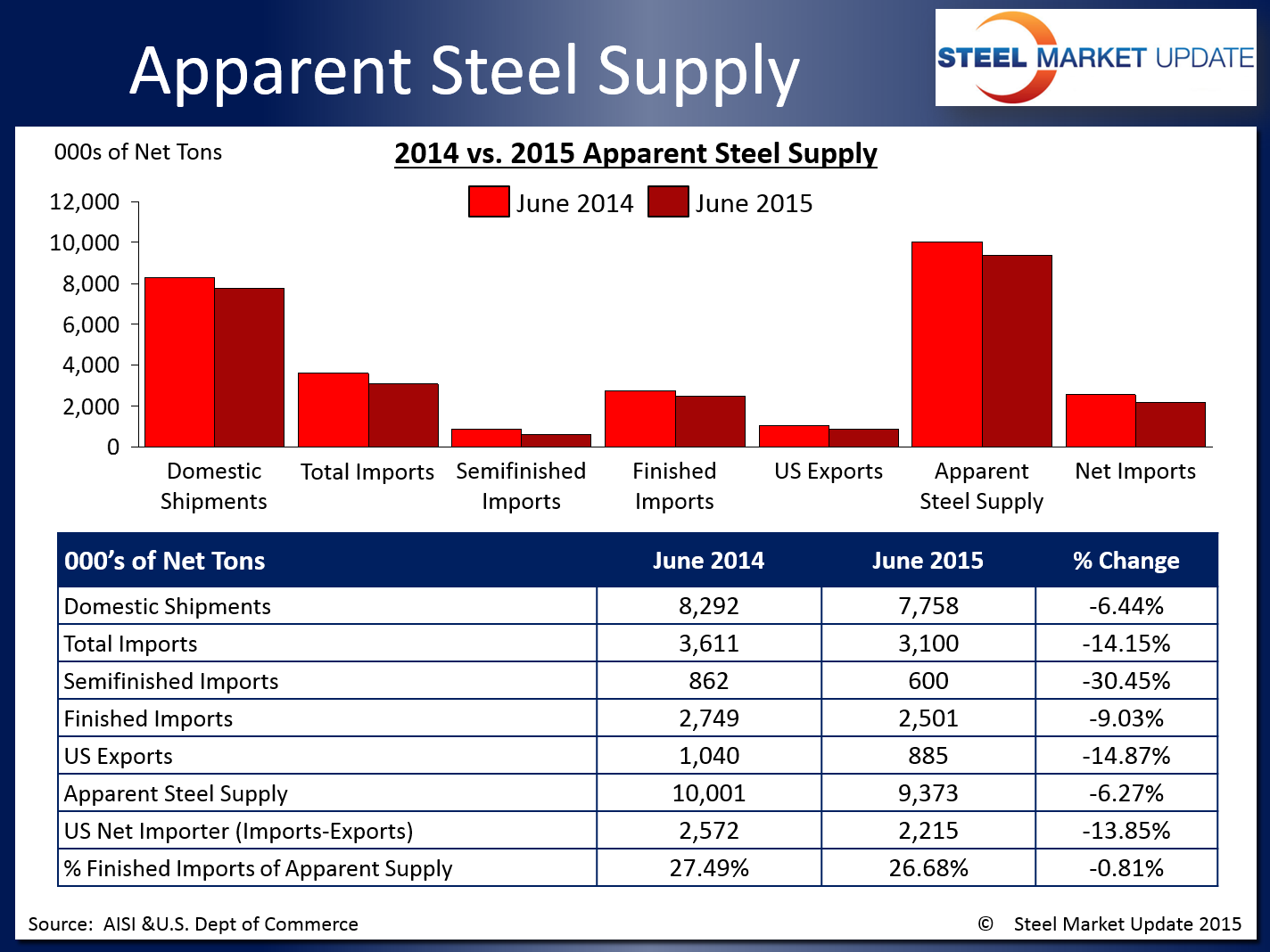

According to the latest data released from the US Department of Commerce and the American Iron and Steel Institute, apparent steel supply for the month of June 2015 was 9,373,498 net tons. Apparent steel supply is calculated by adding domestic steel shipments and finished US steel imports and subtracting total US steel exports.

June supply represents a 627,382 ton or 6.3 percent decrease compared to the same month one year ago when apparent steel supply was 10,000,880 tons. This is attributed to a 533,736 ton or 6.4 percent drop in domestic shipments, a decline in finished imports of 248,260 tons or 9.0 percent, and a decrease in total exports of 154,614 tons or 14.9 percent. The net trade balance between imports and exports was a surplus of 2,215,261 tons in June 2015, 356,240 tons less than that of June 2014.

SMU Note: Our Premium Level apparent steel supply analysis goes into more detail as we provide data on apparent steel supply for flat and long products. We published this analysis on Friday afternoon of last week.

When compared to last month when apparent steel supply was at 9,069,541 tons, June supply increased by 303,957 tons or 3.4 percent. The month over month increase is due to a 582,876 ton or 8.1 percent increase in domestic shipments, nearly half of which was negated by a 263,827 ton or 9.5 percent drop in finished imports. Total exports were relatively flat between the two months.

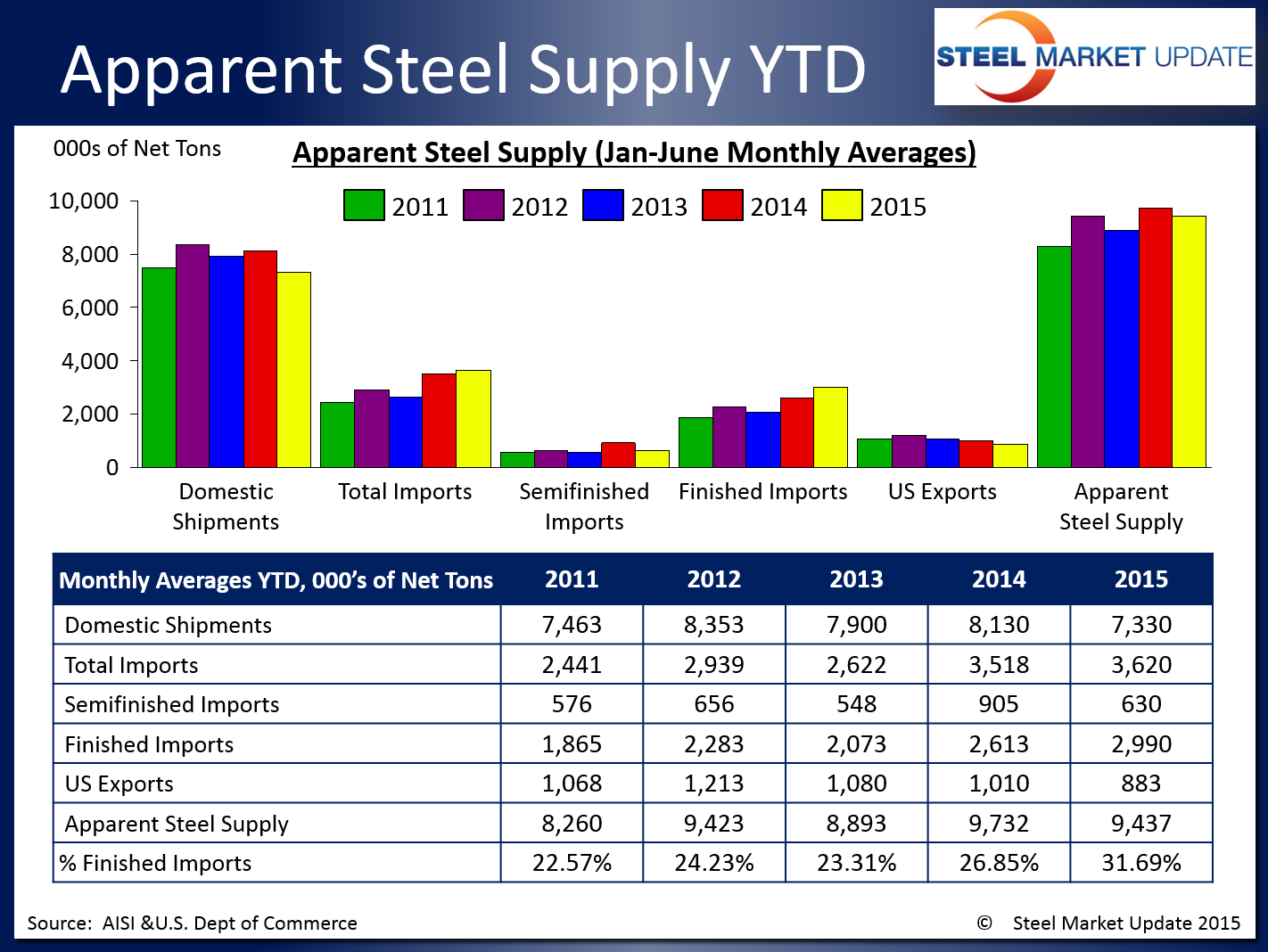

The table below has been revised from the one we normally publish per member request; the monthly averages for each year are now calculated on a year to date basis. Each figure below is based off of January through June data for a more consistent comparison between years.

To see an interactive graphic of our Apparent Steel Supply History, visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.